More house hunters are hitting the pavement as the new year starts, but pending home sales are down as daily average mortgage rates hit a seven-month high.

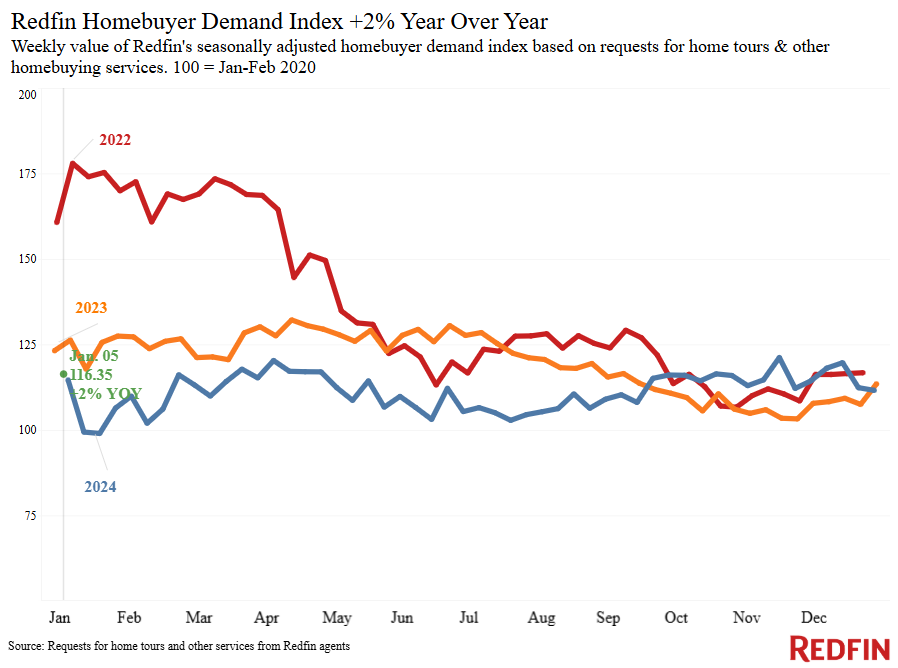

More house hunters are starting their home search as the new year kicks off. Redfin’s Homebuyer Demand Index–a seasonally adjusted measure of tours and other buying services from Redfin agents–posted a small 2% increase from a month earlier during the week ending January 5, and it’s also up 2% year over year.

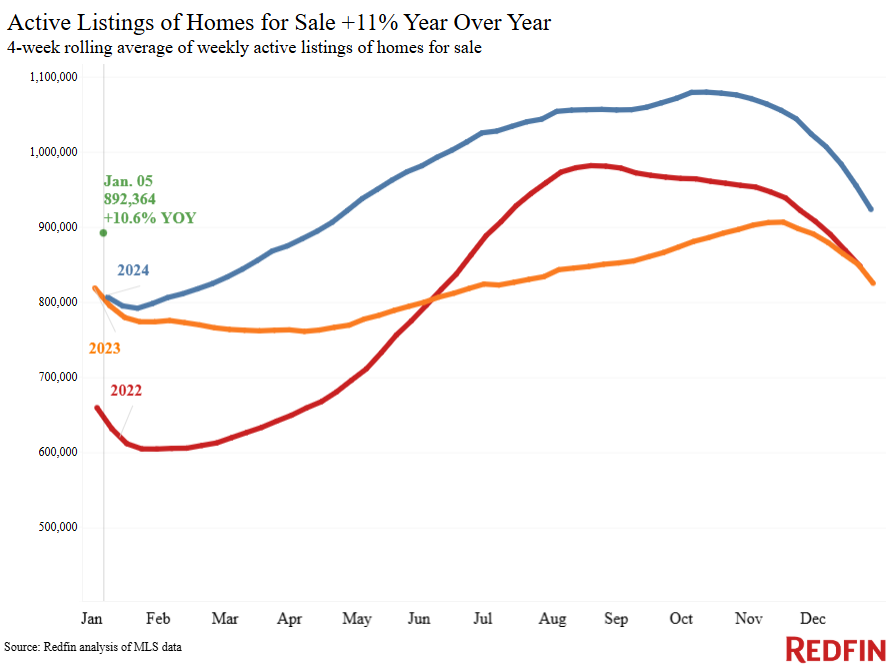

There are several reasons a few more buyers are out there: Some have accepted high mortgage rates; daily average mortgage rates hit a seven-month high this week and they’re unlikely to decline significantly soon. Some are jumping into the market now that the holidays have passed and a new year has begun, and some are taking advantage of the fact that there are more homes on the market than there have been over the last few years.

“Three of the four offers my clients have made in the last week have competed against other offers with competitive terms, like waiving all contingencies and releasing earnest money early. Some homes are getting multiple offers within 24 hours of hitting the market,” said Emily Lam, a Redfin Premier agent in the Seattle area. “Some buyers are getting serious about their search because they’ve come to terms with 7% rates and they’re worried that if they wait longer, home prices will just keep rising. Others are starting their search in hopes that rates will decline soon. Either way, I’m advising buyers to get serious now because desirable listings will get more competitive as the year goes on.”

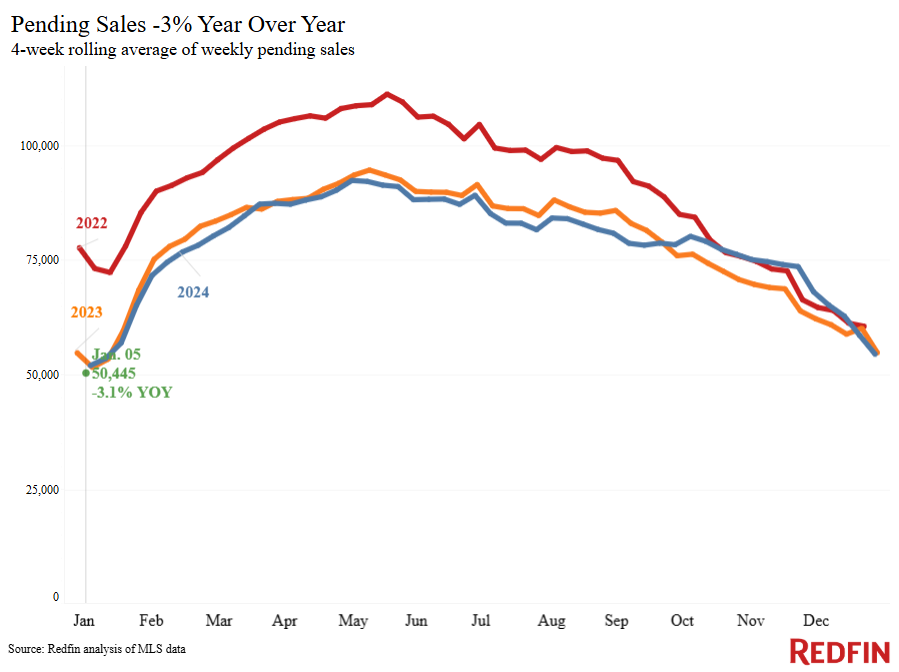

Nationwide, the small increase in tours hasn’t yet translated to an uptick in sales. Pending home sales fell 3.1% from a year earlier during the four weeks ending January 5, though that decline may be artificially large because we’re comparing to a period last year when mortgage rates posted a big drop, bringing a surge in demand.

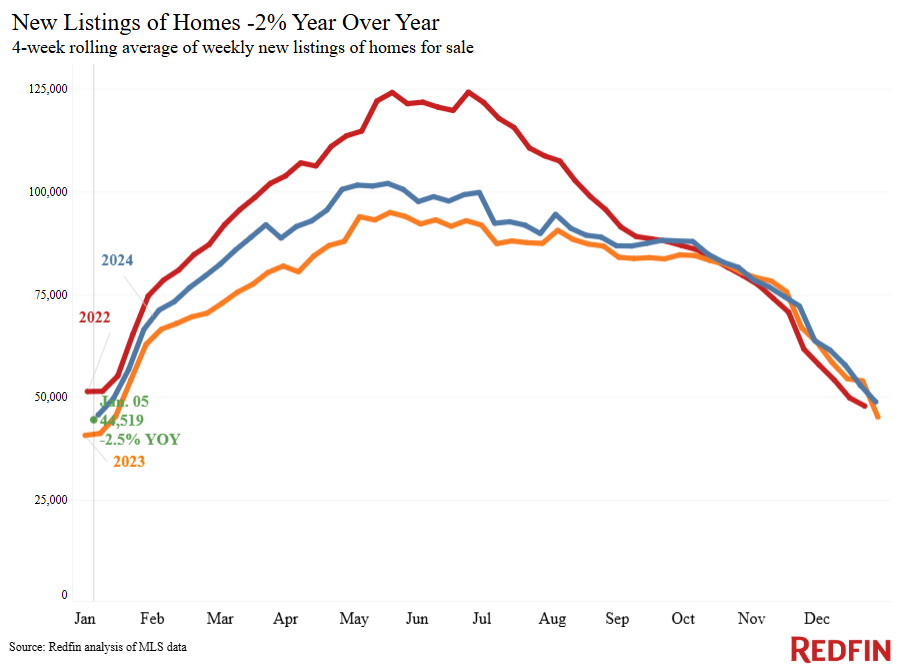

On the selling side, new listings are down 2.5%, the biggest decline in over a year. But for the reason noted above, that drop may appear larger than it actually is. We’ll keep a close eye on pending sales and new listings over the next few weeks to determine whether more home tours eventually turn into more home sales, and whether more sellers start listing their homes as we get settled into 2025.

For Redfin economists’ takes on the housing market, please visit Redfin’s “From Our Economists” page.

Leading indicators

| Indicators of homebuying demand and activity | ||||

| Value (if applicable) | Recent change | Year-over-year change | Source | |

| Daily average 30-year fixed mortgage rate | 7.17% (Jan. 8) | Highest level since May | Up from 6.75% | Mortgage News Daily |

| Weekly average 30-year fixed mortgage rate | 6.91% (week ending Jan. 2) | Highest level since July | Up from 6.61% | Freddie Mac |

| Mortgage-purchase applications (seasonally adjusted) | Down 7% from 1 week earlier (as of week ending Jan. 3 ) | Down 15% | Mortgage Bankers Association | |

| Redfin Homebuyer Demand Index (seasonally adjusted) | Up 2% from a month earlier

(as of week ending Jan. 5) |

Up 2% | Redfin Homebuyer Demand Index a measure of tours and other homebuying services from Redfin agents | |

| Google searches for “home for sale” | Up 29% from a month earlier (as of Jan. 6) | Down 8% | Google Trends | |

Key housing-market data

| U.S. highlights: Four weeks ending Jan. 5, 2025

Redfin’s national metrics include data from 400+ U.S. metro areas, and is based on homes listed and/or sold during the period. Weekly housing-market data goes back through 2015. Subject to revision. |

|||

| Four weeks ending Jan. 5, 2025 | Year-over-year change | Notes | |

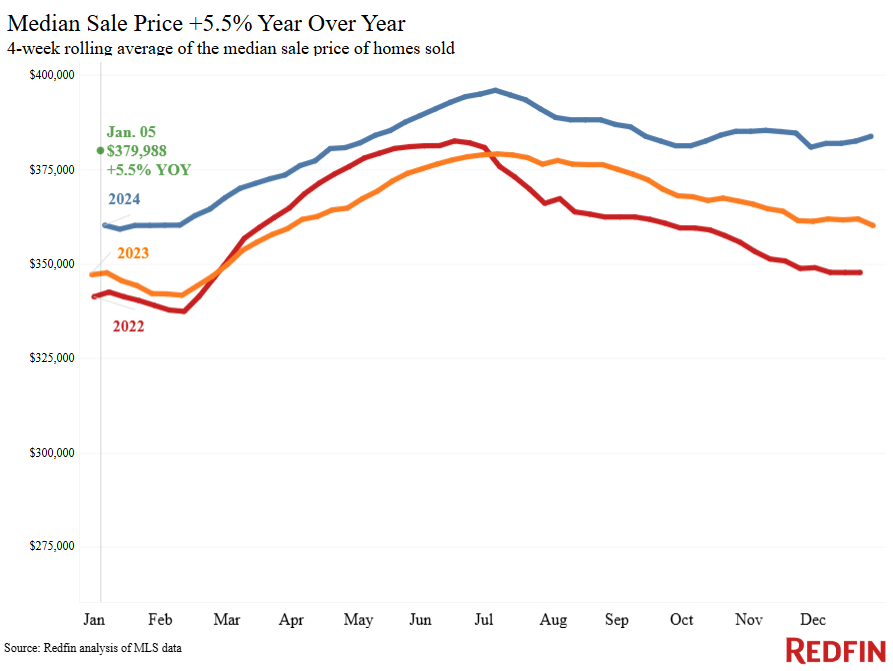

| Median sale price | $379,988 | 5.5% | |

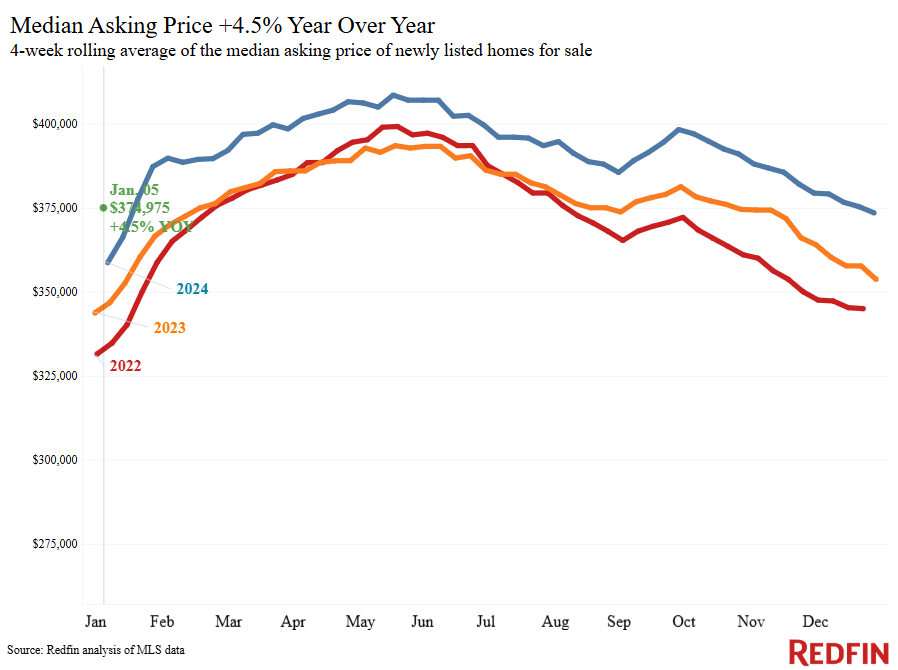

| Median asking price | $374,975 | 4.5% | |

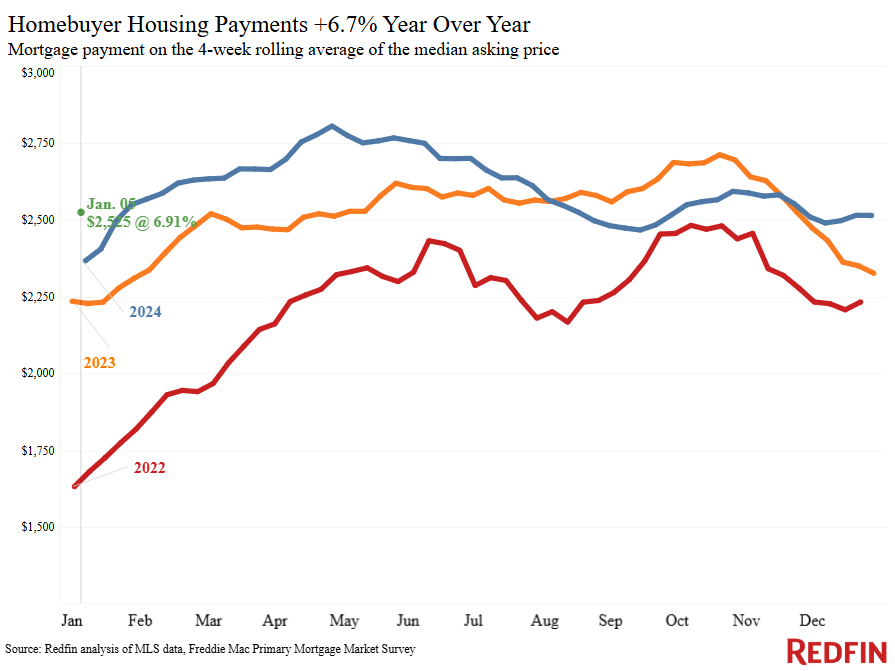

| Median monthly mortgage payment | $2,525 at a 6.91% mortgage rate | 6.7% | |

| Pending sales | 50,445 | -3.1% | Biggest decline since September |

| New listings | 44,519 | -2.5% | Biggest decline in over a year |

| Active listings | 892,364 | 10.6% | |

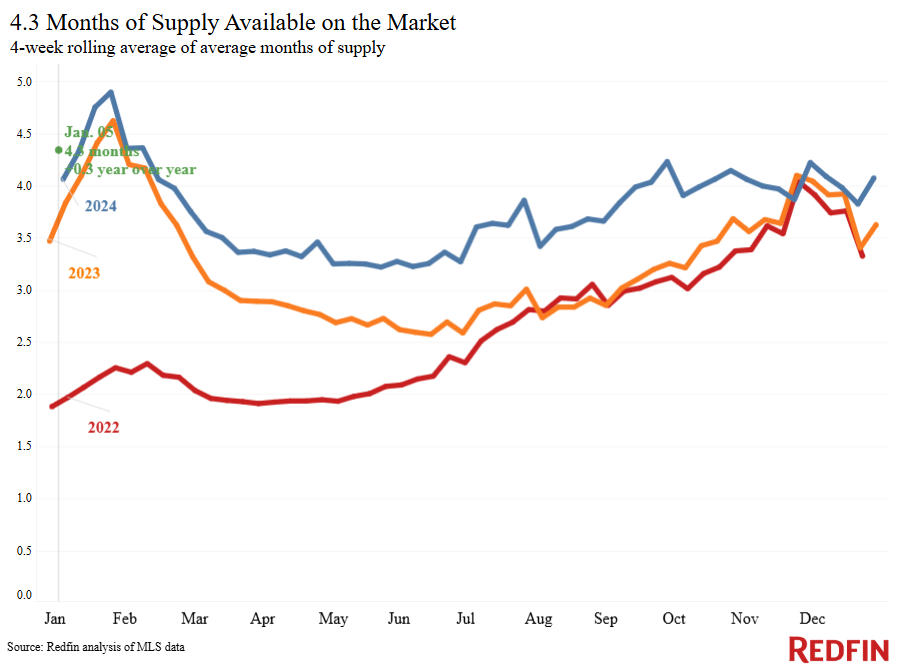

| Months of supply | 4.3 | +0.3 pts. | 4 to 5 months of supply is considered balanced, with a lower number indicating seller’s market conditions. |

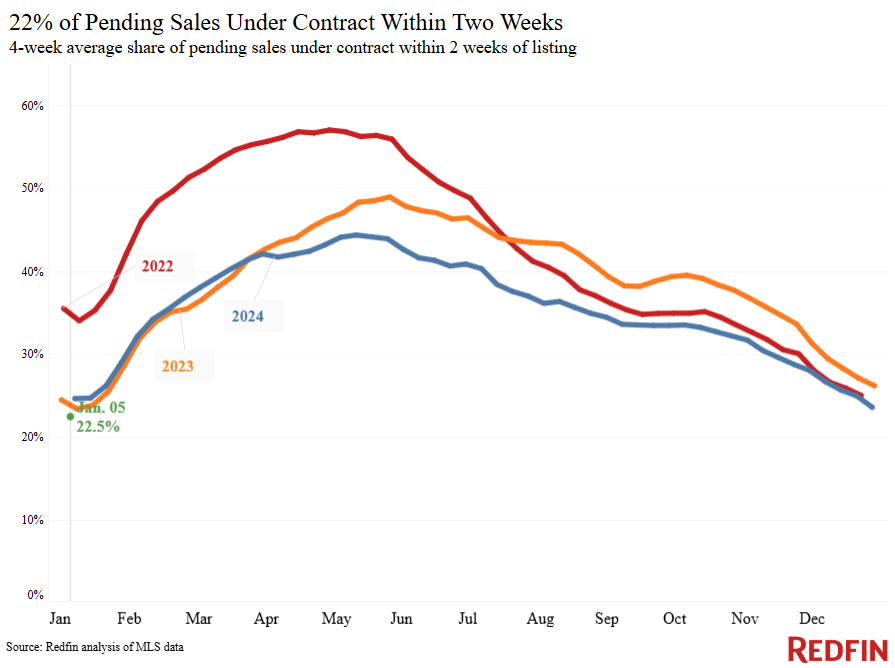

| Share of homes off market in two weeks | 22.5% | Down from 23% | |

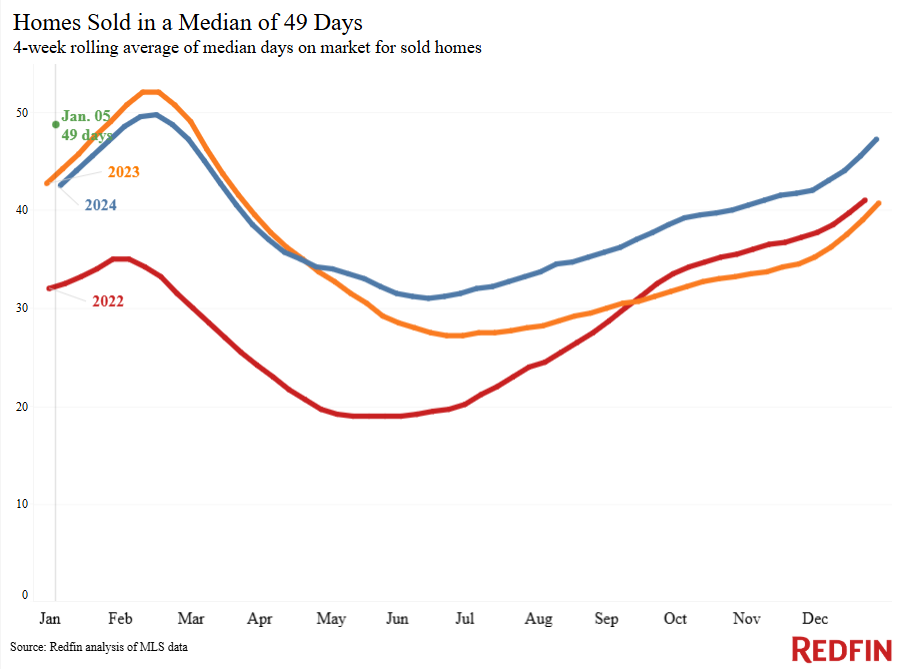

| Median days on market | 49 | +6 days | |

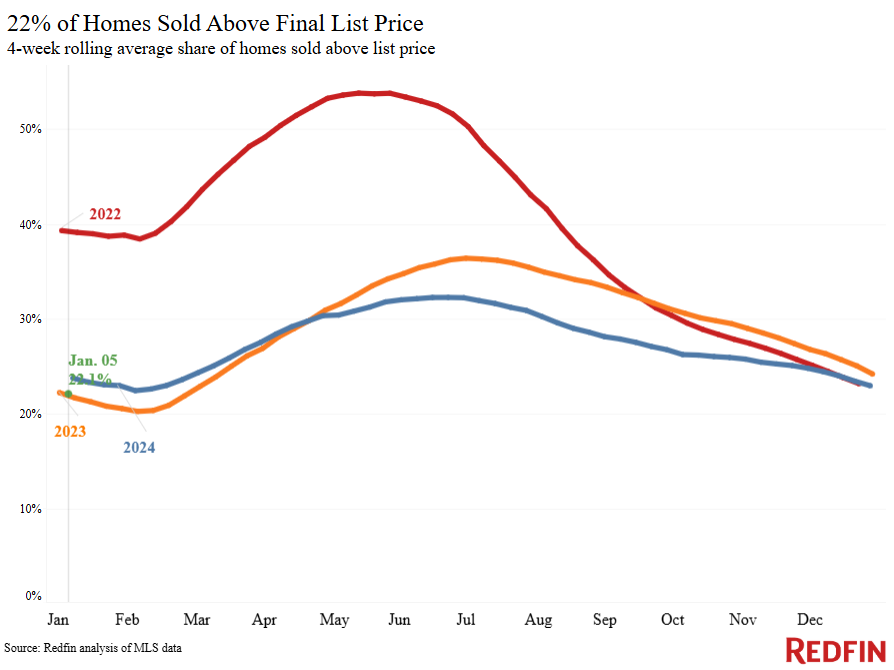

| Share of homes sold above list price | 22.1% | Down from 24% | |

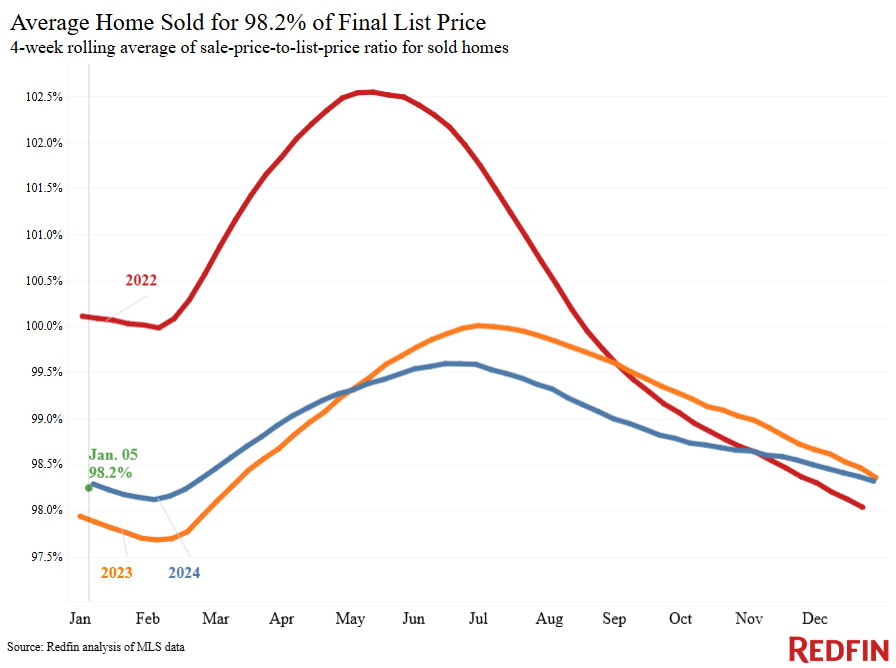

| Average sale-to-list price ratio | 98.2% | Essentially unchanged | |

|

Metro-level highlights: Four weeks ending Jan. 5, 2025 Redfin’s metro-level data includes the 50 most populous U.S. metros. Select metros may be excluded from time to time to ensure data accuracy. |

|||

|---|---|---|---|

| Metros with biggest year-over-year increases | Metros with biggest year-over-year decreases |

Notes |

|

| Median sale price | Milwaukee (19.5%)

Cleveland (17.1%) Warren, MI (13.6%) Philadelphia (13.5%) Nassau County, NY (11%) |

Austin, TX (-1%) |

Declined in 1 metro |

| Pending sales | Anaheim, CA (10%)

Cincinnati (7.7%) San Jose, CA (7%) Portland, OR (3.1%) Montgomery County, PA (2.7%) |

Orlando, FL (-13.5%)

Houston (-12.3%) Fort Lauderdale, FL (-11.4%) Miami (-11%) Nashville, TN (-10.5%) |

Increased in 9 metros |

| New listings | Washington, D.C. (9.4%)

Phoenix (9.2%) Virginia Beach, VA (7.2%) Miami (6.6%) Las Vegas (6%) |

Newark, NJ (-23.6%)

Detroit (-20.8%) Warren, MI (-19.7%) Austin, TX (-18.1%) San Antonio (-17.9%) |

Increased in 13 metros |

Refer to our metrics definition page for explanations of all the metrics used in this report.

Written by: Dana Anderson