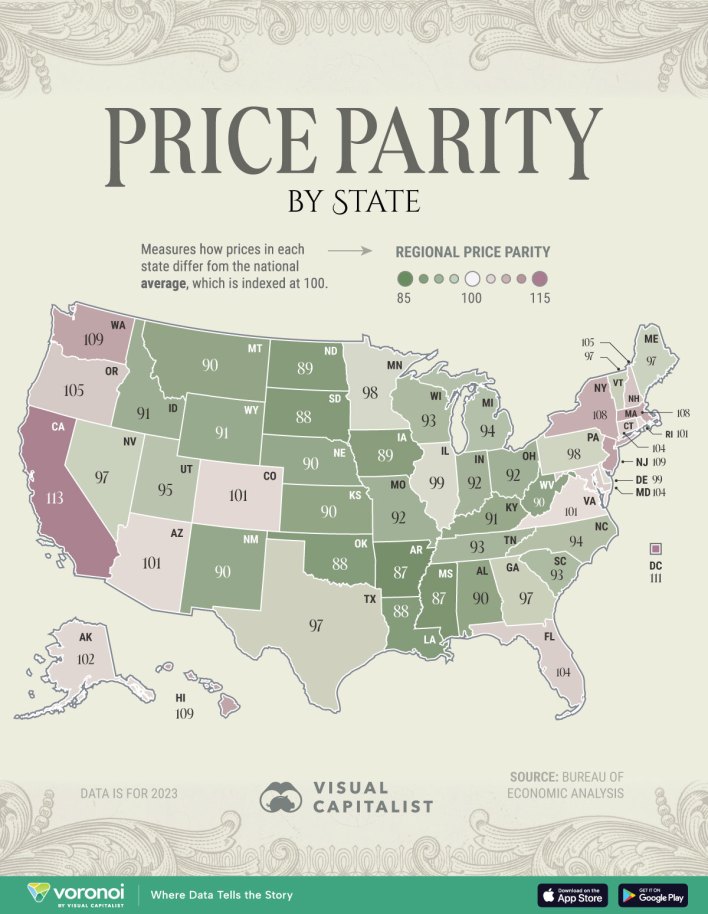

The Visual Capitalist asks; How much do prices actually differ across America? Today’s graphic takes a look at price parity across the U.S. by looking at things like the price of food, bills, gas, and other living costs. Not surprising, California is the nation’s most expensive state with Arkansas, Mississippi, and Oklahoma being the least expensive. Stay safe, watch your wallet and have a Happy Friday!!! Hat tip to the Visual Capitalist. The post The Least & Most Expensive U.S. States appeared first on Real Estate Investing Today.

Pending Sales Fall as U.S. Home Prices Hit Another Record High

Copyright: © 2025 Redfin. All rights reserved. Updated January 2023: By searching, you agree to the Terms of Use, and Privacy Policy. Do not sell or share my personal information. REDFIN and all REDFIN variants, TITLE FORWARD, WALK SCORE, and the R logos, are trademarks of Redfin Corporation, registered or pending in the USPTO. California DRE #01521930 Redfin is licensed to do business in New York as Redfin Real Estate. NY Standard Operating Procedures New Mexico Real Estate Licenses TREC: Info About Brokerage Services, Consumer Protection Notice All mortgage lending products and information are provided by Rocket Mortgage, LLC | NMLS #3030; www.NMLSConsumerAccess.org. Licensed in 50 states. This site is not authorized by the New York State Department of Financial Services for mortgage solicitation or loan applications activities related to properties located in the State of New York. For additional information on Rocket Mortgage or to receive lending services in the State of New York, please visit RocketMortgage.com. If you are …

A Complete Guide to Geocodes

We live in a world of geocodes. Any website or app that requests your name and address will potentially convert that data into geocodes for use. Often, the data are used for analytics and marketing purposes but geocodes are also used by rideshare and food delivery apps, real estate companies and property investors, urban planners, insurance companies for risk mitigation, and countless other use cases. Here’s a detailed look at geocodes and their place in today’s digital and business world. Geocoding 101 How often does your name and address appear on a payment portal or a website? Why do your name and address conveniently appear on a site via autofill? Welcome to the world of geocodes. Practically every organization or business is interested in collecting your data and converting it into geocodes for analysis. Geocodes are unique identifiers consisting of numerical or alphanumeric characters. They represent specific physical geographic locations …

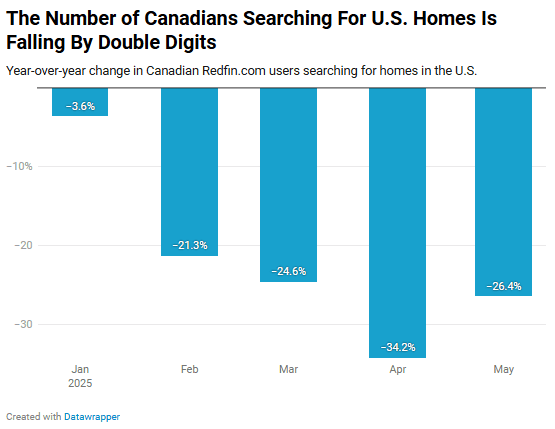

26% Fewer Canadians Are Searching For Homes in the U.S. Than Last Year

The number of Redfin.com users based in Canada searching for U.S. homes to rent or buy fell 26.4% from a year earlier in May. That’s a sign that fewer Canadians are moving south of the border or seeking vacation homes in once-popular destinations like Miami and Phoenix. Fewer Canadians are searching for homes in the United States than they were at the start of 2025, before the U.S. instituted steep tariffs on Canada and relations between the two countries started suffering. The number of Canadian Redfin.com users searching for homes in the U.S. on Redfin.com dropped 26.4% year over year in May. For comparison, the total number of prospective buyers and renters searching on Redfin.com declined, too, but by a fraction of the amount. Canadians searching for homes in U.S. destinations started declining significantly in February, when the White House implemented 25% tariffs on imports from Canada and Mexico. The drop …

The Tale of the Tribe

In closing today’s $2-billion sale of Redfin to Rocket, Redfin has made a careful inventory of every asset to convey to our new home: the sofas, the coffee table, the books. And now that we’ve rolled down the door of the van and set the latch, we just realized that we need to pop back into our old place for one last thing. A Rabid Squirrel It’s a stuffed animal that Goldman gave us at our IPO: a squirrel with a ridiculous, rabid expression on its face. I never knew whether it was a token of appreciation or just a gentle poke. But it represents the way Redfin has thought of ourselves from our start-up days in a stifling apartment to becoming a billion-dollar public company: supposedly savage, a tad self-mocking. Redfin’s Ridiculous Mascot Many Employees Went Feral We failed so consistently to meet corporate norms that we didn’t always …

Redfin Is Now Powered by Rocket®!

We’re excited to announce that Redfin is now officially part of Rocket Companies! By joining forces with America’s largest mortgage lender¹, Rocket Mortgage, we’re creating a more connected experience from your first online home search all the way to closing day. We’re still the #1 brokerage website² and the place to find experienced agents you love—now with new ways to help you Own the Dream. Save Big with Rocket Preferred Pricing One of the first benefits of this partnership is Rocket Preferred Pricing, a new program that helps you save when you buy with a Redfin agent and finance through Rocket Mortgage. You can choose between: A 1% lower interest rate for the first year Up to $6,000 in lender credits from Rocket Mortgage.³ Rocket Preferred Pricing is available to qualified buyers using conventional, FHA or VA loans to purchase a home. Redfin Home Sellers Benefit, Too Rocket Preferred Pricing …

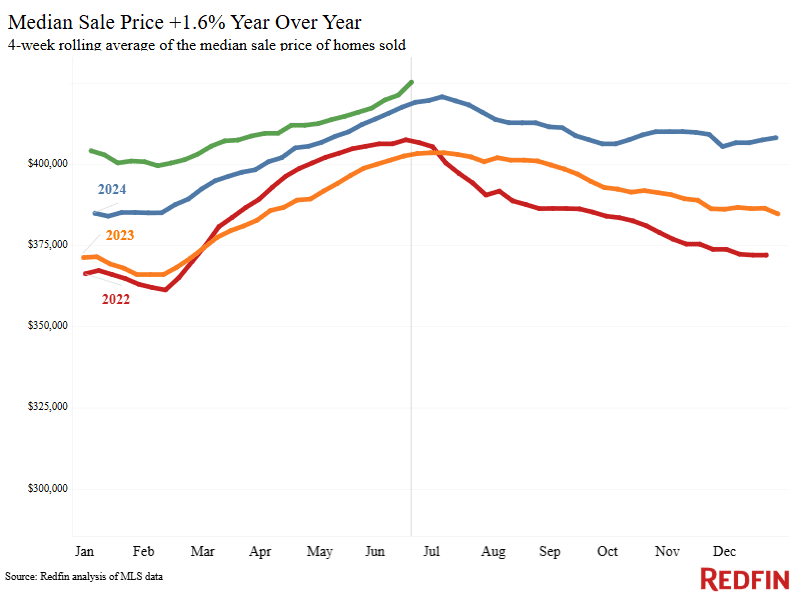

New Listings Lose Steam, Pending Sales Fall As Home Prices Hit Another Record High

Would-be sellers are pulling back as it becomes more clear the housing market is tilting in buyers’ favor in much of the country. New listings of U.S. homes for sale are up 2.5% from a year ago, the smallest increase in five months. On a local level, new listings are falling in 20 of the 50 most populous U.S. metro areas, with the biggest declines in Tampa, FL (-15.2%), San Antonio (-14.4%), and Orlando, FL (-11.1%). There are still hundreds of thousands more home sellers than buyers nationwide. But some would-be sellers are sitting on the sidelines as the market tilts more and more in buyers’ favor in much of the country. “Understandably, sellers want to get as much money as they can. Some homeowners feel they missed the prime selling window; many people who don’t need to sell right now are holding off, either staying put or trying to …

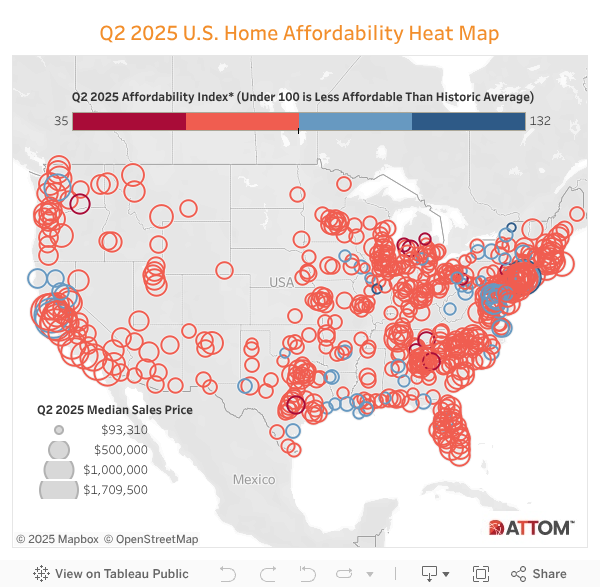

Elevated Home Prices and Stagnant Wages Make Home-Ownership Unaffordable Across the Country

In 77.9 Percent of Counties, Home Expenses are Unaffordable for Typical Residents; Median National Home Price Hits High of $369,000 in Second Quarter IRVINE, Calif. – June 26, 2025 — ATTOM, a leading curator of land, property data, and real estate analytics, today released its latest U.S. Home Affordability Report showing that in 99 percent of counties with sufficient data to analyze median-priced single-family homes and condos were less affordable in the second quarter of 2025 than historical averages. It marks the 14th consecutive quarter where purchasing and maintaining a median-priced home in the U.S. has required a higher percentage of the typical owner’s wages than has historically been necessary. ATTOM’s analysis shows that major expenses for a median-priced home in the U.S. would have consumed 33.7 percent of the average American’s annual income. That was up from 32 percent in the first quarter of the year, and well above …

Here Are the Most Expensive Home Sales of May

All of last month’s most expensive home sales were in Southern California, Florida or Manhattan. A Bel Air estate was the most expensive home sale of May, fetching $110 million. Another Los Angeles home, a Spanish villa in neighboring Holmby Hills, came in second, with a sale price of $57.3 million. All in all, four of last month’s most expensive home sales were in Southern California, four were in coastal Florida, and two were in Manhattan. Four of the homes sold for $55 million or more, and all sold for more than $30 million. Coastal parts of Florida, like Palm Beach and Boca Raton, are typically home to many ultra-expensive home sales in any given month. Despite the increasing risk of climate disasters and skyrocketing insurance costs in those places, mega-wealthy homebuyers have the means to rebuild, repair, or take a loss. These are the most expensive U.S. home sales …

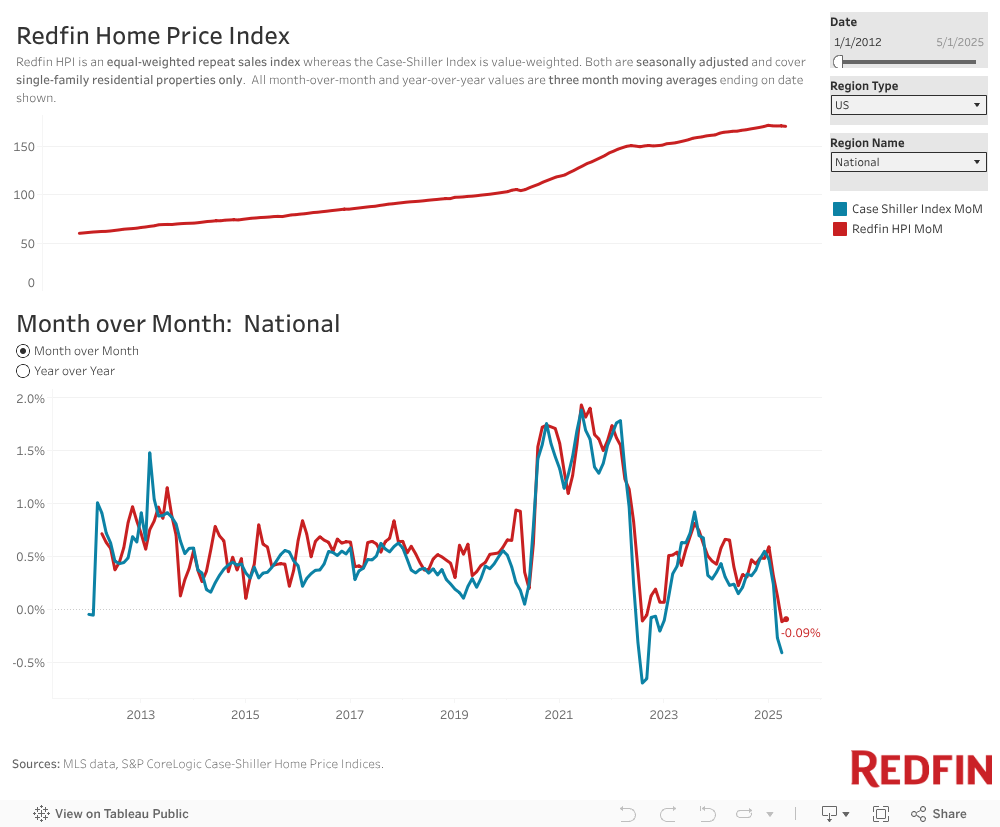

U.S. Home Prices Edged Down 0.1% in May, Only the Fourth Monthly Drop in the Past Decade

U.S. home prices in May ticked down 0.1% on a seasonally adjusted basis—only the fourth time in the past decade when prices have posted a monthly decline. Home prices rose 3.6% year over year—the first time annual growth has been below 4% since July 2023. 32 of the 50 most populous U.S. metros recorded a drop in home prices month over month, led by Charlotte, NC (-2.7%). U.S. home prices edged down 0.1% in May on a seasonally adjusted basis. Home prices have only posted a month-over-month decline three other times in records dating back to 2012: April 2025, and August-September 2022—when mortgage rates were peaking. Home prices rose 3.6% on a year-over-year basis in May, down from 4.1% growth in April. It was the first time annual price growth has been below 4% since July 2023. This is according to the Redfin Home Price Index (RHPI), which uses the …