CoreLogic estimates tornadoes on April 26-27 damaged and destroyed up to 7,000 homes and businesses Multiple severe weather systems, or severe convective storms (SCS), crossed the Great Plains starting Friday, April 26, and continued through Saturday, April 27. A strong, low-pressure system ushered in the requisite meteorological ingredients to create multiple, violent supercells that produced tornadoes across Oklahoma, nearby Lincoln and Omaha, Nebraska, and in southwest Iowa. Understand 2024 Severe Convective Storm Season Risk 2024 SCS Risk Report CoreLogic Estimate: 7,229 Homes Potentially Sustained Tornado Damage CoreLogic estimated that tornadoes across Nebraska, Iowa, and Oklahoma may have damaged1 7,229 single- and multifamily residential properties across the country from April 26 to 27. The combined reconstruction cost of the 7,229 residential properties is $2.1 billion (Table 1). Note, not all homes within the tornado path boundaries were damaged. Homes that were damaged may not be total losses up to the full …

US CoreLogic S&P Case-Shiller Index Bucks Trend, Reaccelerates to 6.4% in February

Monthly appreciation in February heated up beyond the typical seasonal uptick, pushing prices up by 0.6% As with many economic indicators, the road to normalizing housing markets remains bumpy. While home sales and inventories are improving from last year’s bottom, higher mortgage rates continue to challenge affordability and keep many potential buyers on the sidelines. Despite new listings jumping by double digits in many markets, pending home sales activity is tracking about 5% to 7% higher through March compared with last year. Overall, looking across housing markets indicators, including days on market and sales-to-list-price ratios, housing market trends are pretty similar to last year. This suggests that the stabilization of mortgage rates below the current levels and a slower rate of home price appreciation will be needed to further unthaw the market. Still, given the persistent imbalance between buyers and sellers, home price growth remains startlingly strong, as monthly gains …

HousingWire Selects VP, Account Manager Brian Sandrib as 2024 Rising Star

Sandrib recognized among the emerging leaders who are making their mark with leadership qualities and innovative ideas in real estate. IRVINE, Calif. – April 29, 2024 – ATTOM, a leading curator of land, property, and real estate data, is pleased to announce that Brian Sandrib, VP, Account Manager for ATTOM, has been named a recipient of the HousingWire Rising Star Award, recognizing the top 80 leaders ages 40 years and younger who are driving the mortgage, real estate and fintech industries forward. Sandrib is featured on this year’s list located on the HousingWire website and is selected for being an emerging leader who has come to the surface to help guide his company, teams and clients to a more successful and promising future. This year’s Rising Stars were selected by HousingWire’s selection committee based on their professional achievements within their organizations, contributions to the overall housing economy, community outreach, client impact and …

How Do You Ensure AI Ethics In Insurtech?

What are some ethical considerations when using AI and generative AI in insurance? Read on to learn more about the ethics of AI: Artificial Intelligence first surfaced decades ago, but recently there has been a rise in more sophisticated AI technology in insurance— like generative AI, which are systems that can create unique content based on data and patterns they learn from. As AI progresses, its prominence in property insurance will continue to grow. Why? AI can automate the claims processing workflow and detect fraudulent claims. AI-powered technology can conduct virtual inspections and improve risk assessments for underwriters. The applications for generative AI in insurance continue to grow as well thanks to this technology’s ability to ingest enormous amounts of data and assist humans in making better, data-driven decisions. However, insurance providers must be mindful of the regulatory environments they operate within. There are compliance requirements — and therefore ethical …

424: Richard Duncan: U.S. Strong China in Trouble

Podcast: Download I have been asked by many to give my opinion on where the economy is headed and what to do. I have been reluctant to do so because I am not an economist and I do not want to give investment advice. However, I do think I owe

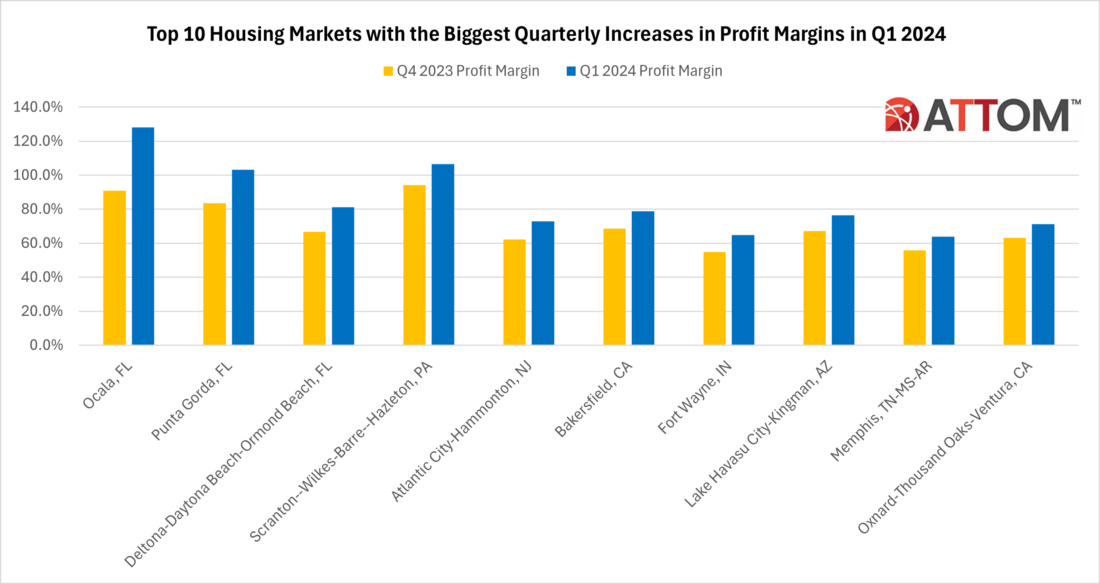

Top 10 Housing Markets with Biggest Quarterly Increases in Profit Margins in Q1 2024

According to ATTOM’s recently released Q1 2024 U.S. Home Sales Report, profit margins on median-priced single-family home and condo sales in the U.S. decreased to 55.3 percent in the first quarter – the lowest level observed in over 2 years. ATTOM’s latest home sales analysis reported that the decrease in average profit margins, declining from 57.1 percent in the fourth quarter of 2023 and from 56.5 percent a year ago, coincided with a quarterly 4.3 percent drop in the median nationwide home price, down to $330,000. The report noted that although prices typically retreat during the slower Winter home-selling season, the recent decline represents one of the most significant quarterly drops in the past decade. Concurrently, investment returns for sellers have decreased for the second consecutive quarter following several rises last year, reaching their lowest point since mid-2021. Also according to the report, despite the decline in seller returns, they …

Profits for U.S. Home Sellers Decline Again in First Quarter of 2024 as Prices Fall

Profit Margins on Typical Home Sales Nationwide Decrease to 55 Percent; Returns Slip Downward as Median U.S. Home Price Slumps 4 percent; IRVINE, Calif. – Apr. 25, 2024 — ATTOM, a leading curator of land, property, and real estate data, today released its first-quarter 2024 U.S. Home Sales Report, which shows that profit margins on median-priced single-family home and condo sales in the United States decreased to 55.3 percent in the first quarter – the smallest level in more than two years. The decline in typical profit margins, from 57.1 percent in the fourth quarter of 2023 and from 56.5 percent a year ago, came as the median nationwide home price went down quarterly by 4.3 percent, to $330,000. While prices often fall back during the slower Winter home-selling season each year, the latest decrease marked one of the largest quarterly declines over the past 10 years. At the same time, investment …

10 of the Best Real Estate APIs for 2024

***This article was originally written in 2022, but has been updated for 2024 to reflect new solution providers*** The growth in the PropTech industry, short for “property technology,” is nowhere better demonstrated than by the growth in application programming interfaces (APIs). These interfaces serve real estate professionals, marketers, investors, and anyone seeking real estate and property information. Real estate APIs are the gateway to extensive data and reports. They use artificial intelligence to streamline property searches, predict market trends, and drive investment decisions. They provide previously unimaginable information such as neighborhood data, crime statistics, geo-based climate risk predictions, and noise pollution. The APIs are integrated into real estate websites for easy access by visitors and subscribers. Here’s a look at what real estate APIs are, how they work, and what they can do for your platform. What Are Real Estate APIs and How Do They Work? APIs are the interface …

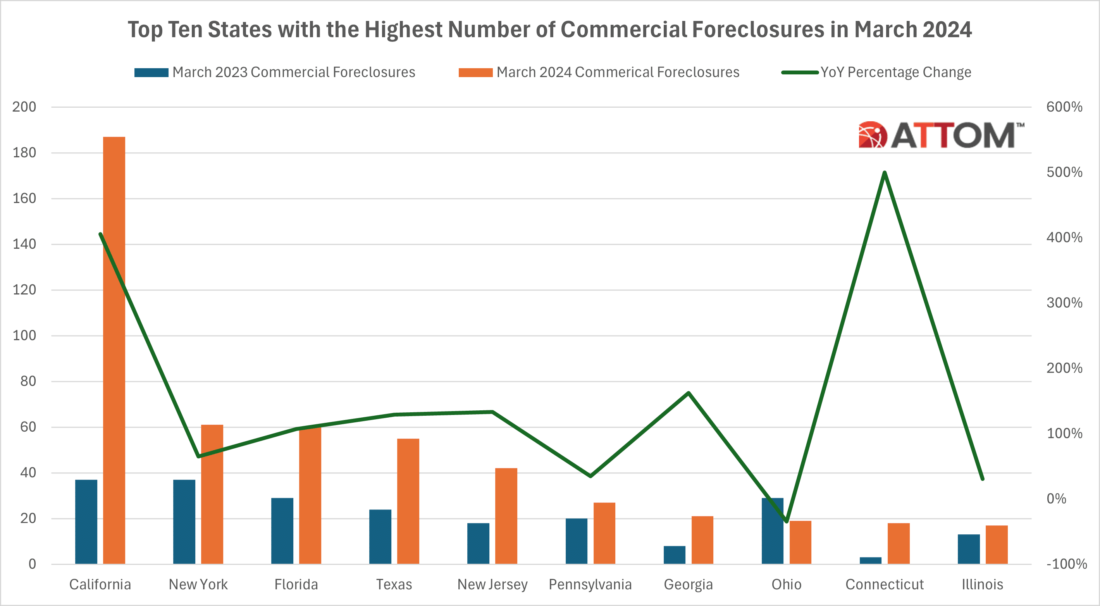

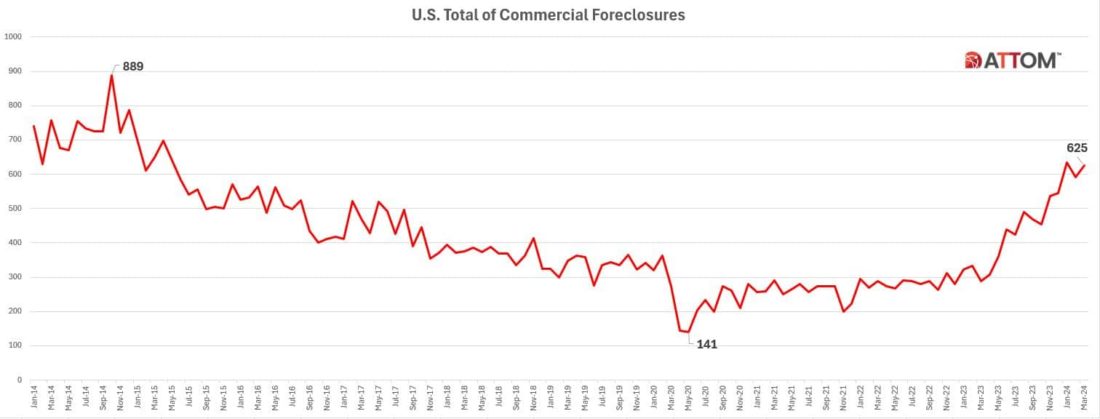

Top 10 States with the Highest Number of Commercial Foreclosure in March 2024

According to ATTOM’s newly released U.S. Commercial Foreclosure Report, there is a persistent uptrend in commercial foreclosures over the years, starting from a minimum of 141 in May 2020 and reaching 625 in March 2024. This signifies a consistent rise over the entire period. ATTOM’s latest commercial foreclosure activity analysis also noted that since January 2014, ATTOM has analyzed data spanning a period of economic recovery, noting 740 commercial foreclosures nationwide. Fluctuations were observed, with a peak of 889 in October 2014, indicating ongoing market adjustments. Despite challenges such as the COVID-19 pandemic, the market displayed adaptability, stabilizing after initial disruptions. In May 2020, commercial foreclosures hit a low of 141, reflecting immediate pandemic impacts and swift response measures. By March 2024, they had risen to 625, marking a 117% year-over-year increase, compared to the 2020 low. The report found that in March 2024, California recorded the highest monthly count …

U.S. Commercial Foreclosures Increase in March 2024

Commercial Foreclosures Increased 6 Percent from Last Month and 117 Percent from Last Year; States with the Most Commercial Foreclosures in March 2024 Included California, New York and Florida IRVINE, Calif. — April 17, 2024 — ATTOM, a leading curator of land, property, and real estate data, today released an updated monthly report on U.S. Commercial Foreclosures. The report reveals a continued increase in commercial foreclosures over the years, from a low of 141 in May 2020 to the current figure of 625 in March 2024. This represents a steady increase throughout the period. Historical Commercial Foreclosure OverviewSince January 2014, ATTOM has been analyzing data, a period marked by the nation’s emergence from economic uncertainty, with commercial foreclosures numbering 740 nationwide. Over the following years, ATTOM monitored fluctuations, observing a peak in October 2014 with 889 commercial foreclosures, indicating ongoing market corrections. Yet, the path wasn’t always upward. Despite challenges like …

- Page 1 of 2

- 1

- 2