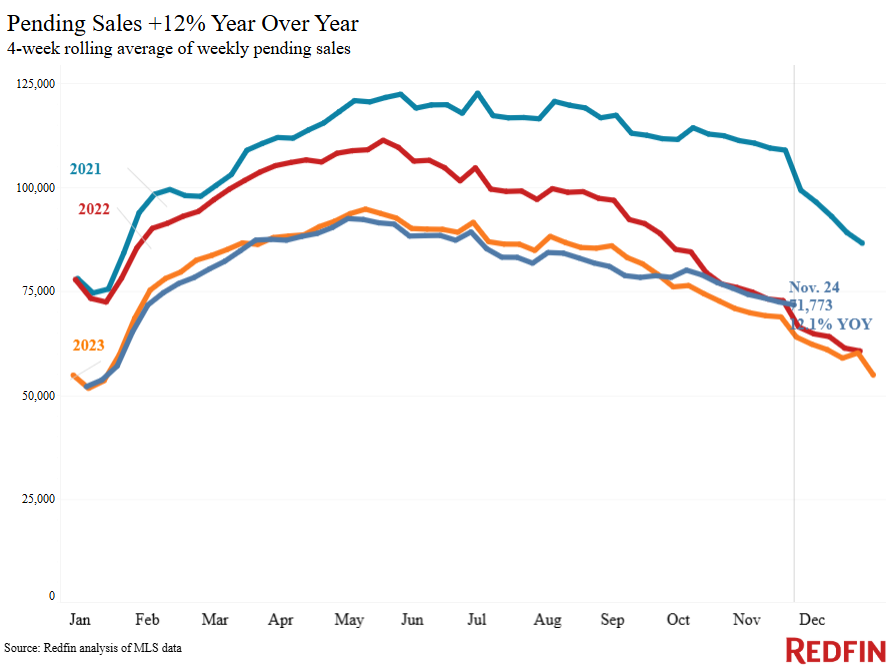

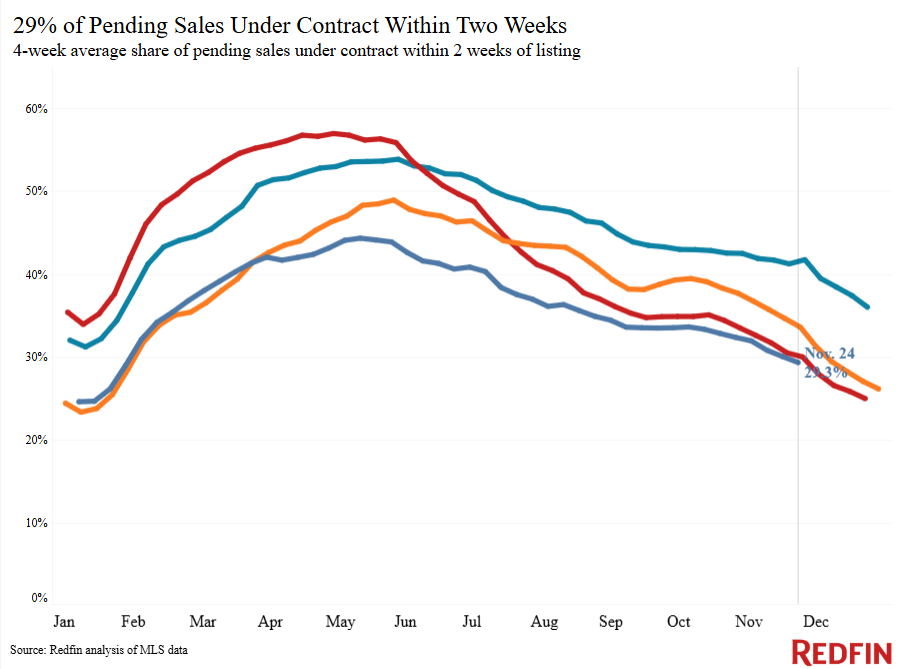

Pending sales posted a big year-over-year increase this week, partly because the boom in early-stage homebuying demand we saw just after the election is translating to sales and partly because we’re comparing to a period in 2023 that included Thanksgiving.

U.S. pending home sales rose 12.1% year over year during the four weeks ending November 24, the biggest increase since May 2021. One reason for the outsized increase is that early-stage homebuying demand, including home tours, boomed in the two weeks following the presidential election. But another notable reason is that we’re comparing to a period in 2023 that included Thanksgiving, a time of year when home sales are typically very slow.

We’ll know in the next few weeks whether the increase in pending sales is a Thanksgiving mirage or a sign of sustained strength in the housing market.

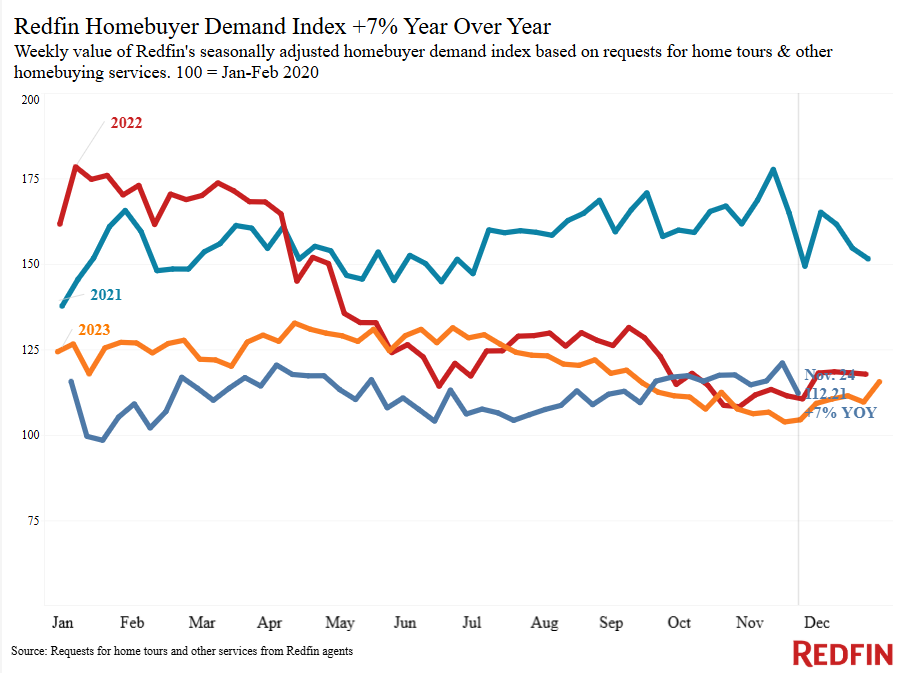

Mortgage purchase applications are up 12% week over week, though home tours and other early-stage signals have tapered off. Redfin’s Homebuyer Demand Index–a measure of tours and other buying services from Redfin agents–fell to its lowest level in over two months during the week ending November 24, though it’s up 7% year over year. The recent dip in early-stage demand follows two weeks of big upswings; the demand index hit its highest level in nearly a year and a half in mid-November.

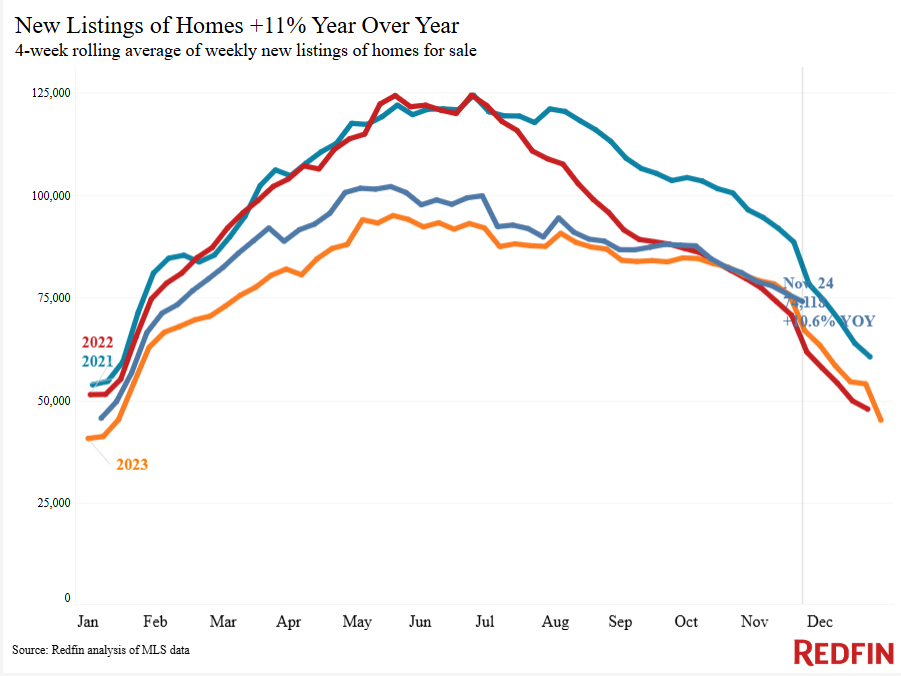

On the selling side, new listings are up 10.6% year over year, the biggest increase since April. That’s also due partly to the fact that Thanksgiving fell into last year’s comparable period. Like the surge in pending sales, we’ll know more soon about whether the improvement in new listings is here to stay.

For Redfin economists’ takes on the housing market, please visit Redfin’s “From Our Economists” page.

Leading indicators

| Indicators of homebuying demand and activity | ||||

| Value (if applicable) | Recent change | Year-over-year change | Source | |

| Daily average 30-year fixed mortgage rate | 6.95% (Nov. 26) | Down from 7.08% one week earlier | Down from 7.3% | Mortgage News Daily |

| Weekly average 30-year fixed mortgage rate | 6.81% (week ending Nov. 27) | Highest level since July | Down from 7.29% | Freddie Mac |

| Mortgage-purchase applications (seasonally adjusted) | Up 12% from a week earlier (as of week ending Nov. 22) | Up 52% | Mortgage Bankers Association | |

| Redfin Homebuyer Demand Index (seasonally adjusted) | Down 5% from a month earlier

(as of week ending Nov. 24) |

Up 7% | Redfin Homebuyer Demand Index a measure of tours and other homebuying services from Redfin agents | |

| Touring activity | Down 8% from the start of the year (as of Nov. 25) | At this time last year, it was down 42% from the start of 2023 | ShowingTime, a home touring technology company | |

| Google searches for “home for sale” | Unchanged from a month earlier (as of Nov. 25) | Unchanged | Google Trends | |

Key housing-market data

| U.S. highlights: Four weeks ending Nov. 24, 2024

Redfin’s national metrics include data from 400+ U.S. metro areas, and is based on homes listed and/or sold during the period. Weekly housing-market data goes back through 2015. Subject to revision. |

|||

| Four weeks ending Nov. 24, 2024 | Year-over-year change | Notes | |

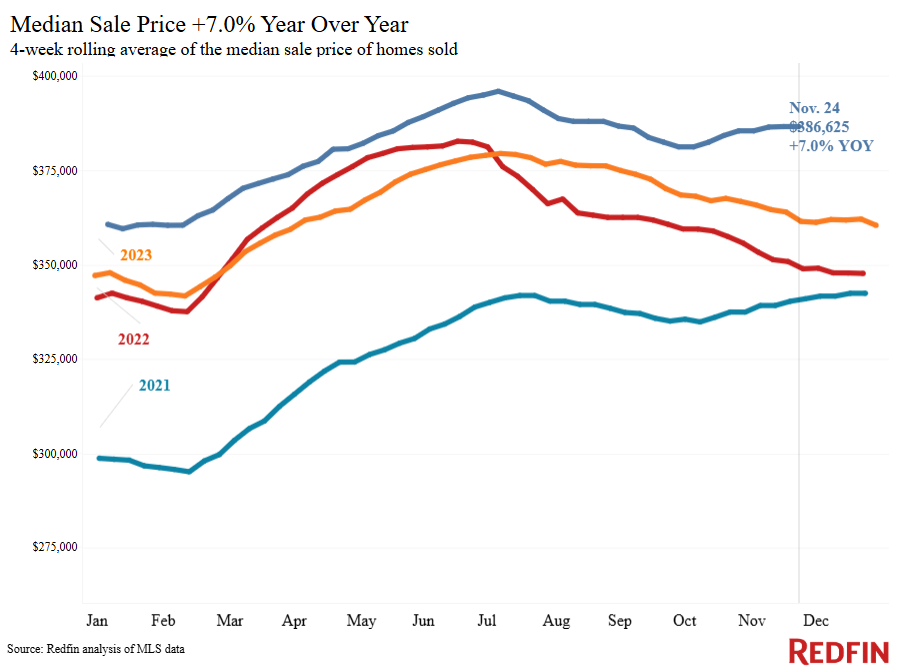

| Median sale price | $386,625 | 7% | Biggest increase since Sept. 2022 |

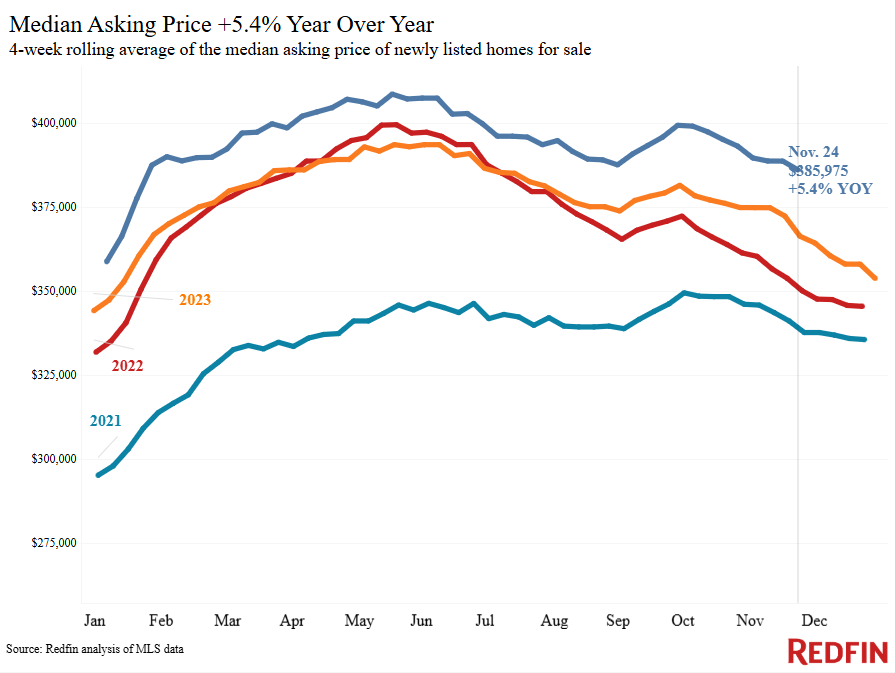

| Median asking price | $385,975 | 5.4% | |

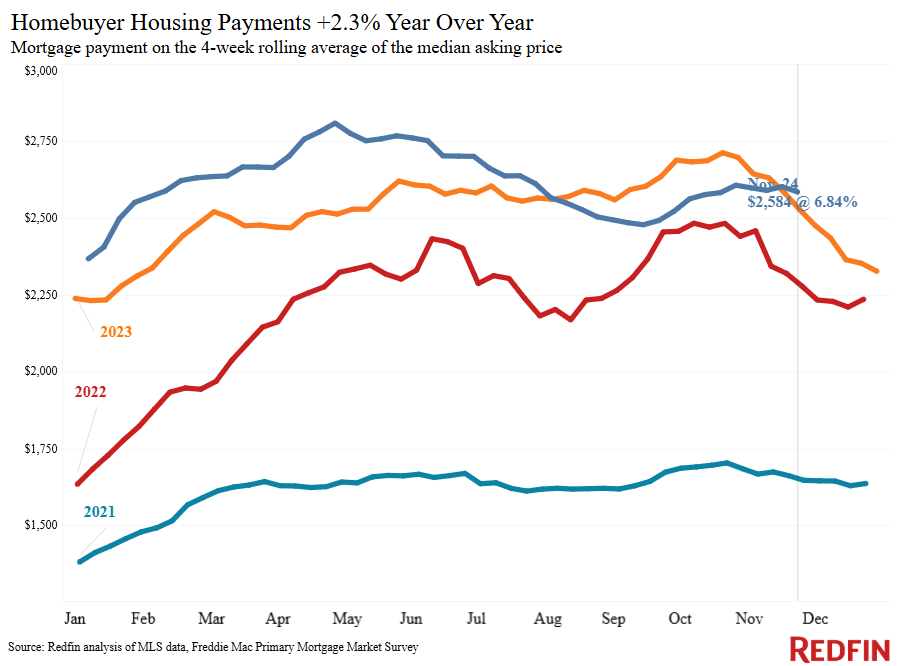

| Median monthly mortgage payment | $2,578 at a 6.81% mortgage rate | 2% | |

| Pending sales | 71,773 | 12.1% | Biggest increase since May 2021 (please note that we’re comparing to a period in 2023 that included Thanksgiving) |

| New listings | 74,118 | 10.6% | Biggest increase since April

(please note that we’re comparing to a period in 2023 that included Thanksgiving) |

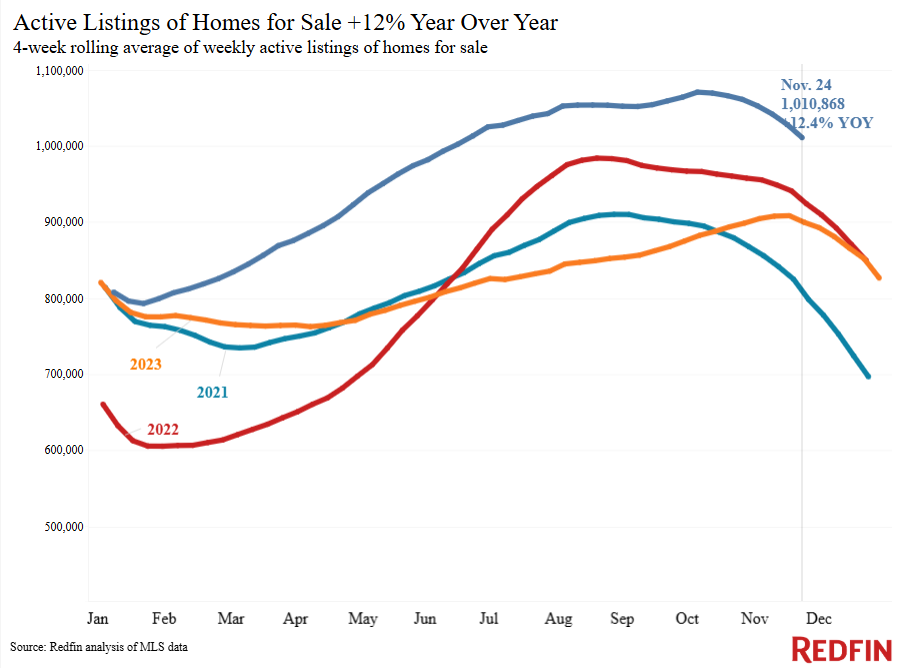

| Active listings | 1,010,868 | 12.4% | Smallest increase since March |

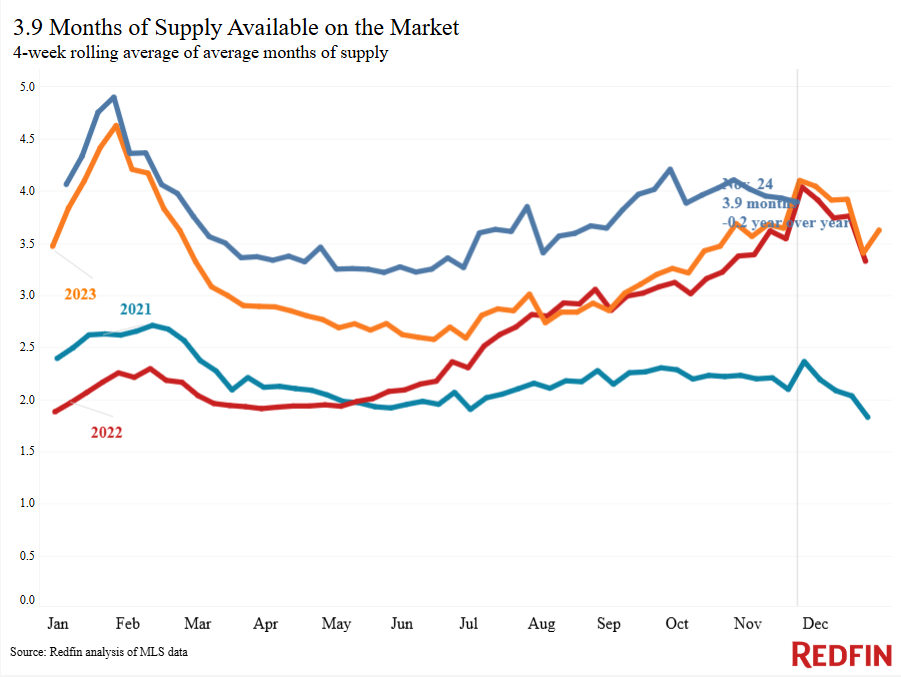

| Months of supply | 3.9 | -0.2 pts. | 4 to 5 months of supply is considered balanced, with a lower number indicating seller’s market conditions. |

| Share of homes off market in two weeks | 29.3% | Down from 34% | |

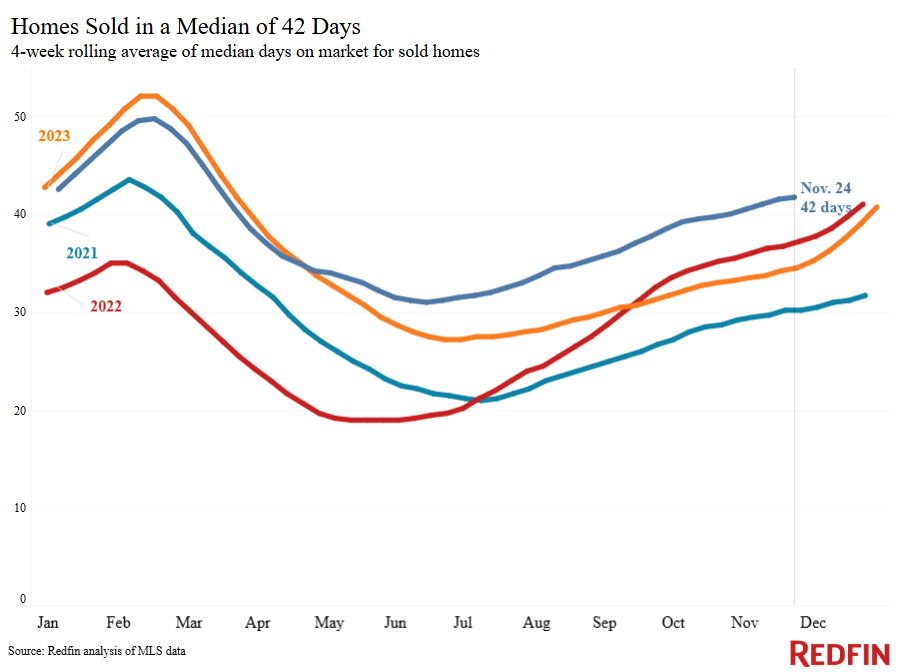

| Median days on market | 42 | +7 days | |

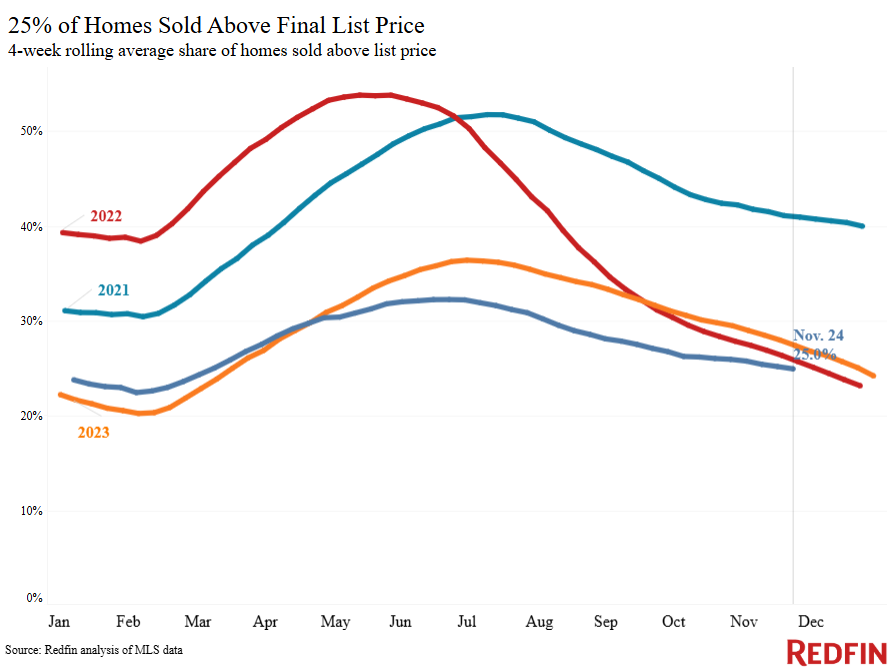

| Share of homes sold above list price | 25% | Down from 27% | |

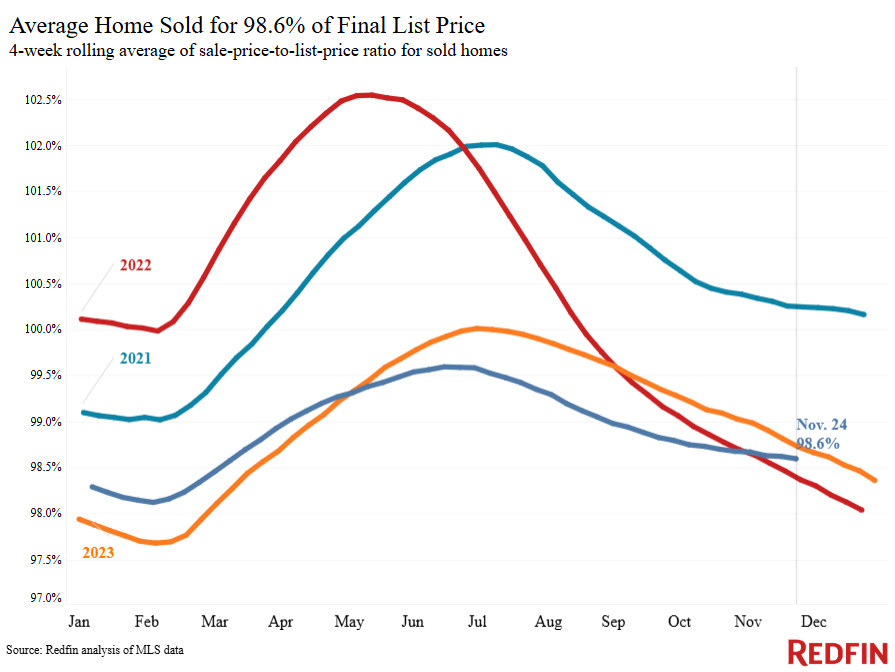

| Average sale-to-list price ratio | 98.6% | -0.1 pt. | |

|

Metro-level highlights: Four weeks ending Nov. 24, 2024 Redfin’s metro-level data includes the 50 most populous U.S. metros. Select metros may be excluded from time to time to ensure data accuracy. |

|||

|---|---|---|---|

| Metros with biggest year-over-year increases | Metros with biggest year-over-year decreases |

Notes |

|

| Median sale price | Philadelphia (21.8%)

Newark, NJ (17.1%) Miami (13.7%) Cleveland (13.6%) Detroit (12.7%) |

Tampa, FL (-1%) |

Declined in 1 metro |

| Pending sales | San Jose, CA (23.7%)

New York (23.7%) San Francisco (23.6%) Dallas (22.4%) Las Vegas (20%) |

Miami (-6.3%)

West Palm Beach, FL (-4.9%) Fort Lauderdale, FL (-3.3%) |

Declined in 3 metros |

| New listings | San Francisco (31.2%)

Washington, D.C. (27.9%) Seattle (25.2%) New York (23.9%) Baltimore (18.6%) |

Austin, TX (-14.2%)

San Antonio (-9.7%) Atlanta (-5.5%) Orlando, FL (-0.1%) |

Declined in 4 metros |

Refer to our metrics definition page for explanations of all the metrics used in this report.

Written by: Dana Anderson