The risk of selling at a loss varies significantly in different parts of the country; nearly 20% of sellers are at risk of losing money in San Francisco, compared to virtually 0% of sellers in Providence, RI. Nearly one in 10 condos are at risk of selling at a loss. And nearly 30% of condos bought after the pandemic are at risk. 16.4% of sellers who bought their homes after the pandemic are at risk of selling at a loss in today’s market, compared to 9% of those who bought during the pandemic and 1.8% of those who bought before the pandemic. Nearly half (47.5%) of for-sale homes in Austin that were bought after the pandemic are at risk of selling at a loss—the highest share among major metros. If U.S. home prices were to fall by 1%, the overall share of homes at risk of selling at a loss …

Home Prices Grow at Slowest Pace in Nearly 2 Years

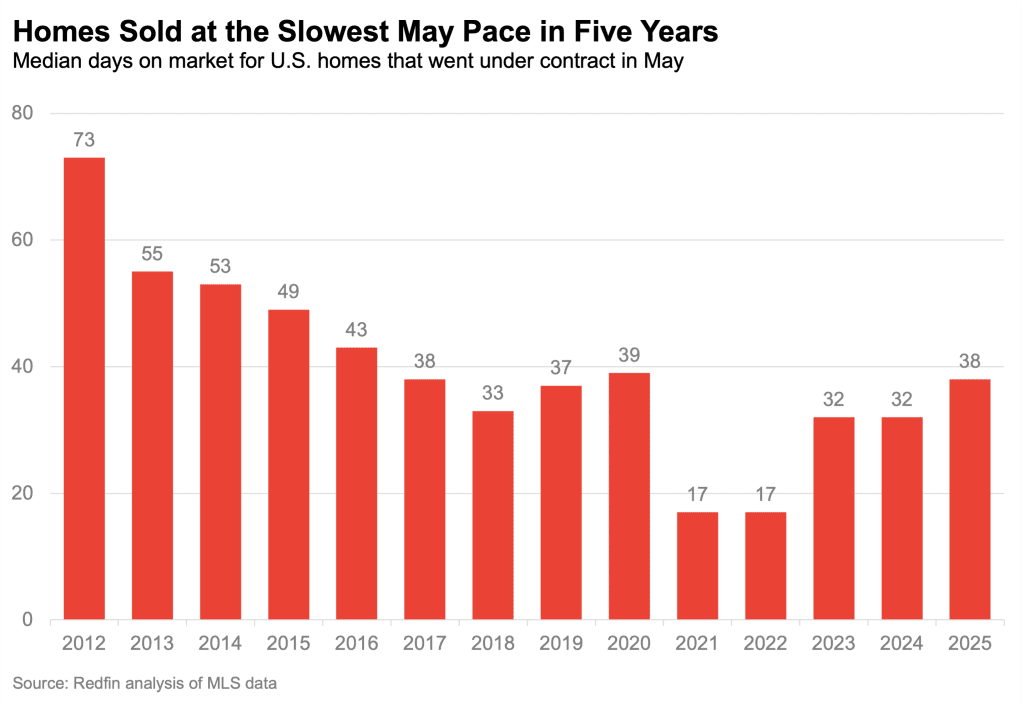

Home prices, while at a record high for this time of year, are growing at the slowest clip since 2023 because sellers outnumber buyers. Active listings hit a 5-year high in May, while existing-home sales hit a 7-month low. It took 38 days for the typical home to go under contract—the slowest May pace since 2020—and sales were canceled at the highest May rate on record. Florida’s housing market saw the biggest slowdown in sales and the biggest uptick in days on market. The Midwest is holding up relatively well when it comes to sales, while the Northeast is holding up best when it comes to prices. The median U.S. home-sale price rose 0.7% year over year in May—the slowest growth since June 2023. Still, last month’s median sale price of $440,997 was the highest of any May in records dating back to 2012. Redfin recently predicted that home prices …

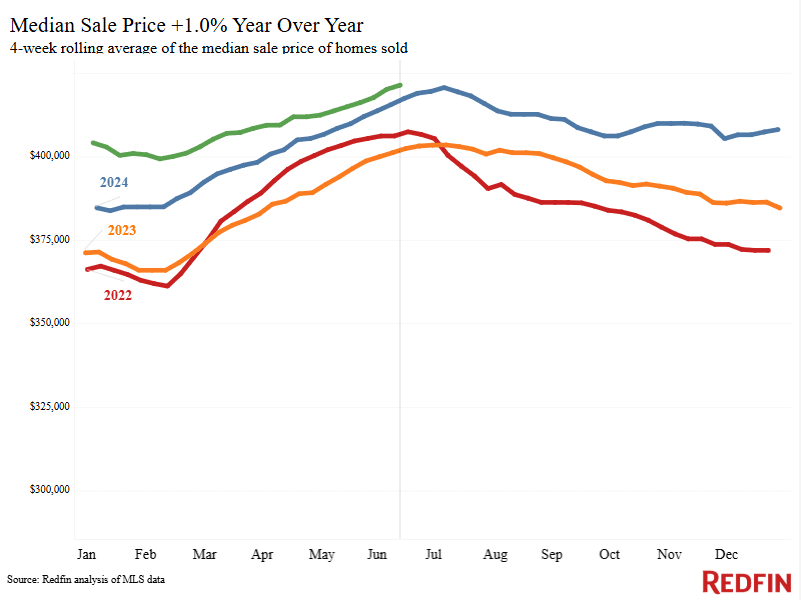

U.S. Home Prices Hit All-Time High

While the median home-sale price is sitting at a record high, it’s notably lower than the median asking price. That’s because sellers are open to negotiating in today’s cooling housing market, in which sellers outnumber buyers. The median U.S. home-sale price hit a record $396,500 during the four weeks ending June 15, up 1% year over year. Prices are at an all-time high even though this spring’s housing market is fairly cool because prices don’t yet fully reflect the historic imbalance of sellers and buyers in today’s market. Note that sale prices are seasonal and typically peak in June or July, and that price growth is cooling: The 1% year-over-year increase is in line with the last several weeks, but down from about 5% at the start of the year. While the median sale price is at an all-time high, it’s roughly $26,000 lower than the median asking price of …

Inman Names ATTOM Technical Architect Dmitry Krasjko a 2025 Future Leader in Real Estate

Krasjko honored among the industry achievers under the age of 40 that are forging new paths and pushing the envelope. IRVINE, Calif. – June 16, 2025 — ATTOM, a leading curator of land, property data, and real estate analytics, is proud to announce that Technical Architect Dmitry Krasjko has been named a 2025 Inman Future Leader in Real Estate in Technology and Data. This award honors emerging leaders who have demonstrated exceptional leadership skills and a commitment to pushing the envelope in the real estate industry. For the second year, Inman is honoring the next generation of visionaries through its 2025 Inman Future Leaders in Real Estate Award. These rising professionals are introducing transformative ideas and making meaningful contributions to the evolution of real estate practices. As Technical Architect, Krasjko has played a pivotal role in advancing ATTOM’s technology infrastructure and reinforcing its leadership in real estate data innovation. His work modernizing …

ATTOM Wins Gold Merit Award for Human Resources Work-Life Balance Initiative

ATTOM recognized for championing employee well-being through flexible, people-first workplace culture IRVINE, Calif. – June 2, 2025 – ATTOM, a leading curator of land, property data, and real estate analytics, is proud to announce it has been named a Gold Award winner in the 2025 Merit Awards for Human Resources, honoring its commitment to work-life balance and employee well-being. The recognition celebrates ATTOM’s innovative approach to creating a flexible, inclusive, and wellness-focused remote work culture. The Merit Awards recognize the efforts of global industries and the markets they serve, honoring the individuals, teams, and organizations working to positively impact their sectors and communities. The Merit Awards for human resources were judged based on submissions that addressed leadership, innovation, positive work environment and more. ATTOM was recognized for its strategic work-life harmony initiative, which integrates flexibility, wellness, and team connectivity into everyday operations. From a fully remote model and wellness incentives to virtual …