Local Market Monitor, a National REIA preferred vendor, recently released their monthly National Economic Outlook where they share their thoughts on developments taking place in the U.S. economy. “One of the key problems for consumers over the last few year has been the high cost of housing. Since 2020 the average home costs 50 percent more and the average rent (pulled up by those high home prices) is 30 percent higher.” Click here for more information about Local Market Monitor. The post Local Market Monitor’s National Economic Outlook for July ’25 appeared first on Real Estate Investing Today.

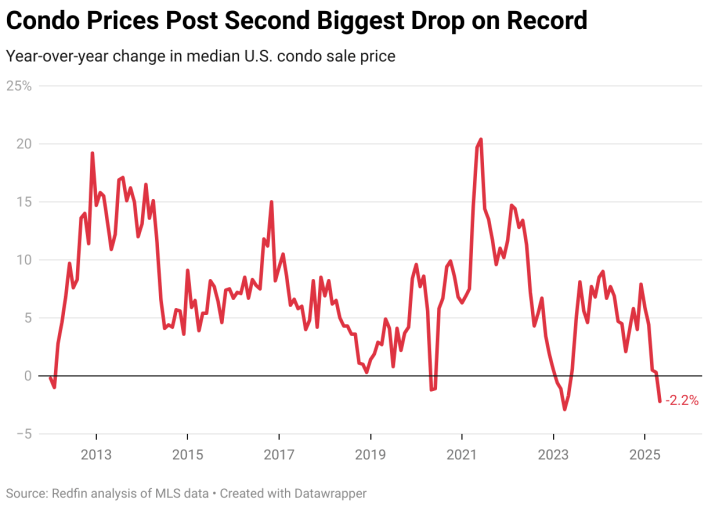

Condo Prices See 2nd Largest Price Drop in May

Citing MLS data, a recent report from Redfin says condo prices are falling because there are roughly 80% more condo sellers than buyers in the market. They point out that the only time condo prices posted a larger year-over-year decline was back in April, 2023. Condo sales were down 11.9% in May – the largest decline since June, 2024. In addition, the report says many condo owners are trying to offload their properties because of higher HOA fees and insurance costs as well as special assessments. “It’s a slow housing market across the board, but condos have been hit particularly hard…A lot of condo associations don’t allow buyers with FHA loans, which is limiting sales…” Said Aditi Jain, a Redfin Premier real estate agent in the Boston area. Click here to read the full report at Redfin. The post Condo Prices See 2nd Largest Price Drop in May appeared …

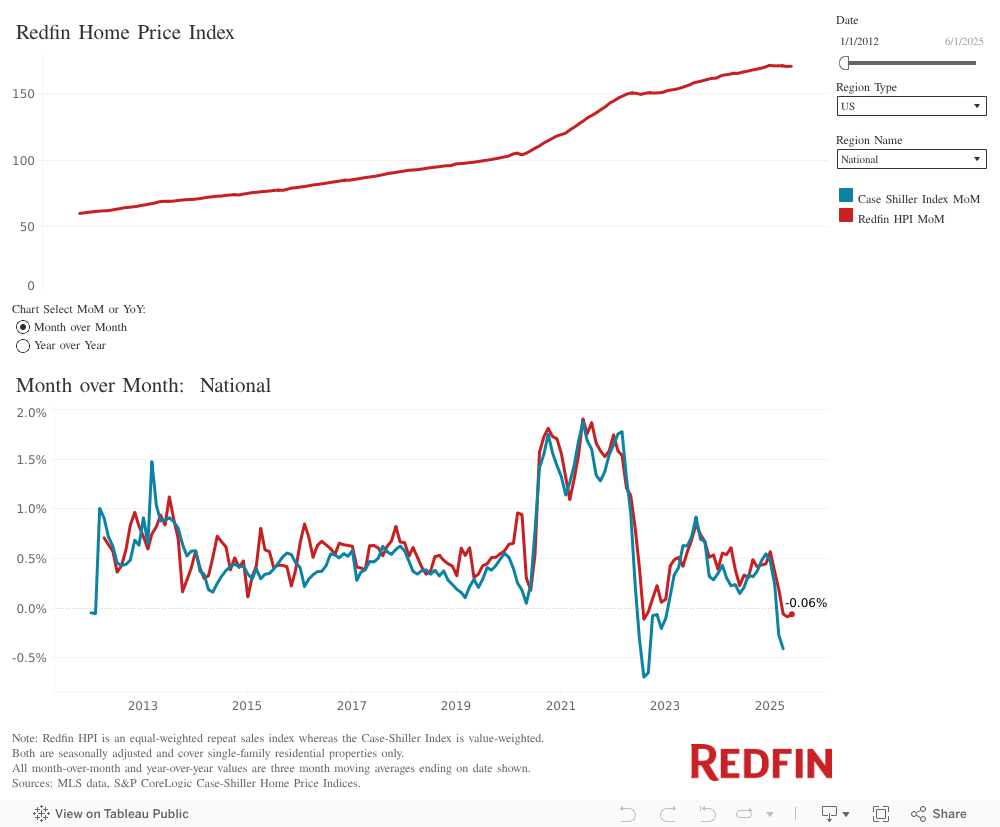

U.S. Home Prices Edge Down 0.1% in June, With Declines in Most Major Metros, Led by Washington, Austin and San Diego

U.S. home prices were down slightly in June for the third consecutive month. Prices rose 3.4% year over year, the slowest rate since June 2023. 30 of the 50 most populous U.S. metros recorded a drop in home prices month over month. Prices fell most in Washington, D.C. (-1.8%), where home prices have been falling by at least 1.5% for three straight months amid federal government job cuts. U.S. home prices ticked down 0.1% in June from a month earlier—the third consecutive month that prices were slightly down on a seasonally adjusted basis. On a year-over-year basis, home prices rose 3.4% , the lowest rate since June 2023. This is according to the Redfin Home Price Index (RHPI), which uses the repeat-sales pricing method to calculate seasonally adjusted changes in prices of single-family homes. The RHPI measures sale prices of homes that sold during a given period, and how those …

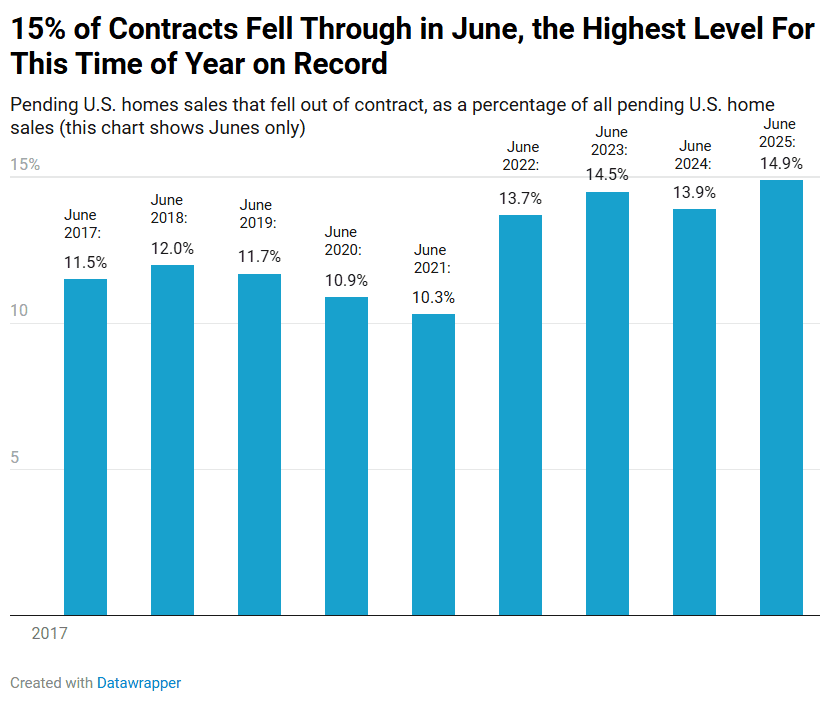

1 in 7 Pending Home Sales Fell Through Last Month, The Highest June Level on Record

14.9% of pending home sales fell through in June, up from 13.9% a year earlier. Some buyers are backing out during the inspection period because a better home comes along, and some are nervous about making a major purchase in uncertain economic times. Just over 57,000 home-sale agreements nationwide were canceled in June, equal to 14.9% of homes that went under contract that month. That’s up from 13.9% a year earlier and is the highest June share in records dating back to 2017. This is based on a Redfin analysis of MLS pending-sales data. The data is seasonal; typically, there’s a higher share of cancellations at the end of the year and a lower share in the spring. That’s why we compare this June to past Junes. Please note: Homes that fell out of contract during a given month didn’t necessarily go under contract that same month. This data is …

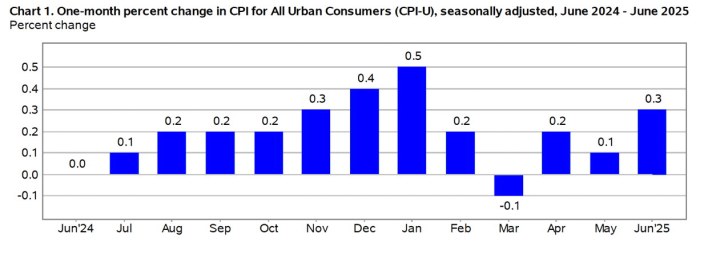

Inflation Up 0.3% in June

The U.S. Bureau of Labor Statistics is reporting that the Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3% in June, 2025. The all items index was up 2.7% for the 12 months ending in June. The shelter index increased 0.2% and was the primary factor in the all items monthly increase. The indexes for used cars & trucks, new vehicles, and airline fares were among the major indexes that decreased in June. Click here to read the full release at the Bureau of Labor Statistics. The post Inflation Up 0.3% in June appeared first on Real Estate Investing Today.

Wyoming First-Time Home Buyer | Grants & Programs 2025

What to know about buying a house in Wyoming If you’re a Wyoming first-time home buyer, you’re aware that home prices in the Equality State have been rising fast — even more quickly than nationwide. That can be a real challenge when saving for a down payment. Fortunately, Wyoming offers some excellent help, including low-interest mortgages, home buyer education courses, and, if you’re eligible, down payment assistance of up to $15,000. Here’s how to get started. Verify your home buying eligibility in Wyoming. Start here In this article (Skip to…) Wyoming first-time home buyer programs The Wyoming Community Development Authority (WCDA)4 says its Standard First-Time Homebuyer product offers special mortgages with low fixed-interest rates. Your loan may also come with down payment assistance (more on that below). Verify your home buying eligibility in Wyoming. Start here As is usual with state-backed mortgage programs, these loans have income and purchase price …

Wisconsin First-Time Home Buyer | Grants & Programs 2025

What to know about buying a house in Wisconsin Wisconsin first-time home buyers have a leg up over buyers in some other states. Both home prices and home price inflation are well below national averages. Of course, saving for your down payment and getting a home loan can still be a challenge. But Wisconsin has loan programs to help. The Badger State offers special mortgages and education to first-time buyers in Wisconsin. It also has several down payment assistance programs that can help you meet your down payment and closing cost needs. Here’s what you can expect. Verify your home buying eligibility in Wisconsin. Start here In this article (Skip to …) Wisconsin first-time home buyer programs The Wisconsin Housing and Economic Development Authority (WHEDA) has two main types of mortgages: WHEDA Advantage Conventional: A type of conventional mortgage conforming with Fannie Mae’s rules. This is a 30-year fixed-rate mortgage …

West Virginia First-Time Home Buyer | Grants & Programs 2025

What to know about buying a house in West Virginia If you’re a West Virginia first-time home buyer, you have an advantage in some ways. The cost of living is relatively lower than the national average, as are home prices. Even better, West Virginia provides home-buyer education classes, special mortgages, and down payment assistance programs that can offer cash assistance to qualified buyers. Are you ready to begin? Verify your home buying eligibility in West Virginia. Start here In this article (Skip to …) West Virginia first-time home buyer programs The West Virginia Housing Development Fund (WVHDF) offers first-time buyers in the Mountain State two paths to homeownership. You can use either of these loan programs to purchase a single-family home, a townhome, a manufactured home, or units in approved condominiums called planned unit developments (PUDs). Verify your home buying eligibility in West Virginia. Start here WVHDF Homeownership Program The …

Washington First-Time Home Buyer | Programs & Grants 2025

What to know about buying a house in Washington If you’re a Washington first-time home buyer, you can face some hurdles. But take heart. The Evergreen State offers extensive support, ranging from free homebuyer education to special mortgages. And, if you’re eligible, you could be in line for cash assistance toward your down payment and closing costs. Here’s how to get started. Verify your home buying eligibility in Washington. Start here In this article (Skip to …) Washington first-time home buyer programs The Washington State Housing Finance Commission (WSHFC) has two main mortgage programs. They are called Home Advantage and House Key Opportunity. Both programs may provide Washington first-time homebuyers with preferential interest rates and down payment assistance. Verify your home buying eligibility in Washington. Start here WSHFC Home Advantage Washington first-time homebuyers may be able to qualify for a reduced interest rate with the help of the Home Advantage …

D.C. First-Time Home Buyer | Grants & Programs 2025

What to know about buying a house in Washington D.C. Washington D.C. first-time home buyers face steep housing prices on average — well above the national median. But there’s good news, too. You might be in line for all sorts of help, from special mortgages to home buyer education courses and even down payment assistance. Explore all your options to find out how you can buy a house in D.C. more affordably. Verify your home buying eligibility in D.C. Start here In this article (Skip to…) D.C. first-time home buyer programs The D.C. Housing Finance Agency (DCHFA) has a range of home buyer assistance programs. Its offerings are mainly designed to help moderate and low-income families purchase a single-family home sooner than they thought possible. Verify your home buying eligibility in D.C. Start here DC Open Doors (DCOD) The DC Open Doors promises “competitive interest rates and lower mortgage insurance …