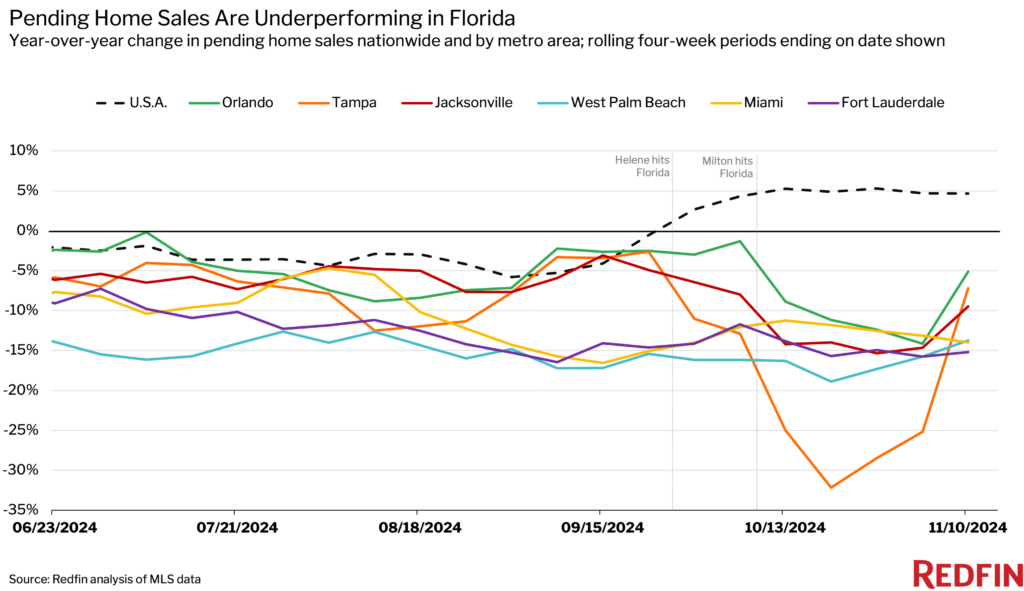

The five U.S. metro areas where pending sales are falling most are all in Florida, though the declines are easing in some metros following a destructive hurricane season. Florida is home to the five U.S. metropolitan areas where pending home sales are falling fastest. In Fort Lauderdale, pending sales dropped 15.2% year over year during the four weeks ending November 10—the biggest decline among the U.S. metropolitan areas Redfin analyzed. Next came Miami (-14%), West Palm Beach (-13.8%), Jacksonville (-9.5%) and Tampa (-7.2%). Nationwide, pending sales rose 4.7% over the same period. The metro-level ranking in this report came from a list of the 50 most populous metros; Redfin included the 47 that had sufficient data. Florida’s housing market has been slowing for months as residents grapple with frequent natural disasters, along with a surge in home insurance costs and HOA fees fueled by intensifying climate risk. The latest shoe …

What Is an Automated Valuation Model (AVM)?

Automated valuation models (AVMs) provide instant property valuations. They are an algorithm-based tool based on mathematical formulas, property databases, and property characteristics. Used by homeowners, real estate professionals, underwriters, mortgage lenders, investors, and anyone who wants a quick property valuation, AVMs are available on digital platforms. They vary in their sophistication depending on the needs of the end-user. Read on to learn how AVMs work, who uses them, where to find them, and how they serve the world of real estate. What Is an Automated Valuation Model (AVM) in Real Estate? An automated valuation model (AVM) is an algorithm-based tool to determine the value of a home or property. The models use property data including information on local real estate and the neighborhood combined with mathematical or statistical modeling to estimate a property’s value. Property AVMs are available on real estate platforms popular among homeowners, such as Trulia.com, Realtor.com, and …

Foreclosure Rates for All 50 States in October 2024

In October 2024, the U.S. housing market experienced a slight uptick in foreclosure activity, with 30,784 properties filing for foreclosure—marking a 4% increase from the previous month but an 11% decrease year-over-year. This nuanced trend shows foreclosure levels remain relatively low despite monthly rises. Foreclosure starts rose 6% from September, while completed foreclosures increased by 12%, reflecting a modest escalation in proceedings that may be influenced by broader economic conditions. Rob Barber, CEO of ATTOM, noted that while foreclosure activity has risen, seasonal factors may offer brief relief, but economic dynamics should be closely monitored as we move into 2025. Nevada led the country with the highest foreclosure rate, followed by New Jersey and Florida, underscoring regional disparities in foreclosure rates across the U.S. Foreclosure Rates by State Foreclosure rates saw a slight increase from the previous month but remained lower than last year. Read on for October 2024 foreclosure …

- Page 2 of 2

- 1

- 2