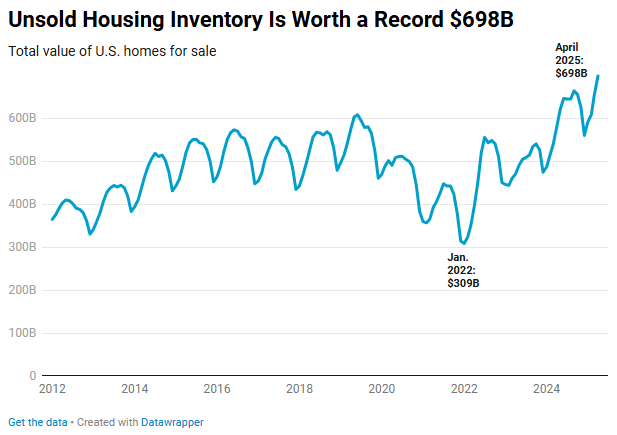

More than $330 billion worth of listings have been sitting on the market for 60 days or longer. Rising inventory and slow homebuying demand is pushing up the total dollar amount of home listings, and will push down home-sale prices by the end of the year. There’s a total of $698 billion worth of homes for sale in the U.S., up 20.3% from a year ago and the highest dollar amount ever. This is based on an analysis of listings on Redfin.com going back through 2012. For the total dollar value of all inventory on the market, we sum up the list price of all active U.S. listings as of the last day of each month; April 2025 is the most recent month for which data is available. For the purposes of this report, the term “value” is interchangeable with “list price”; i.e., when we refer to “total home value,” …

Can I Do a Cash-Out Refinancing on a Paid-Off House?

Yes, you can cash-out refinance a paid-off house. Here’s how. If your home is fully paid off, you’re in a strong position to qualify for a new mortgage. A cash-out refinance on a paid-off house means applying for a new loan secured by the equity you’ve built over time. This is called cash-out refinancing on a mortgage-free property, and it’s a strategy many homeowners use to unlock large sums of cash without selling their property. Because there’s no balance to pay off, the full amount of your new loan (minus closing costs) goes directly to you as cash. Key Takeaways: You can get a cash-out refinance on a home that’s completely paid off. The loan is treated as a new first-lien mortgage backed by your home’s equity. The funds can be used for anything: home upgrades, tuition, retirement, etc. You’ll start making monthly mortgage payments again. Why homeowners cash-out refinance …

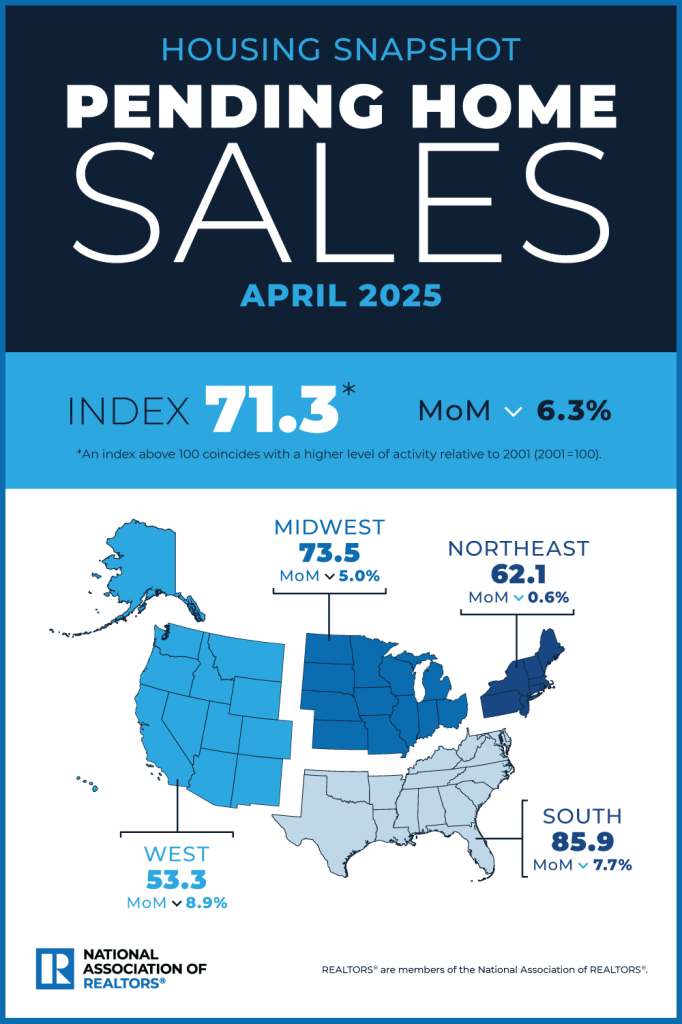

Pending Home Sales Drop 6.4% in April

The National Association of Realtors is reporting that pending home sales dropped 6.4% in in April, 2025. The NAR’s Pending Home Sales Index (a forward-looking indicator based on contract signings) came in at 71.3 in April. The NAR says mortgage rates are negating the increase in market supply. “At this critical stage of the housing market, it is all about mortgage rates…Despite an increase in housing inventory, we are not seeing higher home sales. Lower mortgage rates are essential to bring home buyers back into the housing market.” Said the NAR’s Chief Economist Lawrence Yun. Click here to read the full report at the NAR. The post Pending Home Sales Drop 6.4% in April appeared first on Real Estate Investing Today.