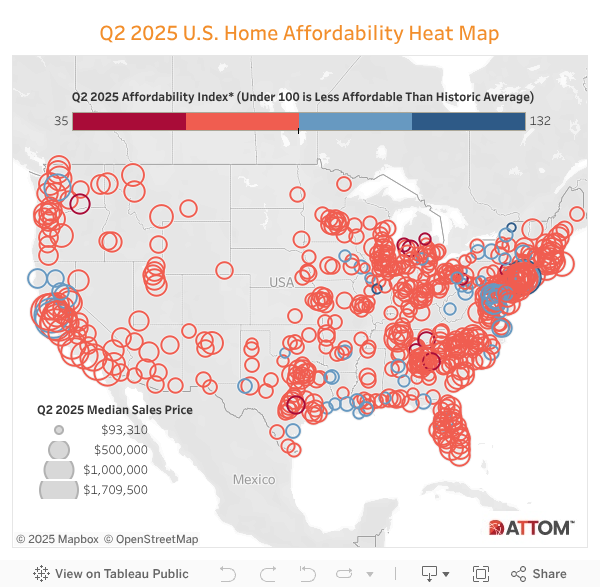

According to ATTOM’s Q2 2025 U.S. Home Affordability Report, 99 percent of counties with enough data to analyze saw median-priced single-family homes and condos become less affordable in Q2 2025 compared to historical averages. This marks the 14th straight quarter where owning and maintaining a median-priced home has consumed a greater share of the average U.S. wage than what’s been typical historically. WATCH: ATTOM #figuresfriday – Top 10 Counties with the Largest Annual Increase in Affordability Indexes in Q2 2025 The report also indicates that major expenses tied to a median-priced home in the U.S. would have taken up 33.7 percent of the average annual wage—an increase from 32 percent in Q1 and significantly above the 28 percent threshold commonly recommended by lenders. ATTOM’s latest home affordability analysis underscores the growing strain on both current homeowners and prospective buyers as home prices climb. Following a brief decline from $355,000 in …

New Listings Lose Steam, Pending Sales Fall As Home Prices Hit Another Record High

Would-be sellers are pulling back as it becomes more clear the housing market is tilting in buyers’ favor in much of the country. New listings of U.S. homes for sale are up 2.5% from a year ago, the smallest increase in five months. On a local level, new listings are falling in 20 of the 50 most populous U.S. metro areas, with the biggest declines in Tampa, FL (-15.2%), San Antonio (-14.4%), and Orlando, FL (-11.1%). There are still hundreds of thousands more home sellers than buyers nationwide. But some would-be sellers are sitting on the sidelines as the market tilts more and more in buyers’ favor in much of the country. “Understandably, sellers want to get as much money as they can. Some homeowners feel they missed the prime selling window; many people who don’t need to sell right now are holding off, either staying put or trying to …

Elevated Home Prices and Stagnant Wages Make Home-Ownership Unaffordable Across the Country

In 77.9 Percent of Counties, Home Expenses are Unaffordable for Typical Residents; Median National Home Price Hits High of $369,000 in Second Quarter IRVINE, Calif. – June 26, 2025 — ATTOM, a leading curator of land, property data, and real estate analytics, today released its latest U.S. Home Affordability Report showing that in 99 percent of counties with sufficient data to analyze median-priced single-family homes and condos were less affordable in the second quarter of 2025 than historical averages. It marks the 14th consecutive quarter where purchasing and maintaining a median-priced home in the U.S. has required a higher percentage of the typical owner’s wages than has historically been necessary. ATTOM’s analysis shows that major expenses for a median-priced home in the U.S. would have consumed 33.7 percent of the average American’s annual income. That was up from 32 percent in the first quarter of the year, and well above …

Here Are the Most Expensive Home Sales of May

All of last month’s most expensive home sales were in Southern California, Florida or Manhattan. A Bel Air estate was the most expensive home sale of May, fetching $110 million. Another Los Angeles home, a Spanish villa in neighboring Holmby Hills, came in second, with a sale price of $57.3 million. All in all, four of last month’s most expensive home sales were in Southern California, four were in coastal Florida, and two were in Manhattan. Four of the homes sold for $55 million or more, and all sold for more than $30 million. Coastal parts of Florida, like Palm Beach and Boca Raton, are typically home to many ultra-expensive home sales in any given month. Despite the increasing risk of climate disasters and skyrocketing insurance costs in those places, mega-wealthy homebuyers have the means to rebuild, repair, or take a loss. These are the most expensive U.S. home sales …

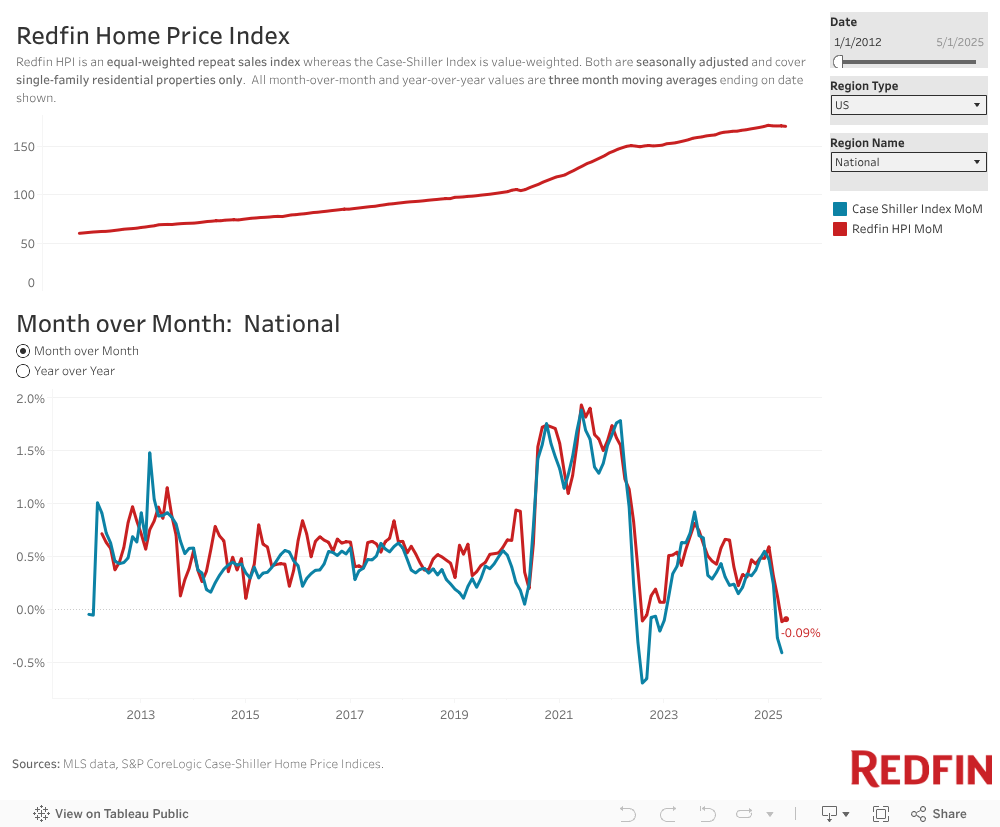

U.S. Home Prices Edged Down 0.1% in May, Only the Fourth Monthly Drop in the Past Decade

U.S. home prices in May ticked down 0.1% on a seasonally adjusted basis—only the fourth time in the past decade when prices have posted a monthly decline. Home prices rose 3.6% year over year—the first time annual growth has been below 4% since July 2023. 32 of the 50 most populous U.S. metros recorded a drop in home prices month over month, led by Charlotte, NC (-2.7%). U.S. home prices edged down 0.1% in May on a seasonally adjusted basis. Home prices have only posted a month-over-month decline three other times in records dating back to 2012: April 2025, and August-September 2022—when mortgage rates were peaking. Home prices rose 3.6% on a year-over-year basis in May, down from 4.1% growth in April. It was the first time annual price growth has been below 4% since July 2023. This is according to the Redfin Home Price Index (RHPI), which uses the …

6% of Today’s Home Sellers Are At Risk of Selling at a Loss. That’s Up From 4.4% a Year Ago, But Still Historically Low.

The risk of selling at a loss varies significantly in different parts of the country; nearly 20% of sellers are at risk of losing money in San Francisco, compared to virtually 0% of sellers in Providence, RI. Nearly one in 10 condos are at risk of selling at a loss. And nearly 30% of condos bought after the pandemic are at risk. 16.4% of sellers who bought their homes after the pandemic are at risk of selling at a loss in today’s market, compared to 9% of those who bought during the pandemic and 1.8% of those who bought before the pandemic. Nearly half (47.5%) of for-sale homes in Austin that were bought after the pandemic are at risk of selling at a loss—the highest share among major metros. If U.S. home prices were to fall by 1%, the overall share of homes at risk of selling at a loss …

ATTOM Webinar Summary: 2025 Mid-Year Housing Market Review

This ATTOM webinar, presented by Aaron Wagner, Head of Data Science for ATTOM and Mike Simonsen, Founder and President of Altos Research features a comprehensive analysis of the latest trends and economic indicators shaping the market and offers data-driven insights into what the rest of the year could hold. Drawing from ATTOM and Altos’ most recent data, this session breaks down key shifts in housing activity, pricing, and risk helping professionals across the real estate and financial sectors navigate an evolving landscape. During this webinar, Aaron Wagner explores trends in historical mortgage rates, residential loan volumes for both purchase and refinance loans, shifts in median home sale prices, patterns in homeownership tenure, foreclosure filings, and the potential implications of these developments. He also addresses distressed market trends, focusing on foreclosure starts and REO completed foreclosures. Also in this webinar, Mike Simonsen examines how inventory levels have evolved, noting the return …

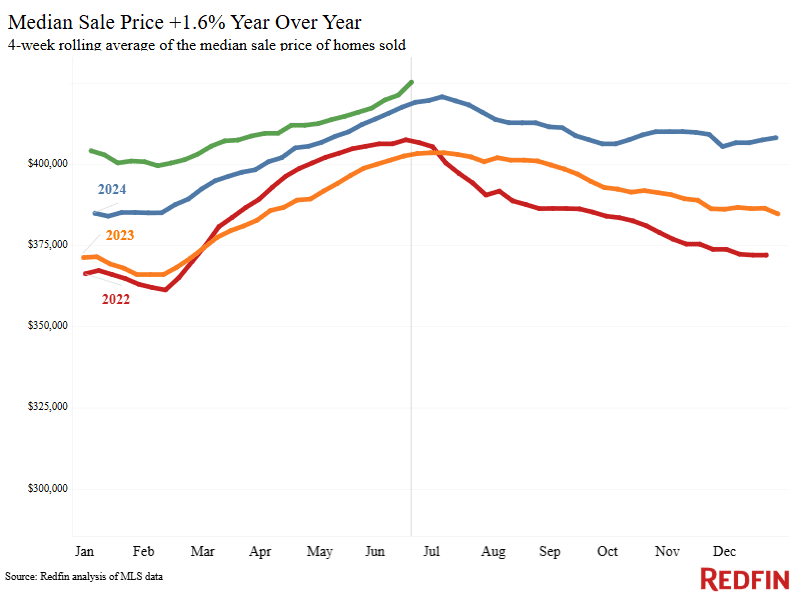

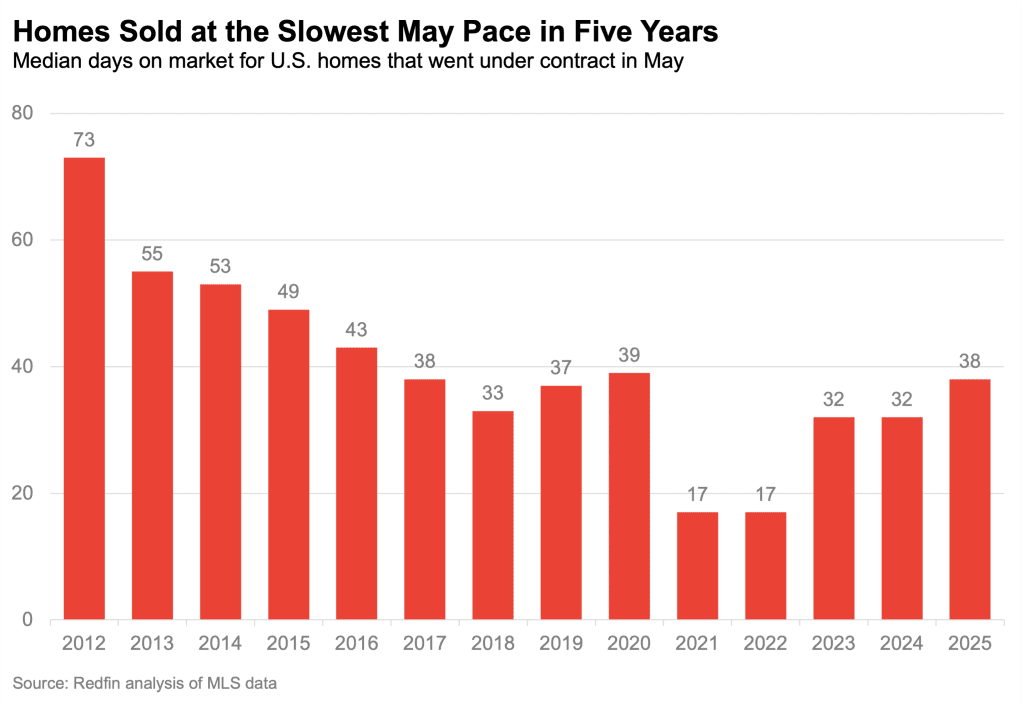

Home Prices Grow at Slowest Pace in Nearly 2 Years

Home prices, while at a record high for this time of year, are growing at the slowest clip since 2023 because sellers outnumber buyers. Active listings hit a 5-year high in May, while existing-home sales hit a 7-month low. It took 38 days for the typical home to go under contract—the slowest May pace since 2020—and sales were canceled at the highest May rate on record. Florida’s housing market saw the biggest slowdown in sales and the biggest uptick in days on market. The Midwest is holding up relatively well when it comes to sales, while the Northeast is holding up best when it comes to prices. The median U.S. home-sale price rose 0.7% year over year in May—the slowest growth since June 2023. Still, last month’s median sale price of $440,997 was the highest of any May in records dating back to 2012. Redfin recently predicted that home prices …

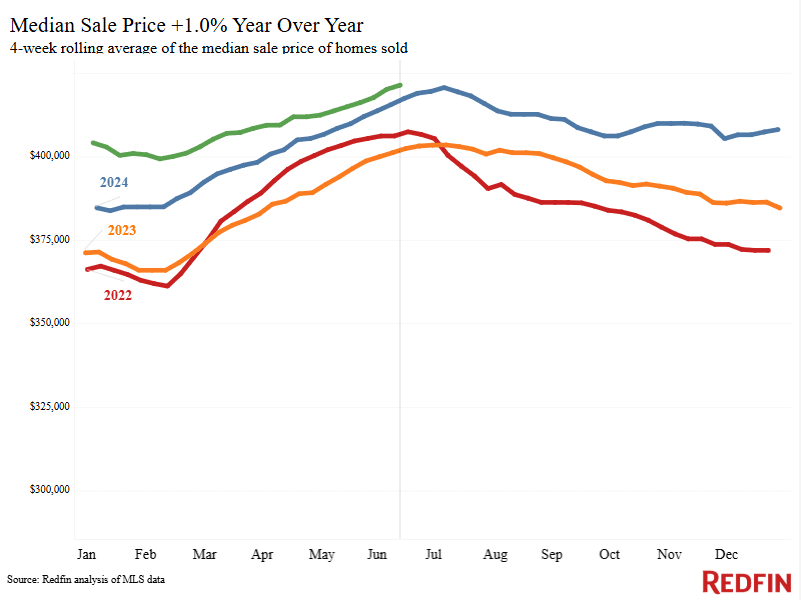

U.S. Home Prices Hit All-Time High

While the median home-sale price is sitting at a record high, it’s notably lower than the median asking price. That’s because sellers are open to negotiating in today’s cooling housing market, in which sellers outnumber buyers. The median U.S. home-sale price hit a record $396,500 during the four weeks ending June 15, up 1% year over year. Prices are at an all-time high even though this spring’s housing market is fairly cool because prices don’t yet fully reflect the historic imbalance of sellers and buyers in today’s market. Note that sale prices are seasonal and typically peak in June or July, and that price growth is cooling: The 1% year-over-year increase is in line with the last several weeks, but down from about 5% at the start of the year. While the median sale price is at an all-time high, it’s roughly $26,000 lower than the median asking price of …

Inman Names ATTOM Technical Architect Dmitry Krasjko a 2025 Future Leader in Real Estate

Krasjko honored among the industry achievers under the age of 40 that are forging new paths and pushing the envelope. IRVINE, Calif. – June 16, 2025 — ATTOM, a leading curator of land, property data, and real estate analytics, is proud to announce that Technical Architect Dmitry Krasjko has been named a 2025 Inman Future Leader in Real Estate in Technology and Data. This award honors emerging leaders who have demonstrated exceptional leadership skills and a commitment to pushing the envelope in the real estate industry. For the second year, Inman is honoring the next generation of visionaries through its 2025 Inman Future Leaders in Real Estate Award. These rising professionals are introducing transformative ideas and making meaningful contributions to the evolution of real estate practices. As Technical Architect, Krasjko has played a pivotal role in advancing ATTOM’s technology infrastructure and reinforcing its leadership in real estate data innovation. His work modernizing …

- Page 1 of 2

- 1

- 2