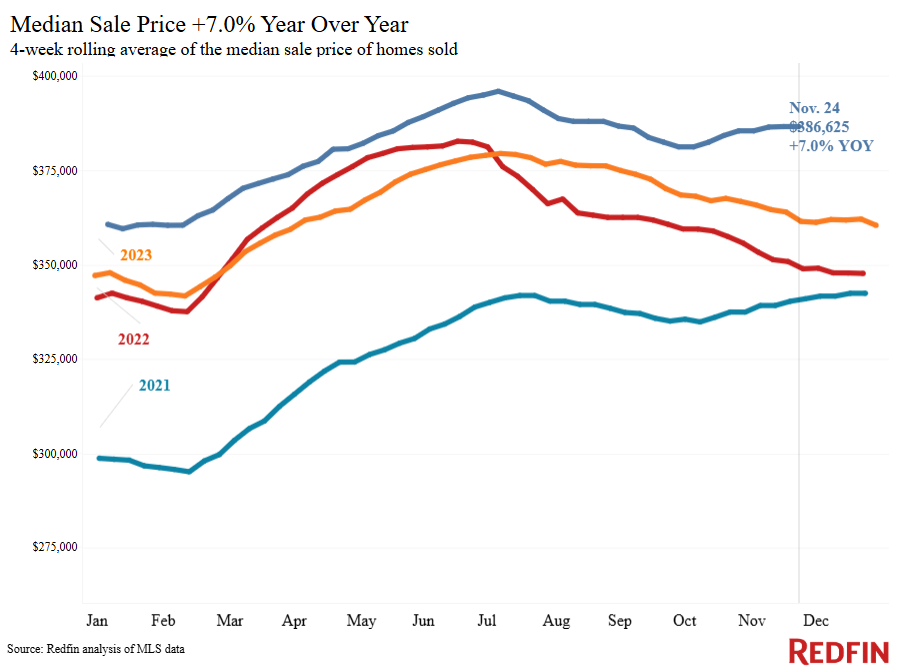

Pending sales posted a big year-over-year increase this week, partly because the boom in early-stage homebuying demand we saw just after the election is translating to sales and partly because we’re comparing to a period in 2023 that included Thanksgiving. U.S. pending home sales rose 12.1% year over year during the four weeks ending November 24, the biggest increase since May 2021. One reason for the outsized increase is that early-stage homebuying demand, including home tours, boomed in the two weeks following the presidential election. But another notable reason is that we’re comparing to a period in 2023 that included Thanksgiving, a time of year when home sales are typically very slow. We’ll know in the next few weeks whether the increase in pending sales is a Thanksgiving mirage or a sign of sustained strength in the housing market. Mortgage purchase applications are up 12% week over week, though home …

What Sets ATTOM Data Apart from Other Real Estate Portals? 10 ATTOM Real Estate Solutions You Need to Know About

Artificial intelligence combined with easy-to-use APIs (applicant programming interfaces) and big data have jettisoned the real estate industry into the digital universe. PropTech startups and data portals serve almost every need of real estate professionals, investors, lenders, and insurers. ATTOM delivers custom real estate data and analytics to its clients. Its extensive range of property data — from property characteristics to geo local environmental risk data — make it a leading player in the real estate data market. This article looks at ten of ATTOM’s unique real estate data solutions and the industry professionals it serves. 10 Solutions from ATTOM that You Need to Know About Every real estate portal has its unique features. Zillow boasts close to 20 APIs, among them a home loan functionality and a portal where landlords can find and screen potential renters. Homesage.ai runs computer vision models on all new listings in the US with …

Top 10 U.S. Metros with Purchase Mortgage Originations on the Rise

ATTOM’s Q3 2024 U.S. Residential Property Mortgage Origination Report shows that during the third quarter, 1.67 million mortgages secured by residential properties (1 to 4 units) were issued in the United States, marking a modest increase of 1.9% both quarterly and annually. WATCH: ATTOM #FiguresFriday – Top 10 U.S. Metros with Purchase Mortgage Originations on the Rise According to the report, this growth represented the second consecutive quarterly increase, a trend not seen in over three years. However, despite 30-year fixed mortgage rates dropping to nearly 6% by the end of Q3 2024, the boost in lending activity fell well short of the surge experienced in spring 2024. Total mortgage activity remained nearly two-thirds below the peak reached in 2021. ATTOM’s Q3 2024 mortgage origination report stated that the recent trend was driven by gains in refinance and home-equity lending rather than an increase in new purchase loans. Refinancing activity …

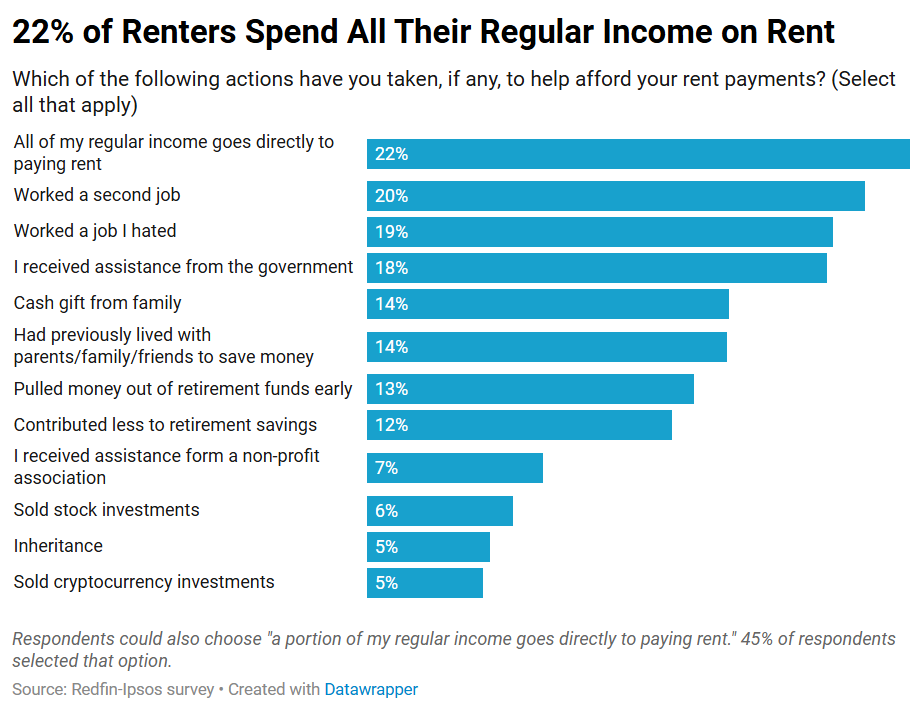

More Than 1 in 5 Renters Say Their Entire Paycheck Goes to Rent

22% of U.S. renters say all their regular income goes toward rent payments, according to a recent Redfin-commissioned survey. 19% of renters report they have worked a job they hated to afford rent. Just over one in five (22%) U.S. renters say all of their regular income goes directly to paying their rent, according to a recent Redfin-commissioned survey. Working a second job is also a fairly common way for renters to pay housing costs, with 20% of renters citing that method. Nearly the same share (19%) say they have worked a job they hated to afford rent. The survey findings in this report are from a Redfin-commissioned survey conducted by Ipsos in September 2024, fielded to 1,802 U.S. residents aged 18-65. This report focuses on the 894 renters who answered this question: Which of the following actions have you taken, if any, to help afford your rent payments? Respondents …

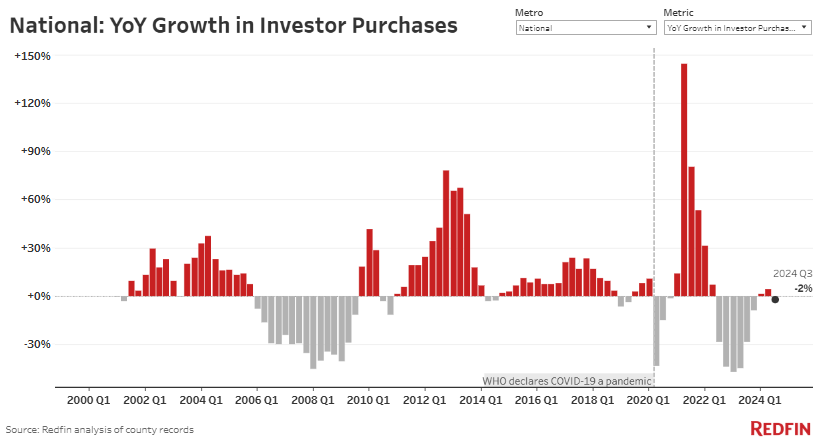

Investor Home Purchases Plateau After a Pandemic-Era Rollercoaster Ride

U.S. investor home purchases fell 2% year over year in the third quarter, a much smaller change than the swings of the last several years. Purchases are now back near pre-pandemic levels. In Florida, investor purchases posted double-digit declines amid an ongoing climate and insurance crisis. But investor purchases saw double-digit gains in a handful of metros, led by Las Vegas and Seattle. Investors purchased 16% of the homes that sold in the third quarter, roughly the same share as a year earlier. Investor purchases of condos fell 11%—the biggest drop in a year—driven by declines in Florida. Broken down by price, low-priced homes made up the lion’s share of investor purchases. Real estate investors purchased 2.3% fewer homes in the third quarter than they did a year earlier. The small size of the change is notable because it comes after four years of huge swings driven by the wild …

The Potential Impact of Immigration Policies on Housing

President-elect Donald Trump’s incoming administration plans to “seal the border” and deport millions of undocumented migrants from the United States, starting in 2025. The housing market relies on immigrants as part of the construction labor force and could be impacted by the deportations, depending on the size and scale of the operation. Immigrants make up around 30% of the construction labor force, so restricting immigration will make housing more costly to build. The recent immigration surge under President Joe Biden has been a key part of the labor market’s surprising resilience in the face of the Fed’s aggressive rate hikes. Border crossings are already on the decline, but further declines under Trump’s new administration will mean less labor supply, a weaker labor market, and less economic growth. Goldman Sachs forecasts that net immigration will slow to about 750,000 per year, due to the Republican sweep of congress. That’s down from …

U.S. Mortgage Lending Rises in Q3 2024 Amid Refinancing Surge, But Remains Below Historic Highs

Residential Lending Grows Just 2 Percent Even as Rates Keep Declining; Refinance and Home-Equity Deals Rise While Purchase Loans Decrease IRVINE, Calif. – Nov. 21, 2024 — ATTOM, a leading curator of land, property data, and real estate analytics, today released its third-quarter 2024 U.S. Residential Property Mortgage Origination Report, which shows that 1.67 million mortgages secured by residential property (1 to 4 units) were issued in the United States during the third quarter. That led to modest quarterly and annual increases of 1.9 percent. The growth marked the second straight quarterly gain – a pattern not seen for more than three years. But even as home-mortgage rates dropped close to 6 percent for a 30-year fixed loan by the end of Q3 2024, the increase in business for lenders was far below a spike during the Spring of 2024 and still left total mortgages off by nearly two-thirds from a high …

Early-Stage Homebuying Demand Jumps to Its Highest Level in 15 Months Despite High Mortgage Rates

The number of homebuyers and sellers contacting Redfin agents has jumped over the last week, with Redfin’s Homebuyer Demand Index posting its biggest year-over-year increase since early 2022. Homebuyers are jumping into the market now that the election has passed and the Fed has cut interest rates for the second time in a row. The number of people contacting Redfin agents for help buying and/or selling their home is up by double digits from a year ago. Redfin’s Homebuyer Demand Index–a seasonally adjusted measure of those contacts–rose 17% year over year to its highest level since August 2023, continuing an increase that started immediately after the election. That 17% increase is the biggest since January 2022. It’s worth noting that we’re comparing to a period in 2023 when high mortgage rates were pushing down demand. Today’s weekly average mortgage rate is 6.78%, compared to 7.44% a year ago. Mortgage-purchase applications …

Moved By Fear: 18% of Home Hunters Say Safety/Crime is a Reason They’re Moving, 14% Cite Climate Risks

17.5% of respondents who plan to move in the next year cited a concern for safety/crime as one of the reasons why, while 13.7% cited a concern for natural disasters or climate risks. Safety and climate risk fears outranked a range of reasons to move, including lower property taxes, family changes, and higher rated schools. Nearly one in seven (13.7%) home hunters say a concern for natural disasters or climate risks in their area is a reason they are likely to move in the next year. Even more (17.5%) say a concern for safety/crime is prompting them to move. That’s according to a Redfin-commissioned survey conducted by Ipsos in September 2024. The survey was fielded to 1,802 U.S. homeowners and renters aged 18-65. This report focuses on 904 respondents who indicated they will move in the next year. Fears around crime/safety and climate risks were among the top reasons for …

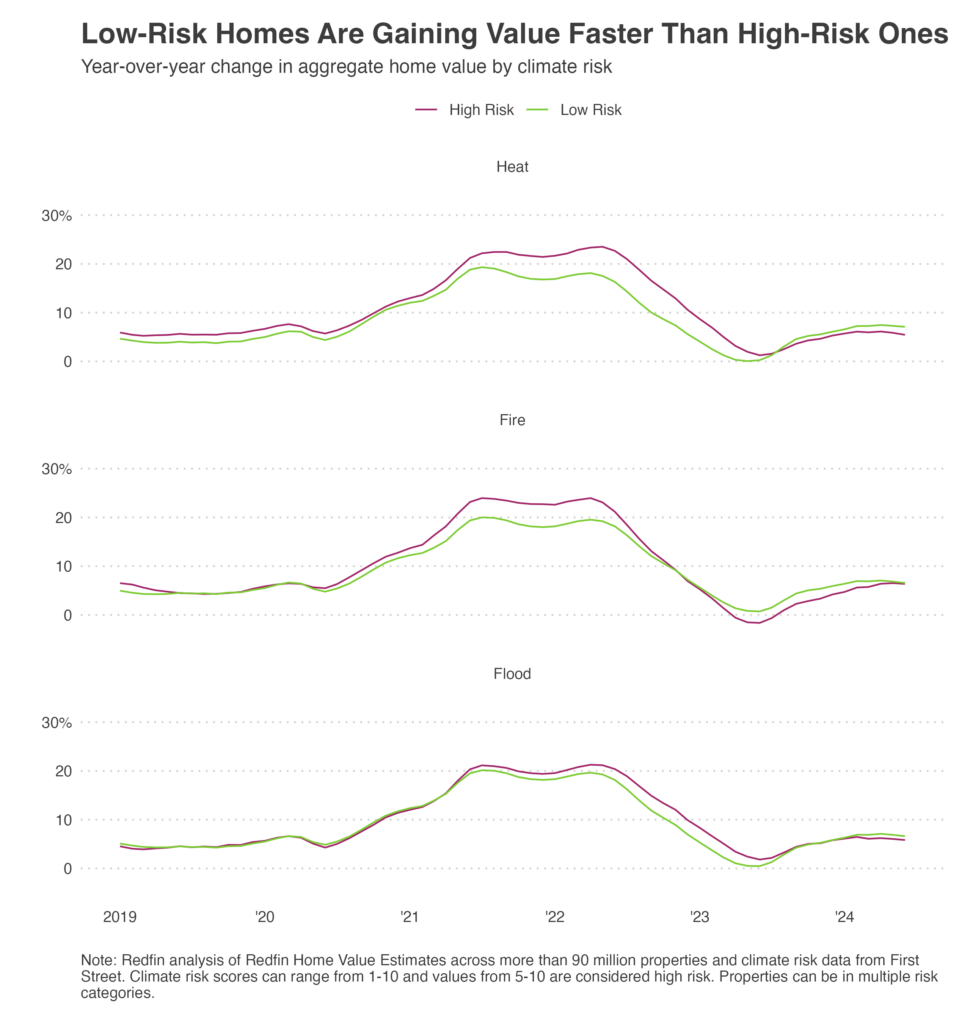

Homes With Low Natural Disaster Risk Are Rising in Value Faster Than Homes With High Risk for the First Time in Over a Decade

This year marked the first time since 2010 that low-risk homes across three major climate categories—heat, fire and flood—gained value faster than high-risk homes. That may be a sign Americans are growing more responsive to natural disasters. Still, high-risk homes are much more valuable than they were before the pandemic. Homes facing low risk from natural disasters are rising in value faster than homes facing high risk: The total value of U.S. homes facing low risk of extreme heat is up 7% year over year to $17.7 trillion. The total value of homes facing high risk of extreme heat is up 6.3% to $29.7 trillion. The total value of homes facing low flood risk is up 6.7% year over year to $40.2 trillion. The total value of homes facing high flood risk is up 6% to $7.2 trillion. The total value of homes facing low fire risk is up 6.6% …

- Page 1 of 2

- 1

- 2