Welcome! Kick your feet up and browse a while.

Up-To-Date Investment News & Trends

Arizona Lawsuit Against Investors

Real EstateArizona Lawsuit Against Investors By Jeffery S. Watson On March 7, 2025, a complaint was filed in the Superior Court of Arizona in Maricopa County by the Attorney General of the State of Arizona, Kristin K. Mayes, which laid out allegati...

Will Mortgage Rates Go Down After the July Fed Meeting?

Real EstateWill mortgage rates rise after the Fed meets? The Federal Reserve will hold its next Open Market Committee meeting on July 29-30. Will it come with a rate cut? Or will the committee keep rates steady (or possibly even raise them)? The an...

Can You Remove Someone from a Mortgage Without Their Permission?

Real EstateKey Takeaways You generally can’t remove someone from a mortgage without their permission. Refinancing, loan assumption, or selling the home are the most common solutions. Legal action may be necessary if the co-borrower refuses to coo...

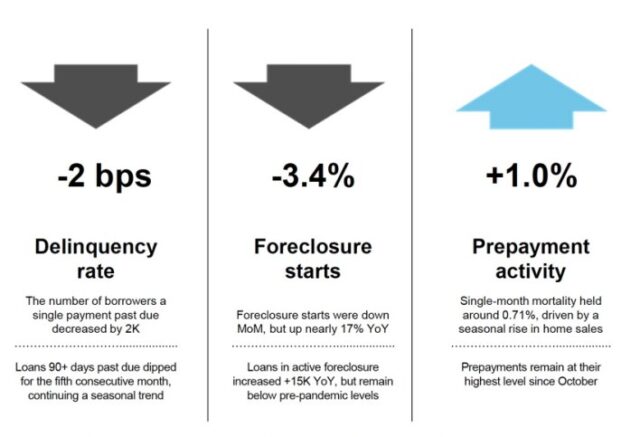

ICE Mortgage Monitor – July 2025

Real EstateAccording to the latest ICE Mortgage Monitor, the national delinquency rate ticked down 2 basis points (bps) to 3.20% in May, though it is up 5.2% (16 bps) year over year. Serious delinquencies (loans 90+ days past due but not in forec...

From Ghost Town to Boomtown? How Real Estate Investors Use Property Data

Real EstateTable of Contents How Investors Spot Hot Markets Inventory Data Trends in Months of Supply and Homes For Sale Decreasing Days on Market (DOM) New Jobs or Rising Salaries Government Investment Neighborhood Trends Indicating Hot Markets An...

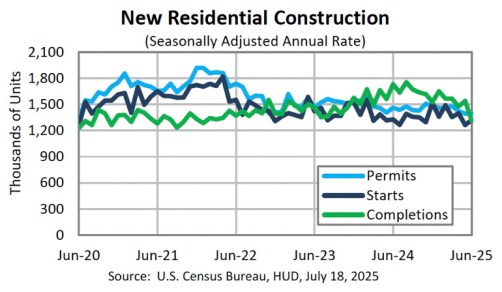

Housing Starts Jump in June

Real EstateThe U.S. government is reporting that privately‐owned housing starts in June, 2025 were at a seasonally adjusted annual rate of 1,321,000, which is 4.6% higher than May’s revised number but is 0.5% lower than one year ago. June’s rate...

How to Successfuly Execute Mortgage Release of Liability?

Real EstateKey Takeaways A release of liability removes one person from the mortgage, but only with lender approval. It’s commonly used during divorce, property transfers, or when selling a share of a home. Alternatives include refinancing, selli...

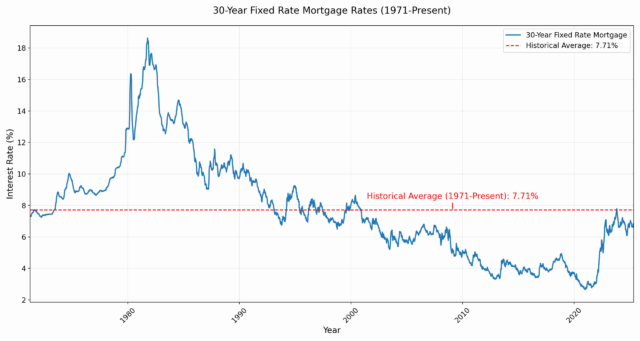

Mortgage Rate History | Chart & Trends Over Time 2025

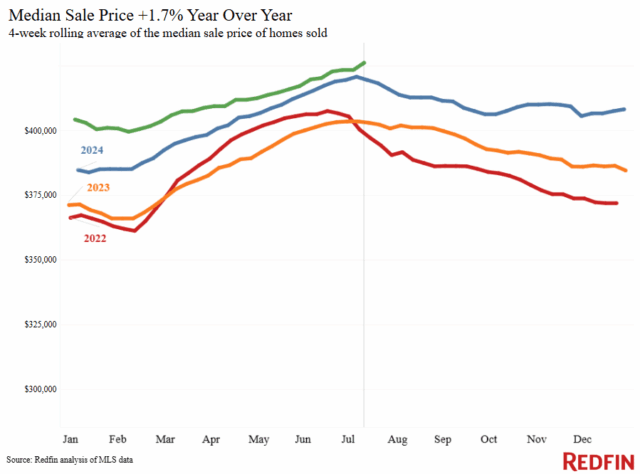

Real EstateTrends in historical mortgage rates After years of rising home prices and elevated mortgage rates, the first half of 2025 has shown signs of relief for buyers. While mortgage rates remain relatively unchanged, slower home price growth, i...

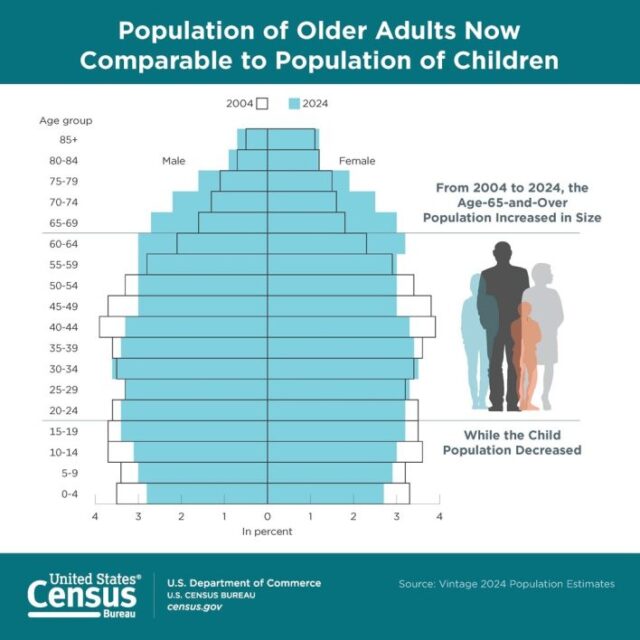

Population of Older Adults Now Comparable to Children

Real EstateThe U.S. Census Bureau says that from 2023-2024, the population aged 65+ increased by 3.1% (to 61.2 million) while the population under age 18 decreased by 0.2% (to 73.1 million). Interestingly, this means ongoing growth among older...

Good News For Homebuyers: Sellers Start Pricing Lower, Monthly Mortgage Payments Dip to 4-Month Low

Real EstateThe median U.S. asking price posted its smallest increase since the start of 2025 as more sellers come to terms with the reality of today’s buyer’s market. The median U.S. asking price was $407,000 during the four weeks ending July...

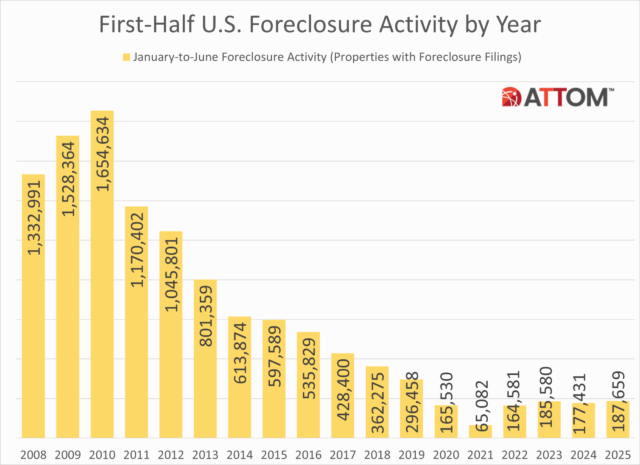

Foreclosure Activity in First Half of 2025 Up From Previous Year

Real EstateU.S. Foreclosure Starts increase 7 Percent in First Six Months of 2025; Average Days to Complete a Foreclosure Down Third Quarter in a Row; June and Q2 2025 Foreclosure Activity Post Annual Increase IRVINE, Calif. — July 17, 2025 — ATTOM...

Financing Outside the Box: How Today’s Investors Fund Deals

Real EstateOn a recent episode of the Idaho Real Estate Investor Show, Jonna Weber talks with Patrick Penner from Coast to Coast Mortgage, about creative financing options for real estate investors. They explore strategies such as Buy, Rehab,...

ATTOM Expands Data Delivery Solutions to Meet Growing Industry Demand

Real EstateAvailability on Snowflake enables seamless access to ATTOM’s trusted property data in a cloud-native environment; Parquet delivery powers faster, cheaper, and scalable property data analytics IRVINE, Calif. — July 15, 2025 —...

Homeowner’s Insurance Premiums are Increasing

Real EstateCNBC is reporting that while homeowner’s insurance premiums vary widely from state to state, they are all going up. They say that according to experts, increasingly severe storms and other disasters, combined with rising housing cost...

Harvard’s 2025 State of the Nation’s Housing Report

Real EstateIn their new State of the Nation’s Housing Report, Harvard’s Joint Center for Housing Studies says the US housing market is shrouded in uncertainty. Among their conclusions, they say high home prices and interest rates have pushed...

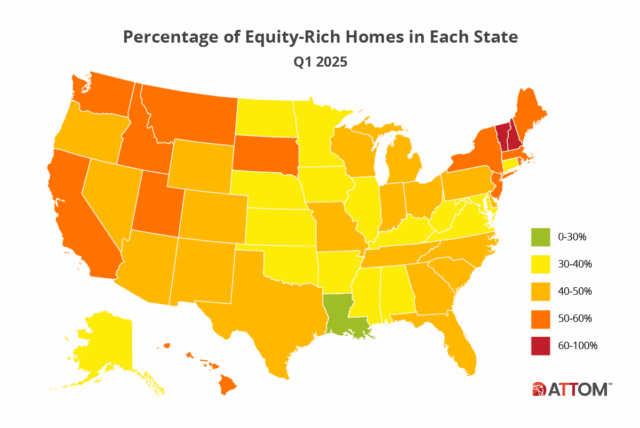

The State of Mortgages in 2025: Percent of Equity-Rich Properties for the First Quarter 2025

Real EstateATTOM’s latest data on mortgage equity for the first quarter 2025 show that the number of equity-rich mortgages remain historically high in the nation overall. Although equity-rich rates fell in 47 states quarterly, annually, the rates...

Mortgage Rates to Remain Mostly Unchanged After Stronger-Than-Expected Jobs Report

Real EstateThe U.S. added more jobs than expected in June, and the unemployment rate declined despite expectations that it would increase. Mortgage rates may rise slightly in the short term, but they’ll stay mostly unchanged. The June jobs repo...

Homebuyers Gain $16,000 in Purchasing Power As Mortgage Rates Dip to Lowest Level in 3 Months

Real EstateThe daily average mortgage rate dipped to 6.67% to start July, down from roughly 7.1% five weeks earlier. On-the-fence house hunters should consider jumping in while they have more purchasing power–and more negotiating power. A homeb...

Top 10 Counties with the Largest Annual Increase in Affordability Indexes in Q2 2025

Real EstateAccording to ATTOM’s Q2 2025 U.S. Home Affordability Report, 99 percent of counties with enough data to analyze saw median-priced single-family homes and condos become less affordable in Q2 2025 compared to historical averages. This ma...

ATTOM Webinar Summary: 2025 Mid-Year Housing Market Review

Real EstateThis ATTOM webinar, presented by Aaron Wagner, Head of Data Science for ATTOM and Mike Simonsen, Founder and President of Altos Research features a comprehensive analysis of the latest trends and economic indicators shaping the market an...