On a recent episode of the AZREIA Show, Michael Del Prete talks with Sophia Willets who shares her journey about growing up in a real estate investor family to becoming a successful multifamily real estate investor herself. She discusses the advantages of starting in single-family homes before moving to multifamily properties, her strategy for off-market deals, and how she achieved significant returns on her investments. She also talks about the challenges she faced, including losing everything in the 2007 financial crisis and rebuilding her career and personal life. Click here to listen. The post How to Succeed in Multifamily Real Estate Investing appeared first on Real Estate Investing Today.

CoreLogic Says Rent Growth Posts Highest Annual Increase Since Spring ’23

According to the latest CoreLogic Single-Family Rent Index (SFRI), U.S. single-family home rental prices rose by 3.4% year over year in February 2024 – the strongest growth recorded in 10 months. CoreLogic says February’s annual rental cost increases could again signal that Americans are slowly migrating back to larger, more expensive coastal metros. “Single-family rent growth regained strength in February, posting the highest annual appreciation since April 2023…Monthly rent growth also picked up in February and was higher than what is typically recorded in winter months. Lower-priced properties had the smallest annual rent growth in February, which should be welcome news to renters…” Said Molly Boesel, principal economist for CoreLogic. Click here to read the full report at CoreLogic. The post CoreLogic Says Rent Growth Posts Highest Annual Increase Since Spring ’23 appeared first on Real Estate Investing Today.

Nearly 40% of Homeowners Couldn’t Afford Their Home If They Were to Buy It Today

Many U.S. homeowners couldn’t afford to buy their home if they were to purchase it today because home prices have doubled over the last decade, and monthly housing costs are at an all-time high due to elevated mortgage rates. Nearly two of every five (38%) homeowners don’t believe they could afford to buy their own home if they were purchasing it today. This is according to a Redfin-commissioned survey of roughly 3,000 U.S. residents conducted by Qualtrics in February 2024. This report focuses on the 1,988 respondents who indicated they are homeowners. The relevant question was: “If you were looking to purchase a home, do you think you could afford a home like yours in your neighborhood today?” Nearly three in five (59%) homeowners who answered this question have lived in their home for at least 10 years, and another 21% have lived in their home for at least five …

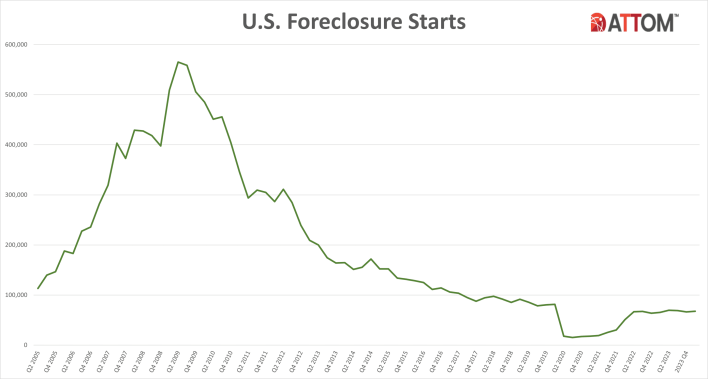

Foreclosure Starts Increase Slightly

According to the ATTOM Data’s Q1 2024 Foreclosure Report, there were 95,349 with a foreclosure filing during the first quarter of 2024, up 3% from the previous quarter but down less than 1 percent from one year ago. There were a total of 67,657 U.S. properties that started the foreclosure process in Q1 2024, up 2% from the previous quarter and up 4% from one year ago In addition, the report shows there were a total of 32,878 U.S. properties with foreclosure filings in March 2024, down less than 1 percent from the previous month and down 10% from one year ago. Key Takeaways: Nationwide in March 2024, one in every 4,286 properties had a foreclosure filing. States with the highest foreclosure rates in March 2024 were Illinois (one in every 2,548 housing units with a foreclosure filing); Connecticut (one in every 2,609 housing units); New Jersey (one in every …

Housing Starts & Permits Drop in April ’24

The U.S. government is reporting that privately‐owned housing starts in March, 2024 were at a seasonally adjusted annual rate of 1,321,000, which is 14.7% lower than February’s revised number and is 4.3% lower than one year ago. March’s rate for units in buildings with five units or more was 290k. Privately‐owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 1,458,000, which is 4.3% below February’s revised number but is 1.5% higher than one year ago. Authorizations of units in buildings with five units or more were at a rate of 433k in March. Click here to read the full report at the U.S. Census Bureau. The post Housing Starts & Permits Drop in April ’24 appeared first on Real Estate Investing Today.

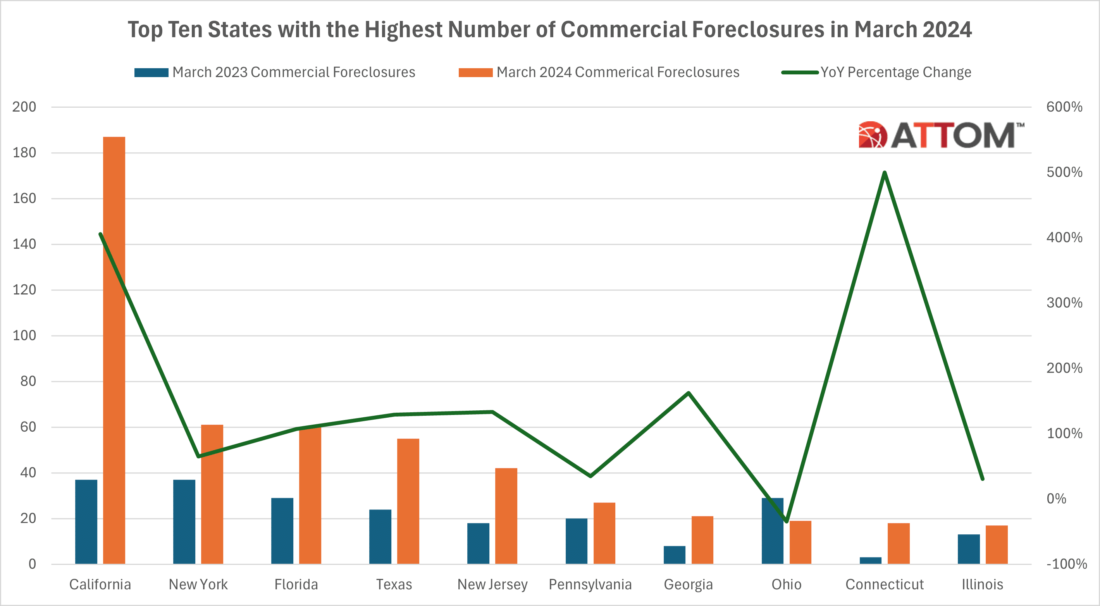

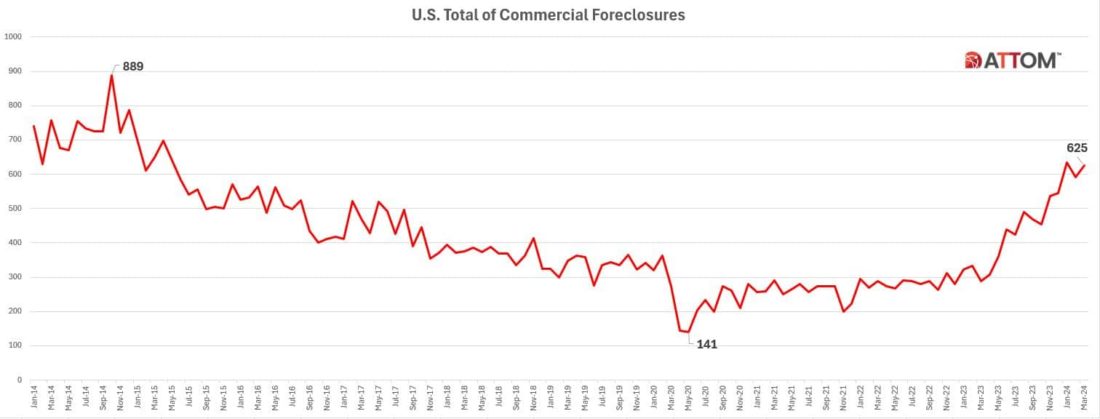

Top 10 States with the Highest Number of Commercial Foreclosure in March 2024

According to ATTOM’s newly released U.S. Commercial Foreclosure Report, there is a persistent uptrend in commercial foreclosures over the years, starting from a minimum of 141 in May 2020 and reaching 625 in March 2024. This signifies a consistent rise over the entire period. ATTOM’s latest commercial foreclosure activity analysis also noted that since January 2014, ATTOM has analyzed data spanning a period of economic recovery, noting 740 commercial foreclosures nationwide. Fluctuations were observed, with a peak of 889 in October 2014, indicating ongoing market adjustments. Despite challenges such as the COVID-19 pandemic, the market displayed adaptability, stabilizing after initial disruptions. In May 2020, commercial foreclosures hit a low of 141, reflecting immediate pandemic impacts and swift response measures. By March 2024, they had risen to 625, marking a 117% year-over-year increase, compared to the 2020 low. The report found that in March 2024, California recorded the highest monthly count …

An Unexpected Surprise: More Homeowners Paying Capital Gains Taxes Due to Strong Price Growth

Almost 8% of U.S. homes sold in 2023 exceeded the capital gains tax limit of $500,000 The 2024 tax season officially ended earlier this week, with the IRS expecting Americans to file more than 146 million returns. It is this time of the year that many homeowners who sold their properties during the previous year will enjoy a significant tax benefit on their homeownership investment. Since 1997, homeowners can exclude housing capital gains for up to $500,000 (or $250,000 for a single filer) when they sell their houses. [1] For anything below the exemption limit, homeowners do not even need to report the sale to the IRS. But with skyrocketing home prices during 2021 and 2022, a growing number of homeowners are finding for the first time that they may owe taxes on excess capital gains beyond the exemption limits. This is because their property values have doubled, tripled …

Looking for Location Intelligence Insights and Data? Ask CoreLogic

April 19, 2024 Looking for Location Intelligence Insights and Data? Ask CoreLogic Whether you realize it or not, location data is instrumental in helping you make everyday decisions. Sometimes, it’s as simple as noticing that the Ace Hardware store is nearer than Home Depot, and since you only need to pick up a few items, you’ll choose convenience first. Other times it can be …

Housing Market Update: The Cost of Buying a Home Hits New Record As Mortgage Rates Jump, Prices Rise 5%

Daily average mortgage rates jumped to their highest level since last November after last week’s disappointing inflation report. Persistently high home prices are exacerbating affordability challenges for buyers. The average daily mortgage rate this week surpassed 7.4%, the highest level since last November, after a hotter-than-expected inflation report and the Fed’s confirmation that interest-rate cuts will be delayed. Home prices are rising, too: The median U.S. home-sale price increased 5% from a year earlier during the four weeks ending April 14, bringing it to $380,250—just $3,095 shy of June 2022’s all-time high. The combination of high mortgage rates and prices have brought homebuyers’ median monthly housing payment to a record $2,775, up 11% year over year. There are signals that buyers are out there touring homes despite rising rates. Mortgage-purchase applications are up 5% week over week, and Redfin’s Homebuyer Demand Index–a measure of requests for tours and other buying …

U.S. Commercial Foreclosures Increase in March 2024

Commercial Foreclosures Increased 6 Percent from Last Month and 117 Percent from Last Year; States with the Most Commercial Foreclosures in March 2024 Included California, New York and Florida IRVINE, Calif. — April 17, 2024 — ATTOM, a leading curator of land, property, and real estate data, today released an updated monthly report on U.S. Commercial Foreclosures. The report reveals a continued increase in commercial foreclosures over the years, from a low of 141 in May 2020 to the current figure of 625 in March 2024. This represents a steady increase throughout the period. Historical Commercial Foreclosure OverviewSince January 2014, ATTOM has been analyzing data, a period marked by the nation’s emergence from economic uncertainty, with commercial foreclosures numbering 740 nationwide. Over the following years, ATTOM monitored fluctuations, observing a peak in October 2014 with 889 commercial foreclosures, indicating ongoing market corrections. Yet, the path wasn’t always upward. Despite challenges like …