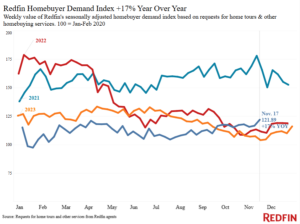

The number of homebuyers and sellers contacting Redfin agents has jumped over the last week, with Redfin’s Homebuyer Demand Index posting its biggest year-over-year increase since early 2022.

Homebuyers are jumping into the market now that the election has passed and the Fed has cut interest rates for the second time in a row.

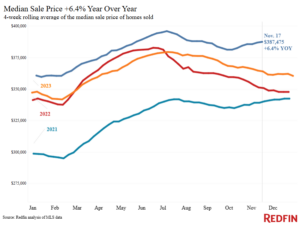

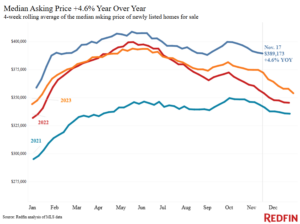

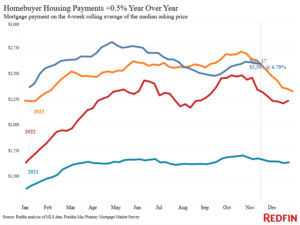

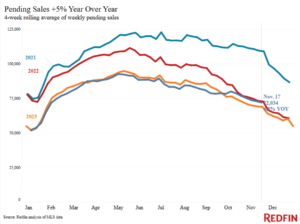

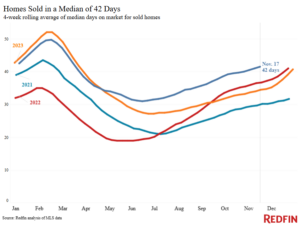

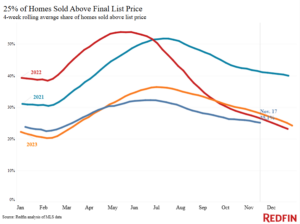

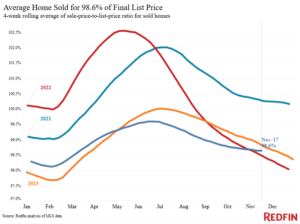

The number of people contacting Redfin agents for help buying and/or selling their home is up by double digits from a year ago. Redfin’s Homebuyer Demand Index–a seasonally adjusted measure of those contacts–rose 17% year over year to its highest level since August 2023, continuing an increase that started immediately after the election. That 17% increase is the biggest since January 2022. It’s worth noting that we’re comparing to a period in 2023 when high mortgage rates were pushing down demand. Today’s weekly average mortgage rate is 6.78%, compared to 7.44% a year ago. Mortgage-purchase applications are up 2% week over week, and pending home sales rose 4.5% year over year during the four weeks ending November 17, in line with the increases we’ve seen over the last month and a half.

“The burst of buyers and sellers jumping into the market is the result of pent-up demand from people who were waiting for the election to pass, and for the Fed to cut interest rates a second time,” said Redfin Economic Research Lead Chen Zhao. “Even though mortgage rates have been rising since both of those things happened, house hunters who had pressed pause are jumping back in. Now we’re keeping a close eye on whether this is a short post-election boom, or if it translates into a steady improvement in pending sales.

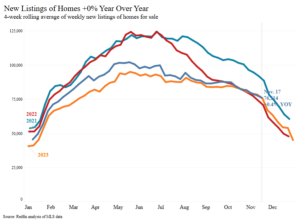

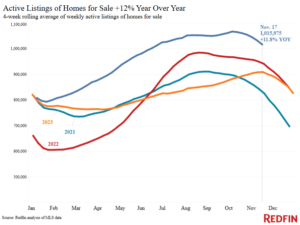

New listings rose marginally (0.4%) year over year, and the total number of homes for sale is up 11.8%.

“The market is moving surprisingly quickly right now, given that rates are fairly high and we’re well into fall, when buyers and sellers are typically winding down for the holidays,” said Meme Loggins, a Redfin Premier agent in Portland, OR. “Some homebuyers are still having trouble getting over the psychological barrier of high mortgage rates, but plenty others are accepting that rates aren’t coming down anytime soon and taking out conventional or FHA loans. I’m advising buyers who can afford today’s high costs to move forward because prices are lower in this area than they were a year ago, and they’re likely to shoot back up soon as competition heats up. And sellers should consider listing now, because there are serious buyers out there–especially for desirable homes.”

For Redfin economists’ takes on the housing market, please visit Redfin’s “From Our Economists” page.

Leading indicators

| Indicators of homebuying demand and activity | ||||

| Value (if applicable) | Recent change | Year-over-year change | Source | |

| Daily average 30-year fixed mortgage rate | 7.05% (Nov. 20) | Near highest level since July, but down from 7.13% 2 weeks earlier | Down from 7.37% | Mortgage News Daily |

| Weekly average 30-year fixed mortgage rate | 6.78% (week ending Nov. 14) | Near highest level since July | Down from 7.44% | Freddie Mac |

| Mortgage-purchase applications (seasonally adjusted) | Up 2% from a week earlier (as of week ending Nov. 15) | Down 1% | Mortgage Bankers Association | |

| Redfin Homebuyer Demand Index (seasonally adjusted) | Highest level since August 2023

(as of week ending Nov. 17) |

Up 17%

Biggest increase in nearly 3 years |

Redfin Homebuyer Demand Index a measure of tours and other homebuying services from Redfin agents | |

| Touring activity | Down 3% from the start of the year (as of Nov. 16) | At this time last year, it was down 19% from the start of 2023 | ShowingTime, a home touring technology company | |

| Google searches for “home for sale” | Up 15% from a month earlier (as of Nov. 18) | Unchanged | Google Trends | |

Key housing-market data

| U.S. highlights: Four weeks ending Nov. 17, 2024

Redfin’s national metrics include data from 400+ U.S. metro areas, and is based on homes listed and/or sold during the period. Weekly housing-market data goes back through 2015. Subject to revision. |

|||

| Four weeks ending Nov. 17, 2024 | Year-over-year change | Notes | |

| Median sale price | $387,475 | 6.4% | Biggest increase since Oct. 2022 |

| Median asking price | $389,173 | 4.6% | |

| Median monthly mortgage payment | $2,593 at a 6.78% mortgage rate | 0.5% | |

| Pending sales | 72,034 | 4.5% | |

| New listings | 76,114 | 0.4% | |

| Active listings | 1,015,975 | 11.8% | Smallest increase since March |

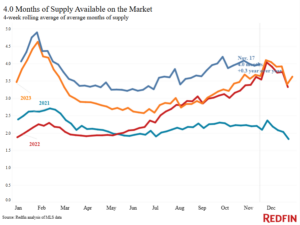

| Months of supply | 4 | +0.3 pts. | 4 to 5 months of supply is considered balanced, with a lower number indicating seller’s market conditions. |

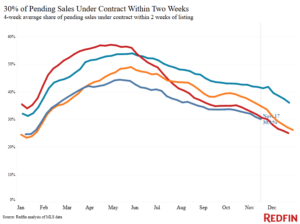

| Share of homes off market in two weeks | 30.1% | Down from 35% | |

| Median days on market | 42 | +7 days | |

| Share of homes sold above list price | 25.1% | Down from 28% | |

| Average sale-to-list price ratio | 98.6% | -0.2 pts. | |

|

Metro-level highlights: Four weeks ending Nov. 17, 2024 Redfin’s metro-level data includes the 50 most populous U.S. metros. Select metros may be excluded from time to time to ensure data accuracy. |

|||

|---|---|---|---|

| Metros with biggest year-over-year increases | Metros with biggest year-over-year decreases | Notes | |

| Median sale price | Cleveland (13.7%)

Newark, NJ (12.5%) Milwaukee (12.4%) Detroit (11.8%) Miami (11.5%) |

Atlanta (-0.8%)

San Antonio (-0.3%) |

Declined in 2 metros |

| Pending sales | San Jose, CA (17.8%)

Dallas (17.4%) New York (15.5%) Portland, OR (14.9%) Fort Worth, TX (14.1%) |

Miami (-14.3%)

Fort Lauderdale, FL (-12.8%) West Palm Beach, FL (-11.7%) Atlanta (-5.7%) Houston (-5.3%) |

Increased in 38 metros |

| New listings | Washington, D.C. (15.3%)

San Francisco (15.1%) Seattle (14.3%) New York (12.8%) Baltimore (8.3%) |

Austin, TX (-21.4%)

Atlanta (-16.3%) San Antonio (-15%) Las Vegas (-13.1%) Detroit (-9%) |

Declined in 20 metros |

Refer to our metrics definition page for explanations of all the metrics used in this report.

Written by: Dana Anderson