For the fourth consecutive month, the number of delinquent loans increased year over year. In September, 3% of all U.S. mortgages were in some stage of delinquency. Although the majority of U.S. metro areas saw increases in delinquency rates, the nation’s serious delinquency rate did not change year over year, and the U.S. foreclosure rate stayed roughly the same as last year in September. While delinquency rates are increases, compared to previous periods, the overall delinquency rate in the U.S. remains low. Click here to read CoreLogic’s full Loan Performance Insights report with September 2024 data, which features commentary from Senior Principal Economist Molly Boesel. All archived Loan Performance Insights reports are available at this home page, while regular housing market reports and blog posts from CoreLogic’s economists can be found here.

Foreclosure Filings Ease Nationwide in November 2024 Amid Seasonal Influences

Foreclosure Starts Decrease 3 Percent from Last Month; Completed Foreclosures Increase 5 Percent from Last Month IRVINE, Calif. — Dec. 10, 2024 — ATTOM, a leading curator of land, property data, and real estate analytics, today released its November 2024 U.S. Foreclosure Market Report, which shows there were a total of 29,390 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions – down 9 percent from a year ago, and down 5 percent from the prior month. “The slight decline in U.S. foreclosure activity during November most likely reflects the seasonal ebb we often see this time of year,” said Rob Barber, CEO at ATTOM. “While foreclosure filings are down both month-over-month and year-over-year, the data highlights areas of the country, such as Nevada, Florida, and Connecticut, where foreclosure rates remain relatively high. As we move into 2025, we’ll be closely monitoring how economic pressures and market dynamics …

Storm Darragh Brings Hurricane-Force Winds to Western Europe

Storm Darragh brought hurricane-force winds and infrastructure disruptions to Western Europe. Power outages, travel chaos, and damages were reported across the UK, Ireland, France, and other nations. Storm Darragh formed in the Atlantic last week and was officially named on Thursday, December 5 by The UK Met Office. It is the fourth named storm of the 2024-2025 season for Western Europe, namely the United Kingdom, the Republic of Ireland, and the Netherlands. The storm was also named Storm Xaveria by the Freie Universität Berlin. The storm formed in the Atlantic mid-last week before traveling eastwards, with the center of the low reaching Ireland early evening on Friday, December 6. This brought an initial swath of strong winds to Ireland and western coastal regions of the UK. The UK Met Office issued rare red alert wind warnings for coastal communities from Anglesey to the North Devon coast. During the early hours of …

The Importance of Transaction Transparency in Real Estate

[PART 2] In today’s market, real estate professionals need to be just that — professional. That means more than giving the tour, explaining the steps involved in buying and selling a home and giving clients a to-do list to meet deadlines. Agents increasingly will be required to demonstrate their value by helping clients make sound decisions during what is often the biggest financial decision of their lives. To do that, you need to know the property, the neighborhood and local market, backed by the most current and reliable real estate data. Brokers need to become market insiders. If you aren’t, clients will know. Providing reliable data on your city, its neighborhoods and the property is crucial in building trust. Establishing Trust with Data-Driven Insight To do so, the broker needs access to comprehensive and reliable property data to paint a nuanced picture about the home and neighborhood and compare that …

Connecting Markets: How Trestle Share Simplifies Data Sharing Between Multiple Listing Organizations

As real estate markets grow increasingly interconnected, seamless data sharing has become a critical component of success, spanning local, national, and global boundaries. Data sharing empowers agents to better serve their clients, grow their business through referrals and, in many cases, reduce costs. Despite its importance, traditional data sharing methods remain costly and time-consuming, slowing progress and collaboration. The reliance on standalone connections, custom mapping, and repetitive onboarding introduces unnecessary complexity, inflates costs, and further delays efficiency. Trestle Share™ from CoreLogic® solves these challenges with a centralized database that makes onboarding and data-sharing connections much simpler. Once listing data is mapped and onboarded, organizations can easily create new connections, saving time and money. This scalable approach not only meets current needs but also sets organizations up for future growth. The advancements in data sharing that Trestle Share offers are creating collaborative opportunities between MLS markets including a recent partnership between …

Top 10 Most Vulnerable U.S. Housing Markets in Q3 2024

According to ATTOM’s newly released Q3 2024 Housing Market Impact Risk Report, California, New Jersey, and Illinois once again feature a high concentration of the most at-risk markets, with several areas in Florida also falling into this category. Meanwhile, the least-vulnerable markets remain predominantly clustered in the South. The report highlights county-level housing markets across the United States that are more or less susceptible to declines in the third quarter of 2024. WATCH: ATTOM #FiguresFriday – Top 10 Most Vulnerable U.S. Housing Markets in Q3 2024 The analysis also noted that third-quarter trends, based on factors such as affordability gaps, underwater mortgages, foreclosures, and unemployment rates, showed that two-thirds of the 50 counties deemed most vulnerable to potential declines were located in California, Florida, Illinois, and New Jersey. Notably, Florida joined this group in the third quarter, marking a shift from earlier periods when fewer of its markets were categorized …

Homeowner Equity Insights – Q3 2024

Data Through Q3 2024 The CoreLogic Homeowner Equity Insights report is published quarterly with coverage at the national, state, and metro level and includes negative equity share and average equity gains. The report features an interactive view of the data using digital maps to examine CoreLogic homeowner equity analysis through the third quarter of 2024. Negative equity, often referred to as being “underwater” or “upside down,” applies to borrowers who owe more on their mortgages than their homes are worth. Negative equity can occur because of a decline in home value, an increase in mortgage debt, or both. This data only includes properties with a mortgage. Non-mortgaged properties (that are owned outright) are not included. Homeowner Equity Q3 2024 Chart 1: U.S. home equity changes year over year, Q3 2024 CoreLogic analysis shows U.S. homeowners with mortgages (roughly 62% of all properties*) have seen their equity increase by a total …

Trump Policies 2.0: What Can State, Local Governments Expect?

What will happen to the property market under Trump’s housing policies? The U.S. government touches the lives of nearly everyone living within its borders. Therefore, when a key position — like the current sitting president — changes, people pay attention. The relationship between the U.S. federal government and lower-level authorities is pivotal in shaping how policies are implemented and how services are delivered. Naturally, the enormous influence of the federal government on daily life has many asking: As the incoming Trump administration prepares to hit the ground running, what does the future look like for state and local governments? With each new presidential administration comes a shift in priorities, resources, and regulations, all of which trickle down to impact state and local governments. In the property industry, those changes will range across touch points, including: Keep Pace With the Property Market Property Pulse Newsletter A Republican-Controlled Government Will Influence Trump …

This Election’s Biggest Winner Might Be Landlords

This Election’s Biggest Winner Might Be Landlords By Scot Aubrey As the 2024 U.S. presidential election recently closed, landlords across the country are celebrating many of the positive outcomes they saw in regard to housing, tax, and economic policies that will affect their businesses. Whether it’s rent control, tenant protection laws, or economic conditions, this often-contentious election outcome will have an impact on the investment real estate market for years to come. Here’s what landlords should be on the lookout for: Rent Control Normally reserved for large population center cities, rent control has moved beyond big-city limits and is trying to make its way into our local communities. The outcome of many propositions around the country promoting rent control policies were effectively shot down, mostly by landlord voters like you. Even in California, Prop 33, which would have put rent control policies in place statewide, was defeated. These proposals could …

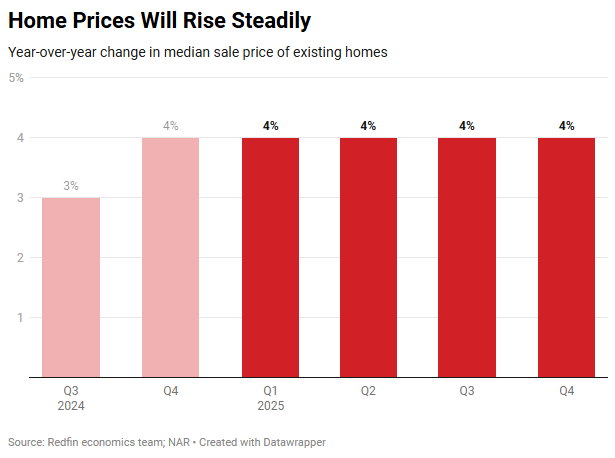

Redfin’s 2025 Predictions: Pent-Up Demand Will Lead to More Home Sales, But Many Would-Be Buyers Will Opt to Rent

Redfin’s economists expect there will be more home sales in 2025, largely due to pent-up demand. But some would-be homebuyers will still be priced out, with home prices climbing and mortgage rates remaining near 7%. Rental prices, on the other hand, should stay flat while wages increase, improving affordability for renters. Politicians from both sides of the aisle have pledged to lower housing costs for working-class Americans and build more homes; we are hopeful that will happen over the next several years. Prediction 1: Home Prices Will Rise 4% in 2025 We expect the median U.S. home-sale price to rise steadily throughout 2025, ending the year 4% higher than it was in 2024. Prices will rise at a pace similar to that of the second half of 2024 because we don’t expect there to be enough new inventory to meet demand. Rising prices are one factor that will keep homeownership …