According to ATTOM’s just released Q4 2024 U.S. Home Equity & Underwater Report, in the fourth quarter, 47.7 percent of mortgaged residential properties in the United States were classified as equity-rich. This means the total loan balances secured by these properties did not exceed 50 percent of their estimated market values. WATCH: ATTOM #FiguresFriday – Top 10 Metros with the Highest Percentages of Equity Rich Properties in Q4 2024 The latest home equity and underwater analysis compiled by ATTOM found that figure dipped slightly from 48.3 percent in the third quarter of 2024 and a recent peak of 49.2 percent in the previous three-month period. However, it remained above the 46.1 percent recorded in the fourth quarter of 2023 and continued to reflect historically high levels, highlighting one of the key benefits of the nation’s 13-year housing market boom. ATTOM’s fourth-quarter home equity and underwater report noted that 47.7 percent …

Home Equity Holds Steady Around U.S. During Fourth Quarter as Housing Market Remains Strong

Equity-Rich Portion of Home Mortgages Dips Slightly, but Nearly 95 Percent of Homeowners Continue to Have Property Wealth Built Up; Portion of Owners Seriously Underwater Stays Near Six-Year Low; Equity Measures Largely Unchanged as Home Prices Inch Upward IRVINE, Calif. — Jan. 30, 2025— ATTOM, a leading curator of land, property data, and real estate analytics, today released its fourth quarter 2024 U.S. Home Equity & Underwater Report, which shows that 47.7 percent of mortgaged residential properties in the United States were considered equity-rich in the fourth quarter, meaning that the combined estimated amount of loan balances secured by those properties was no more than half of their estimated market values. That level was down slightly from 48.3 percent in the third quarter of 2024 and from a recent peak of 49.2 in the prior three-month period. However, it was still up from 46.1 percent in the fourth quarter of 2023 and remained at …

An In-Depth Look at California’s Real Estate Market Using ATTOM

California’s real estate market in 2024 presented a complex mix of affordability challenges, foreclosure activity, and evolving sales trends, according to the latest reports from ATTOM. The Q4 2024 Home Affordability Index revealed mounting pressures on homebuyers, with affordability well below historic benchmarks in many counties due to rising home prices and slower wage growth. Meanwhile, ATTOM’s Year-End Foreclosure Report showcased a stable yet modest increase in foreclosure activity, far removed from the peaks of the housing crisis years. Additionally, key sales trends highlighted shifts in buyer preferences, with increases in cash and institutional investor activity alongside steady reliance on FHA financing. Together, these insights paint a nuanced picture of California’s housing market in a period of economic and market transformation. Home Prices and Affordability The Q4 2024 Home Affordability Index report from ATTOM highlights the affordability challenges facing homebuyers across all counties in California. The data reveals that the …

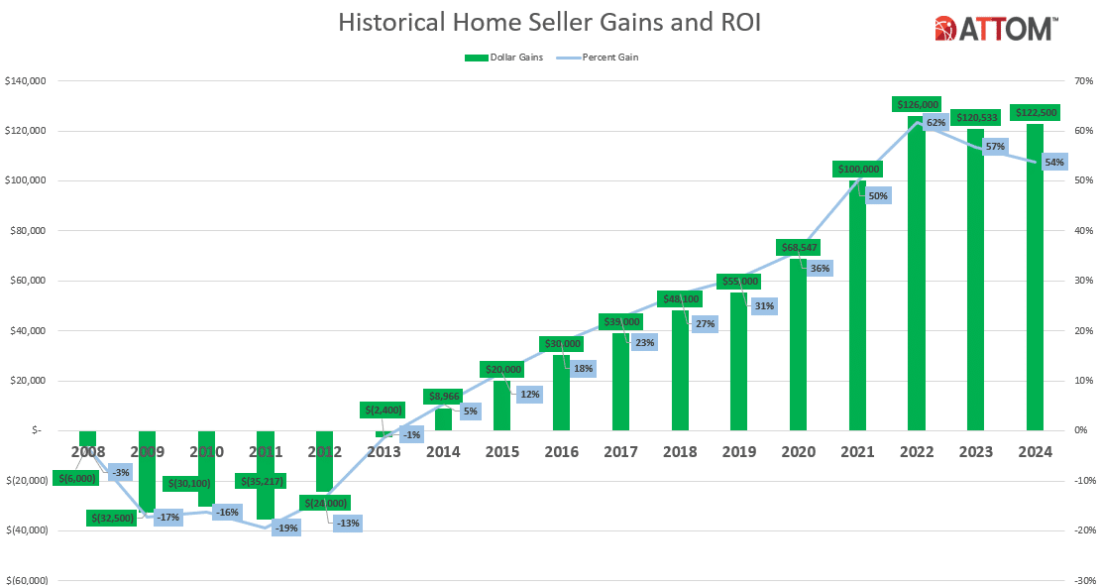

Top 10 Metros with Highest Annual Increases in Gross Profits in 2024

According to ATTOM’s newly released 2024 Year-End U.S. Home Sales Report, home sellers nationwide realized a profit of $122,500 on the typical sale in 2024, representing a 53.8% return on investment. WATCH: ATTOM #FiguresFriday – Top 10 Metros with Highest Annual Increase in Gross Profits in 2024 ATTOM’s latest home sales analysis reported that although both metrics stayed near record highs and home prices continued to climb nationwide, the profit margin on median-priced sales across the country fell from 56.9% in 2023. This decline marked the second consecutive annual drop—a trend not seen since the aftermath of the Great Recession in the late 2000s. Also, according to the report, although the gross profit on median-priced single-family home and condo sales increased by about $2,000 compared to 2023, the typical profit margin remained eight percentage points below its peak in 2022. The 2024 analysis also found that the downward trend in …

Home Selling Profits Slide Again in 2024 Across U.S. Despite Continued Price Gains

Profit Margins for Sellers Decrease for Second Straight Year; Typical Seller Return Remains Near Record Highs, But Declines to 54 Percent; Returns Dip Even as National Median Home Price Climbs to $350,000 IRVINE, Calif. – Jan. 23, 2024 — ATTOM, a leading curator of land, property data, and real estate analytics, today released its Year-End 2024 U.S. Home Sales Report, which shows that home sellers made a $122,500 profit on typical sales nationwide in 2024, generating a 53.8 percent return on investment. But even as both measures remained near record levels, and home prices kept rising around the country, the profit margin on median-priced sales nationwide decreased from 56.9 percent from 2023. The drop-off marked the second straight annual decline – a pattern of consecutive downturns that hadn’t happened since the aftermath of the Great Recession in the late 2000s. While the gross profit on median-priced single-family home and condo sales did inch up …

Where To Find Parcel Boundary Data

Parcel boundary data show the legal boundaries of a property or piece of land. A parcel is an area of owned land that is defined by clear perimeters or property lines. Property lines can become blurred over time as development occurs and natural landmarks that may have indicated boundaries disappear. Accurate boundary and property measurements are critical for legal and planning purposes. There are many resources for boundary and property data, such as local assessor offices and county recorders. However, property data providers like ATTOM offer convenient online access to the most recent parcel boundary data for the United States. Here’s an in-depth look at US parcel boundary data, who uses it and why, and where to find the most accurate information. What Are Parcel Boundaries? Parcel boundary data show the legal boundaries of a property or piece of land that have been determined by the city, county, or state …