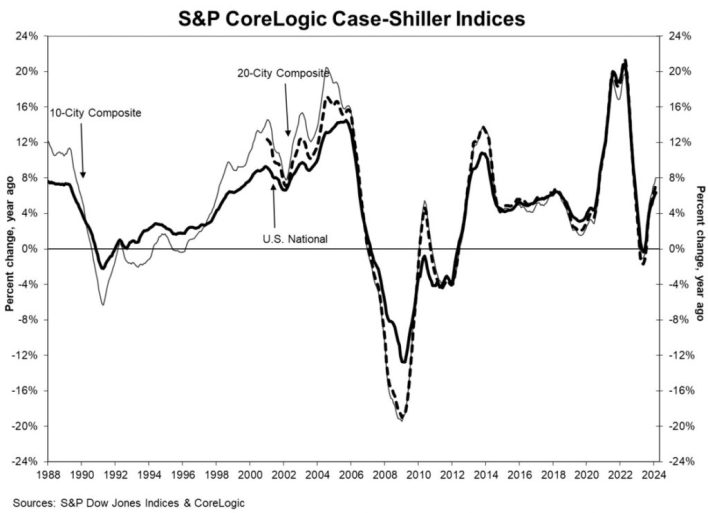

The latest S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index reported a 6.4% annual increase for February, 2024. Their 10-City Composite increased 8% and their 20-City Composite increased 7.3%, year-over-year. “U.S. home prices continued their drive higher.” Said Brian D. Luke, Head of Commodities, Real & Digital assets at S&P DJI. Click here to read the full report at S&P Dow Jones Indices. The post S&P CoreLogic Case-Shiller Says Prices Up 6.4% Year-Over-Year appeared first on Real Estate Investing Today.

US Home Price Insights – May 2024

Home prices nationwide, including distressed sales, increased year over year by 5.3% in March 2024 compared with March 2023. On a month-over-month basis, home prices grew by 1.2% in March 2024 compared with February 2024 (revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results). The CoreLogic HPI Forecast indicates that home prices will rise by 0.8% from March 2024 to April 2024 and increase by 3.7% on a year-over-year basis from March 2024 to March 2025. U.S. year-over-year home price gains remained above 5% in March for the fifth straight month and are projected to stay in that general range for most of the next 12 months. Northeastern states continued to post the nation’s largest gains, as more Americans migrate to bedroom communities of major cities and job hubs, as well as areas where household incomes are …

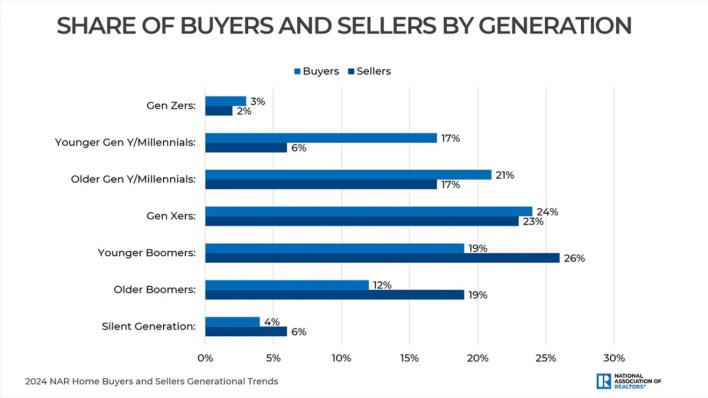

Millennials Are Now the Largest Group of Home Buyers

According to data from the 2024 National Association of Realtors’ Home Buyers and Sellers Generational Trends Report, millennials are now the largest group of home buyers, marking a significant shift in the housing market’s demographic landscape. The annual report examines the similarities and differences among recent home buyers & sellers across generations. “Leading the charge” were younger millennials, whose proportion of first-time buyers increased from 70% to 75% over the past year. “The generational tug-of-war between millennials and baby boomers continued this year, with millennials rebounding to capture the largest share of home buyers…This notable rise is attributed to both younger millennials stepping into homeownership for the first time and older millennials transitioning to larger homes that suit their evolving needs.” said Dr. Jessica Lautz, NAR deputy chief economist and vice president of research. Key highlights: Millennials surpass baby boomers and become the largest group of home buyers at 38%. …

U.S. Employment Situation – April 2024

According to the U.S. Department of Labor’s Bureau of Labor Statistics, total nonfarm payroll employment increased by 175k in April, 2024 with the unemployment rate rising to 3.9% (up 0.1 percentage points). Once again, employment in the government sector continued to climb with the BLS saying it increased by 51k, close to the average monthly gain of 54k over the past 12 months. Click here to read the full report at the Bureau of Labor Statistics. The post U.S. Employment Situation – April 2024 appeared first on Real Estate Investing Today.

Low-Income Americans Have Lost the Homebuying Progress They Made During the Pandemic

Roughly 1 in 5 new mortgages went to low-income homebuyers in 2023, down from 23% in 2020. Meanwhile, high-income buyers have gained share because they’re more prepared to weather the storm of high home prices and mortgage rates. Roughly one in five (20.6%) new mortgages issued last year went to low-income Americans, bringing that group’s piece of the homebuying pie back down to where it was in 2018. Low-income earners gained ground at the start of the pandemic, taking out 23.2% of all new mortgages in 2020, but that progress has since been erased because high home prices and elevated mortgage rates have eroded affordability. This is according to a Redfin analysis of Home Mortgage Disclosure Act (HMDA) data covering purchases of primary homes. It does not cover purchases of investment properties or second homes. We categorized home purchasers into four groups according to their household income: Very low, low, …

425: The US Government Ponzi scheme?

Podcast: Download Is it me or is no one talking about high U.S. debt levels anymore? Conventional wisdom has always been that high debt levels lead to inflation and the destruction of currencies, and money printing conjured up images of wheelbarrows full of worthless bills and economies in freefall. Then

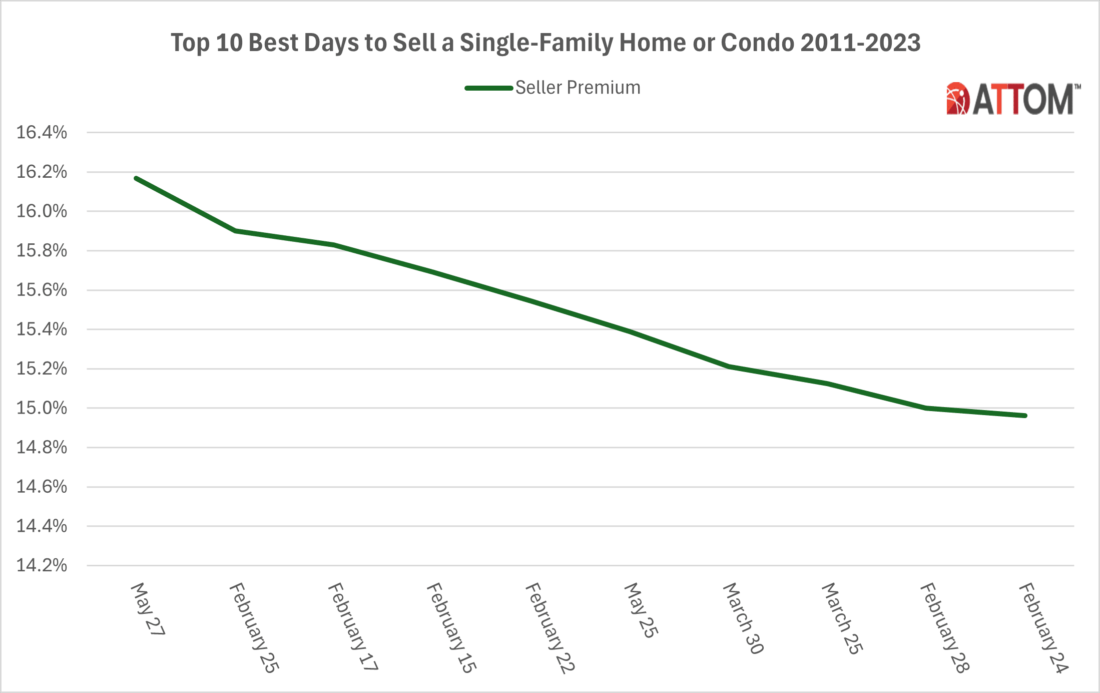

Top 10 Best and Worst Days to Sell a Home

ATTOM’s newly released Best Days to Sell A Home Analysis reveals that over the span of the last 13 years, the months of May, February, and April have consistently yielded the highest seller premiums in home sales – making this month the time to sell your home. According to ATTOM’s latest analysis of more than 59 million single-family home and condo sales spanning from 2011 to 2023, listing a property in May, February, or April often results in higher seller premiums. This data underscores that the period from early in the year through summer marks not only the peak season for home buying but also an advantageous time for sellers to showcase their properties. Therefore, now could be the opportune moment to consider placing your home on the market. In this post, we dive even deeper into the data behind the latest ATTOM analysis to uncover those top 10 days …

Construction Claims – May 2024

Defined Regions © 2024 CoreLogic,Inc., All rights reserved. CoreLogic curates this monthly bulletin of regional construction cost insights, which are reflected in the CoreLogic Claims Pricing Database. We combine the current month’s pricing data with four common loss scenarios to create models illustrating market impacts that are applied across nine regions and compared month over month and year over year. Our experts provide detailed analyses of changes and trends to provide additional insight into key drivers. View our Construction Database Pricing Methodology white paper to gain additional insight into how we populate cost values. May Pricing Insights 2024 Updates From the CoreLogic Pricing Analysis and Delivery Team The CoreLogic Pricing Analysis and Delivery Team continues to research labor costs and industry best practices for all construction categories within the Claims Construction Cost Database. To standardize labor trade assignments in the CoreLogic Pricing Database, CoreLogic will continue implementing incremental monthly changes throughout …

The Benefits of Joining a local REIA

This week’s infographic is really a no-brainier. It illustrates just a few of the awesome benefits of joining a real estate investors association, or REIA as they’re commonly known. You really do get “a bang for your buck” when you become a part of a local community of real estate investors. Click here to find a REIA near you! As always, stay safe and have a Happy Friday!!! Click here to find a REIA near you! The post The Benefits of Joining a local REIA appeared first on Real Estate Investing Today.

Ask Redfin Launches Nationwide, Helping House Hunters Get Quick Answers to Questions about For-Sale Homes

The AI-powered tool is available to all Redfin iPhone app users across the U.S. Since its beta launch on March 7, Ask Redfin has made house hunting a little easier—and now all people searching via the Redfin iPhone app in the U.S. will automatically see it on a home’s listing page. Ask Redfin is our generative AI-powered virtual assistant that helps you easily find the information you care about within a home’s listing details, local market conditions, nearby amenities, touring availability and much more. It’s integrated with Redfin’s support team, so you can be quickly connected to a licensed real estate agent if your question goes beyond the details of a listing, such as how to make an offer or to get an agent’s opinion on the market value of a home. Now that we’re about two months into its existence, we wanted to share how people are using Ask …