Arizona Lawsuit Against Investors By Jeffery S. Watson On March 7, 2025, a complaint was filed in the Superior Court of Arizona in Maricopa County by the Attorney General of the State of Arizona, Kristin K. Mayes, which laid out allegations regarding “a convoluted scheme by the defendants to strip Arizona homeowners of millions of dollars of equity in their homes.” The AG then defined “equity stripping schemes” as targeting “homeowners who have significant equity in their homes, but are facing foreclosure by their mortgage lenders,” and “these high-equity homes are worth significantly more than the balance of the mortgage in foreclosure.” The allegations in the complaint focus on investors engaging in marketing and buying activities designed to “prevent the distressed homeowner from receiving that excess cash by blocking the auction and tricking the homeowner into selling the home far below the fair market value.” The complaint alleges that since …

Will Mortgage Rates Go Down After the July Fed Meeting?

Will mortgage rates rise after the Fed meets? The Federal Reserve will hold its next Open Market Committee meeting on July 29-30. Will it come with a rate cut? Or will the committee keep rates steady (or possibly even raise them)? The annualized inflation rate remains above the Fed’s long-term goal of 2%, and most recently increased to 2.7% in June from 2.4% in May and 2.3% in April. The central bank held rates steady at its four previous meetings in January, March, May, and June. How will economic data and indicators weigh on the July fed funds rate decision? Find your lowest mortgage rate. Start here Will the Fed cut rates in July? The FOMC is coming off four consecutive holds on the federal funds rate after three straight cuts. The central bank had waited for the economy to show sustainable softness before loosening its monetary policy in 2024. …

Can You Remove Someone from a Mortgage Without Their Permission?

Key Takeaways You generally can’t remove someone from a mortgage without their permission. Refinancing, loan assumption, or selling the home are the most common solutions. Legal action may be necessary if the co-borrower refuses to cooperate. Check options to remove a name from your mortgage. Start here When a relationship ends, shared financial responsibilities, like a mortgage, can become a major source of stress. Maybe you’re going through a divorce or dealing with a co-borrower who’s no longer contributing. Whatever the reason, you may find yourself asking: Can you remove someone from a mortgage without their permission? In most cases, the answer is no. A mortgage is a legal agreement between the lender and all borrowers. That means you can’t make changes without everyone’s consent, but that doesn’t mean you’re out of options. Common situations that might bring up this question Divorce or breakup: Jess and Mike are finalizing their …

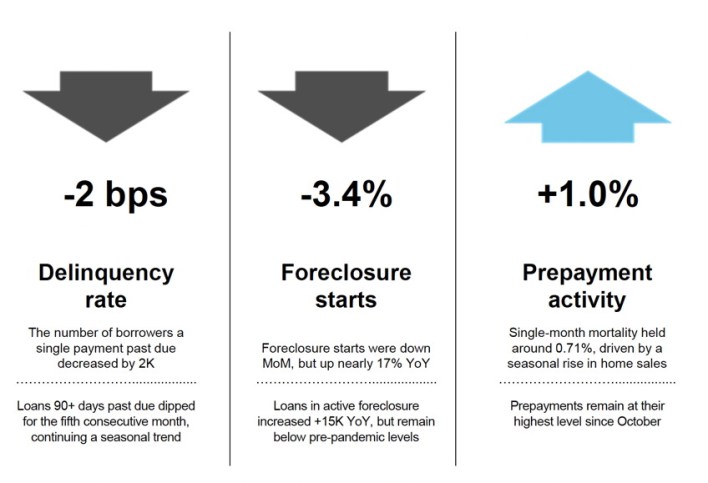

ICE Mortgage Monitor – July 2025

According to the latest ICE Mortgage Monitor, the national delinquency rate ticked down 2 basis points (bps) to 3.20% in May, though it is up 5.2% (16 bps) year over year. Serious delinquencies (loans 90+ days past due but not in foreclosure) improved seasonally for the 5th consecutive month but are still up 56k (14%) from the same time last year. However, the 3rd consecutive month, foreclosure starts, active foreclosure and foreclosure sales rose on an annual basis as VA foreclosure resumptions continue to make their way through the pipeline. In addition, the U.S. Department of Education resumed collections efforts on defaulted student loans in May following a five-year pause with student loan debt in the coming months for any emerging signs for stress. ICE says 20% of mortgage holders in the U.S. carry student loan debt, with that share rising to nearly 30% among FHA mortgage holders. The resumption …

From Ghost Town to Boomtown? How Real Estate Investors Use Property Data

Table of Contents How Investors Spot Hot Markets Inventory Data Trends in Months of Supply and Homes For Sale Decreasing Days on Market (DOM) New Jobs or Rising Salaries Government Investment Neighborhood Trends Indicating Hot Markets An Uptick in Home Improvements Gentrification New Development and Amenities Real Estate and Financial Industry Trends Indicating Hot Markets New Real Estate Agencies and Banks Data for Risk Analysis for Investing Decisions How Investors Can Use Property Data to Predict Hot and Cooling Markets Steadily rising prices are an indicator of a market heating up. But savvy investors look for earlier indicators of property price movements to stay a step ahead. Trends derived from relevant data, when pieced together, can reveal areas where investors stand to gain from rising property prices. Increasingly, investors are looking to data providers like ATTOM to drive their prospecting. By incorporating the right data — economic, population, or neighborhood …

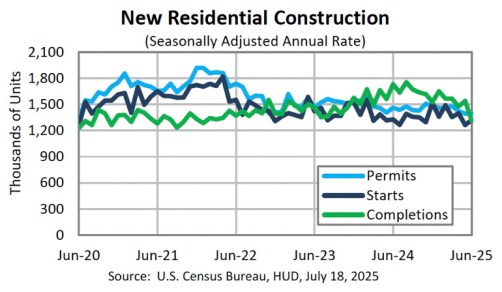

Housing Starts Jump in June

The U.S. government is reporting that privately‐owned housing starts in June, 2025 were at a seasonally adjusted annual rate of 1,321,000, which is 4.6% higher than May’s revised number but is 0.5% lower than one year ago. June’s rate for buildings with five units or more was 414k. Privately‐owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 1,397,000, which is 0.2% higher than May’s revised number and is 4.4% lower than one year ago. Authorizations of units in buildings with five units or more were at a rate of 478 in June. Click here to read the full report at the U.S. Census Bureau. The post Housing Starts Jump in June appeared first on Real Estate Investing Today.

How to Successfuly Execute Mortgage Release of Liability?

Key Takeaways A release of liability removes one person from the mortgage, but only with lender approval. It’s commonly used during divorce, property transfers, or when selling a share of a home. Alternatives include refinancing, selling the home, or mortgage assumption with a release. Check options for a mortgage release of liability. Start here A mortgage release of liability is a legal agreement that removes one person from a home loan — usually after a divorce or property transfer — but it only happens if the lender agrees. In this article (Skip to…) What is a release of liability from a mortgage? A release of liability from a mortgage is a formal agreement with your lender that takes one person off the loan. It means they’re no longer legally or financially responsible for making payments or covering the debt if something goes wrong. Check options for a mortgage release of …

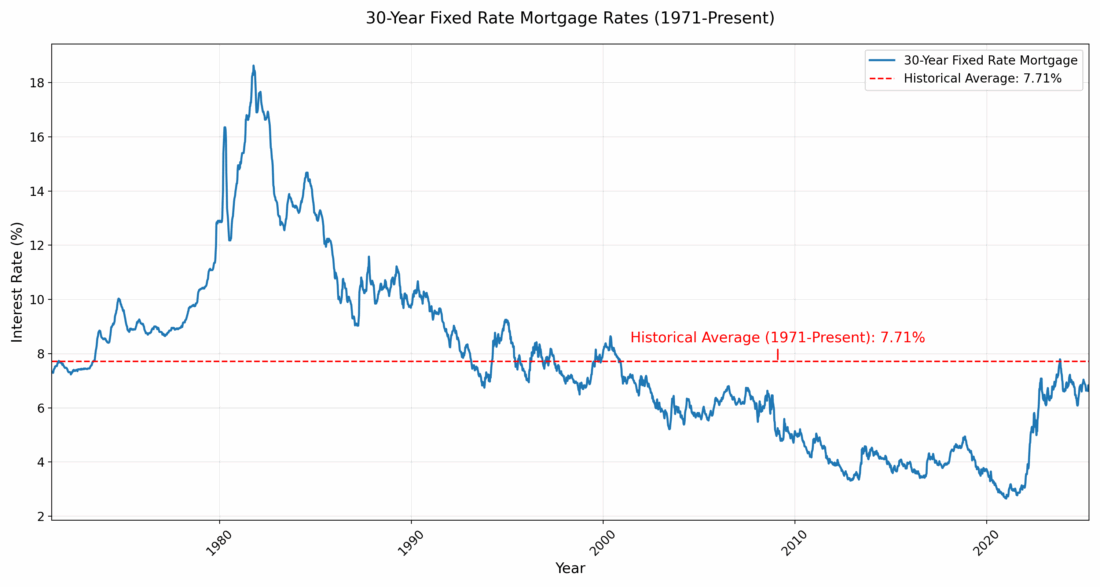

Mortgage Rate History | Chart & Trends Over Time 2025

Trends in historical mortgage rates After years of rising home prices and elevated mortgage rates, the first half of 2025 has shown signs of relief for buyers. While mortgage rates remain relatively unchanged, slower home price growth, increased inventory, and more negotiating power have begun to tip the scales in buyers’ favor. But the big question remains: Will rates come down meaningfully, or are we in for a longer period of high borrowing costs? Mortgage rates have held steady this year, dipping just 16 basis points with only modest changes expected ahead. With the Federal Reserve holding rates steady and remaining cautious about inflation, any future cuts are likely to be measured. For now, buyers and homeowners are watching closely, hoping for affordability gains, but preparing for a slower pace of change. But here’s what many overlook: The average rate is just that—an average. If you have strong credit and …

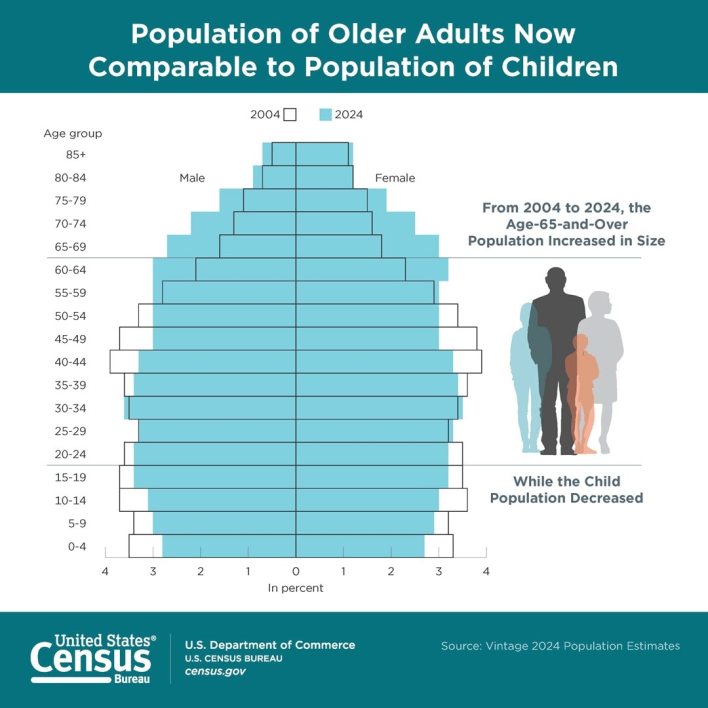

Population of Older Adults Now Comparable to Children

The U.S. Census Bureau says that from 2023-2024, the population aged 65+ increased by 3.1% (to 61.2 million) while the population under age 18 decreased by 0.2% (to 73.1 million). Interestingly, this means ongoing growth among older folks, coupled with persistent annual declines those under 18 has reduced the gap between these two groups from just over 20 million in 2020 to just below 12 million in 2024. Indeed….Stay safe and have a Happy Friday!!! Click here to read the full report at the U.S. Census Bureau. The post Population of Older Adults Now Comparable to Children appeared first on Real Estate Investing Today.

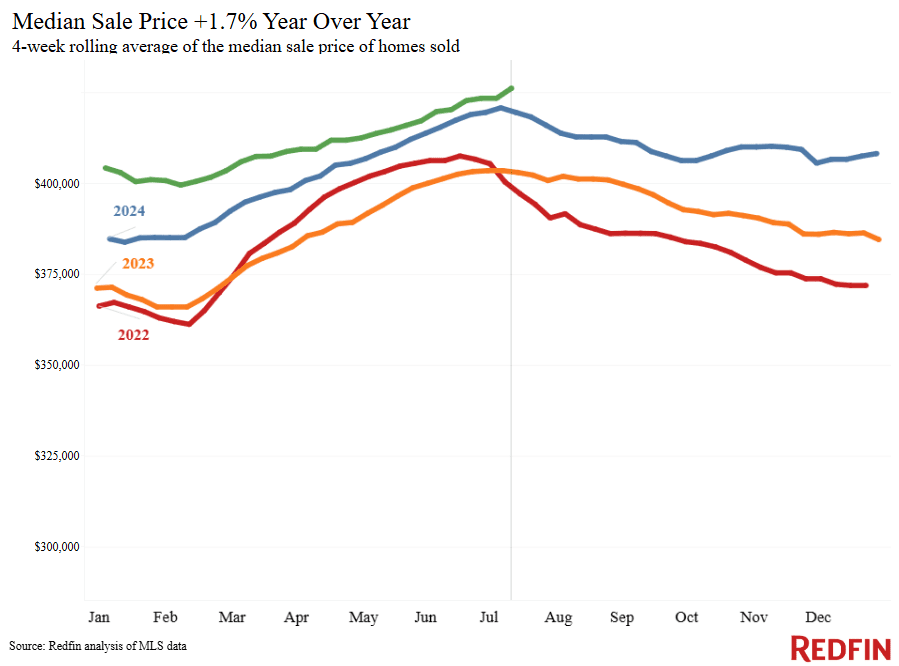

Good News For Homebuyers: Sellers Start Pricing Lower, Monthly Mortgage Payments Dip to 4-Month Low

The median U.S. asking price posted its smallest increase since the start of 2025 as more sellers come to terms with the reality of today’s buyer’s market. The median U.S. asking price was $407,000 during the four weeks ending July 13, up 2.9% year over year, the smallest increase in over four months. That’s just slightly higher than the median home-sale price of $401,120; the small size of that gap is a sign that sellers are starting to price their homes lower as they realize it’s a buyer’s market. The median sale price is up just 1.7% year over year; given that the average U.S. wage has increased by more than 4%, homes are more affordable than they were last year. The housing market has been tilting in buyers’ favor for months, with buyers getting concessions from sellers and often successfully negotiating sale prices down. The slowdown in asking-price growth, …