The NAHB’s Eye On Housing says data from the latest Producer Price Index shows the prices of inputs related to residential construction (less food and energy,) rose for the 5th straight month. Data shows that the non-seasonally adjusted index increased 0.21% in March following a 0.54% increase in February and a 1.25% in January, 2024. They point out that the index continues to grow at a faster rate than in 2023 as the average monthly change in 2023 was 0.15%. Click here to read the full report at the NAHB’s Eye on Housing. The post Building Material Prices Continue to Rise appeared first on Real Estate Investing Today.

ICE April 2024 Mortgage Monitor

According to the latest ICE Mortgage Monitor (formerly Black Knight), the national delinquency rate eased to 3.34% in February, an 11 basis point improvement over last year. In addition serious delinquencies fell to their lowest level in three months, while foreclosure starts, sales and inventory were all down on both a monthly and annual basis. The ICE Mortgage Monitor provides a view of the current mortgage market, including loan-level performance, home price trends data, secondary market metrics and public records. ICE, McDash ICE, McDash Click here to read the full report at ICE Mortgage Technology (formerly Black Knight). The post ICE April 2024 Mortgage Monitor appeared first on Real Estate Investing Today.

How to Succeed in Multifamily Real Estate Investing

On a recent episode of the AZREIA Show, Michael Del Prete talks with Sophia Willets who shares her journey about growing up in a real estate investor family to becoming a successful multifamily real estate investor herself. She discusses the advantages of starting in single-family homes before moving to multifamily properties, her strategy for off-market deals, and how she achieved significant returns on her investments. She also talks about the challenges she faced, including losing everything in the 2007 financial crisis and rebuilding her career and personal life. Click here to listen. The post How to Succeed in Multifamily Real Estate Investing appeared first on Real Estate Investing Today.

Supreme Court Rules Government Can’t Use Permit Process to Coerce Property Owners

The Pacific Legal Foundation recently announced that the U.S. Supreme Court ruled unanimously that legislatures cannot use the permit process to coerce owners into paying exorbitant development fees. They say this ruling is a major victory for property rights, remove costly barriers to development, and help combat the housing crisis. The case began in 2016 when a man bought a vacant lot in rural El Dorado County, California, and planned to build a small home where he and his wife would live and raise their grandson. But he was told he would have to pay a so-called traffic impact fee of more than $23,000 in exchange for the building permit. The County claimed he was required to pay under local legislation that sought to shift the cost of addressing existing and future road deficiencies onto new development. The Court ruled that the case must return to the lower court to …

CoreLogic Says Rent Growth Posts Highest Annual Increase Since Spring ’23

According to the latest CoreLogic Single-Family Rent Index (SFRI), U.S. single-family home rental prices rose by 3.4% year over year in February 2024 – the strongest growth recorded in 10 months. CoreLogic says February’s annual rental cost increases could again signal that Americans are slowly migrating back to larger, more expensive coastal metros. “Single-family rent growth regained strength in February, posting the highest annual appreciation since April 2023…Monthly rent growth also picked up in February and was higher than what is typically recorded in winter months. Lower-priced properties had the smallest annual rent growth in February, which should be welcome news to renters…” Said Molly Boesel, principal economist for CoreLogic. Click here to read the full report at CoreLogic. The post CoreLogic Says Rent Growth Posts Highest Annual Increase Since Spring ’23 appeared first on Real Estate Investing Today.

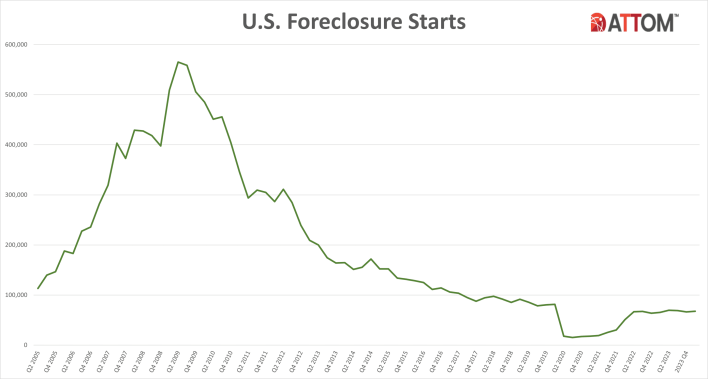

Foreclosure Starts Increase Slightly

According to the ATTOM Data’s Q1 2024 Foreclosure Report, there were 95,349 with a foreclosure filing during the first quarter of 2024, up 3% from the previous quarter but down less than 1 percent from one year ago. There were a total of 67,657 U.S. properties that started the foreclosure process in Q1 2024, up 2% from the previous quarter and up 4% from one year ago In addition, the report shows there were a total of 32,878 U.S. properties with foreclosure filings in March 2024, down less than 1 percent from the previous month and down 10% from one year ago. Key Takeaways: Nationwide in March 2024, one in every 4,286 properties had a foreclosure filing. States with the highest foreclosure rates in March 2024 were Illinois (one in every 2,548 housing units with a foreclosure filing); Connecticut (one in every 2,609 housing units); New Jersey (one in every …

Existing Home Sales Drop 4.3% in March

The National Association of Realtors is reporting that existing home sales were down 4.4% in march to a seasonally-adjusted annual rate of 4.19 million – down 3.7% year over year. Total housing inventory at the end of March was 1.11 million units, up 4.7% from February and up 14.4% from one year ago. Unsold inventory sits at a 3.2-month supply at the current sales rate with properties remaining on the market for around 33 days. The median existing-home price for all housing types in march was $397,200, up 4.7% from one year ago. “Though rebounding from cyclical lows, home sales are stuck because interest rates have not made any major moves…There are nearly six million more jobs now compared to pre-COVID highs, which suggests more aspiring home buyers exist in the market. Said NAR Chief Economist Lawrence Yun. Click here to read the full report at the National Association of …

Housing Starts & Permits Drop in April ’24

The U.S. government is reporting that privately‐owned housing starts in March, 2024 were at a seasonally adjusted annual rate of 1,321,000, which is 14.7% lower than February’s revised number and is 4.3% lower than one year ago. March’s rate for units in buildings with five units or more was 290k. Privately‐owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 1,458,000, which is 4.3% below February’s revised number but is 1.5% higher than one year ago. Authorizations of units in buildings with five units or more were at a rate of 433k in March. Click here to read the full report at the U.S. Census Bureau. The post Housing Starts & Permits Drop in April ’24 appeared first on Real Estate Investing Today.

The Costs of a Running Toilet

If you’ve ever experienced a leaky toilet (especially by non-caring tenant) you know that it can be a big bill and may even cause serious damage. Today’s graphic from the Infographics Zone illustrates the potential costs of a running toilet. They remind us that it’s essential to address any issues with your toilet promptly and make sure to turn it off when not in use. Indeed…. Stay safe, make sure those toilets aren’t running and have a Happy Friday!!! “A continuously running toilet can waste hundreds of gallons of water every day, increasing your water bill and having a negative impact on the environment. Even a small leak in your toilet can waste up to 200 gallons of water per day, which can add up quickly over time. Not only does this waste valuable resources, but it can also result in higher water bills and potentially costly repairs.” Hat tip …

Property Taxes On Single-Family Homes Up 7% Across America In 2023

According to ATTOM’s 2023 Property Tax Analysis, for 89.4 million U.S. single family homes, $363.3 billion in property taxes were levied on single-family homes in 2023. That figure is up 6.9% from 2022, and almost double the 3.6% growth seen in 2022. In 2023, the effective tax rate nationwide was 0.87 percent. In 2022 that figure was 0.83 percent. ATTOM says that states with the highest effective property tax rates in 2023 were Illinois (1.88%), New Jersey (1.64%), Connecticut (1.54%), new York (1.46%), and Nebraska (1.46%). “Property taxes took an unusually high turn upward last year, pushing effective rates up, while huge gaps in average tax bills between different parts of country remained in place…The tax increases were likely connected, at least in part, to inflationary pressures on the cost of operating local governments and schools, along with rising public employee wages and other major expenses.” Said Rob Barber, CEO …

- Page 1 of 2

- 1

- 2