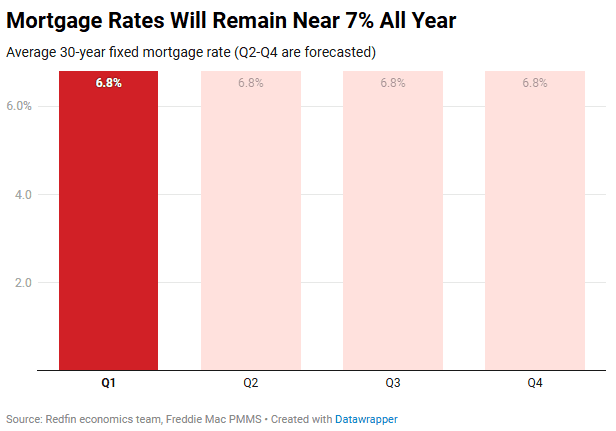

Mortgage rates are forecasted to stay elevated near 7%.

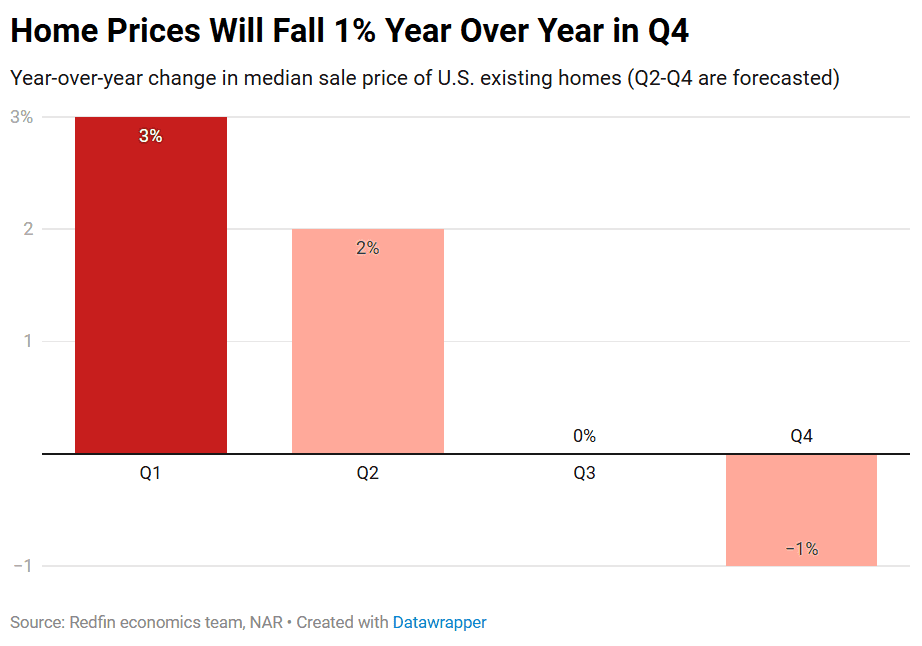

Redfin economists expect the median U.S. home-sale price to fall flat in the third quarter, and fall 1% year over year by the fourth quarter. When it comes to mortgage rates, we expect them to remain elevated near 7% for the remainder of the year.

This marks a stark reversal from years of home-price increases. Aside from a brief period in 2023, home prices have been rising year over year since 2012 due to a prolonged seller’s market.

Sale Prices Will Decline Because Inventory Is Rising While Sales Are Falling

Home prices are expected to decline nationwide because there are more home sellers than homebuyers in the market. Homebuying demand is down, sales of existing homes fell 1.1% year over year in April to a six-month low, and the typical home that did sell took 40 days to do so–five days longer than a year earlier. On the selling side, total inventory rose 16.7% year over year to its highest level in five years, and new listings rose 8.6%.

The U.S. housing market has been lackluster since mortgage rates rose sharply at the start of 2022, and has slowed further in the last several months due to widespread economic instability and stubbornly high housing costs.

More homes for sale, combined with fewer people interested in buying them, is expected to push U.S. sale prices down in two key ways:

- Discounts on list prices. It’s a buyer’s market. That means homebuyers in many parts of the country are able to successfully negotiate prices down, especially for fixer uppers and/or homes that aren’t located in desirable neighborhoods.

- Lower list prices. The longer the market is slow, the more sellers will come to terms with the fact that they can’t sell their homes for what they could have at the height of the market.

Redfin agents advise buyers looking for a deal to target homes that have been on the market for more than a few weeks. Those offer a shot at negotiation: Buyers should submit offers for under list price and/or ask for concessions, like mortgage-rate buydowns or money for repairs. Nearly half of today’s sellers are giving concessions, just shy of the highest level on record. Sellers should price their homes in line with the market from the start to avoid price drops. Some sellers may consider pricing slightly under comparable homes in the same neighborhood to entice buyers.

“A lot of the people selling right now bought in 2021 or 2022, when home prices were near their height. Even though we advise them to list at today’s market value, a lot of them decide to list high to recoup their money,” said Corey Stambaugh, a Redfin Premier agent in North Carolina. “But those sellers face reality once their home has been sitting for a couple weeks without any offers. At that point, they’re willing to seriously consider low offers and even throw in some concessions, because they’d rather sell today than face the uncertainty of tomorrow.”

While Redfin economists expect the national median home price to decline 1%, prices will decline more in some metro areas and prices will likely continue rising in parts of the country where demand is holding up better, like the Midwest and the Northeast.

Buying a Home Will Become More Affordable Because Wages Are Expected to Rise While Prices Fall

Homebuying affordability will improve a bit more than a small price decline and flat mortgage rates suggest. That’s because while home prices are forecasted to come down by 1% year over year, incomes are expected to continue increasing at a rate of around 4%.

Still, for house hunters looking to buy soon, waiting until the end of the year for prices to fall slightly is unlikely to pay off. “We know there’s room to negotiate right now, so that’s the best way to take advantage of the changing market,” said Chen Zhao, Redfin’s head of economics research. “And the sooner you buy, the sooner you start to build equity.”

Mortgage Rates Expected to Remain Around 6.8% Until the End of 2025

We expect the weekly average mortgage rate to remain right around 6.8% through the rest of the year.

Zhao said mortgage rates are staying stubbornly high mainly because of two economic concerns: Tariffs, which drive up the price of goods and discourage the Fed from cutting rates, and the rising U.S. budget deficit, which has caused analysts to downgrade the country’s credit.

Although the Trump administration recently slashed its proposed tariffs on China, they are still three times higher than at the beginning of the year and there are still high tariffs on goods from other countries. Additionally, the back-and-forth on the policy has exacerbated economic uncertainty for both the Fed and American consumers.

Written by: Dana Anderson