Parcel, deed, and tax assessor data — what’s the difference between them, and which type of data do you need? If you are a real estate agent, how can parcel data improve your client experience or increase traffic to your website? If you are a marketer, what value added is deed or tax data to your marketing efforts? It’s worthwhile understanding parcel vs. deed vs. tax data, the different data points they include, and the role they can play in your business strategy. ATTOM offers all three of these valuable resources. Your needs may be met by one of them, or you may need all three. Here’s a breakdown of what you need to know about these similar but different real estate data types. What Is Parcel Data? Parcels, or property boundaries, can be defined as a shape or polygon and displayed on a map. These mapped areas comprise parcel …

Charles Tassell Accepts Position with USDA in Trump Administration

The headline says it all; National REIA’s Charles Tassell is heading to the U.S. Department of Agriculture. The USDA announced this week their latest slate of presidential appointments for key positions at the U.S. Department of Agriculture (USDA) including the Food and Nutrition Service (FNS), Farm Service Agency (FSA) and Rural Development (RD). Charles will serve as the State Director for Rural Development in his home state of Ohio. Click here to wish him well. Brooke Rollins “President Trump is putting Farmers First, and so is the incredible team we are building at the Department of Agriculture. Our latest additions to the USDA family are personally invested in ensuring farmers and rural America prosper. I look forward to seeing the work they will do supporting farmers, ranchers, and producers across the country by implementing President Trump’s America First policies.” Said USDA Secretary Brooke Rollins. Rebecca McLean “It has been …

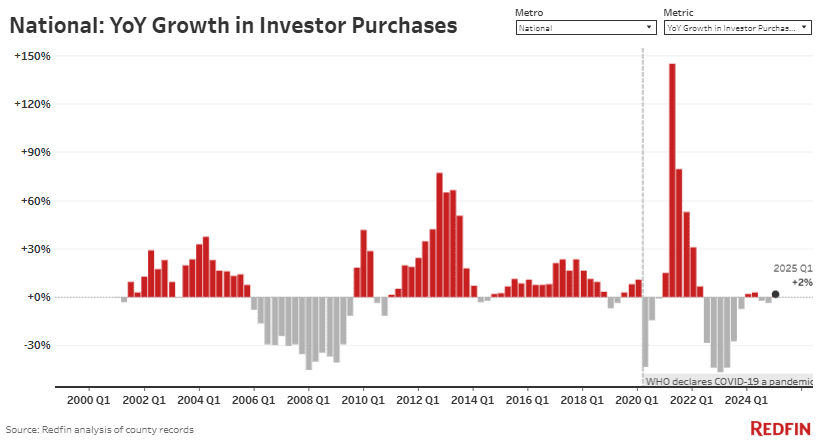

Investor Purchases of Condos Fall to Lowest Level in 10 Years, Aside From Start of Pandemic

Investor purchases of U.S. homes rose 2% year over year in the first quarter. Investor activity has been fairly stable for the past two years, after the wild up-and-down swings of the pandemic era. Investor purchases of condos fell 3% year over year to the lowest level in 10 years, aside from Q2 2020. That’s driven largely by investors retreating from Florida. Investor market share is holding steady at around 19% of total U.S. home sales Investors are buying more high-priced homes and fewer low-priced homes U.S. real estate investors purchased 46,726 homes in the first quarter, up 2% year over year. Investor purchases have been relatively stable for the last year, increasing or decreasing by 4% or less each quarter. This is based on a Redfin analysis of county-level home purchase records across 39 of the most populous U.S. metropolitan areas going back through 2000. We define an investor …

The War on Landlords

The War on Landlords From Covid eviction bans to tenant-slanted laws, property owners are under financial siege. Here’s what Trump can do about it. by Steven Malanga One of the ironies of Donald Trump’s first presidency is that a former real-estate investor and landlord enacted an unprecedented federal eviction ban. In early 2020, as Covid lockdowns paralyzed the country, Trump signed the CARES Act, placing a moratorium on evictions for any rental properties with federal loans or assistance. Despite the unprecedented scope of the eviction ban and billions in aid, tenant-advocacy groups blasted Trump for doing too little to prevent what headlines called an impending “eviction tsunami.” While landlords sued to overturn the expanding moratorium, states and cities imposed their own tenant protections, including broad eviction bans and numerous laws rewriting landlord–tenant relationships. Many of these measures outlasted the pandemic, shifting the legal balance sharply toward tenants and jeopardizing the …

Can You Get a HELOC While on Social Security?

If you’re retired or living on Social Security and wondering whether you can tap into your home’s equity to cover medical bills, rising living costs, or even help a family member in need — you’re not alone. Many older homeowners are asking the same question, especially as fears of a potential recession grow. In fact, nearly 1 in 3 U.S. homeowners say they’re likely to tap into their home equity in the next 12 months, according to a national survey by MeridianLink. That’s a significant increase from just a few years ago, and it reflects the pressure many Americans are feeling amid high interest rates, inflation, and economic uncertainty. Key Takeaways: Yes, you can get a HELOC on Social Security. Most lenders accept Social Security income as qualifying, stable income if properly documented. You’ll need to meet other requirements, too. Strong credit, sufficient home equity, and low debt levels help improve your …

Washington State Institutes Rent Control

In early May, Washington Governor Bob Ferguson (D) signed a bill into law that will limit annual rent increases (rent control). According to Yahoo News, the measure (HB 1217) caps rent increases at 7% plus inflation or 10% (whichever is lower) and includes single-family homes. The rent for manufactured home rent is also capped at 5%. Yahoo News says this makes the state among the first in the country to “provide protections for tenants.” Rent control continues to be on the march…. “Washington needs more affordable housing — a lot more,” Governor Ferguson said. “We must make it easier, faster and less expensive to build housing of all kinds. These bills will address this pressing need.” WA Governor Bob Ferguson Click here to read the full story at Yahoo News. Click here to read the media release from Governor Bob Furguson. The post Washington State Institutes Rent Control appeared …

Foreclosure Activity Up 13.9% Year-Over-year

According to ATTOM’s April 2025 U.S. Foreclosure Market Report, there were a total of 26,033 U.S. properties with foreclosure filings in April. This figure is up 0.4% from March and up 13.9% from a year ago. In addition, lenders repossessed 3,580 properties as REOs in April – up 23.3% from one year ago. Across the nation, one in every 3,950 housing units had a foreclosure filing in April. States with the worst foreclosure rates were South Carolina (one in every 2,311 housing units with a foreclosure filing); Illinois (one in every 2,405); Florida (one in every 2,526); Delaware (one in every 2,617); and Nevada (one in every 2,944). “April’s foreclosure activity continued its gradual climb, with both starts and completions up annually…While volumes remain below historical norms, the year-over-year increases may suggest that some homeowners are beginning to feel the effects of persistent economic pressures.” Said Rob Barber, CEO of …

New Home Sales Up 10.9% in April

The U.S. Government is reporting that sales of new single-family houses in April, 2025 were at a seasonally adjusted annual rate of 743k, which is 10.9% higher than March’s revised rate and is 3.3% higher than one year ago. The median sales price of new houses sold in April was $407,200 with an average sales price of $518,400. There were an estimated 504k new houses for sale at the end of April representing an 8.1-month supply at the current sales rate. Click here to read the full report at the U.S. Census Bureau. The post New Home Sales Up 10.9% in April appeared first on Real Estate Investing Today.

Location, Location, Renovation: Where Your Remodel Dollars Go Further

For many homeowners, 2025 is shaping up to be the year of renovation. As elevated mortgage rates continue to keep people in their current homes longer, along with a nationwide shortage of homes for sale, more homeowners are deciding to invest in upgrades instead of entering the current competitive housing market. But when it comes to remodeling, not all projects are created equal, and not all updates will increase your home’s value in the same way. One of the most important things you can do before starting a renovation is ask yourself this simple but critical question: Will this project actually pay off? Whether you’re considering new siding, replacing a garage door, adding stone veneer to your home’s exterior, or remodeling a bathroom or kitchen, understanding how much value a project adds—and how that value varies depending on where you live—can help you make smarter choices. This is especially true …

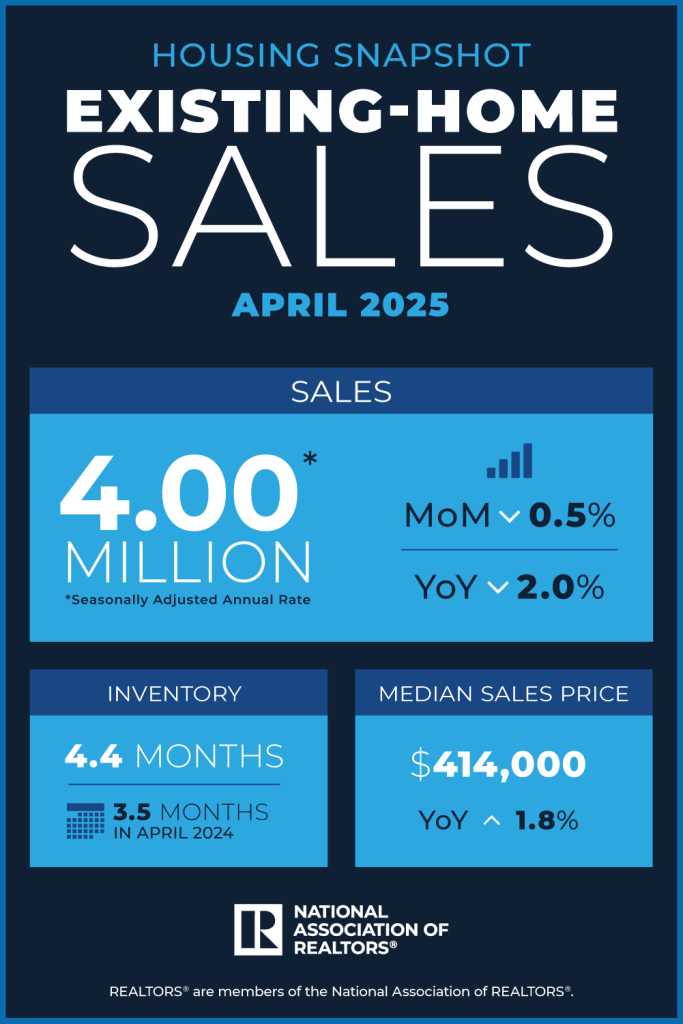

Existing Home Sales Down 0.5% in April

The National Association of Realtors is reporting that existing home sales were down 0.5% in April to a seasonally-adjusted annual rate of 4 million – down 2% year over year. Total housing inventory at the end of April was 1.45 million units, up 9% from March and up 20.8% from one year ago. Unsold inventory sits at a 4.4-month supply at the current sales rate with properties remaining on the market for around 29 days. The median existing-home price for all housing types in April was $414k. The NAR says there is a lot of unrealized pent up demand out there: “Home sales have been at 75% of normal or pre-pandemic activity for the past three years, even with seven million jobs added to the economy…Pent-up housing demand continues to grow, though not realized. Any meaningful decline in mortgage rates will help release this demand.” Said the NAR’s Chief Economist …