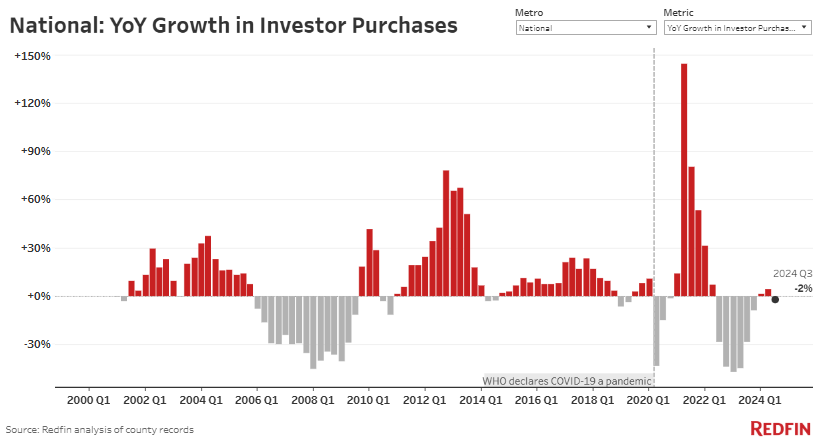

- U.S. investor home purchases fell 2% year over year in the third quarter, a much smaller change than the swings of the last several years. Purchases are now back near pre-pandemic levels.

- In Florida, investor purchases posted double-digit declines amid an ongoing climate and insurance crisis. But investor purchases saw double-digit gains in a handful of metros, led by Las Vegas and Seattle.

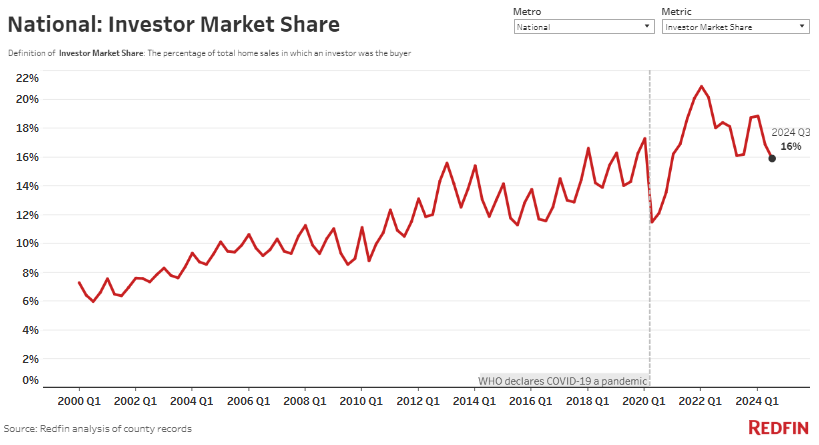

- Investors purchased 16% of the homes that sold in the third quarter, roughly the same share as a year earlier.

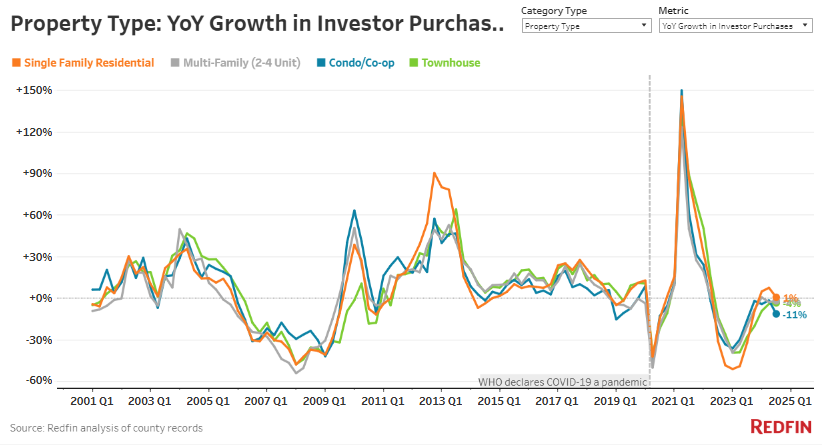

- Investor purchases of condos fell 11%—the biggest drop in a year—driven by declines in Florida.

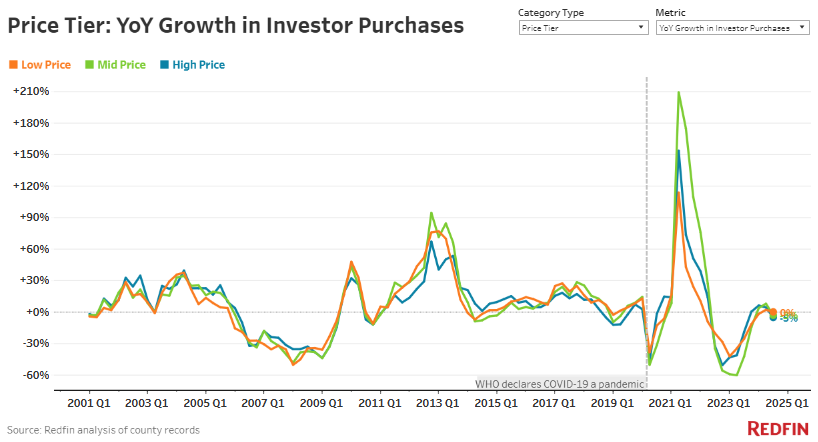

- Broken down by price, low-priced homes made up the lion’s share of investor purchases.

Real estate investors purchased 2.3% fewer homes in the third quarter than they did a year earlier.

The small size of the change is notable because it comes after four years of huge swings driven by the wild pandemic-era housing market. For instance, investor purchases surged as much as 144% year over year in 2021, then dropped as much as 47% last year.

This is based on a Redfin analysis of county-level home purchase records across 39 of the most populous U.S. metropolitan areas going back through 2000. We define an investor as any institution or business that purchases residential real estate, meaning this report covers both institutional and mom-and-pop investors. Please see the end of this report for a more detailed methodology.

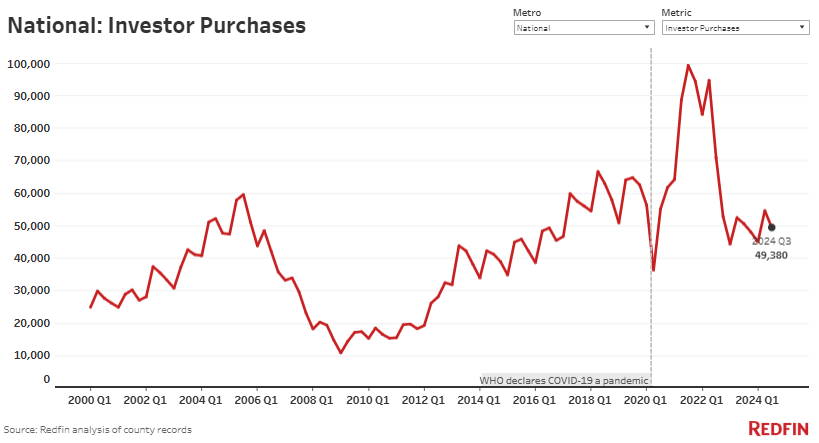

Investor home purchases have settled near pre-pandemic levels of around 50,000 per quarter, with typical seasonal ups and downs. Investors bought 49,380 homes in the third quarter, compared with 50,535 last year. By comparison, investors were buying nearly 100,000 homes per quarter during the 2021 homebuying frenzy.

In dollar terms, investors purchased $38.8 billion worth of homes in the third quarter. That’s up 3.4% from a year earlier, similar to the increase in home-sale prices over the same period.

In September, 8.3% of home listings were from investors, down marginally from 8.7% a year earlier but up slightly from the pre-pandemic share.

“Investors are finding a balance after several years of whiplash: They bought up homes at a frenzied pace in 2021 and the beginning of 2022, then quickly backed off when the housing market slowed as mortgage rates rose,” said Redfin Senior Economist Sheharyar Bokhari. “Now there’s a middle ground. It’s less appealing to buy homes to flip or rent out than it was at the start of the pandemic, when demand from both homebuyers and renters was robust. But it’s more appealing than it was last year, when soaring home prices and borrowing costs put a big damper on demand.”

There are a few key reasons investor activity is settling back to pre-pandemic levels:

- It’s harder for investors to buy homes then sell them for a big profit than it was during the pandemic because home prices and loan costs are high. The typical home sold by an investor in October went for 55% more ($181,567) than the investor bought it for. That’s down from a 64% gain a year earlier. But interest rates are lower than a year ago and homebuying demand has improved a bit over the last few months. Investors who flip homes are still reaping bigger gains than they were before the pandemic, when homes bought by investors were selling for roughly 45% more. Just 7% of homes bought by investors sold for a loss in October; shortly before the pandemic, the norm was about 10%.

- A glut of new apartment supply hitting the market has put a lid on rent growth, meaning it’s less lucrative to buy a rental property than it was during the pandemic. But there is strong demand for rentals, largely because it’s hard for individuals to afford to buy a home. In fact, the number of renter households is growing three times faster than that of homeowner households. Rents have stabilized over the last year, but they’re still much higher than they were before the pandemic–and rents are rising quickly on the East Coast and in the Midwest.

Investors Bought 16% of Homes That Sold in the Third Quarter, the Lowest Share in 4 Years

Real estate investors purchased 15.9% of U.S. homes that sold in the third quarter. That’s

the lowest share since the end of 2020, though it’s down just incrementally from 16.2% a year earlier.

Investors’ market share has fallen to near pre-pandemic levels: In the third quarters of both 2018 and 2019, investors bought roughly 14% of homes that sold.

Investor market share hit a record high of 20.9% at the start of 2022, when investors were taking advantage of low mortgage rates to buy up properties during the pandemic-driven moving boom.

Market share is evening out now because the number of homes investors are buying has returned to around pre-pandemic levels.

Investor Purchases Are Falling Fast in Florida

While investor purchases are stabilizing nationwide, they are falling fast in some metros and rising quickly in others.

Investor purchases fell most in Fort Lauderdale, FL, where they declined 23.8% year over year. Next come Newark, NJ and Miami, which each posted 19.4% declines.

Investors are backing off from buying homes in Florida for similar reasons individuals are backing off: Florida has become a less desirable place to live as the intensity and frequency of natural disasters increase. Additionally, home insurance and HOA fees are skyrocketing.

In Las Vegas, investor purchases rose 27.6% year over year in the third quarter–the biggest increase of any metro in this analysis. Next come Seattle, where investor purchases rose 21.8%, and San Jose, CA, where they rose 19.5%.

Investor Purchases of Condos Fell 11.4% Year Over Year

Investor purchases of condos fell 11.4% year over year during the third quarter, the biggest decline in a year. That’s compared to a 3.5% decline in purchases of townhouses, a 2.1% decline for multifamily properties, and a 0.5% uptick for single-family homes.

The downturn in investor activity in Florida mentioned above partly explains why investor purchases of condos have fallen nationwide. Miami, for example, typically has the most condo sales of any major U.S. metro. But investor purchases of Miami condos have fallen 23.1% year over year, largely because demand for condos in Florida has fallen so much.

Investors bought far more single-family homes in the third quarter than any other property type. Single-family homes made up 69.9% of investor purchases, up from 68% a year earlier. Condos made up 18.2% of their purchases in the third quarter, down from 20.1% a year earlier. Townhouses made up 6.7% and multi-family properties made up 5.2%, both equal to the shares a year earlier.

In terms of market share, investors bought 16% of U.S. condos that sold in the third quarter, the lowest share in three years but down just marginally from 16.8% a year earlier. Investors bought 31.1% of multi-family properties that sold in the third quarter, 15.4% of single-family homes, and 14.9% of townhouses, all roughly unchanged year over year.

Low-Priced Homes Made Up 46% of Investor Purchases

Just under half (45.7%) of investor purchases in the third quarter were low-priced homes, while 30.4% were high-priced and 23.9% were mid-priced.

Investors bought nearly one quarter (22.9%) of low-priced homes that sold in the third quarter, similar to the share a year earlier. They bought 14% of high-priced homes and 11.3% of mid-priced homes, both roughly the same share as last year.

Investors bought roughly the same number of low-priced properties in the third quarter as they did a year earlier. They bought 3% fewer mid-priced homes, and 5.2% fewer high-priced homes. Those declines are small compared to the big swings we’ve seen over the last several years.

Low-priced homes are appealing to investors mainly because they cost less. Because of their relatively low price, investors who buy them have a bigger pool of buyers if they’re looking to re-sell, and a bigger pool of renters if they’re looking to become a landlord.

Other Metro-Level Highlights

Investor Market Share: Q3 2024

- In Miami, investors bought 28.2% of all homes that sold in the third quarter, the biggest share of any metro in this analysis. It’s followed by Anaheim, CA (24.3%) and San Diego (23.3%).

- Investors bought 7.8% of homes that sold in Providence, RI in the third quarter, the smallest share of the metros in this analysis. Next come Montgomery County, PA (8%) and Warren, MI (8.4%).

- Investor market share increased most in Anaheim, CA, rising to 24.3% from 22.2%. Next come Seattle (10.5%, up from 9%) and Sacramento, CA (20.4%, up from 19%).

- Even though investors still have the highest market share in Miami, it has fallen the most from a year ago, dropping to 28.2% from 31.2%. Next comes Fort Lauderdale, FL, where investor market share dropped to 17.6% from 20.4%, followed by Cincinnati (14.9%, down from 17.5%).

Investor Capital Gains: October 2024

- In Detroit, the typical home sold by an investor went for 135% more than they bought it for, the biggest gain among the metros in this analysis. Next are Philadelphia (109% gain) and Newark, NJ (106%).

- The smallest capital gains were in Phoenix (32%), Las Vegas (34%) and Sacramento, CA (39%).

- In Milwaukee, the typical home sold by an investor went for 97% more than they bought it for, up from a 31% gain a year earlier. That’s the biggest gain among the metros Redfin analyzed. Detroit and San Francisco had the next-biggest gains.

- In roughly half of the metros in this analysis, investors’ median capital gain declined year over year. In Washington, D.C., the typical home sold by an investor went for a 45% premium, down from a 74% premium. The next-biggest declines were in Phoenix and Oakland, CA.

| Metro Summary: Investor Home Purchases, Q3 2024 | |||||

| U.S. metro area | Investor purchases, YoY change | Total value of homes bought by investors | Median purchase price of homes bought by investors | Share of purchased homes bought by investors | Share of purchased homes bought by investors, YoY change (in percentage points) |

| Anaheim, CA | 12.1% | $2,547,407,877 | $1,378,000 | 24.3% | 2 pts. |

| Atlanta, GA | -9.7% | $1,219,901,997 | $268,739 | 17.9% | -0.6 pts. |

| Baltimore, MD | -4.2% | $668,861,229 | $190,112 | 15.0% | -0.7 pts. |

| Charlotte, NC | -9.8% | $622,982,186 | $291,750 | 16.9% | -2.1 pts. |

| Chicago, IL | -0.1% | $947,891,036 | $281,250 | 11.8% | 0.2 pts. |

| Cincinnati, OH | -12.5% | $228,732,095 | $185,000 | 14.9% | -2.7 pts. |

| Cleveland, OH | 7.6% | $248,617,457 | $114,950 | 20.8% | 0.9 pts. |

| Columbus, OH | -6.2% | $272,070,931 | $228,000 | 13.9% | -0.1 pts. |

| Denver, CO | -3.5% | $901,778,045 | $535,000 | 13.2% | -1 pts. |

| Detroit, MI | -4.1% | $127,010,846 | $90,000 | 17.9% | 0.1 pts. |

| Fort Lauderdale, FL | -23.8% | $793,947,534 | $405,100 | 17.6% | -2.8 pts. |

| Jacksonville, FL | -5.7% | $355,404,134 | $239,900 | 18.7% | -0.6 pts. |

| Las Vegas, NV | 27.6% | $1,020,643,150 | $420,000 | 22.9% | 0.9 pts. |

| Los Angeles, CA | 7.2% | $4,978,583,050 | $1,090,000 | 20.9% | 0.6 pts. |

| Miami, FL | -19.4% | $1,755,189,275 | $452,500 | 28.2% | -3 pts. |

| Milwaukee, WI | -1.0% | $229,695,400 | $217,400 | 13.4% | 0.2 pts. |

| Minneapolis, MN | 4.1% | $529,571,980 | $300,000 | 10.0% | 0.7 pts. |

| Montgomery County, PA | -15.0% | $229,524,938 | $325,000 | 8.0% | -1.2 pts. |

| Nashville, TN | -14.2% | $579,600,903 | $373,500 | 15.8% | -1.6 pts. |

| New Brunswick, NJ | 1.8% | $597,224,881 | $460,000 | 11.7% | 0.8 pts. |

| New York, NY | 1.2% | $3,721,182,024 | $859,000 | 16.7% | -0.1 pts. |

| Newark, NJ | -19.4% | $340,284,609 | $475,000 | 9.7% | -2.5 pts. |

| Oakland, CA | -6.4% | $1,068,967,500 | $1,100,000 | 16.3% | 0.2 pts. |

| Orlando, FL | -13.3% | $677,999,051 | $313,000 | 18.7% | -1.4 pts. |

| Philadelphia, PA | 0.0% | $200,994,342 | $140,000 | 16.1% | -0.4 pts. |

| Phoenix, AZ | -0.5% | $1,625,389,613 | $400,000 | 18.3% | -0.7 pts. |

| Portland, OR | 5.5% | $419,037,145 | $528,647 | 12.3% | 0.7 pts. |

| Providence, RI | -0.9% | $151,343,369 | $375,000 | 7.8% | -0.6 pts. |

| Riverside, CA | 6.8% | $1,207,733,486 | $567,750 | 16.5% | -1.8 pts. |

| Sacramento, CA | 14.2% | $1,067,525,000 | $610,000 | 20.4% | 1.5 pts. |

| San Diego, CA | 7.5% | $2,264,067,409 | $1,060,750 | 23.3% | 0.9 pts. |

| San Francisco, CA | 13.8% | $1,563,383,985 | $1,800,000 | 21.4% | 0.5 pts. |

| San Jose, CA | 19.5% | $1,379,641,000 | $1,800,000 | 17.3% | 0.9 pts. |

| Seattle, WA | 21.8% | $910,641,733 | $965,000 | 10.5% | 1.5 pts. |

| Tampa, FL | -2.7% | $882,375,677 | $295,000 | 17.8% | -0.1 pts. |

| Virginia Beach, VA | -5.8% | $202,464,818 | $200,000 | 11.1% | -0.2 pts. |

| Warren, MI | -13.2% | $204,603,054 | $195,700 | 8.4% | -0.7 pts. |

| Washington, DC | 15.0% | $979,162,642 | $500,000 | 9.8% | 1.2 pts. |

| West Palm Beach, FL | -16.0% | $1,102,452,536 | $500,000 | 17.4% | -0.2 pts. |

Methodology

For this analysis, we looked at county sale records for homes purchased from January 2000 through September 2024. We define an investor as any buyer whose name includes at least one of the following keywords: LLC, Inc, Trust, Corp, Homes. We also define an investor as any buyer whose ownership code on a purchasing deed includes at least one of the following keywords: association, corporate trustee, company, joint venture, corporate trust. This data may include purchases made through family trusts for personal use.

We analyzed home sales in the 50 most populous metro areas, but only included 39 metros in this report due to non-disclosure of sale prices in some counties. The national figures in this report represent an aggregation of those 39 metros.

When we refer to a “record,” the record dates back to the first quarter of 2000. Data is subject to revision.

Written by: Dana Anderson