Key Insights on Foreclosures, Affordability, Home Prices, and Sales Trends Florida, the Sunshine State, presents a dynamic real estate market influenced by various factors, including economic cycles, migration patterns, and natural disasters. Using data from ATTOM, we explore key aspects such as foreclosures, affordability, home prices, and recent sales trends. In Q4 2024, the home affordability index varied significantly across different counties in Florida. For instance, Miami-Dade County had a median sales price of $525,000 and an affordability index of 62, indicating higher home prices relative to local incomes. Broward County, with a median sales price of $440,000, had an affordability index of 59, also reflecting affordability challenges. On the other hand, counties like Alachua and Bay offered relatively more affordable options. Alachua County had a median sales price of $303,000 and an index of 72, while Bay County’s median price was $365,000 with an index of 67. Foreclosure activity …

Housing Supply Just Hit a Four-Year High. But That’s Partly Because So Many Homes Are Sitting on the Market Unsold.

Over half of home listings last month sat on the market for 60 days or longer—the highest November share since 2019. That’s a major reason housing supply jumped 12%. Active listings—the total number of homes for sale—climbed to the highest level since 2020 in November on a seasonally adjusted basis, rising 0.5% month over month and 12.1% year over year. For all the talk of America’s housing shortage, one would think that’s great news. But the story is nuanced; a major reason for the jump in supply is a pileup of unsold homes, many of which buyers have deemed undesirable because they seem overpriced. Over half (54.5%) of home listings in November sat on the market for at least 60 days without going under contract. That’s the highest share for any November since 2019 and is up from 49.9% a year earlier. The typical home that did go under contract …

America’s Renters Are Moving Less Than Ever, With a Third Staying in the Same Home for at Least 5 Years

33.6% of U.S. renters have lived in the same home for at least five years, up from 28.4% a decade ago. Baby boomers stay put the longest, with more than a third having been in their rental at least a decade. Gen Z renters move the most, with more than half having lived in their current home for less than a year. Renters move most often in Denver, Austin and Salt Lake City. They stay put longest in New York, Los Angeles and Riverside. A third (33.6%) of U.S. renters have lived in the same home for at least five years, up from 28.4% a decade ago. That’s according to a Redfin analysis of 2023 renter tenure data from the U.S. Census Bureau—the most recent data available. There are more methodology details at the end of this report. While the majority of renters move within five years—including 25.6% moving within …

Unpacking 2024 Housing Market Trends

The market slowdown in 2024 was perceptible, but that doesn’t mean that price growth stopped This year, the housing market evolved in ways that few anticipated. Affordability tumbled to the lowest level in decades despite home price growth slowing from previous years. Growth in home prices continued, but there were stark divisions between the areas of the country with gains and areas that were at risk of price declines. Home price growth forecasts responded to these headwinds with year-over-year outlooks dipping deeply mid-year before recovering slightly in Q3. CoreLogic’s economy team compiled a snapshot of this year’s major trends. Dive Deeper Into a Discussion on 10 Housing Market Trends Core Conversations With Economist Molly Boesel Home Price Growth Cooled in 2024 Although home prices continue to increase throughout the U.S., they are doing so at a much slower pace than in previous years. Inflationary pressures, high interest rates, and affordability …

At What Point Will Refinancing Become Worth It Again?

Refinance activity contracted after reaching a two-year high in September 2024 Refinance demand fluctuates, and dramatic changes can occur in a matter of months. Just look at the difference in volumes between 2021 and 2023. In 2021, historically low mortgage rates and significant home price appreciation sent aggregate origination volumes of refinance mortgages to the highest point in decades. However, as interest rates began to rise, demand for refinance loans contracted. By 2023 refinancing volumes hit a low not seen since 2001 (Figure 1). In the first ten months of 2021, total mortgage refinance volume exceeded $2.2 trillion. In contrast, during the same period in 2023, refinance volume plummeted to just $273 billion, marking the lowest level since 2001. That said, refinance activity showed a slight rebound in the first ten months of 2024, rising to $347 billion. Keep Pace With the Property Market Property Pulse Newsletter Figure 1: Refinance …

ATTOM Webinar Summary: 2025 Housing Market Outlook

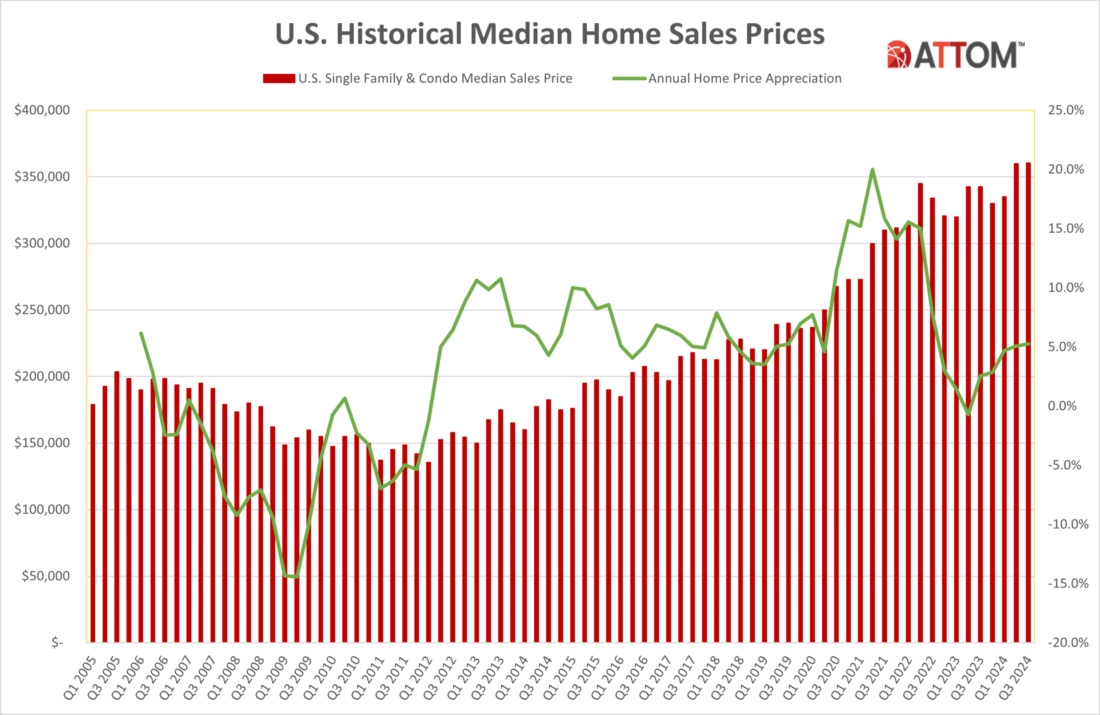

This ATTOM webinar features industry experts Todd Teta, ATTOM Chief Product & Technology Officer, and Mike Simonsen, Altos Research Founder and President, as they discuss what’s to come for the housing market in 2025. During this webinar, Todd and Michael examine essential market indicators, along with the present housing market situation, while assessing the current economic climate and delving into recent data on loan data, sale prices, foreclosure data, housing inventory, and related factors. Todd begins by reviewing historical mortgage rates, residential loan volume over time, median prices and home appreciation trends, as well as average homeownership tenure, foreclosure filings, foreclosure starts and foreclosure completions. Also, during this webinar, Michael explores signs of improving inventory by looking at historical trends, active inventory, and projected 2025 inventory, as well as median price of new contracts trends, price appreciation, change in pending sales price from prior year, and changes in pending contracts. …

A Comprehensive Look at ATTOM’s Boundary Data: Types, Benefits & Use Cases

At the core of every home sale, mortgage, refinancing or property assessment are boundary lines. Most obviously, parcel boundaries are needed to create maps and see the location and shape of a property. But boundary data is crucial for compiling key data on individual properties and putting that data into context. Boundaries are all important for property data aggregation. To yield precise and accurate intelligence, a property’s key features, like the square footage and lot size, need to be put into a hyperlocal context. Comparing properties to citywide averages is often misleading. It is best to compare one home to similar homes near it; homes served by the same schools, located near the same shops and affected by the same crime rates, flood risks and other external factors. But to produce hyperlocal data for a property, you first need to draw accurate boundaries from the building footprint and parcel boundary …

2024 Look Back: The Year That Redefined Housing Market Trends

How homebuyers adapted to the 2024 market gives insights into upcoming trends As we close the chapter on 2024, it’s clear this year was anything but predictable for the property market. From unexpected mortgage rate spikes to creative homeownership solutions emerging out of necessity, the housing landscape evolved in ways that even seasoned experts didn’t anticipate. What’s striking about 2024 is not just the record-breaking highs in home values, but the stark contrast between optimistic housing market predictions and harsh economic realities. Interest rates that were expected to decline instead hit new peaks, pushing affordability to the lowest level in decades. Meanwhile, a new wave of innovation saw buyers banding together to purchase homes. This wrap-up captures the defining moments of 2024’s property market and sets the stage for what’s next, offering a glimpse into the future of real estate as we head into 2025. What Can You Expect From …

Top 10 Counties with the Largest Quarterly Increase in Affordability Indexes in Q4 2024

According to ATTOM’s Q4 2024 U.S. Home Affordability Report median-priced single-family homes and condos are still less affordable compared to historical norms in 99 percent of counties with sufficient data. This trend, observed since 2022, reflects a persistent challenge in homeownership, with housing costs consuming historically significant portions of incomes nationwide. WATCH: ATTOM #FiguresFriday – Top Ten U.S. Counties with the Largest Quarterly Increase in Affordability Indexes in Q4 2024 The report indicates that major expenses for median-priced homes now consume 34% of the average national wage, up over one percentage point both quarterly and annually. This figure exceeds the 28% lending guideline commonly preferred by lenders. ATTOM’s latest home affordability analysis revealed that current and historic affordability downturns highlight how home ownership remains a financial challenge for average workers. With the national median home price reaching $364,750 and mortgage rates still above 6%, ownership expenses continue to outpace wages, …

US Single-Family Rent Index – December 2024

Annual U.S. rent growth registered a 1.7% increase in October, marking the lowest rate recorded since June 2020. On a monthly basis, October marks the third consecutive month of below-trend seasonal growth. This month-over-month decrease is a clear sign that rent growth is decelerating, especially in markets in the South and the West where rent growth is approaching historical averages following multiple years of red-hot rent growth. Click here to read CoreLogic’s full SFRI report with September 2024 data, which features commentary from Principal Economist Molly Boesel. All archived SFRI reports are available at this home page, while regular housing market reports and blog posts from CoreLogic’s Office of the Chief Economist can be found here.

- Page 1 of 2

- 1

- 2