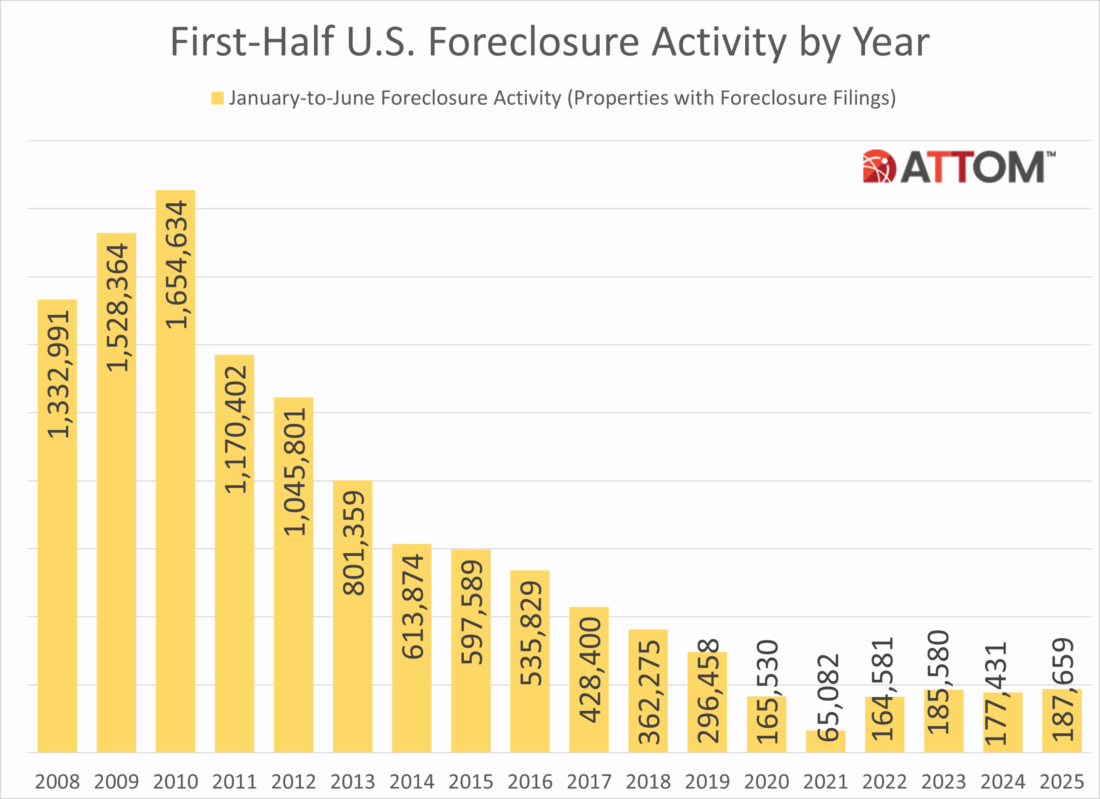

U.S. Foreclosure Starts increase 7 Percent in First Six Months of 2025; Average Days to Complete a Foreclosure Down Third Quarter in a Row; June and Q2 2025 Foreclosure Activity Post Annual Increase IRVINE, Calif. — July 17, 2025 — ATTOM, a leading curator of land, property data, and real estate analytics, today released its Mid-Year 2025 U.S. Foreclosure Market Report, which shows there were a total of 187,659 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in the first six months of 2025. That figure is up 5.8 percent from the same time period a year ago and up 1.1 percent from the same time period two years ago. “Foreclosure activity continued its upward trend in the first half of 2025, with increases in both starts and completed foreclosures compared to last year,” said Rob Barber, CEO at ATTOM. “While the overall numbers …

Financing Outside the Box: How Today’s Investors Fund Deals

On a recent episode of the Idaho Real Estate Investor Show, Jonna Weber talks with Patrick Penner from Coast to Coast Mortgage, about creative financing options for real estate investors. They explore strategies such as Buy, Rehab, Rent, Refinance, Repeat (BRRR), Debt Service Coverage Ratio (DSCR) loans, and the importance of asset protection. Patrick shares insights from his 30+ years in the mortgage industry, emphasizing the value of planning and pre-approval before investing. Click here to listen. The post Financing Outside the Box: How Today’s Investors Fund Deals appeared first on Real Estate Investing Today.

ATTOM Expands Data Delivery Solutions to Meet Growing Industry Demand

Availability on Snowflake enables seamless access to ATTOM’s trusted property data in a cloud-native environment; Parquet delivery powers faster, cheaper, and scalable property data analytics IRVINE, Calif. — July 15, 2025 — ATTOM, a leading curator of land, property data, and real estate analytics, today announced the availability of its comprehensive property datasets on Snowflake, marking the next step in ATTOM’s ongoing expansion of modern, cloud-based delivery solutions. This integration allows clients to work with ATTOM’s trusted property data directly within the Snowflake environment, streamlining analytics workflows and accelerating time to insight. Concurrently, ATTOM is broadening its delivery options with the launch of Parquet file delivery—including support for GeoParquet—offering even more flexible, high-performance solutions for clients managing complex datasets. By leveraging Snowflake’s secure and scalable architecture, users can now incorporate ATTOM’s robust property data—including ownership details, tax assessments, neighborhood data, transaction history and more—directly into their cloud-native analytics environments. The addition of Parquet …

Homeowner’s Insurance Premiums are Increasing

CNBC is reporting that while homeowner’s insurance premiums vary widely from state to state, they are all going up. They say that according to experts, increasingly severe storms and other disasters, combined with rising housing costs, are pushing rates higher. In fact, California’s recent wildfires could cause insurance premiums to go up by 21% across the state. “An event like that in California just has a really significant impact on how much we project premiums to go up,” said Chase Gardner, data insights manager at Insurify. He added that when insurance companies “are paying out more than they’re bringing in premiums, the more that goes up, the more they need to raise prices.” Click on the maps below to make them interactive. Click on the image to make it interactive Click on the image to make it interactive Click here to read the full story at CNBC.com. The post …

Harvard’s 2025 State of the Nation’s Housing Report

In their new State of the Nation’s Housing Report, Harvard’s Joint Center for Housing Studies says the US housing market is shrouded in uncertainty. Among their conclusions, they say high home prices and interest rates have pushed sales to their lowest level in 30 years; insurance premiums and property taxes are rising; and high rents have left many cost burdened. “There must be a concerted effort to do more to address the affordability and supply crises…The potential consequences of inaction are simply too harmful to the macroeconomy and the millions of households striving for a safe, affordable place to call home.” Said Chris Herbert, Managing Director of the Center. Click here to read the full report at Harvard.edu. The post Harvard’s 2025 State of the Nation’s Housing Report appeared first on Real Estate Investing Today.

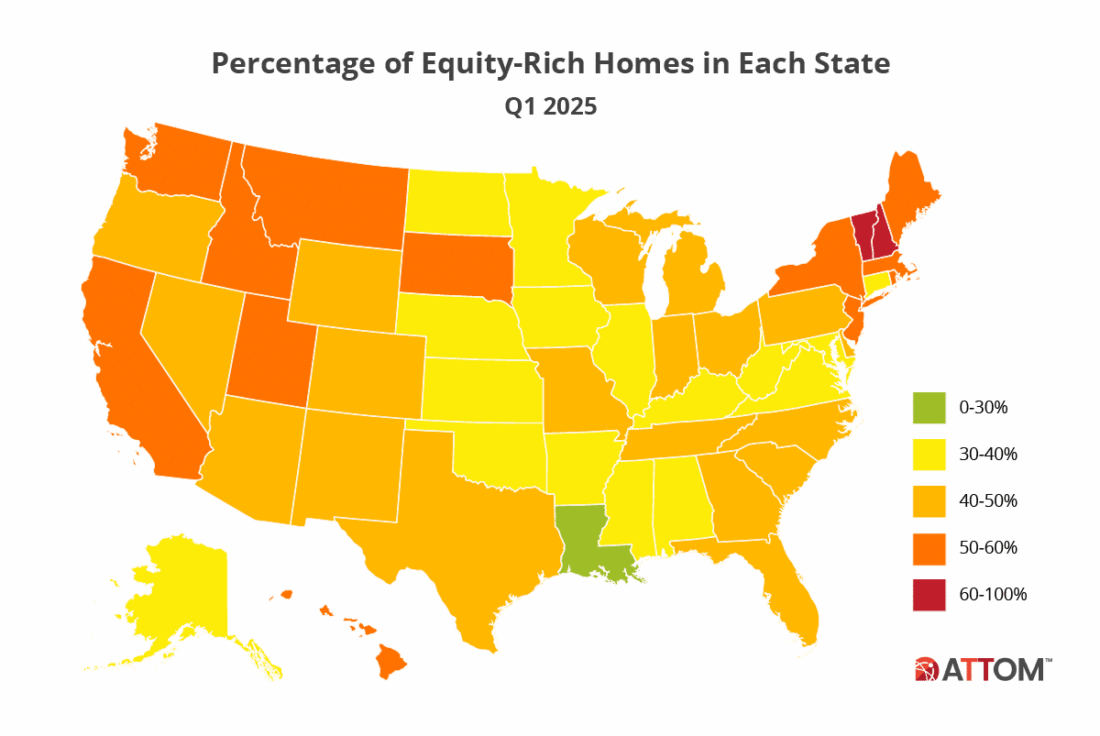

The State of Mortgages in 2025: Percent of Equity-Rich Properties for the First Quarter 2025

ATTOM’s latest data on mortgage equity for the first quarter 2025 show that the number of equity-rich mortgages remain historically high in the nation overall. Although equity-rich rates fell in 47 states quarterly, annually, the rates in the majority of states were higher. An equity-rich mortgage is defined as one where the loan balance is no more than half of their estimated market value. In the first quarter of 2025, 46.2 percent of mortgaged residential properties in the country were considered equity-rich, down from 47.7 percent in the fourth quarter of 2024. Here’s a closer look at the equity trends in the nation and by state. Equity-Rich Mortgages by State Vermont Vermont had the highest percentage of equity-rich mortgages in Q1 2025. The percent increased from 82.0% to 85.8% from Q1 2024 to Q1 2025. In Vermont, close to every mortgage is equity rich. The counties with the most equity-rich …

Mortgage Rates to Remain Mostly Unchanged After Stronger-Than-Expected Jobs Report

The U.S. added more jobs than expected in June, and the unemployment rate declined despite expectations that it would increase. Mortgage rates may rise slightly in the short term, but they’ll stay mostly unchanged. The June jobs report was stronger than expected. That means mortgage rates will tick up slightly today, but stay mostly unchanged. The strength of the latest jobs report rules out a July rate cut; however, for the second month in a row, the headline strength disguises underlying weakness–which leaves a September rate cut on the table. The numbers: 147,000 jobs were added in June, more than the 110,000 expected by forecasters and 144,000 in May. Similarly, the unemployment rate declined to 4.12% from 4.24% despite expectations it would increase to 4.3%. For the first time since January, revisions to previous months were positive, adding 16,000 more jobs than earlier reported. The unemployment rate has been bouncing …

Homebuyers Gain $16,000 in Purchasing Power As Mortgage Rates Dip to Lowest Level in 3 Months

The daily average mortgage rate dipped to 6.67% to start July, down from roughly 7.1% five weeks earlier. On-the-fence house hunters should consider jumping in while they have more purchasing power–and more negotiating power. A homebuyer on a $3,000 monthly budget has gained $16,000 in purchasing power in the last five weeks. That buyer can afford a $455,000 home with a 6.65% mortgage rate, roughly the daily average on July 1. That’s the lowest daily average mortgage rate since early April. Declining rates are giving homebuyers some wiggle room in their budgets. Rates fell from a recent peak of 7.08% in late May to 6.67% at the start of July. On a $3,000 monthly budget, a buyer could have purchased a $439,000 home with a 7.08% rate. To look at affordability another way, the monthly mortgage payment on the median-priced U.S. home, which goes for roughly $441,000, is $2,705 …

Top 10 Counties with the Largest Annual Increase in Affordability Indexes in Q2 2025

According to ATTOM’s Q2 2025 U.S. Home Affordability Report, 99 percent of counties with enough data to analyze saw median-priced single-family homes and condos become less affordable in Q2 2025 compared to historical averages. This marks the 14th straight quarter where owning and maintaining a median-priced home has consumed a greater share of the average U.S. wage than what’s been typical historically. WATCH: ATTOM #figuresfriday – Top 10 Counties with the Largest Annual Increase in Affordability Indexes in Q2 2025 The report also indicates that major expenses tied to a median-priced home in the U.S. would have taken up 33.7 percent of the average annual wage—an increase from 32 percent in Q1 and significantly above the 28 percent threshold commonly recommended by lenders. ATTOM’s latest home affordability analysis underscores the growing strain on both current homeowners and prospective buyers as home prices climb. Following a brief decline from $355,000 in …

ATTOM Webinar Summary: 2025 Mid-Year Housing Market Review

This ATTOM webinar, presented by Aaron Wagner, Head of Data Science for ATTOM and Mike Simonsen, Founder and President of Altos Research features a comprehensive analysis of the latest trends and economic indicators shaping the market and offers data-driven insights into what the rest of the year could hold. Drawing from ATTOM and Altos’ most recent data, this session breaks down key shifts in housing activity, pricing, and risk helping professionals across the real estate and financial sectors navigate an evolving landscape. During this webinar, Aaron Wagner explores trends in historical mortgage rates, residential loan volumes for both purchase and refinance loans, shifts in median home sale prices, patterns in homeownership tenure, foreclosure filings, and the potential implications of these developments. He also addresses distressed market trends, focusing on foreclosure starts and REO completed foreclosures. Also in this webinar, Mike Simonsen examines how inventory levels have evolved, noting the return …