New listings posted their second-biggest annual increase since early summer this week, and pending home sales continue to rise.

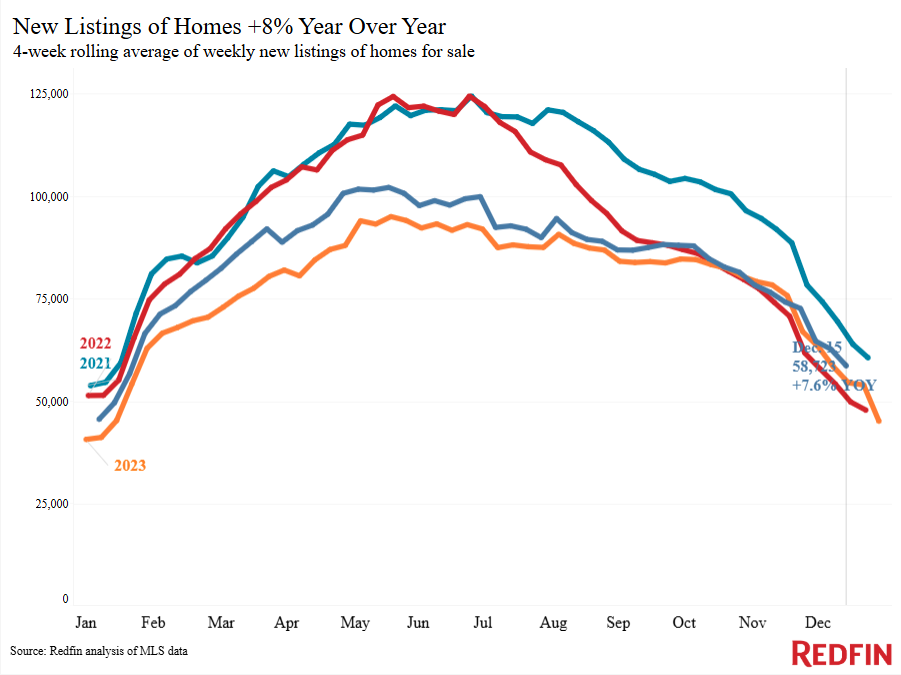

New listings of homes for sale are up 7.6%, the biggest year-over-year increase since June (except the four weeks ending November 24, when the increase was inflated due to Thanksgiving). This is based on data from the four weeks ending December 15.

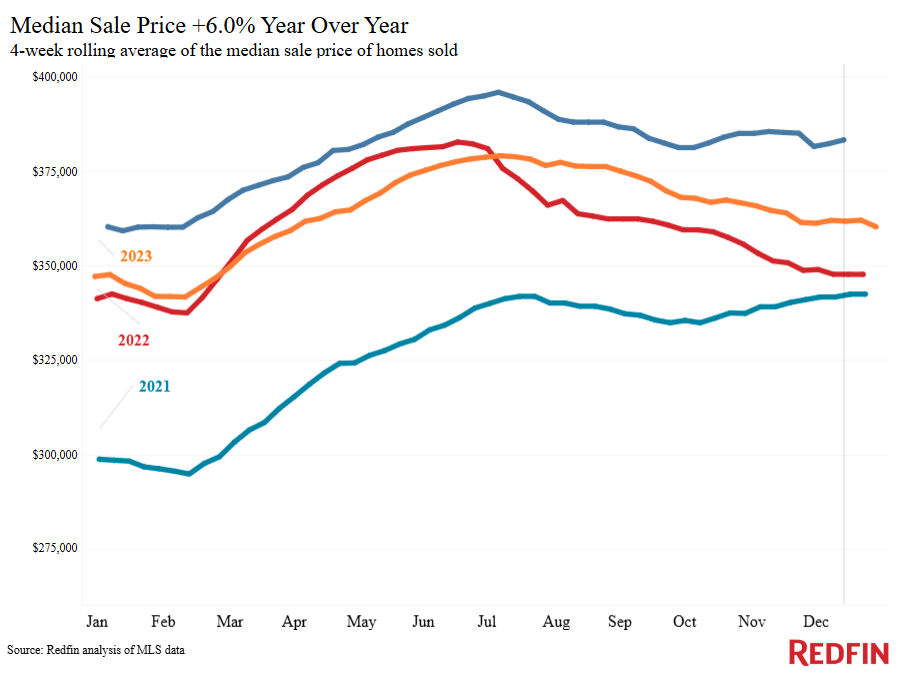

There are several reasons more sellers are putting their homes on the market. One, home prices are high; the median U.S. home sale price is up 6% year over year, the second-biggest increase since October 2022. Two, consumer confidence rose to a 16-month high after November’s election, motivating more sellers to make the major financial decision to list their home. And finally, some sellers are hoping to take advantage of the increased homebuying demand we’ve seen over the last month.

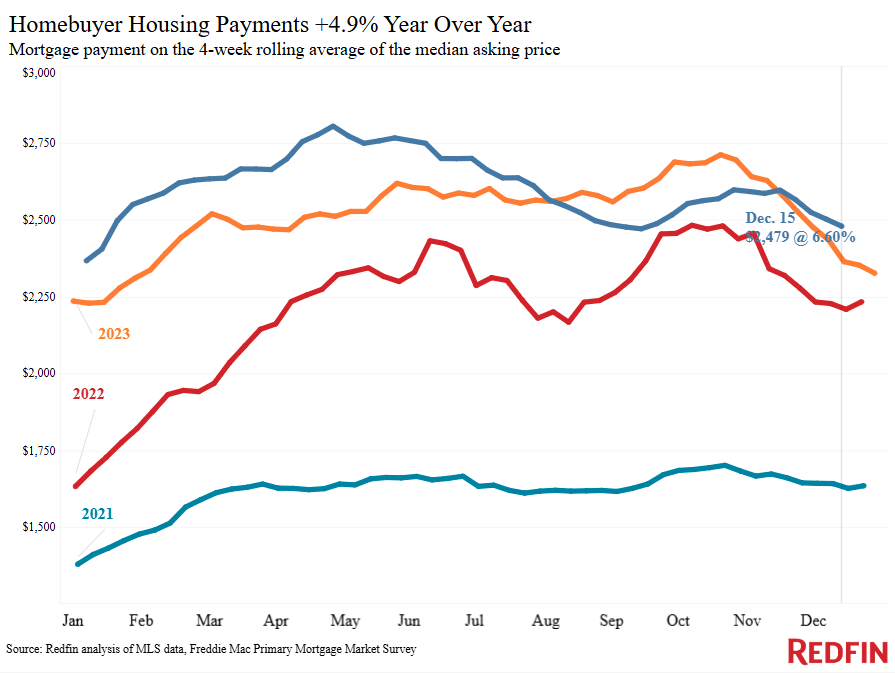

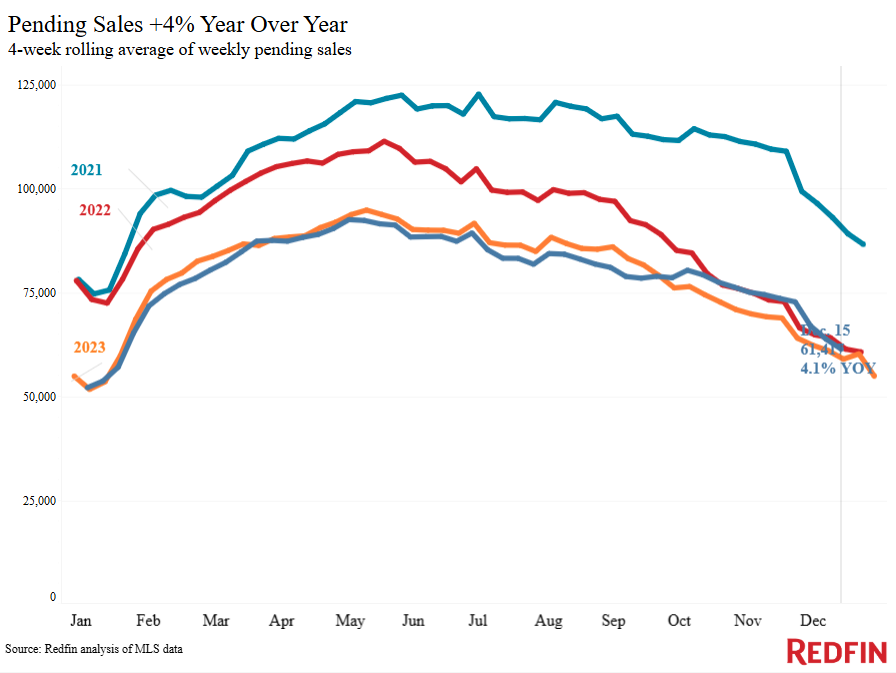

The latest demand signals show it is continuing to strengthen. Redfin’s Homebuyer Demand Index–a seasonally adjusted measure of tours and other buying services from Redfin agents–is up 9% year over year, and is sitting near its highest level since August 2023. Mortgage-purchase applications are up 18% month over month, and pending home sales are up 4.1%, similar to the increases we’ve seen over the last few months. Like sellers, many homebuyers are feeling more confident about making a big financial move after the summer and early-fall slump. Declining mortgage rates are another reason more buyers are coming off the fence: The weekly average rate has declined for three weeks in a row to a two-month low of 6.6%. It’s worth noting that mortgage rates may have bottomed out for the time being; daily average rates rose above 7% on December 18 after the Fed signaled it will cut interest rates twice in 2025, instead of four times.

“We’re having a busier winter than usual; I have a handful of listings ready to hit the market right after the new year. This time last year, it was crickets,” said David Palmer, a Redfin Premier agent in the Seattle area. “Buyers are coming out of the woodwork because they’ve accepted that rates in the 6% to 7% range are the new normal, and they know that if they wait to buy, mortgage rates will probably stay the same but prices will be higher.”

For Redfin economists’ takes on the housing market, please visit Redfin’s “From Our Economists” page.

Leading indicators

| Indicators of homebuying demand and activity | ||||

| Value (if applicable) | Recent change | Year-over-year change | Source | |

| Daily average 30-year fixed mortgage rate | 7.13% (Dec. 18) | Up from 6.68% a week earlier | Up from 6.82% | Mortgage News Daily |

| Weekly average 30-year fixed mortgage rate | 6.6% (week ending Dec. 12) | Down from 6.84% two weeks earlier | Down from 6.95% | Freddie Mac |

| Mortgage-purchase applications (seasonally adjusted) | Up 1% from a week earlier (as of week ending Dec. 13) | Up 6% | Mortgage Bankers Association | |

| Redfin Homebuyer Demand Index (seasonally adjusted) | Up 5% from a month earlier; near highest level since August 2023

(as of week ending Dec. 15) |

Up 9% | Redfin Homebuyer Demand Index a measure of tours and other homebuying services from Redfin agents | |

| Touring activity | Down 23% from the start of the year (as of Dec. 16) | At this time last year, it was down 32% from the start of 2023 | ShowingTime, a home touring technology company | |

| Google searches for “home for sale” | Essentially unchanged from a month earlier (as of Dec. 16) | Down 15% | Google Trends | |

Key housing-market data

| U.S. highlights: Four weeks ending Dec. 15, 2024

Redfin’s national metrics include data from 400+ U.S. metro areas, and is based on homes listed and/or sold during the period. Weekly housing-market data goes back through 2015. Subject to revision. |

|||

| Four weeks ending Dec. 15, 2024 | Year-over-year change | Notes | |

| Median sale price | $383,302 | 6% | Biggest increase since October 2022, except the 4-week period ending Nov. 2024, when the increase was inflated due to Thanksgiving |

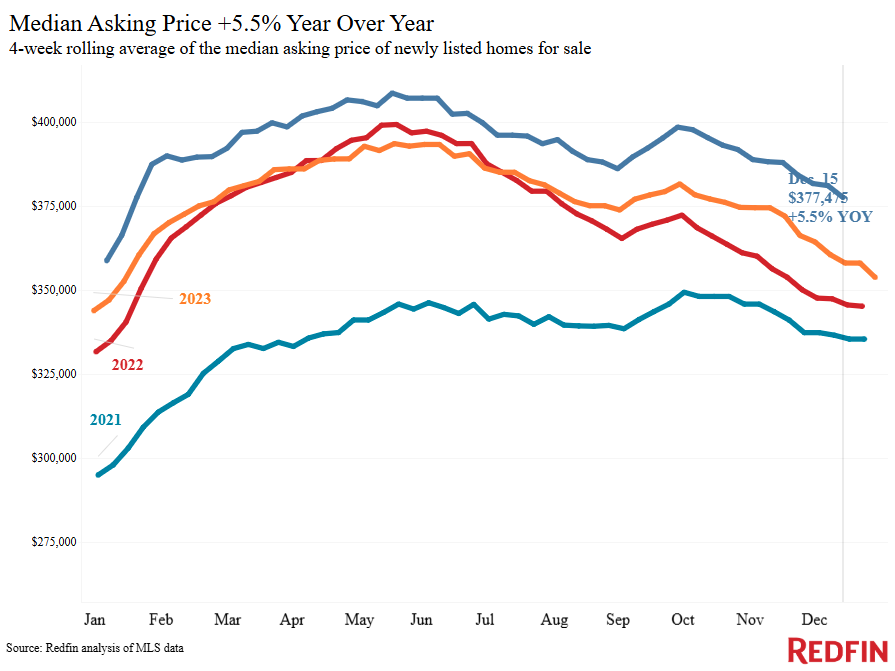

| Median asking price | $377,475 | 5.5% | |

| Median monthly mortgage payment | $2,479 at a 6.6% mortgage rate | 4.9% | Lowest level since September |

| Pending sales | 61,417 | 4.1% | |

| New listings | 58,723 | 7.6% | |

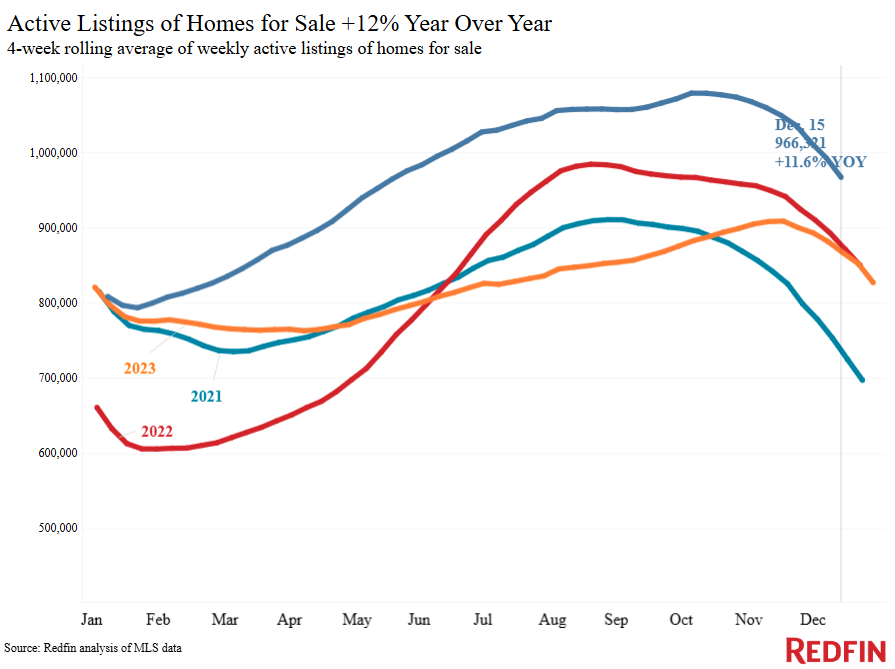

| Active listings | 966,321 | 11.6% | |

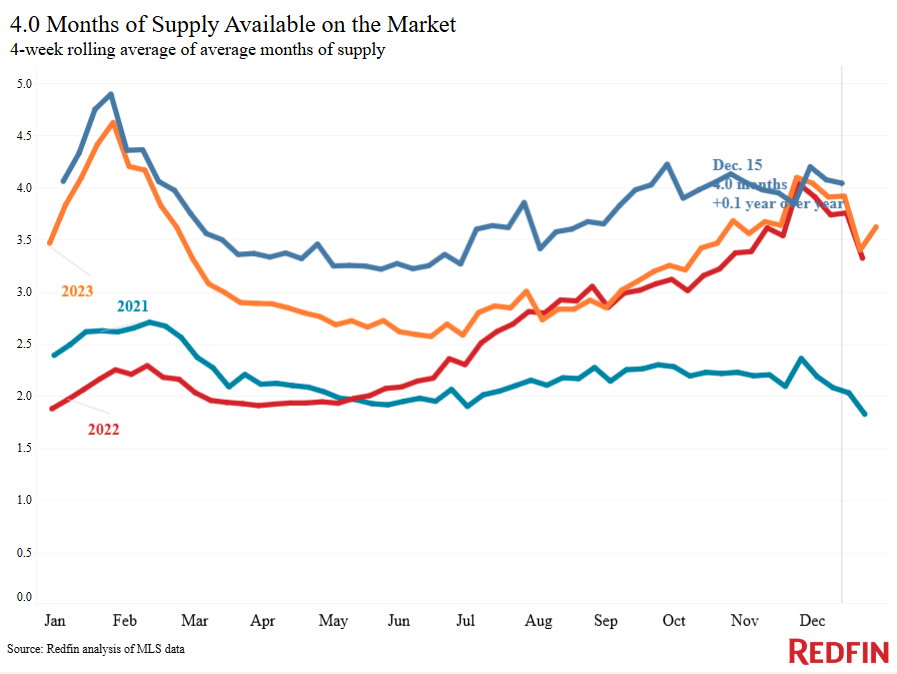

| Months of supply | 4 | +0.1 pt. | 4 to 5 months of supply is considered balanced, with a lower number indicating seller’s market conditions. |

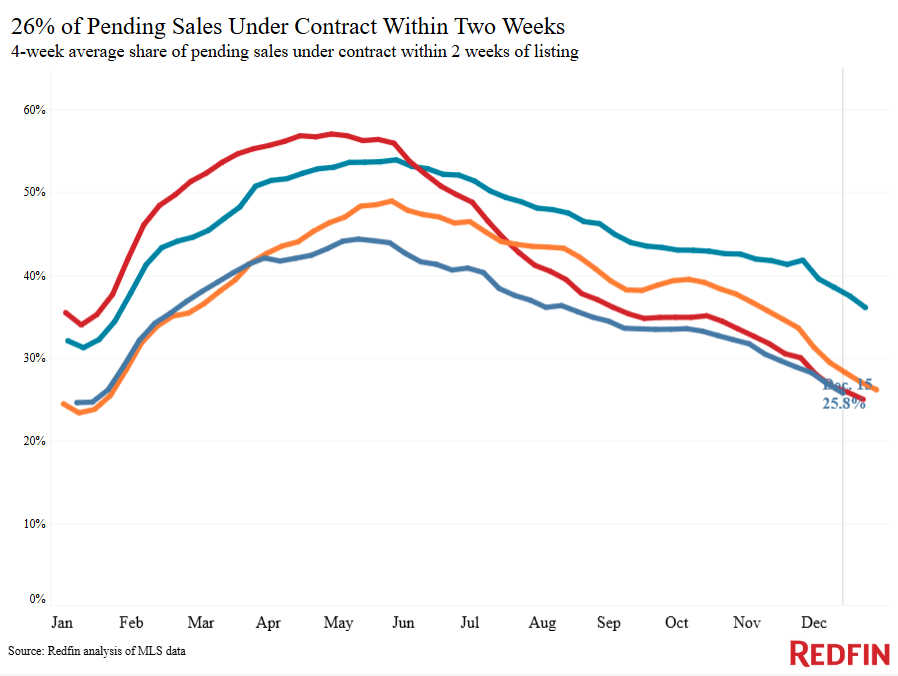

| Share of homes off market in two weeks | 25.8% | Down from 28% | |

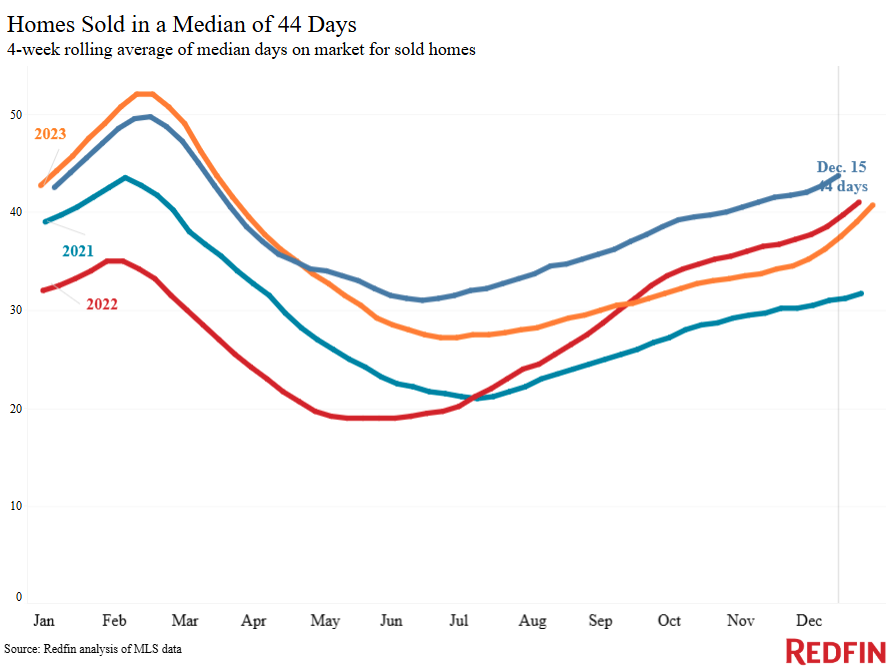

| Median days on market | 44 | +6 days | |

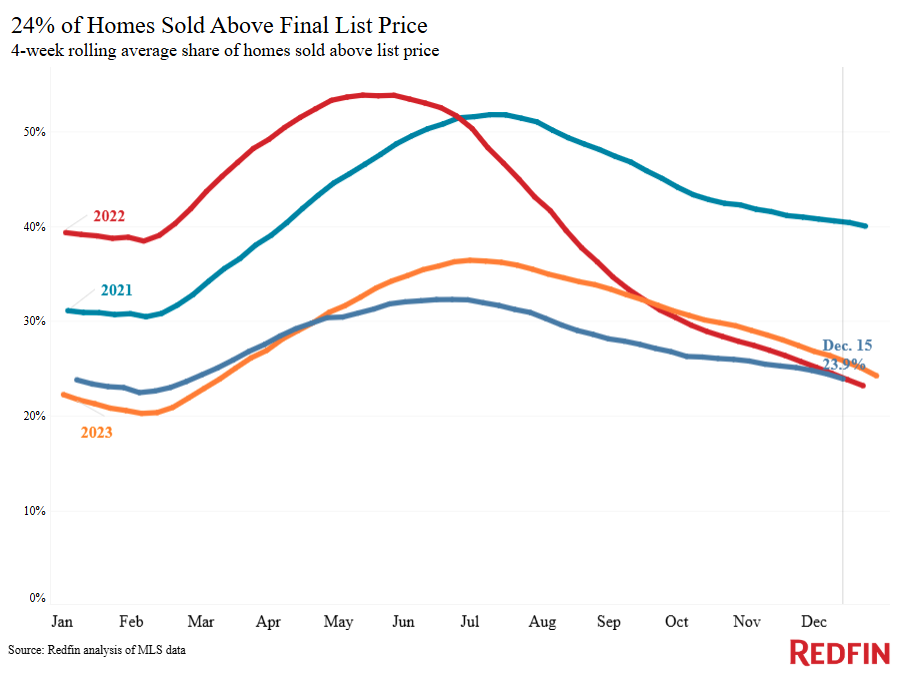

| Share of homes sold above list price | 23.9% | Down from 25% | |

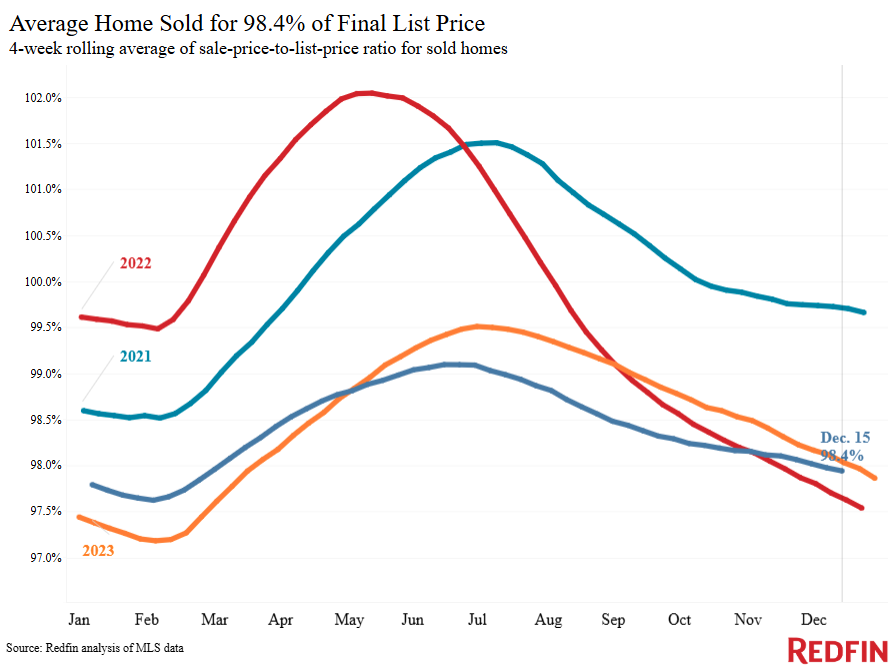

| Average sale-to-list price ratio | 98.4% | -0.1 pt. | |

|

Metro-level highlights: Four weeks ending Dec. 15, 2024 Redfin’s metro-level data includes the 50 most populous U.S. metros. Select metros may be excluded from time to time to ensure data accuracy. |

|||

|---|---|---|---|

| Metros with biggest year-over-year increases | Metros with biggest year-over-year decreases |

Notes |

|

|

Median sale price |

Warren, MI (12.1%)

Milwaukee (12%) Cleveland (11.9%) Miami (11.4%) Chicago (10.6%) |

Tampa, FL (-1.2%) |

Declined in 1 metro |

| Pending sales | Jacksonville, FL (16.4%)

San Jose, CA (14.6%) Cincinnati (13.3%) Columbus, OH (13.3%) Denver (11.5%) |

Warren, MI (-9.4%)

San Diego (-7.2%) Orlando, FL (-5.9%) Houston (-5.6%) Philadelphia (-4.9%) |

Declined in 12 metros |

| New listings | San Francisco (16.5%)

Virginia Beach, VA (16.4%) Oakland, CA (15.8%) Columbus, OH (15.7%) Tampa, FL (15.4%) |

San Antonio (-10%)

Newark, NJ (-8.9%) Detroit (-7.6%) Orlando, FL (-6.2%) San Diego (-6%) |

Declined in 12 metros |

Refer to our metrics definition page for explanations of all the metrics used in this report.

Written by: Dana Anderson