Many homeowners are staying put because today’s housing costs are so high.

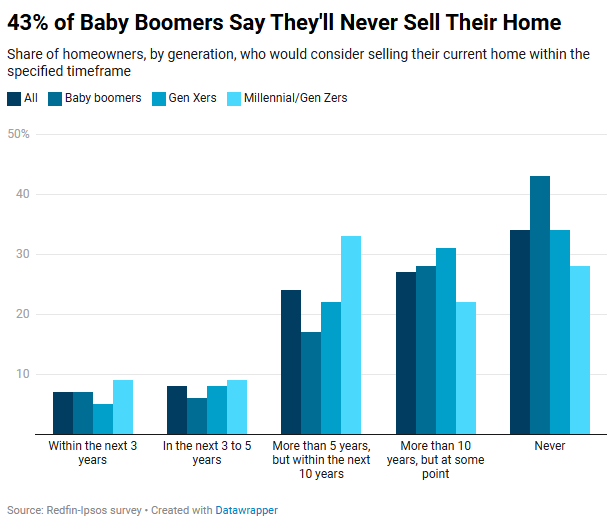

More than one-third (34%) of U.S. homeowners say they’ll never sell their home, according to a recent Redfin-commissioned survey. Another 27% say they wouldn’t consider selling for at least 10 years. Roughly one-quarter (24%) plan to sell in five to 10 years, while just 8% plan to sell in three to five years and 7% within the next three years.

Broken down by generation, older homeowners are more likely than their younger counterparts to say they’ll never sell. More than two of every five (43%) baby boomer homeowners say they’ll never sell, compared to 34% of Gen X owners and 28% of millennial/Gen Z owners.

The survey findings in this report are from a Redfin-commissioned survey conducted by Ipsos in September 2024, fielded to 1,802 U.S. residents aged 18-65. This report focuses on the 471 homeowners who answered the question “When would you consider selling your current home?” and the 267 homeowners who answered the question “You mentioned you have lived in your house for several years and do not plan on selling soon. Why do you intend to stay in your current home”? For the first question, 127 baby boomers (aged 60-65), 203 Gen Xers (aged 44-59) and 141 millennial/Gen Zers (aged 18-43) responded.

The fact that the lion’s share of homeowners say they’ll never sell is one reason new listings are below pre-pandemic levels in much of the country, though listings have started ticking up in recent months. A recent Redfin analysis found that just 25 of every 1,000 U.S. homes changed hands in the first eight months of 2024, the lowest turnover rate in decades.

Homeowners are staying put because their home is paid off, or they just don’t want to move

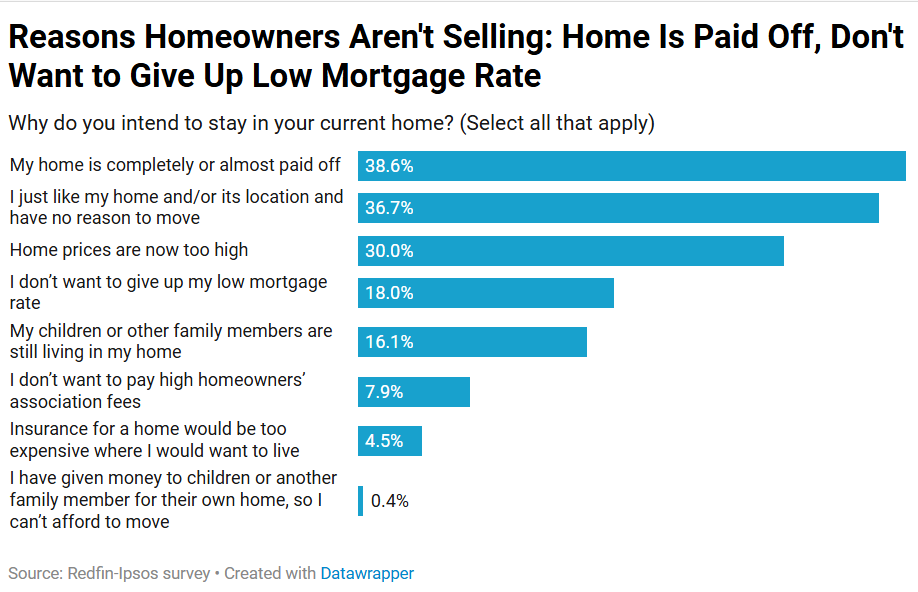

Nearly two in five (39%) homeowners who don’t plan to sell anytime soon say it’s because their home is almost or completely paid off, making that the most commonly cited reason. Homeowners who have paid off their mortgage are motivated to stay put because it means they own their home free and clear, and get to live there while paying only for things like property taxes and HOA fees. Almost as many respondents (37%) said they’re not selling because they simply like their home and have no reason to move.

Affordability is another major reason homeowners are hesitant to sell. Nearly one-third (30%) of respondents said they’re staying in their current home because today’s home prices are too high, and 18% don’t want to give up their low mortgage rate. This survey question was asked to respondents who have owned their home for at least six years and have no intention of selling within the next five years.

Housing costs have risen significantly since before the pandemic; home prices are up roughly 40% since then, and the weekly average mortgage rate is 6.91%, up from just under 4% in 2019. A recent Redfin analysis found that more than 85% of U.S. homeowners with mortgages have an interest rate below 6%.

“The just-because movers—those who just want a bigger or nicer house—are staying put, mostly because it’s so expensive to buy a new house,” said Marije Kruythoff, a Redfin Premier agent in Los Angeles. “The people who are selling are doing so because they need to. Either they’re relocating to a different part of the country, or they’re moving due to a major life event like having a baby or taking a new job on the opposite side of the city.”

Written by: Dana Anderson