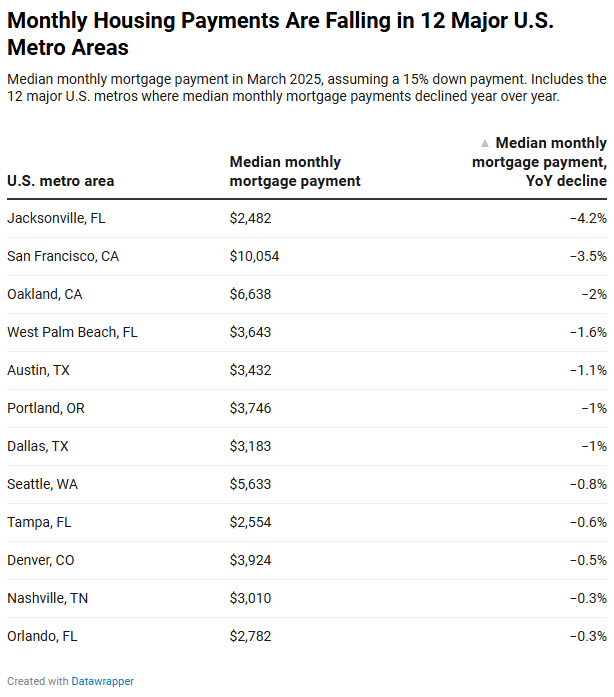

Monthly mortgage payments are declining in some parts of the country as homebuying demand slows amid widespread economic uncertainty. The silver lining for buyers in those places: They have some negotiating power. Monthly mortgage payments are declining in 12 of the 50 most populous U.S. metro areas, half of them in Florida or Texas. The typical homebuyer in Jacksonville, FL had a monthly mortgage payment of $2,482 in March, down 4.2% from a year earlier—the biggest decline among the metros in this analysis. The next-biggest declines were in the Bay Area: San Francisco, with a 3.5% decline to $10,054, and Oakland, with a 2% decline to $6,638. Other West Coast metros including Seattle and Portland, OR are also among the places where monthly mortgage payments are falling, as are three more Florida metros and a pair of Texas metros. This is from a Redfin analysis of the 50 most populous …

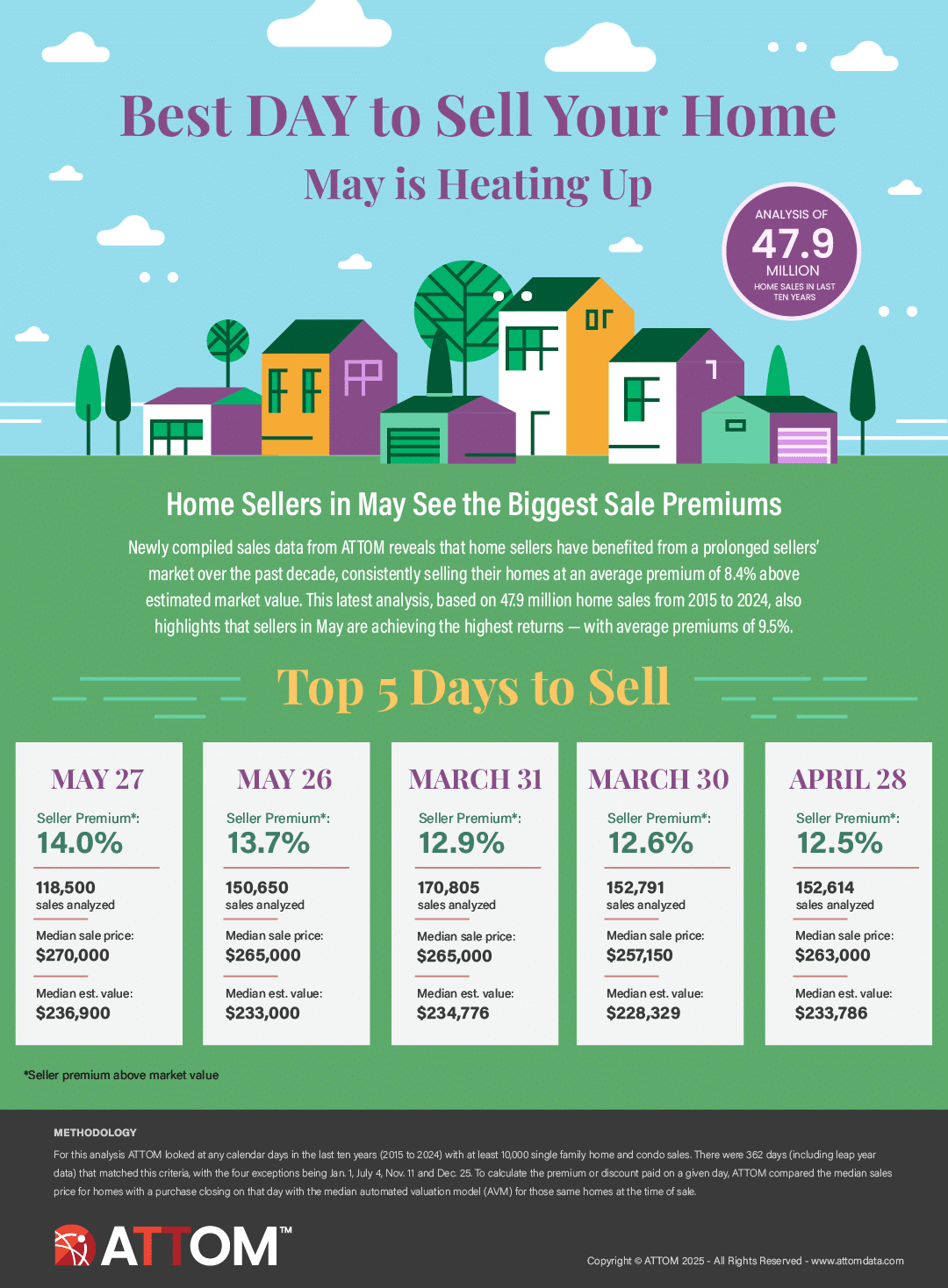

The Best Time to Sell a Home is in May

New study shows home sellers see 9.5 percent premium in May; Annual analysis also looks at best days to sell a home IRVINE, Calif. – April 30, 2025 – ATTOM, a leading curator of land, property data, and real estate analytics, today released its annual analysis of the best days of the year to sell a home, which shows that based on home sales over the past 10 years, the months of May, February and April offer the highest seller premiums – making this month the time to sell your home. An analysis of more than 47 million single-family home and condo sales between 2015 and 2024 reveals that listing a property in May, February, or April tends to generate the highest seller premiums. The data indicates that the early months of the year not only mark peak home-buying activity but also offer prime opportunities for sellers. For those considering …

ATTOM Webinar Summary – Mastering Location: How ATTOM Boundary Data Powers Precision

This ATTOM webinar features industry expert Sean Mooney, VP of Product Management, as he discusses how ATTOM’s boundary datasets are empowering businesses across a wide range of industries to improve decision-making and enhance user experiences. During the webinar, Sean explores the critical role of location precision in today’s data-driven world. He highlights how ATTOM’s neighborhood, school, and parcel boundary datasets provide the spatial context needed for smarter insights, more accurate property analysis, and seamless search experiences. He explains the importance of boundary data for real estate portals, direct marketing, risk assessment, policy decision-making, and more. Sean provides an in-depth look at ATTOM’s comprehensive boundary product family, which includes Census boundaries, ZIP Codes, Postal Cities, flood zones, and Canadian boundary products. He then delves into ATTOM’s Neighborhood Boundaries, explaining how they are carefully hand-digitized, organized into a four-level hierarchy, and designed to support hyperlocal search and analysis with unmatched accuracy. He …

Top 10 Housing Markets with Biggest Quarterly Increases in Profit Margins in Q1 2025

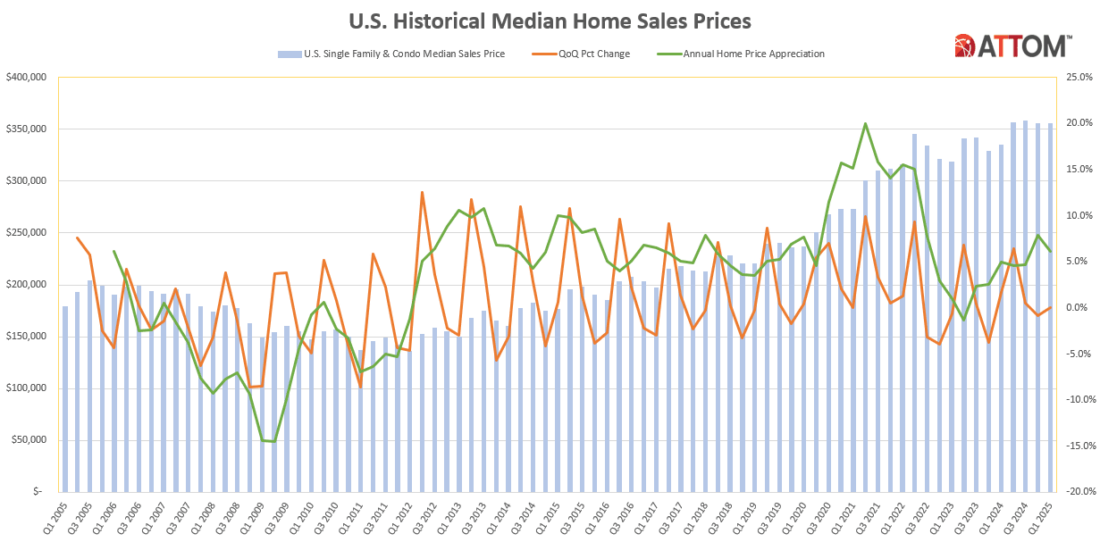

According to ATTOM’s recently released Q1 2025 U.S. Home Sales Report, homeowners earned an average profit margin of 50.2 percent on the sale of single-family homes and condos. This marks a decline of 3.2 percentage points from the previous quarter and 4.8 points from the same period in 2024. WATCH: ATTOM #figuresfriday Top 10 Housing Markets with Biggest Quarterly Increases in Profit Margins in Q1 2025 ATTOM’s latest home sales analysis reported that the national median profit margin on home sales has seen modest declines nearly every quarter since mid-2022, yet it continues to sit well above pre-pandemic levels. The report noted that while the national median home sale price has held steady at $355,000 for two consecutive quarters—just below its peak of $358,000 in Q3 2024—the median raw profit for sellers slipped by roughly 4 percent, falling from $124,000 in Q4 2024 to $119,000 in Q1 2025. Also according …

Profit Margins on Home Sales Continue to Drop in First Quarter

Typical home sales profit margin fell to 50 percent, from peak of 64 percent in 2022; Home sales prices remain near historic highs IRVINE, Calif. – Apr. 24, 2025 – ATTOM, a leading curator of land, property data, and real estate analytics, today released its first quarter 2025 U.S. Home Sales Report, which shows that homeowners, on average, made a 50.2 percent profit selling single-family homes and condos during the first quarter of the year. That was down 3.2 percentage points from the previous quarter and down 4.8 percentage points from the first quarter of 2024. The national median profit margin for home sales has declined slightly almost every quarter since the summer of 2022, but it still remains well above pre-pandemic levels. The national median home sale price—whose historic peak was $358,000 in the third quarter of 2024—has held steady for the last two quarters at $355,000. However, the …

The 5 Best APIs for Demographics

Demographic data are used from everything to personalizing website experiences to deciding where to build your next business. Demographic data provide an overview of the population and market characteristics in an area, and where you source that data from matters. The best source for depends on how you plan to use the data, and the questions you are trying to answer to achieve your business goals. Whether you are researching homes sales to find a hot market, average salaries to find a fair compensation structure, or education levels to find certain skills, there is a data provider suited to your purposes. If you are looking for an overview of demographic-related data, here are five of the best API sources. Full disclosure – you’re reading this on ATTOM, so naturally, we’re starting with our own API. But if you’re looking for access to property data, population stats, education levels, ancestry, crime rates, …

Top 10 U.S. Counties with Highest Effective Property Tax Rates in 2024

According to ATTOM’s 2024 Property Tax Analysis for 85.7 million U.S. single-family homes, $357.5 billion in taxes were levied in 2024—down 1.6% from 2023. WATCH: ATTOM #figuresfriday Top 10 U.S. Counties with Highest Effective Property Tax Rates in 2024 ATTOM’s latest property tax analysis indicated that the average U.S. single-family home tax bill reached $4,172 in 2024, up 2.7% from the previous year. That growth rate was slightly below the 4.1% increase recorded in 2023. The report found the nationwide average effective tax rate for single-family homes dipped slightly to 0.86% in 2024, down from 0.87% in 2023. Please note that New York was excluded from this year’s analysis due to limited data availability from a third-party source. ATTOM’s 2024 property tax analysis reported that in 2024 the slight decline in effective tax rates across much of the U.S. coincided with a rebound in home values, which rose 4.8% in …