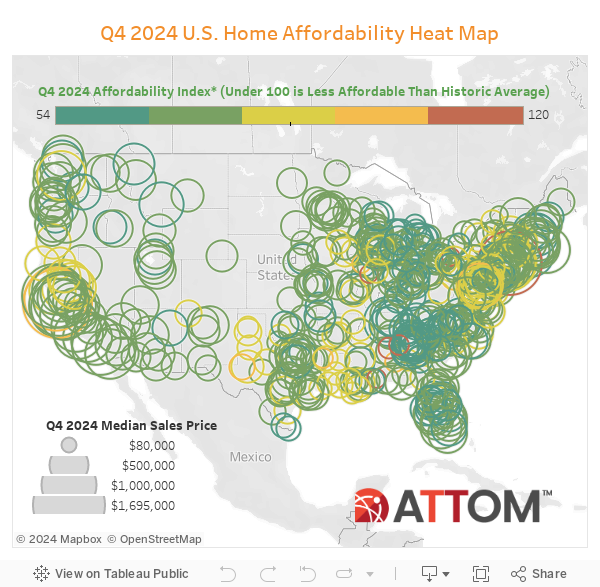

Major Home-Ownership Expenses Consume 34 Percent of National Average Wage IRVINE, Calif. – Dec. 19, 2024 — ATTOM, a leading curator of land, property data, and real estate analytics, today released its fourth-quarter 2024 U.S. Home Affordability Report showing that median-priced single-family homes and condos remain less affordable in the fourth quarter of 2024 compared to historical averages in 98 percent of counties around the nation with enough data to analyze. The latest trend continues a three-year pattern of home ownership requiring historically large portions of wages as U.S. home prices keep reaching new heights. The report also shows that major expenses on median-priced homes currently consume 34 percent of the average national wage. That level marks an increase of more than one percentage point both quarterly and annually, pushing the figure even farther above the common 28 percent lending guideline preferred by lenders. The downturns in current and historic affordability …

Mom-and-Pop Investors Are Quietly Shaping the Housing Market

Why institutional investors aren’t the housing market’s biggest players Investor activity in the U.S. housing market is often associated with deep-pocketed institutional buyers, but data from Q3 2024 paints a different picture. While institutional investors tend to dominate headlines, they account for only a small fraction of total investor activity. Most real estate investors are mom-and-pop landlords, who own three to 10 properties. While investors have been active in 2024, data on investor activity for Q3 shows only a 2% uptick from mid-year. And this slow growth trend is expected to hold. All signs point to investor share remaining around 25% of total sales for the foreseeable future as mortgage rates and home prices remain high. Smaller-scale investors play a powerful but understated role in the market, buoying home prices even as overall demand has softened. Yet, historical trends from mid-2022 to early 2024 show no consistent correlation between investor …

Rental Beast Apply Now: Integration Now Available in OneHome

Platform Integration to Make Rental Application and Tenant Screening Tool Available in OneHome Boston, MA (December 9, 2024)—Rental Beast, an industry-leading real estate technology firm, and CoreLogic®, a leading provider of property insights and innovative solutions, announced today a new integration of Rental Beast’s powerful platform into OneHome™ from CoreLogic. This integration streamlines and enhances OneHome users’ rental application and tenant screening process while expanding the visibility of an MLS’ rental listings. Users of CoreLogic’s OneHome client search portal for participating MLSs will now have seamless access to Rental Beast’s Apply Now, a tenant application and screening tool, directly within the platform. This integration offers a more efficient application process, enabling consumers to manage and initiate rental inquiries with ease and speed. The integration will also increase listing exposure and lead quality by syndicating listings through the Rental Beast platform and getting exposure to millions of unique visitors by integrating …

Quarterly Construction Insights – Q4 2024

Summary Q4 2024: The cost of lumber has decreased by 6% in the U.S. and by 5% in Canada since January. Costs for carpet, insulation, and clay bricks have notably increased. Single unit housing and the South have been leading in permit approvals for 2024. CoreLogic tracks construction costs for all types of goods (labor and materials) for commercial, residential, and agricultural construction throughout the U.S. and Canada. Details from this quarter’s research include: From January 2024 to October 2024, costs for lumber decreased by 6% or less, while costs for carpet increased by over 20%. Costs for clay bricks increased by over 12%. Overall residential reconstruction costs from August 2024 to November 2024 increased by an average of 2.8% in the U.S. and 0.9% in Canada. Residential reconstruction cost this quarter increased the most in Minnesota, with growth of 3.7%. The South has led the nation in 2024 for …

The Best Resources for Real Estate Targeted Mailing Lists in 2025

Agents, These Are the Best Resources for Real Estate Targeted Mailing Lists in 2025 Marketing via direct mail and email may seem antiquated compared to other methods like SMS and social media. But direct mail is still one of the most effective real estate marketing tools, particularly for targeting older generations who are less tech savvy. Direct mailing and emailing should be part of every real estate agent’s marketing plan, and the best part is you don’t have to do all the work yourself. Today, there are plenty of services that will do the hard work of data segmentation for you. With that in mind, below is a roundup of the four best resources for real estate mailing list providers in 2025. ***This article was originally written in 2022, but has been updated to reflect new solution providers*** 1. ATTOM Property Navigator – Best Overall Powered by property data from …

Four Tips to Build Contact Lists and Increase Referral Networks

Building and nurturing your contact list is essential for long-term success in the mortgage industry. According to a study by STRATMOR, 89% of borrowers made their decision to choose a lender based on relationships. A well-maintained list allows you to stay connected with potential borrowers and offer solutions tailored to their evolving needs. Whether people are actively shopping for homes, considering a refinance, or looking at home equity products, by regularly engaging with your contacts, you build trust and increase the likelihood of keeping the business of past and current clients. Learn how to increase your network, grow your business, and retain your customer base in a competitive market. It only takes four simple steps. 1. Make Sure Your Current and Past Customers Like You Referrals are one of the most trusted and cost-effective ways to build your contact list. Leveraging your existing network of former clients and other trustworthy …

Top 10 Counties with Highest Home Flipping Profit

According to ATTOM’s Q3 2024 U.S. Home Flipping Report, a total of 74,618 single-family homes and condominiums were flipped across the United States. These transactions accounted for 7.2% of all home sales nationwide, equivalent to one in every 14 sales, during the months of July through September. WATCH: ATTOM #FiguresFriday – Top 10 Counties with Highest Home Flipping Profit ATTOM’s latest home flipping analysis revealed that the share of flipped properties dropped to 7.2% in the third quarter of 2024, down from 7.6% in the previous quarter. This decline aligns with a typical trend during the Spring and Summer homebuying seasons, when other types of sales typically increase. The flipping rate returned to the same 7.2% level observed in the third quarter of 2023. The report stated the nationwide, home flipping in the third quarter of 2024 yielded an average return on investment of 28.7% before expenses. This marks a …

Home Flipping Declines and Investor Profits Stumble Across U.S. During Third Quarter of 2024

Typical Raw Flipping Profit Drops to $70,000; Flipping Rate Also Decreases to Low Point Over Past Year IRVINE, Calif. – Dec. 12, 2024 — ATTOM, a leading curator of land, property data, and real estate analytics, today released its third-quarter 2024 U.S. Home Flipping Report showing that 74,618 single-family homes and condominiums in the United States were flipped in the third quarter. Those transactions represented 7.2 percent, or one of every 14 home sales, nationwide during the months running from July through September of 2024. The latest portion of flipped properties was down from 7.6 percent of all sales in the U.S. during the second quarter of 2024, extending a common pattern seen during annual Spring and Summer buying seasons when other types of home sales spike. The flipping rate returned to the 7.2 percent level recorded in the third quarter of last year. However, while the flipping rate followed historical trends, …

Foreclosure Filings Ease Nationwide in November 2024 Amid Seasonal Influences

Foreclosure Starts Decrease 3 Percent from Last Month; Completed Foreclosures Increase 5 Percent from Last Month IRVINE, Calif. — Dec. 10, 2024 — ATTOM, a leading curator of land, property data, and real estate analytics, today released its November 2024 U.S. Foreclosure Market Report, which shows there were a total of 29,390 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions – down 9 percent from a year ago, and down 5 percent from the prior month. “The slight decline in U.S. foreclosure activity during November most likely reflects the seasonal ebb we often see this time of year,” said Rob Barber, CEO at ATTOM. “While foreclosure filings are down both month-over-month and year-over-year, the data highlights areas of the country, such as Nevada, Florida, and Connecticut, where foreclosure rates remain relatively high. As we move into 2025, we’ll be closely monitoring how economic pressures and market dynamics …

The Importance of Transaction Transparency in Real Estate

[PART 2] In today’s market, real estate professionals need to be just that — professional. That means more than giving the tour, explaining the steps involved in buying and selling a home and giving clients a to-do list to meet deadlines. Agents increasingly will be required to demonstrate their value by helping clients make sound decisions during what is often the biggest financial decision of their lives. To do that, you need to know the property, the neighborhood and local market, backed by the most current and reliable real estate data. Brokers need to become market insiders. If you aren’t, clients will know. Providing reliable data on your city, its neighborhoods and the property is crucial in building trust. Establishing Trust with Data-Driven Insight To do so, the broker needs access to comprehensive and reliable property data to paint a nuanced picture about the home and neighborhood and compare that …

- Page 2 of 2

- 1

- 2