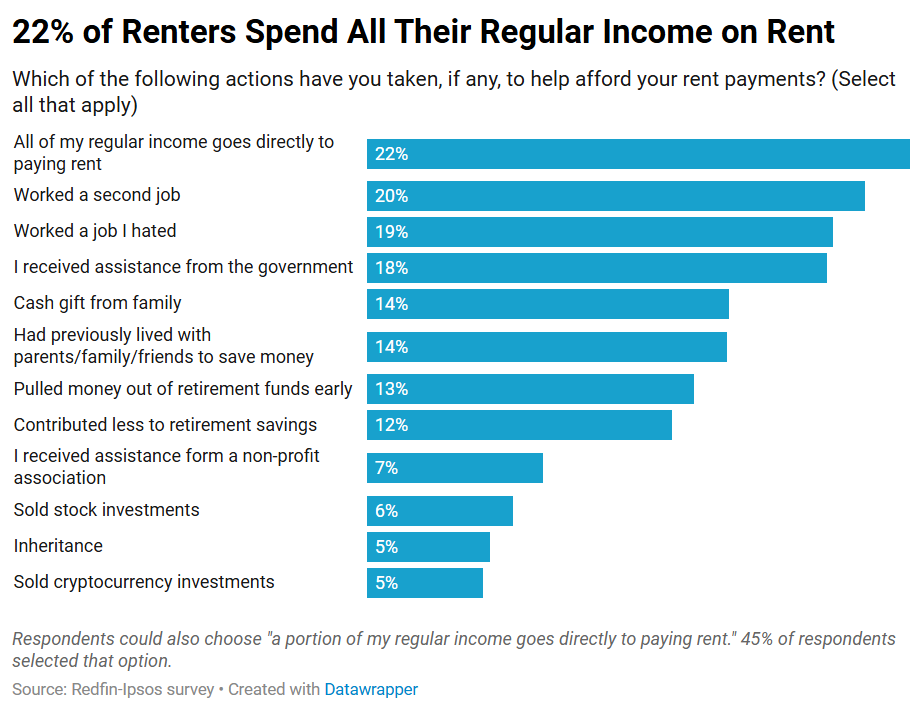

22% of U.S. renters say all their regular income goes toward rent payments, according to a recent Redfin-commissioned survey. 19% of renters report they have worked a job they hated to afford rent.

Just over one in five (22%) U.S. renters say all of their regular income goes directly to paying their rent, according to a recent Redfin-commissioned survey.

Working a second job is also a fairly common way for renters to pay housing costs, with 20% of renters citing that method. Nearly the same share (19%) say they have worked a job they hated to afford rent.

The survey findings in this report are from a Redfin-commissioned survey conducted by Ipsos in September 2024, fielded to 1,802 U.S. residents aged 18-65. This report focuses on the 894 renters who answered this question: Which of the following actions have you taken, if any, to help afford your rent payments? Respondents could select all that apply from a list of options, which are all listed in the chart.

One in seven (14%) renters have used a cash gift from family to pay rent. Renters also report dipping into money that was earmarked for retirement to pay their housing costs. More than one in 10 (13%) pulled money out of retirement funds early, and 12% contributed less to retirement savings.

While U.S. rents have flattened out over the last year, rents are much higher than they were before the pandemic. Because rental prices have surged faster than wages, it’s more difficult than it used to be for Americans to afford rentals, particularly lower-income Americans. Rental affordability may improve in the near future, with prices already showing signs of losing steam as more newly constructed apartments come on the market.

Even though it’s difficult for many Americans to make their rent payments, renting is a popular choice because affordability has become even more strained for people looking to buy a home. A separate Redfin analysis found that the number of renter households is growing three times faster than homeowner households, largely because the cost of buying has increased faster than the cost of renting.

Written by: Dana Anderson