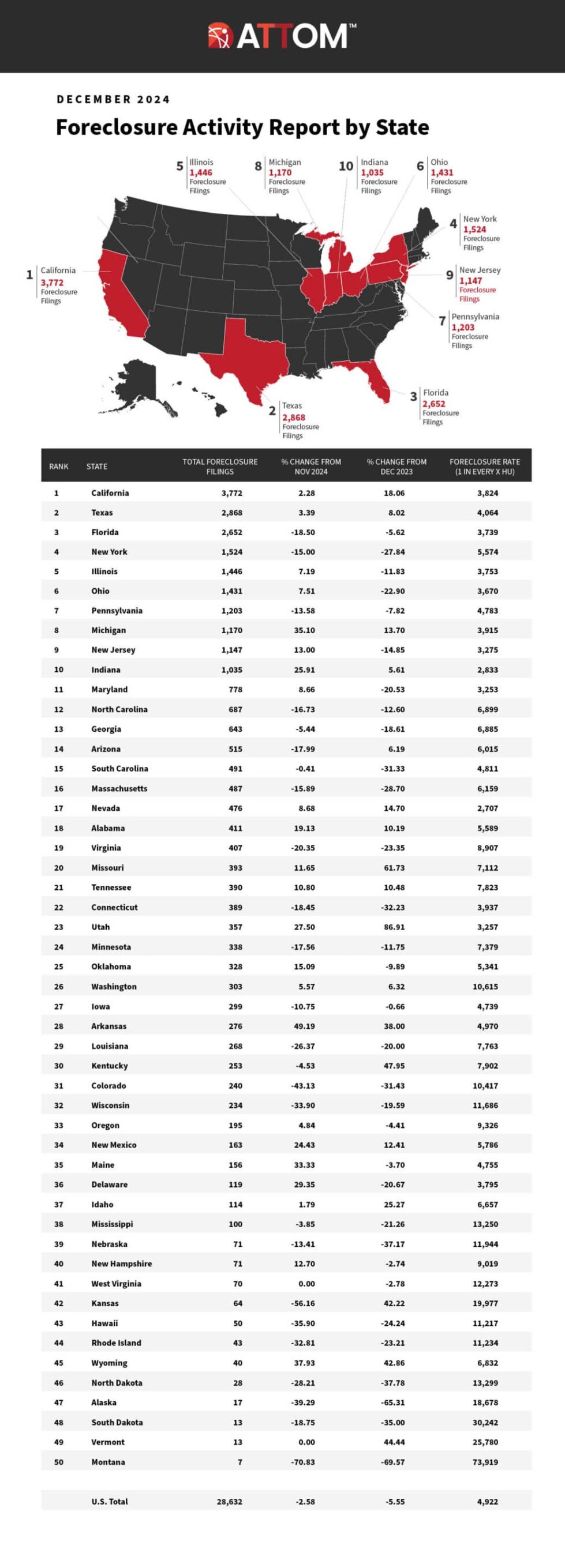

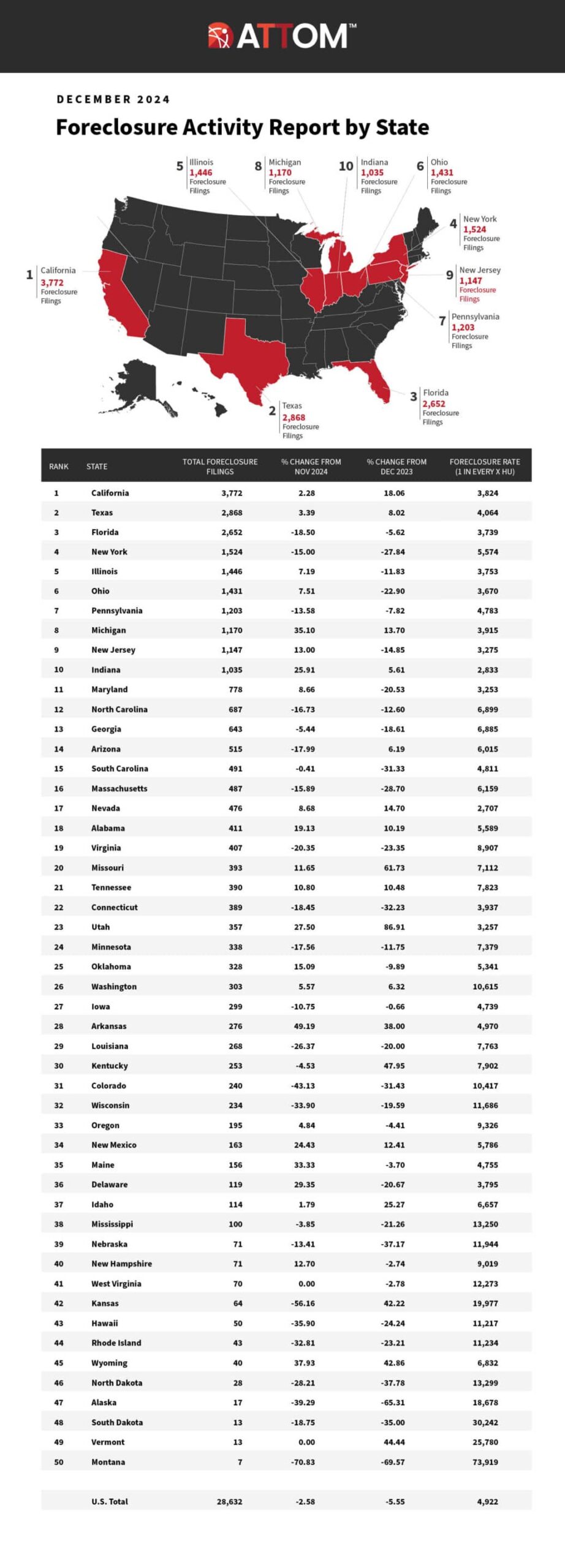

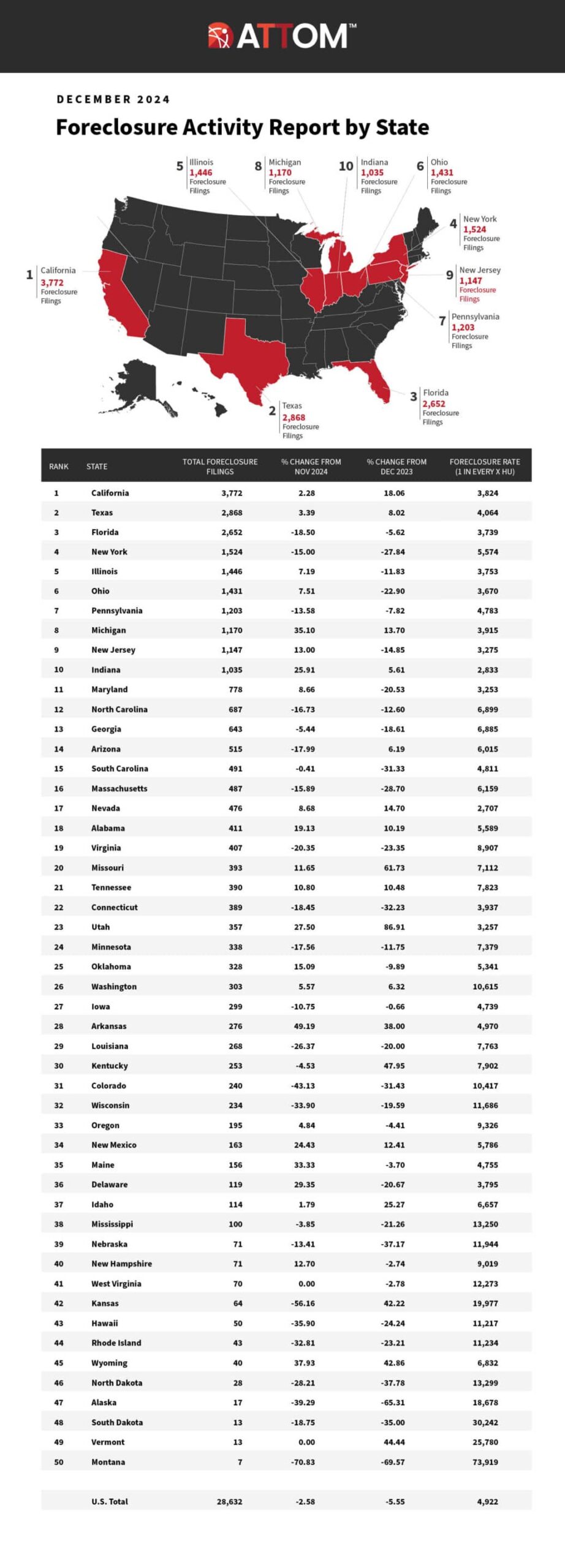

In December 2024, the U.S. housing market experienced a slight decline in foreclosure activity with 28,632 U.S. properties with foreclosure filings – marking a 3% decline from the previous month and 6% decline from a year ago. The U.S. housing market recorded foreclosure filings on one in every 4,922 properties, reflecting a slight easing in foreclosure activity. Foreclosure starts totaled 19,376 properties, down 4% from the previous month and 5% from December 2023, while completed foreclosures decreased by 4% monthly and 16% annually. These trends highlight modest changes in foreclosure activity that may be shaped by evolving economic conditions.

Rob Barber, CEO of ATTOM, observed that the continued decline in foreclosure activity throughout 2024 suggests a housing market that may be stabilizing, despite persistent economic uncertainties. He noted that this year’s data indicates foreclosure trends potentially returning to more predictable levels, offering some clarity for industry professionals, investors, and homeowners. While foreclosure filings remain an essential metric for assessing market health, Barber highlighted that current trends may reflect a more balanced landscape, influenced by prudent lending practices and resilient homeowners.

Foreclosure Filings by State

Foreclosure filings experienced a slight decline compared to the previous month and a slightly more pronounced decrease compared to the same period last year. Read on for December 2024 foreclosure filings across all 50 states, starting with the state that had the highest number of foreclosure filings.

1. California

California led the nation with 3,772 foreclosure filings in December 2024, resulting in a foreclosure rate of one in every 3,824 housing units. Of the state’s counties, the top five for foreclosure activity were Los Angeles (898 foreclosure filings), Riverside (361), San Bernardino (332), Sacramento (187), and San Diego (186).

2. Texas

Texas recorded 2,868 foreclosure filings, with a foreclosure rate of one in every 4,064 housing units. The leading counties for foreclosure filings were Harris (784 foreclosure filings), Dallas (345), Tarrant (321), Bexar (272), and Travis (221).

3. Florida

Florida reported 2,652 foreclosure filings, equating to one foreclosure for every 3,739 housing units. The counties with the highest filings were Miami-Dade (712 foreclosure filings), Broward (502), Palm Beach (431), Hillsborough (267), and Orange (218).

4. New York

New York had 1,524 foreclosure filings, or one in every 5,574 housing units. The top counties for foreclosure activity were Kings (402 foreclosure filings), Nassau (283), Suffolk (265), Queens (217), and Bronx (190).

5. Illinois

Illinois recorded 1,446 foreclosure filings, translating to a foreclosure rate of one in every 3,753 housing units. The counties with the most foreclosure filings were Cook (642 foreclosure filings), DuPage (184), Lake (162), Will (123), and Kane (113).

6. Ohio

Ohio reported 1,431 foreclosure filings, with a foreclosure rate of one in every 3,670 housing units. The leading counties were Cuyahoga (365 foreclosure filings), Franklin (247), Hamilton (182), Summit (141), and Montgomery (125).

7. Michigan

Michigan recorded 1,170 foreclosure filings, resulting in a foreclosure rate of one in every 3,915 housing units. The top counties for foreclosure filings included Wayne (482 foreclosure filings), Oakland (294), Macomb (221), Kent (93), and Genesee (80).

8. New Jersey

New Jersey had 1,147 foreclosure filings, equating to one in every 3,275 housing units. The counties with the highest foreclosure activity were Essex (272 foreclosure filings), Bergen (168), Middlesex (146), Union (132), and Hudson (121).

9. Indiana

Indiana reported 1,035 foreclosure filings, or one in every 2,833 housing units. The top counties for foreclosure filings were Marion (245 foreclosure filings), Lake (196), Allen (94), Hamilton (77), and St. Joseph (68).

10. Maryland

Maryland recorded 778 foreclosure filings, translating to a foreclosure rate of one in every 3,253 housing units. Leading counties for foreclosure activity were Baltimore City (195 foreclosure filings), Prince George’s (183), Montgomery (124), Baltimore County (117), and Anne Arundel (96).

11. Pennsylvania

Pennsylvania recorded 1,203 foreclosure filings, equating to one in every 4,783 housing units. The leading counties were Philadelphia (412 foreclosure filings), Allegheny (285), and Montgomery (181).

12. North Carolina

North Carolina had 687 foreclosure filings, or one in every 6,899 housing units. The top counties were Mecklenburg (187 foreclosure filings), Wake (135), and Guilford (94).

13. Georgia

Georgia reported 643 foreclosure filings, equating to one in every 6,885 housing units. The leading counties were Fulton (201 foreclosure filings), Gwinnett (164), and Cobb (139).

14. Arizona

Arizona recorded 515 foreclosure filings, resulting in a foreclosure rate of one in every 6,015 housing units. The top counties were Maricopa (342 foreclosure filings), Pima (87), and Pinal (42).

15. South Carolina

South Carolina had 491 foreclosure filings, translating to one in every 4,811 housing units. The top counties were Charleston (148 foreclosure filings), Greenville (122), and Richland (89).

16. Massachusetts

Massachusetts recorded 487 foreclosure filings, or one in every 6,159 housing units. The leading counties were Middlesex (132 foreclosure filings), Worcester (116), and Essex (94).

17. Nevada

Nevada reported 476 foreclosure filings, equating to one in every 2,707 housing units. The top counties were Clark (315 foreclosure filings), Washoe (104), and Lyon (57).

18. Alabama

Alabama recorded 411 foreclosure filings, translating to one in every 5,589 housing units. The leading counties were Jefferson (66 foreclosure filings), Madison (40), and Mobile (34).

19. Virginia

Virginia had 407 foreclosure filings, or one in every 8,907 housing units. The top counties were Fairfax (127 foreclosure filings), Prince William (91), and Henrico (63).

20. Missouri

Missouri reported 393 foreclosure filings, equating to one in every 7,112 housing units. The leading counties were St. Louis (144 foreclosure filings), Jackson (108), and St. Charles (74).

21. Tennessee

Tennessee recorded 390 foreclosure filings, or one in every 7,823 housing units. The top counties were Shelby (155 foreclosure filings), Davidson (112), and Knox (79).

22. Connecticut

Connecticut had 389 foreclosure filings, translating to one in every 3,937 housing units. The top counties were Hartford (136 foreclosure filings), New Haven (115), and Fairfield (102).

23. Utah

Utah recorded 357 foreclosure filings, equating to one in every 3,257 housing units. The leading counties were Salt Lake (172 foreclosure filings), Utah (95), and Weber (56).

24. Minnesota

Minnesota had 338 foreclosure filings, or one in every 7,379 housing units. The top counties were Hennepin (132 foreclosure filings), Ramsey (89), and Dakota (57).

25. Oklahoma

Oklahoma reported 328 foreclosure filings, equating to one in every 5,341 housing units. The top counties were Oklahoma (108 foreclosure filings), Tulsa (96), and Cleveland (63).

26. Washington

Washington recorded 303 foreclosure filings, with a foreclosure rate of one in every 10,615 housing units. The top counties for foreclosure activity were King (125 foreclosure filings), Pierce (84), and Clark (64).

27. Iowa

Iowa had 299 foreclosure filings, equating to a foreclosure rate of one in every 4,739 housing units. The leading counties were Polk (74 foreclosure filings), Linn (53), and Black Hawk (42).

28. Arkansas

Arkansas recorded 276 foreclosure filings, translating to one in every 4,970 housing units. The top counties for foreclosure activity were Pulaski (35 foreclosure filings), Saline (17), and Washington (17).

29. Louisiana

Louisiana had 268 foreclosure filings, resulting in a foreclosure rate of one in every 7,763 housing units. The top counties were Orleans (52 foreclosure filings), East Baton Rouge (43), and Caddo (32).

30. Kentucky

Kentucky reported 253 foreclosure filings, equating to a foreclosure rate of one in every 7,902 housing units. The leading counties were Jefferson (71 foreclosure filings), Fayette (38), and Kenton (24).

31. Colorado

Colorado recorded 240 foreclosure filings, or one in every 10,417 housing units. The top counties were El Paso (78 foreclosure filings), Denver (63), and Jefferson (52).

32. Wisconsin

Wisconsin had 234 foreclosure filings, equating to one in every 11,686 housing units. The leading counties were Milwaukee (98 foreclosure filings), Dane (56), and Waukesha (42).

33. Oregon

Oregon reported 195 foreclosure filings, translating to one in every 9,326 housing units. The top counties were Multnomah (58 foreclosure filings), Washington (47), and Clackamas (39).

34. New Mexico

New Mexico recorded 163 foreclosure filings, or one in every 5,786 housing units. The top counties were Bernalillo (62 foreclosure filings), Doña Ana (45), and Santa Fe (29).

35. Maine

Maine had 156 foreclosure filings, equating to one in every 4,755 housing units. The leading counties were Cumberland (48 foreclosure filings), York (39), and Penobscot (24).

36. Delaware

Delaware reported 119 foreclosure filings, or one in every 3,795 housing units. The top counties were New Castle (67 foreclosure filings), Kent (34), and Sussex (18).

37. Idaho

Idaho recorded 114 foreclosure filings, equating to one in every 6,657 housing units. The top counties were Ada (46 foreclosure filings), Canyon (34), and Kootenai (21).

38. Mississippi

Mississippi had 100 foreclosure filings, translating to one in every 13,250 housing units. The top counties were Hinds (32 foreclosure filings), Harrison (24), and Rankin (18).

39. Nebraska

Nebraska reported 71 foreclosure filings, or one in every 11,944 housing units. The leading counties were Douglas (28 foreclosure filings), Lancaster (21), and Sarpy (15).

40. New Hampshire

New Hampshire recorded 71 foreclosure filings, equating to one in every 9,019 housing units. The top counties were Hillsborough (26 foreclosure filings), Rockingham (22), and Merrimack (14).

41. West Virginia

West Virginia had 70 foreclosure filings, or one in every 12,273 housing units. The top counties were Kanawha (22 foreclosure filings), Cabell (17), and Monongalia (11).

42. Kansas

Kansas recorded 64 foreclosure filings, translating to one in every 19,977 housing units. The leading counties were Sedgwick (24 foreclosure filings), Johnson (18), and Shawnee (10).

43. Hawaii

Hawaii reported 50 foreclosure filings, equating to one in every 11,217 housing units. The top counties were Honolulu (23 foreclosure filings), Hawaii County (15), and Maui (12).

44. Rhode Island

Rhode Island recorded 43 foreclosure filings, or one in every 11,234 housing units. The leading counties were Providence (21 foreclosure filings), Kent (12), and Washington (10).

45. Wyoming

Wyoming had 40 foreclosure filings, equating to one in every 6,832 housing units. The top counties were Laramie (12 foreclosure filings), Natrona (9), and Campbell (8).

46. North Dakota

North Dakota reported 28 foreclosure filings, or one in every 13,299 housing units. The top counties were Cass (10 foreclosure filings), Burleigh (8), and Grand Forks (5).

47. Alaska

Alaska recorded 17 foreclosure filings, equating to one in every 18,678 housing units. The leading counties were Anchorage (5 foreclosure filings), Matanuska-Susitna (4), and Fairbanks North Star (3).

48. South Dakota

South Dakota had 13 foreclosure filings, translating to one in every 30,242 housing units. The top counties were Minnehaha (5 foreclosure filings), Pennington (4), and Lincoln (2).

49. Vermont

Vermont reported 13 foreclosure filings, or one in every 25,780 housing units. The leading counties were Chittenden (5 foreclosure filings), Rutland (4), and Washington (3).

50. Montana

Montana recorded 7 foreclosure filings, equating to one in every 73,919 housing units. The top counties were Yellowstone (3 foreclosure filings), Missoula (2), and Gallatin (1).

Discover ATTOM’s full breadth of foreclosure data and how it provides insight into loan default trends, property risks, and investment opportunities, empowering stakeholders to make informed decisions based on timely and comprehensive market data.

Written by: Megan Hunt