Welcome to our pre-vetted assets example page. By REGISTERING HERE you will receive free access to our vetted assets download page as well as our newsletter. Currently, we are sending out PDF packages that contain vetted investment opportunities, fully analyzed, which you will receive on a monthly basis. If you are already logged in, you can directly access the vetted assets download page by clicking here.

Our Goal

Our goal is to provide a trusted resource for acquiring and selling residential notes and off-market REO. Here you will be able to navigate through pre-analyzed performing and non-performing residential notes, in addition to off-market REO.

How it Works

We work with many sellers and receive thousands of assets every month. When you receive a pre-vetted package from us, the best assets have already been weeded out. We look at all the "what ifs" over multiple exit strategies. These assets are cherry-picked and delivered to meet specific investment criteria. For each asset, we are looking to maximize your returns, mitigate risk, and negotiate the best offer price possible. You can offer whatever you want within reason. However, please note: we will not entertain ridiculous offers that put us at risk with our sellers unless there is a good reason.

What makes our service different?

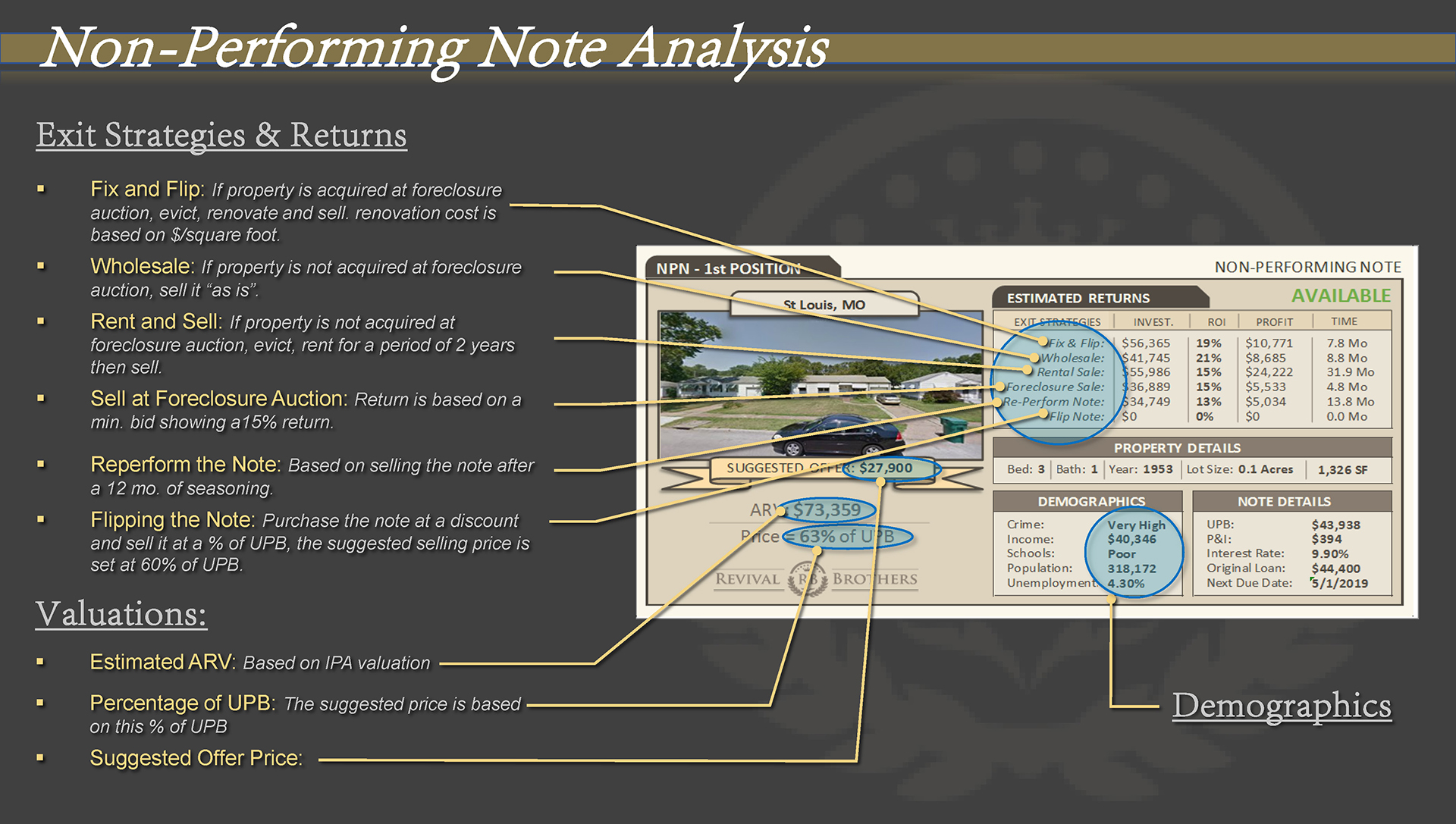

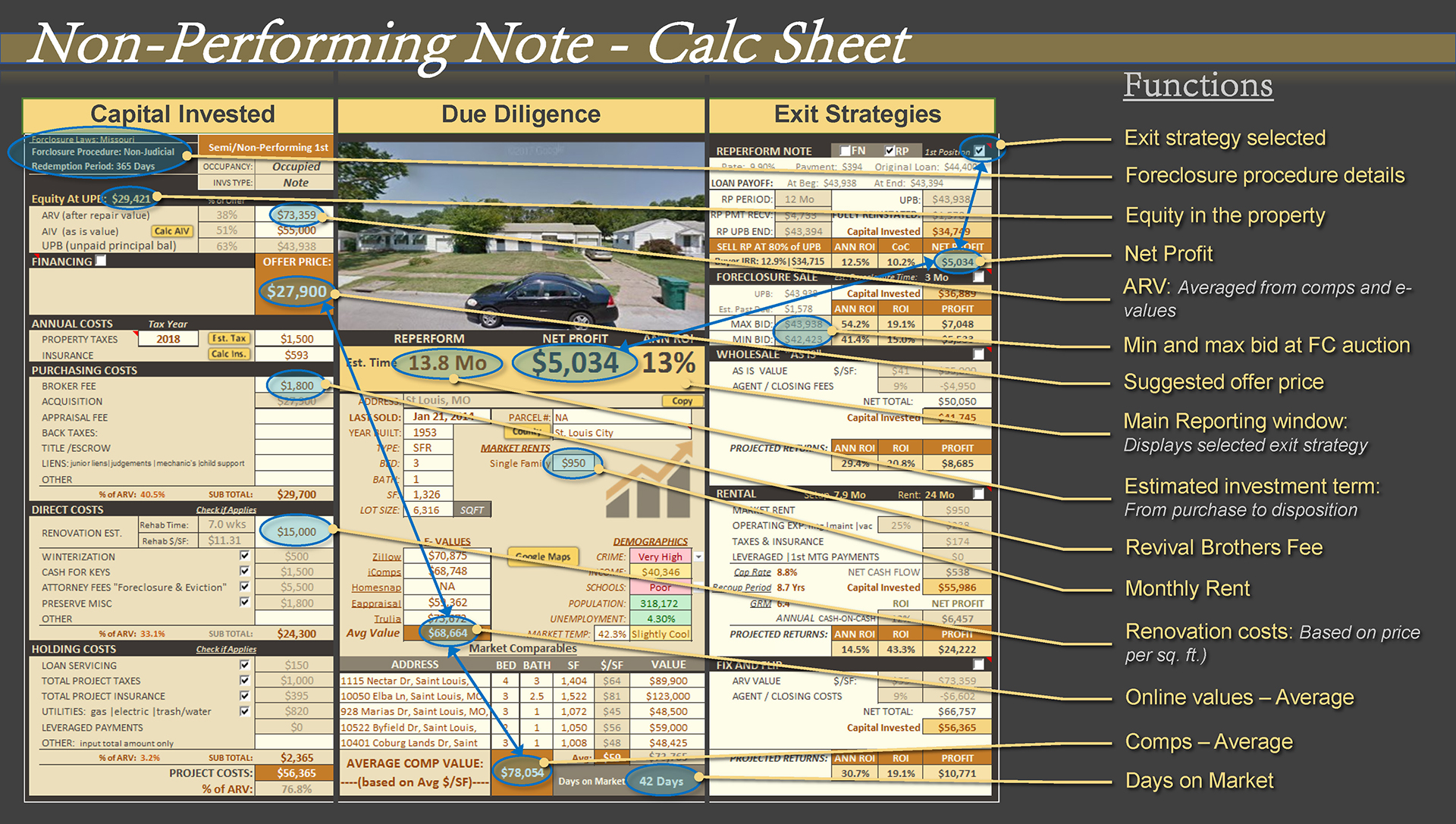

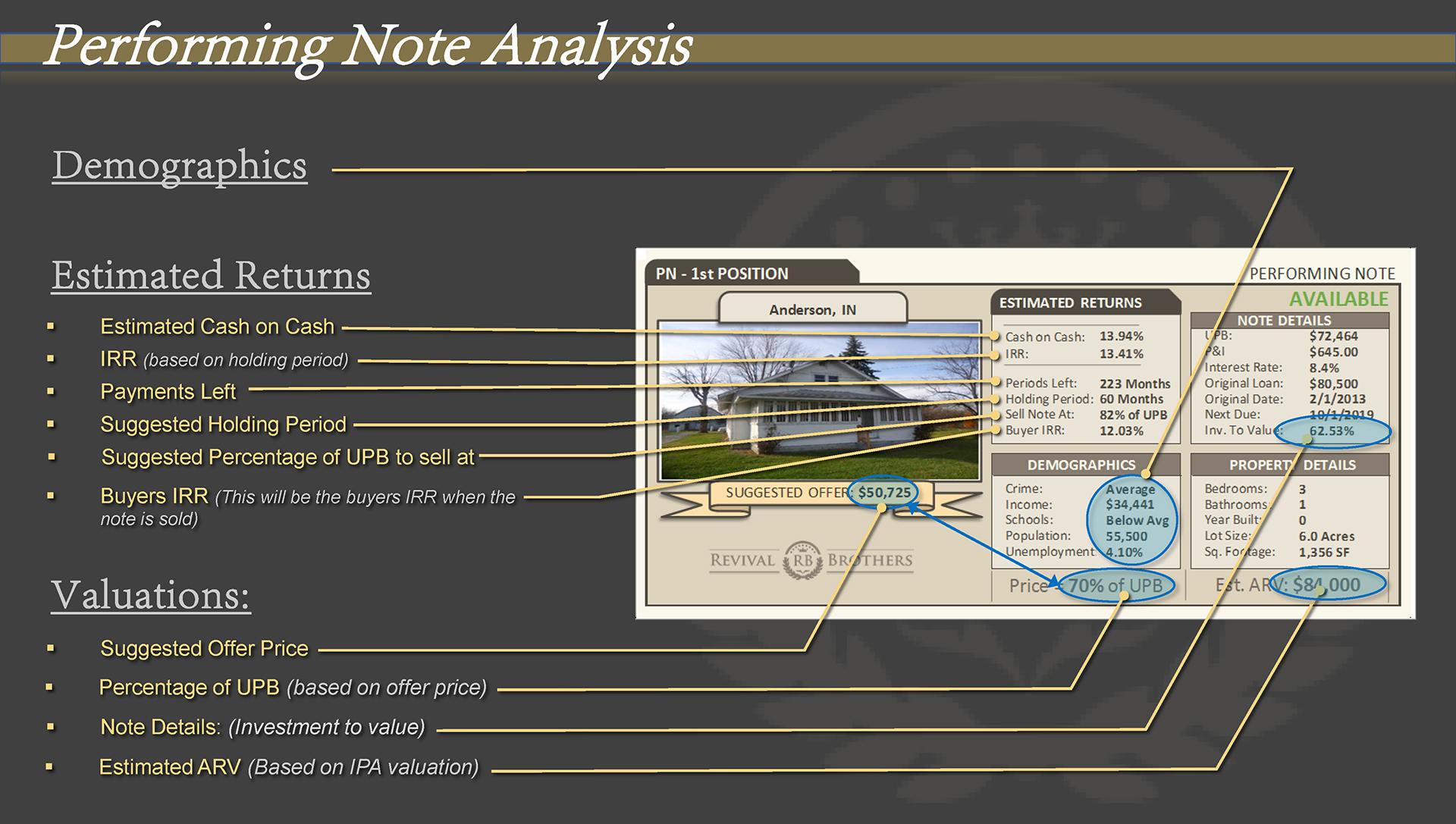

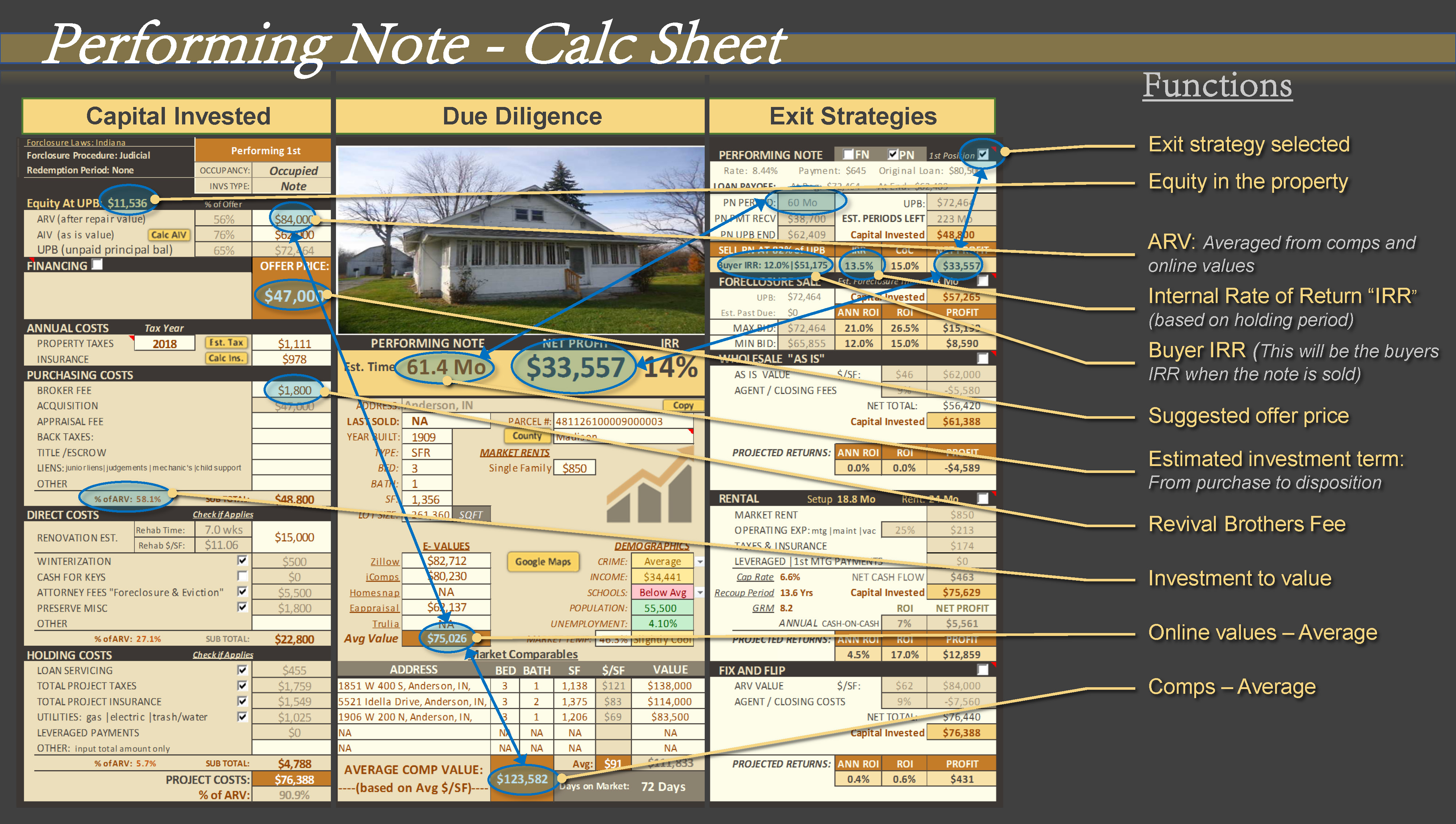

As a company, we wanted to change the paradigm of how people interact and engage with real estate investment companies by first, making all transactions 100% transparent. This leads to better communication, trusted relationships, and realistic expectations. Second, provide users and investors with trusted assets, powerful analytics, and investment tools. We have created a convenient, trustworthy outlet of quality assets. Our predictive analytics are conservative and include multiple exit strategies. All expenses have been taken into consideration such as servicing, utilities, insurance, time, annual taxes, renovation, preservation, legal, and even our broker fee. The estimated ROI, profit, and capital expenditures are true predictive numbers based on the information the sellers are providing. This does not mean you will not have any due diligence to do. If you make an offer, you will have 5-7 days to complete your due diligence.

How much do we charge?

For brokering each deal, which includes finding it, analyzing it, posting it, and negotiating with the seller, the Revival Brothers have a minimum fee of 3% of the UPB or a minimum of $1000 per asset, whichever is greater. For pools larger than 5 assets our fee is 2.4%. This fee is included in all Cherry Picked assets. When you purchase an asset at the suggested or fixed offer price, there are no hidden fees or surprises, and the full projected returns are reflected in the reports. It is important to note, the Revival Brothers do not inflate the value of their Cherry-picked assets to look like they are worth more than they are. Everything is conservative based on the information provided to us.

As you browse through the vetted assets below, you will notice some have fixed fees, and some must be bid on through our network of sellers. If you are interested in fresh assets, register here. There is no other service out there like this and we believe we are setting a new precedent that keeps transactions transparent and helps better inform investors.

Examples of Asset Listings

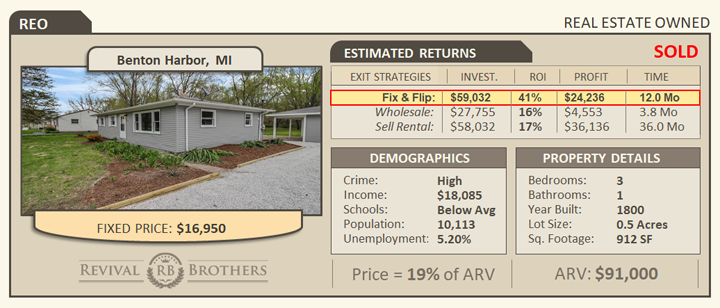

Pre-Vetted by Revival BrothersDispositioned Asset

Exit Strategy = Fix and Flip

This asset was purchased as an REO, renovated and sold at full market value. The Ideal Project Analyzer (IPA) was used to track the assets performance from purchase to sale. Below are the final investment results.

Total Investment

|

Total Profit

|

|---|

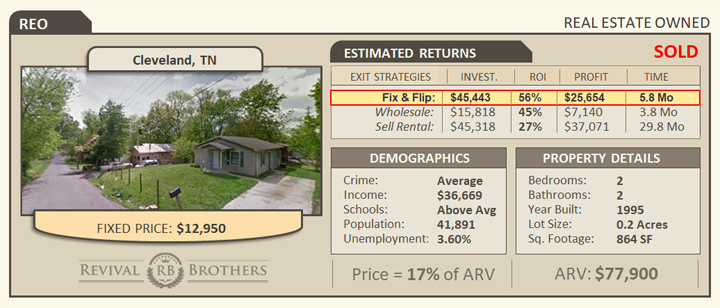

Dispositioned Asset

Exit Strategy = Fix and Flip

This asset was purchased as an REO, renovated and sold at full market value. The Ideal Project Analyzer (IPA) was used to track the assets performance from purchase to sale. Below are the final investment results.

Total Investment

|

Total Profit

|

|---|

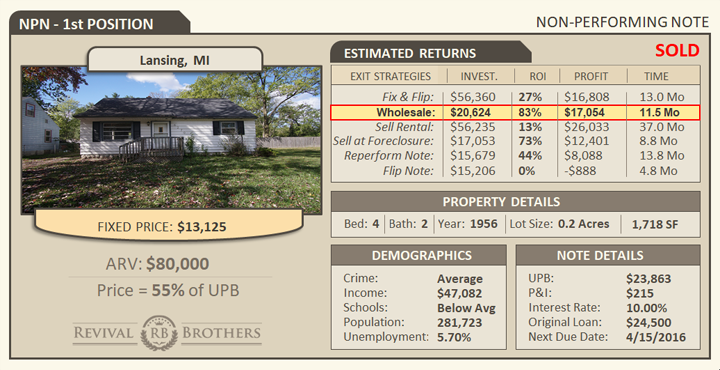

Dispositioned Asset

Exit Strategy = Wholesale

This asset was purchased as a note and sold "AS IS". The Ideal Project Analyzer (IPA) was used to track the assets performance from the boarding of the note though the foreclosure and sale of the property. Below are the final investment results.

Total Investment

|

Total Profit

|

|---|

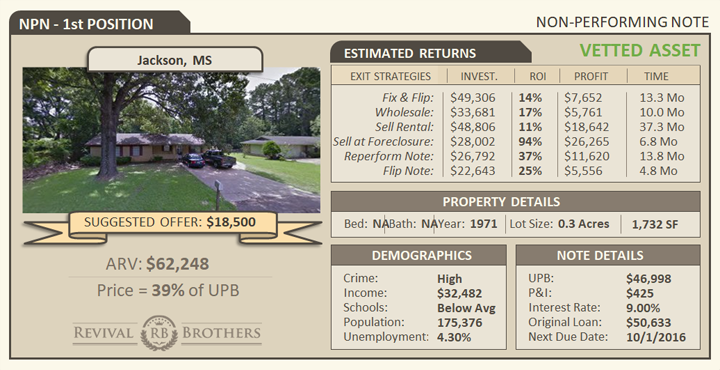

Always Trust But Verify!

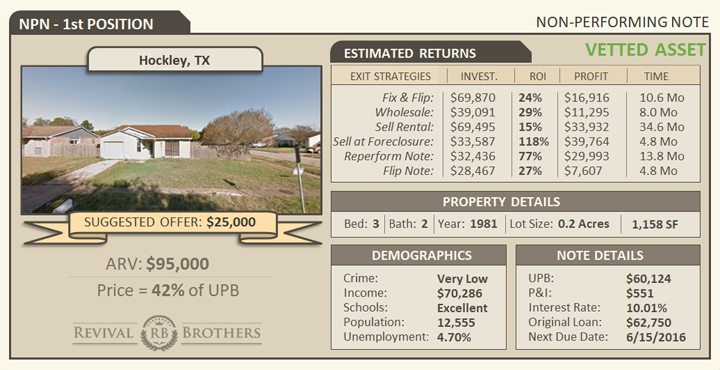

Revival Brothers Vetted Asset

Our Initial due diligence indicates this asset has great potential with a lower estimated risk factor. As part of our service, RB will submit the offer for you at or below the suggested offer price and negotiate with the seller to get the best deal possible. If you are interested in purchasing this asset, click on the “Check Availability” button below to start a dialog.

Important Note: Our fee (as described above) is calculated into the analysis. All projected values are conservative with no hidden fees. All calculations are 100% transparent and easily verifiable especially if you are using our “Ideal Project Analyzer (IPA)”.

Always Trust But Verify!

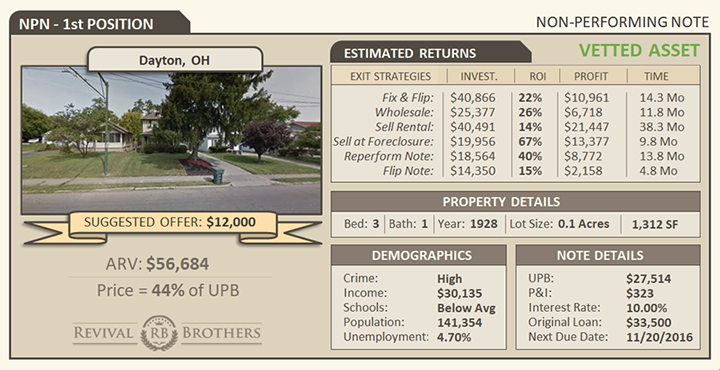

Revival Brothers Vetted Asset

Our Initial due diligence indicates this asset has great potential with a lower estimated risk factor. As part of our service, RB will submit the offer for you at or below the suggested offer price and negotiate with the seller to get the best deal possible. If you are interested in purchasing this asset, click on the “Check Availability” button below to start a dialog.

Important Note: Our fee (as described above) is calculated into the analysis. All projected values are conservative with no hidden fees. All calculations are 100% transparent and easily verifiable especially if you are using our “Ideal Project Analyzer (IPA)”.

Always Trust But Verify!

Revival Brothers Vetted Asset

Our Initial due diligence indicates this asset has great potential with a lower estimated risk factor. As part of our service, RB will submit the offer for you at or below the suggested offer price and negotiate with the seller to get the best deal possible. If you are interested in purchasing this asset, click on the “Check Availability” button below to start a dialog.

Important Note: Our fee (as described above) is calculated into the analysis. All projected values are conservative with no hidden fees. All calculations are 100% transparent and easily verifiable especially if you are using our “Ideal Project Analyzer (IPA)”.