Key Deadlines and Considerations for Reporting 1031 Exchanges By David Gorenberg, JD, CES As Tax Day approaches, individuals and businesses are gearing up to file their tax returns. If you completed or started a 1031 Exchange in 2024, it’s important to be aware of the specific reporting requirements for your return. In this blog, we cover key tax deadlines and provide guidance on how to properly report a 1031 Exchange for the 2024 tax year. Reporting Deadlines for Different Entities in 2025 The due dates for 2024 tax returns, based on the type of entity and form being filed, generally follow these timelines: Individuals Standard Filing Deadline: Most individuals living and working in the U.S. must file their 2024 tax returns (Form 1040 or 1040-SR) and pay any taxes due by April 15, 2025. Extended Filing Deadline and Extension: If you elect to file for an extension, you must submit …

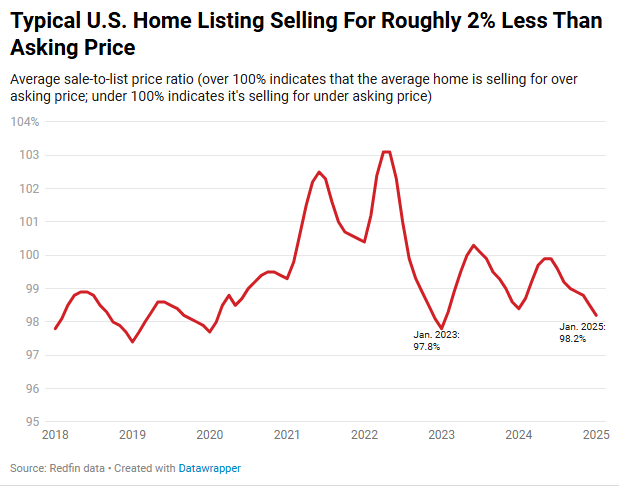

The Typical Homebuyer Pays Roughly 2% Less than the List Price–The Biggest Discount in 2 Years

Homebuyers, take note: Many listings are selling for under asking price, and most are lingering on the market. Florida homebuyers are seeing the biggest discount. Today’s average home listing is selling for under its asking price, and taking a long time to sell. While that’s not ideal for sellers, it’s good news for homebuyers who have been grappling with high housing costs and a shortage of inventory. Redfin data as of January shows that nationwide, buyers may have more room for negotiation than they have in several years: The typical U.S. home is selling for 1.8% less than its asking price, the biggest discount in nearly two years. The typical home that sells is taking 56 days to go under contract, the longest span in nearly five years. More than half (56%) of listings are sitting on the market for at least 60 days without going under contract, roughly the …

Empowering Figure Technologies’ Fintech Innovation

CoreLogic’s partnership transformed Figure Technologies into a top non-bank HELOC lender Overview Figure Technologies needed a real-time, reliable property data solution to scale its marketplace and streamline home loan origination to revolutionize lending. By integrating CoreLogic’s API and CLIP™ technology, Figure gained access to instant property data, accelerated HELOC funding, and enhanced marketing efforts. This significantly improved lead conversion and loan processing speed. Figure became the nation’s top non-bank HELOC lender, funded over $12.5 billion in home equity, and reduced loan costs. These advancements earned them industry recognition for fintech innovation and efficiency. In the fast-paced world of fintech, having a great idea is just the beginning. The real challenge lies in effectively implementing that idea to drive growth and deliver results. For Figure Technologies, a fintech company focused on revolutionizing the financial services industry through digital financial solutions, forging a path to success required nimble operations to adapt to …

Unemployment Rate was 4% in January

According to the U.S. Department of Labor’s Bureau of Labor Statistics, total nonfarm payroll employment increased by 256k in January, 2025 with the unemployment rate coming in at 4%. As always, the BLS says employment in government continued its upward growth trend in January (up 32K) with an average monthly gain of 38k in 2024. However, with the new administration’s policy changes this trend will surely change. Click here to read the full report at the Bureau of Labor Statistics. The post Unemployment Rate was 4% in January appeared first on Real Estate Investing Today.

Monthly U.S. Foreclosure Activity Increases in January 2025

Completed Foreclosures (REOs) Increase Monthly in 30 States; Foreclosure Starts Up Monthly and Down Annually Nationwide IRVINE, Calif. — February 11, 2025 — ATTOM, a leading curator of land, property data, and real estate analytics, today released its January 2025 U.S. Foreclosure Market Report, which shows there were a total of 30,816 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions – up 8 percent from the prior month but down 7 percent from a year ago. “January showed a monthly increase in foreclosure filings that may in some part be the result of a normal post-holiday catch up of filings,” said Rob Barber, CEO at ATTOM. “It’s too early to know if 2025 will shift from the general 2024 trends of a continued decline in foreclosure activity. We will keep a close eye on the market to see how interest rates, inflation, employment shifts, and other market …

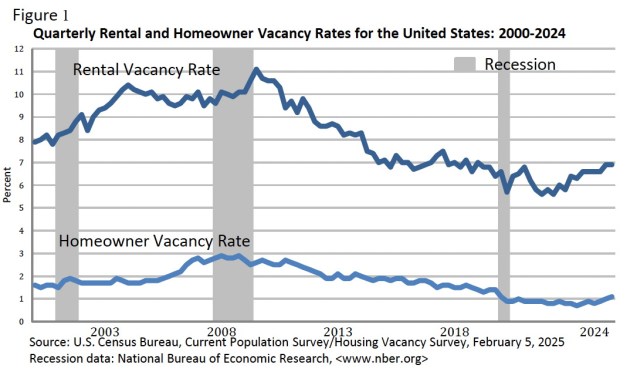

U.S. Homeownership & Rental Vacancy Rates for Q4 2024

The U.S. government is reporting that the national vacancy rates for Q4 2024 were 6.9% for rental housing and 1.1% for homeowner housing. The national homeownership rate for Q4 2024 was 65.7%. In addition, approximately 89.8% of the housing units in the United States in Q4 were occupied and 10.2% were vacant. Owner-occupied housing units made up 59% of total housing units, while renter-occupied units made up 30.8% of the inventory. Vacant year-round units comprised 8% of total housing units, while 2.2% were vacant for seasonal use. Interestingly, all of these number are nearly the same as the previous quarter. a Click here to read the full release at the U.S. Census Bureau. The post U.S. Homeownership & Rental Vacancy Rates for Q4 2024 appeared first on Real Estate Investing Today.

Here Are the 10 Most-Viewed Online Home Listings of January

Most of Redfin.com’s most-viewed listings have two things in common: They’re located in tech hubs, and they’re expensive. Seven of Redfin.com’s 10 most-viewed home listings in January were in the Bay Area, specifically the East Bay and neighborhoods near San Jose, and two were in Seattle’s eastside suburbs. One was in the Los Angeles neighborhood of the Pacific Palisades, which attracted a lot of attention in January due to the devastating wildfires that swept through the area. Nine of the 10 most-viewed listings are priced at more than $1 million, and five are priced at more than $2 million. That’s well over the median U.S. home-sale price of roughly $430,000. Here are the 10 most-viewed listings on Redfin.com in January: 1171 Ironstone Ct., San Jose, CA 95132: Listed for $1,497,000 7307 Kolb Pl., Dublin, CA 94568: Listed for $1,297,000 3558 Sequoia Common, Fremont, CA 94536: Listed for $544,841 14638 SE …

Where Were the Top 15 Cities for Home Sales Growth in 2024

Although U.S. home sales decreased in 2024 compared with 2023, some metro areas still posted substantial sales growth Daniel Boswell provided the research and analysis for these insights As housing markets begin to normalize after the country’s post-pandemic sales explosion, sales have been highly scrutinized. Despite the nation’s 2024 housing inventory being well above 2023 levels for most of the year, national sales were near or below 2023 volumes for most of 2024, according to CoreLogic MLS data. However, in examining metro-level sales figures, it turns out that there are quite a few cities that were well above the national sales levels. Markets Where Home Sales and Prices Grew in 2024 Home sales and price change trends varied greatly by geography in 2024. For example, while sales dropped by about 35% in the Cincinnati metro, prices were up by 4%. Meanwhile some relatively expensive markets — including San Jose; Anaheim, …

Why I Joined Redfin: Julie Granahan

Julie Granahan is a Redfin Premier agent in the greater Seattle area, specializing in West Seattle and Burien. She originally joined Redfin in 2016 and quickly became one of the brokerage’s top-producing agents. She rejoined us in June 2024 after two years at Compass. We caught up with Julie to hear more about her experience coming home to Redfin. What brought you back to Redfin? I missed a lot of things about Redfin, but Redfin Next was the biggest factor that brought me back. I remember reading a news article about it as soon as the pilot launched. I was at Compass at the time, and as much as I loved real estate, I didn’t love all the aspects of running the business. I thought, wouldn’t it be great if I could still sell homes, make commission, and have support and have someone take care of all the business stuff …

Inman Selects ATTOM CEO Rob Barber as a 2025 Power Player

Barber recognized among the leaders whose power and influence are shaping the future of real estate IRVINE, Calif. – Feb. 10, 2025 – ATTOM, a leading curator of land, property data, and real estate analytics, is pleased to announce that Rob Barber, CEO, has once again been named a recipient of the annual Inman Power Players award. This award recognizes those individuals charting a course toward a brighter tomorrow for the real estate community. Barber is featured on this year’s list of 143 notable individuals from the residential real estate, mortgage, finance and proptech ecosystems. The 2025 Inman Power Players includes an impressive list of executives and founders — each of whom has the ability to play a key role in shaping the future of the residential real estate industry. This As CEO of ATTOM, Barber leads the company’s enterprise strategy, customer engagement, and corporate operations, fueling its rapid growth and innovation as a premier …