Building and nurturing your contact list is essential for long-term success in the mortgage industry. According to a study by STRATMOR, 89% of borrowers made their decision to choose a lender based on relationships. A well-maintained list allows you to stay connected with potential borrowers and offer solutions tailored to their evolving needs. Whether people are actively shopping for homes, considering a refinance, or looking at home equity products, by regularly engaging with your contacts, you build trust and increase the likelihood of keeping the business of past and current clients. Learn how to increase your network, grow your business, and retain your customer base in a competitive market. It only takes four simple steps. 1. Make Sure Your Current and Past Customers Like You Referrals are one of the most trusted and cost-effective ways to build your contact list. Leveraging your existing network of former clients and other trustworthy …

Inflation Up 2.7% Year-Over-year

The U.S. Bureau of Labor Statistics is reporting that the Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3% in November, 2024. The all items index was up 2.7% for the 12 months ending in November. The index for shelter rose 0.3% in November, accounting for nearly forty percent of the monthly all items increase. Click here to read the full release at the Bureau of Labor Statistics. The post Inflation Up 2.7% Year-Over-year appeared first on Real Estate Investing Today.

Top 10 Counties with Highest Home Flipping Profit

According to ATTOM’s Q3 2024 U.S. Home Flipping Report, a total of 74,618 single-family homes and condominiums were flipped across the United States. These transactions accounted for 7.2% of all home sales nationwide, equivalent to one in every 14 sales, during the months of July through September. WATCH: ATTOM #FiguresFriday – Top 10 Counties with Highest Home Flipping Profit ATTOM’s latest home flipping analysis revealed that the share of flipped properties dropped to 7.2% in the third quarter of 2024, down from 7.6% in the previous quarter. This decline aligns with a typical trend during the Spring and Summer homebuying seasons, when other types of sales typically increase. The flipping rate returned to the same 7.2% level observed in the third quarter of 2023. The report stated the nationwide, home flipping in the third quarter of 2024 yielded an average return on investment of 28.7% before expenses. This marks a …

Inspiring Future STEAM Leaders Through NextGen Event

We always say our future lies with the next generation. But how do you convince a bunch of first graders to care about the effects of natural disasters on the property market? You show them McDonalds. John Rogers, CoreLogic’s chief data and analytics officer, showed a crowd of first graders how CoreLogic’s Discovery Center provides insights for every location of the fast-food chain, explaining how this information is useful in the event of a natural disaster. He reinforced the importance for owners of understanding when their franchise or operation is in the path of a tornado, blizzard, or other significant weather event. NextGen Invites the Future Generation to Imagine Innovation This experience was one of many at the inaugural CoreLogic NextGen event, which brought nearly 100 kids, from first graders to twelfth graders, to the CoreLogic headquarters in Irvine for a day of STEAM-related activities. Held on Veterans Day, the …

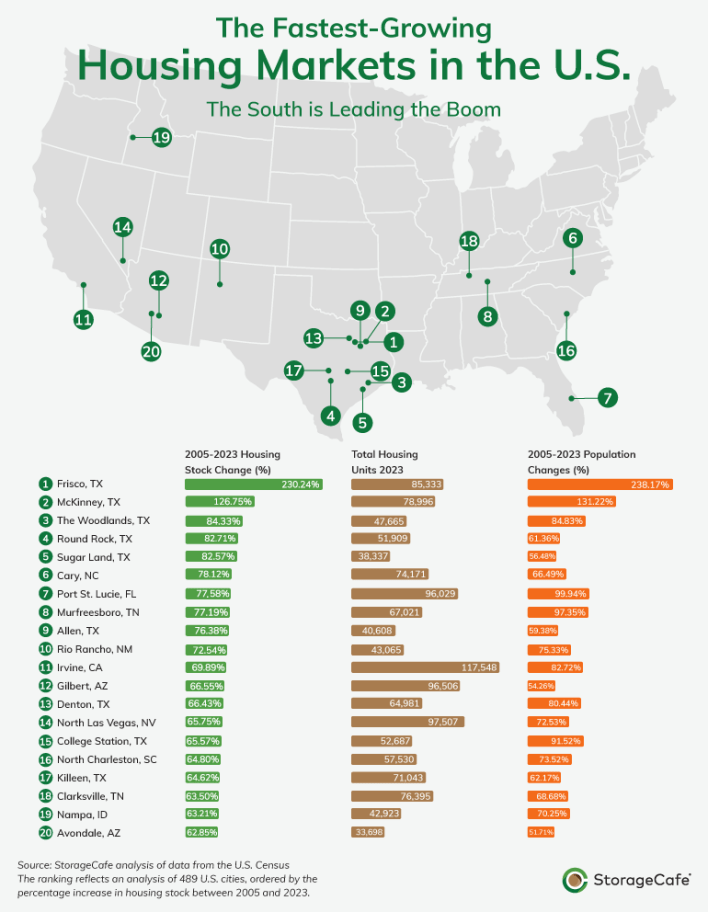

America’s Fastest Growing Housing Markets

A recent report from StorageCafe says the South is leading the boom in America’s fastest-growing housing markets with Texas “stealing the spotlight.” In fact, nationally, they say housing inventory rose by 16.7% from 2005 to 2023. Indeed…stay safe and have a Happy Friday!!! Hat tip to StorageCafe. The post America’s Fastest Growing Housing Markets appeared first on Real Estate Investing Today.

Podcast: CoreLogic’s Shaleen Khatod on the role of AI in real estate

On today’s sponsored episode, Editor in Chief Sarah Wheeler talks with Shaleen Khatod, Senior Vice President of Real Estate Strategy, Products and Innovation at CoreLogic, about the role of AI in real estate and how that should represent not just artificial intelligence, but agent intelligence. Related to this episode: The HousingWire Daily podcast examines the most compelling articles reported across HW Media. Each morning, we provide our listeners with a deeper look into the stories coming across our newsrooms that are helping Move Markets Forward. Hosted and produced by the HW Media team. Related

CoreLogic’s Trestle Share: Connecting markets and increasing broker value

In the real estate industry, we thrive on connections – between agents, clients, and data. For MLSs, seamless data sharing isn’t just a convenience; it has become necessary to stay competitive as geographic borders disappear, creating an even more interconnected marketplace. Even with the reduction of MLSs across America, overlapping market disorder continues to plague data management for brokers spanning multiple markets. MLSs can better serve their broker clients by fulfilling the need for efficient tools to break down data silos and deliver access to broader listing pools. Traditional data-sharing models have often been a roadblock. Costly, time-intensive data-sharing connections and complex custom mapping have hampered collaboration and limited the ability of MLSs to scale. These challenges create friction for organizations trying to provide more value to their members by expanding their reach into markets, reducing costs, and meeting increasingly high client expectations. This is where Trestle Share from CoreLogic …

Construction Claims – December 2024

About CoreLogic Data Research CoreLogic develops this report using up-to-date materials and labor costs. CoreLogic’s team of analysts continuously researches hard costs such as labor, material, and equipment, including mark-ups. CoreLogic updates its database every month accordingly. Our research also covers soft costs, such as taxes and fringe benefits, for reconstruction work performed as part of the insurance industry. CoreLogic monitors demographics and econometric statistics, government indicators, and localization requirements, including market trends from thousands of unique economies throughout the U.S. Other factors in this process include the following: Wage rates for more than 85 union and non-union trades Over 100,000 construction data points Productivity rates and crew sizes Building code requirements and localized cost variables Additionally, we validate cost data by analyzing field inspection records, contractor estimates, phone surveys, and both partial and complete loss claim information. Please complete the online form to provide feedback or request information on any …

Home Flipping Declines and Investor Profits Stumble Across U.S. During Third Quarter of 2024

Typical Raw Flipping Profit Drops to $70,000; Flipping Rate Also Decreases to Low Point Over Past Year IRVINE, Calif. – Dec. 12, 2024 — ATTOM, a leading curator of land, property data, and real estate analytics, today released its third-quarter 2024 U.S. Home Flipping Report showing that 74,618 single-family homes and condominiums in the United States were flipped in the third quarter. Those transactions represented 7.2 percent, or one of every 14 home sales, nationwide during the months running from July through September of 2024. The latest portion of flipped properties was down from 7.6 percent of all sales in the U.S. during the second quarter of 2024, extending a common pattern seen during annual Spring and Summer buying seasons when other types of home sales spike. The flipping rate returned to the 7.2 percent level recorded in the third quarter of last year. However, while the flipping rate followed historical trends, …

Loan Performance Insights – September 2024

For the fourth consecutive month, the number of delinquent loans increased year over year. In September, 3% of all U.S. mortgages were in some stage of delinquency. Although the majority of U.S. metro areas saw increases in delinquency rates, the nation’s serious delinquency rate did not change year over year, and the U.S. foreclosure rate stayed roughly the same as last year in September. While delinquency rates are increases, compared to previous periods, the overall delinquency rate in the U.S. remains low. Click here to read CoreLogic’s full Loan Performance Insights report with September 2024 data, which features commentary from Senior Principal Economist Molly Boesel. All archived Loan Performance Insights reports are available at this home page, while regular housing market reports and blog posts from CoreLogic’s economists can be found here.