Homeowners with kids living under their roof are much more likely to receive help from family with down payments and/or monthly mortgages than their no-kids counterparts, according to a recent Redfin-commissioned survey. That’s partly because they’re buying bigger, more expensive homes.

One-quarter (25%) of recent homebuyers who have kids living at home received a cash gift from family to help fund their down payment, more than double the 12% of recent buyers without kids who received such a gift.

The survey findings in this report are from a Redfin-commissioned survey conducted by Ipsos in September 2024, fielded to 1,802 U.S. residents aged 18-65. This report compares respondents who have children under 18 living in their home to respondents who don’t. Please see the end of this report for more methodology details.

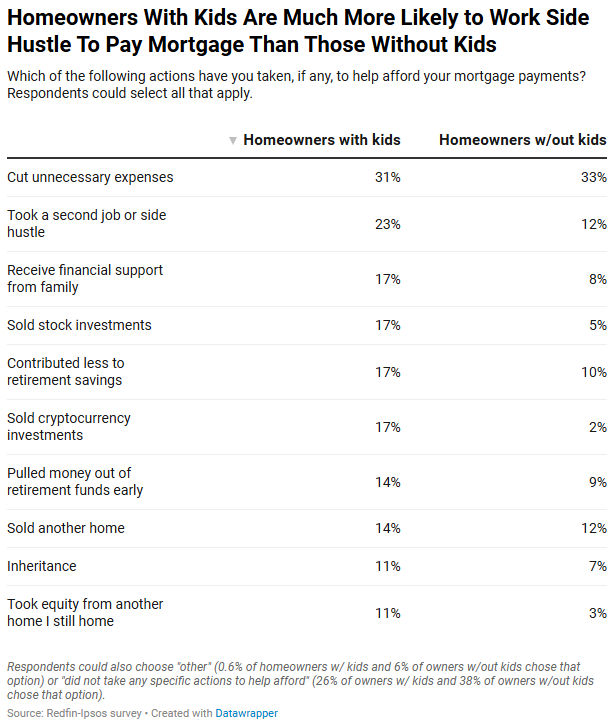

Homeowners with kids living under their roof are also more likely to receive family help for mortgage payments. One in six (17%) homeowners with kids report receiving financial support from family to help pay their mortgage, compared to 8% of those without kids. And 11% of homeowners with kids have used inheritance money to pay their mortgage, versus 7% of those without kids.

Receiving family money is just one way people reported paying their housing expenses. We also asked respondents about a number of other methods people commonly use to pay their mortgage. Homeowners with kids at home were more likely than those without kids to use nearly every method we listed. They’re twice as likely to work a side hustle (23% vs. 12%), and nearly twice as likely to pull money out of retirement funds early (14% vs. 9%).

U.S. housing costs have risen more than 40% since before the pandemic, with soaring home prices and mortgage rates making it difficult for many people—with or without kids—to afford a home. Half of homeowners with kids struggle to afford their housing payments, according to the survey. Homeowners without kids are roughly equally as likely to struggle.

There are several reasons people with kids may be more likely to receive help from family with their down payments and/or mortgage payments:

- People with kids are more likely to buy larger homes with more features and neighborhood amenities, which cost more money. 68% of respondents with kids said indoor space is a “must have” they’d be unwilling to trade off for affordability, compared to 60% of those without kids. In fact, people with kids were more likely than people without kids to rate each of the 19 features we asked about as a “must have.” That includes things like proximity to highly rated schools and grocery stores, space to work from home and homeschool children, and low climate risk. It’s worth noting that people with kids tend to earn more money, which could be one reason they have bigger lists of must-haves. Roughly two-thirds (65%) of respondents with kids earn $50,000 or more, compared to 42% of those without kids.

- Parents may be more likely to provide financial help when it benefits both their children and grandchildren. Redfin Chief Economist Daryl Fairweather said it makes sense that parents are more likely to help their kids pay for housing when doing so also provides their grandchildren with a safe, secure place to live. They are helping multiple family members, including children who have no economic means to better their housing situation, Fairweather said.

- Homeowners with kids under their roof tend to be younger than those without. Nearly 7 in 10 (67%) of respondents with kids are Gen Zers or millennials, compared to 25% of respondents without kids. Younger people are probably more likely to ask for–and receive–help from their parents.

Redfin agents also report that multi-generational homes are becoming more common as it gets more expensive to buy homes. The financial help can go both ways: Older parents helping their grown children and/or adult children helping their parents.

“Monthly costs are so high these days that I’m trying to find big homes for a lot of multi-generational families,” said Julie Zubiate, a Redfin Premier agent in the Bay Area. “A lot of clients who work in tech are looking for homes with ADUs so their older parents can move in, or maybe it’s a Gen Xer looking for a home that’s big enough for their early-20s kids to live in.”

Methodology

The survey findings in this report are from a Redfin-commissioned survey conducted by Ipsos in September 2024, fielded to 1,802 U.S. residents aged 18-65. This report compares respondents who have children under 18 living in their home to respondents who don’t. Much of the report focuses on the 361 respondents with kids and 444 without kids who purchased a home at some point in the 12 months prior to taking the survey.

The first section of this report focuses on this question: “We want to understand how recent homebuyers put together the necessary funds for their down payment. How did you accumulate the money you need for a down payment?” Respondents could select all that apply from a list of 14 options; this report focuses on those who selected “cash gift from family.”

The second section of this report focuses on this question: “Which of the following actions have you taken, if any, to help afford your mortgage payments?” Respondents could select all that apply from a list of 12 options.

We also reference two other survey questions. One asked respondents, “To what extent, if any, do you struggle to afford your regular rent or mortgage payment?” Respondents could choose “I can easily afford them,” “I sometimes struggle, but generally okay,” “I regularly struggle, but sometimes okay,” or “I struggle greatly to afford them.” We considered anyone who selected any of the latter three to “struggle.” The other asked, “When thinking about the next home you live in, which of the following do you consider a must-have feature versus a feature you’d be willing to trade off in order to afford a home?” It listed 19 features; respondents could select “must have” or “willing to compromise to afford a home” for each feature.

Written by: Dana Anderson