President Trump plans to impose tariffs of 25% on imports from Canada and Mexico, and 10% on imports from China, starting Saturday. While the situation is fluid, the introduction of any broad-based tariffs could significantly impact the U.S. housing market.

High Mortgage Rates for Longer

Higher tariffs are inflationary and likely to lead to higher mortgage rates for longer, but how much higher and how much longer depends on a slew of details. We have to ask three questions: (1) how inflationary will these tariffs be? (2) how will the Fed react to this type of inflation? and (3) how will bond markets react?

- How inflationary will these tariffs be? The ultimate magnitude is difficult to predict and depends partly on how universal they are. In general, the more difficult it is to substitute away from the goods that are being tariffed, the higher the likelihood that prices will broadly increase. That means, the more goods and the more countries that are affected, the worse the inflation effect. In addition, currency devaluation may also offset some of the inflationary effect of tariffs, but the magnitude of that offset is difficult to predict in advance. Finally, macroeconomic conditions matter. When President Trump levied new tariffs on specific goods from China in 2018, prices for those goods increased, but the broader economy did not experience high inflation because of how low inflation had been leading up to that period. The result is likely to be different this time because the Fed has been battling high inflation for three years and the job is not yet finished.

- How will the Fed react? The Fed does not have to react to high inflation caused by tariffs because it is a one time price increase. Indeed in 2018, they decided to “look through” the new tariffs because inflation was low and they were more concerned with weak economic growth. This time around, however, all signs point to a different reaction because inflation remains above their 2% target. While they are unlikely to hike rates, they will be more reluctant to continue their cutting cycle if broad-based tariffs are imposed, especially if the economy remains strong.

- How will bond markets react? Whether mortgage rates go higher or just stay where they are for longer depends ultimately on the bond market reaction. Bond markets have already priced in significant new tariffs as it became clear that President Trump was returning to office. Whether mortgage rates increase now depends on how the implemented policy ultimately compares to what markets were expecting the president to do. Markets may also use this episode to forecast whether more tariffs are on the way.

Higher Construction Costs

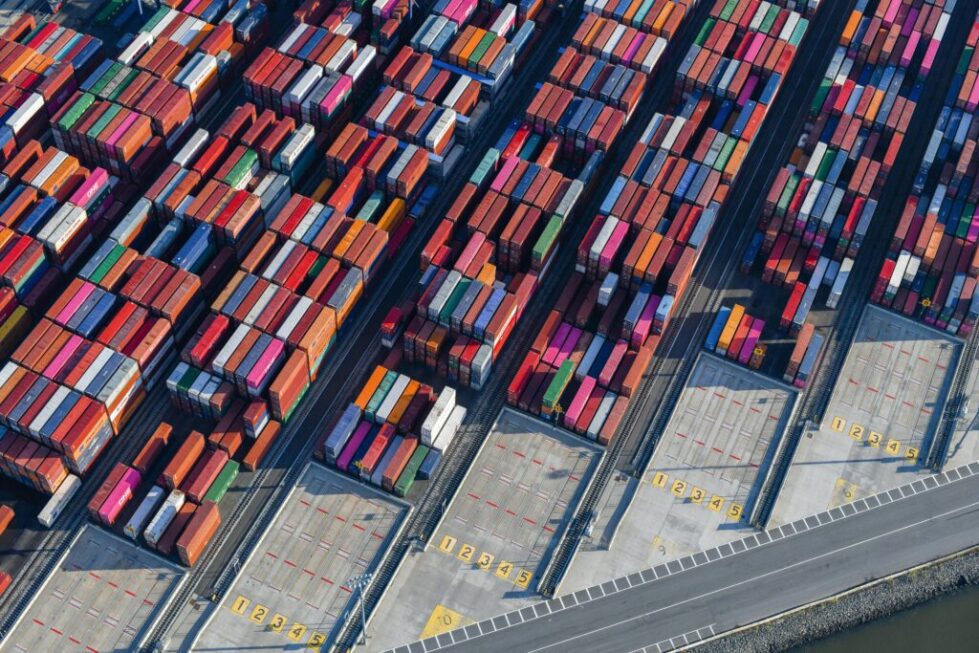

A substantial portion of U.S. building materials are imported from Canada. The proposed tariffs are expected to raise the cost of these materials, leading to higher expenses for home construction and renovations. This increase in costs is likely to reduce housing supply and/or be passed on to homebuyers.

Lower Economic Growth

Depending on the extent of retaliation from Canada, Mexico, and China, tariffs are also likely to reduce economic growth. Estimates vary and depend on the specifics of the policy, but the US economy has already been gradually weakening under the strain of high interest rates. Housing demand would weaken if there is significant labor market deterioration. The worst-case outcome would be a stagflation scenario with entrenched inflation and weak economic growth.

Written by: Chen Zhao