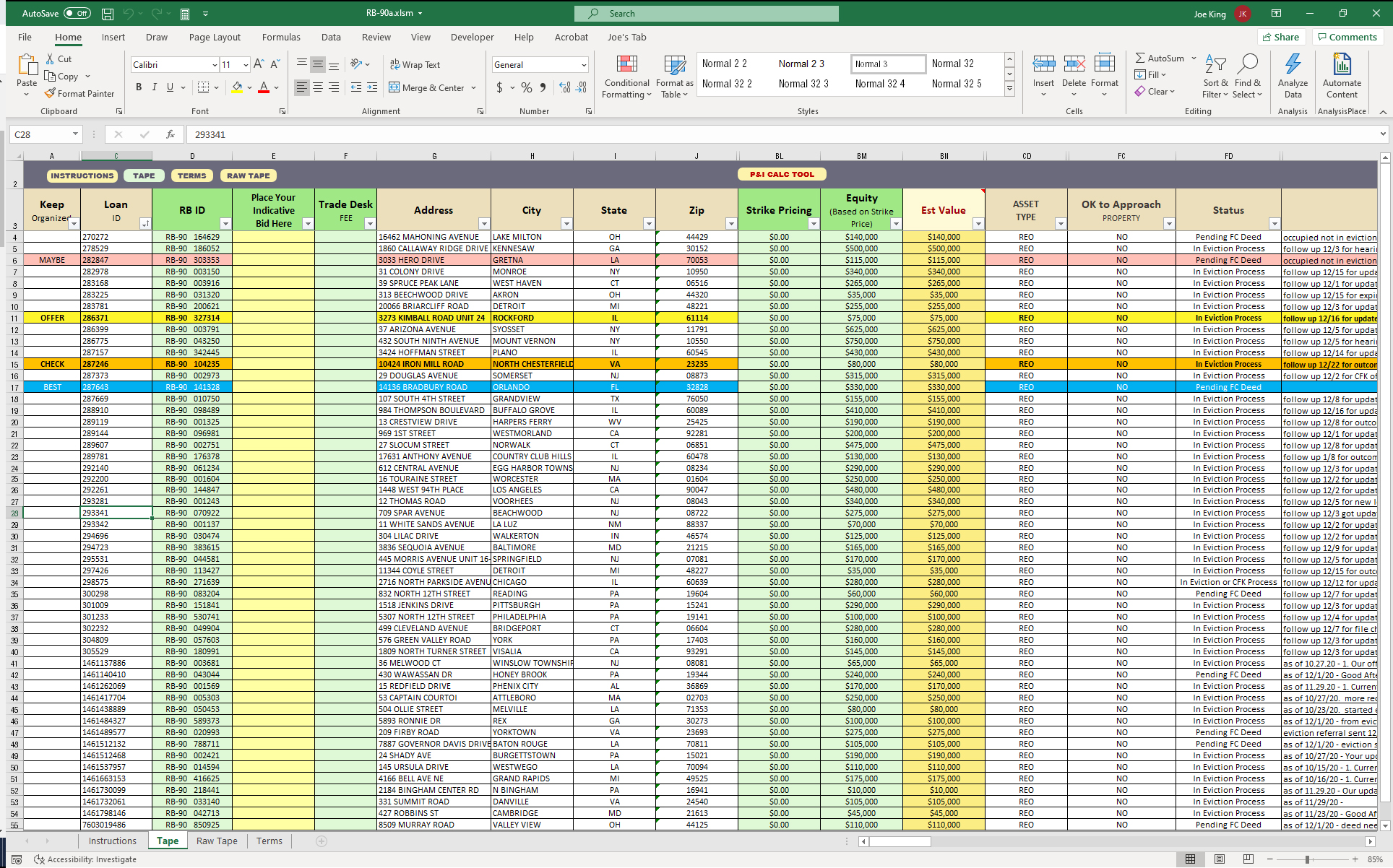

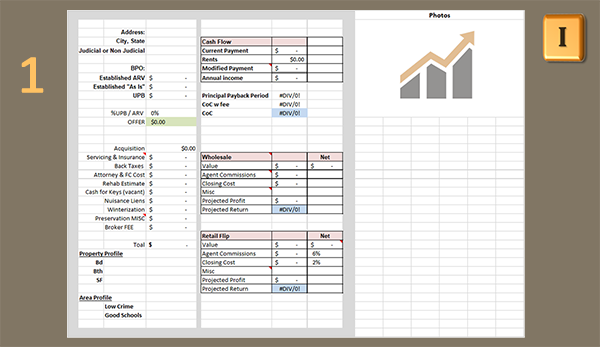

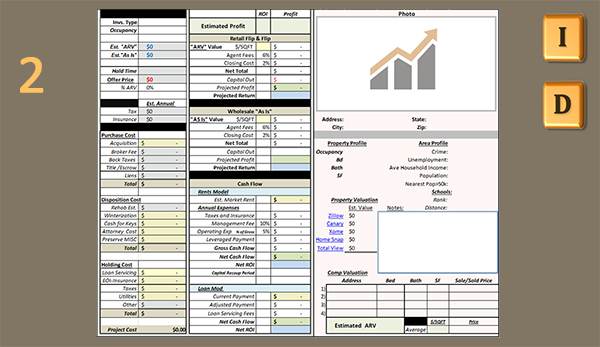

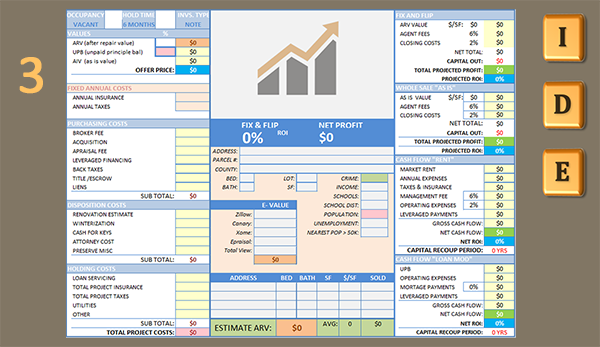

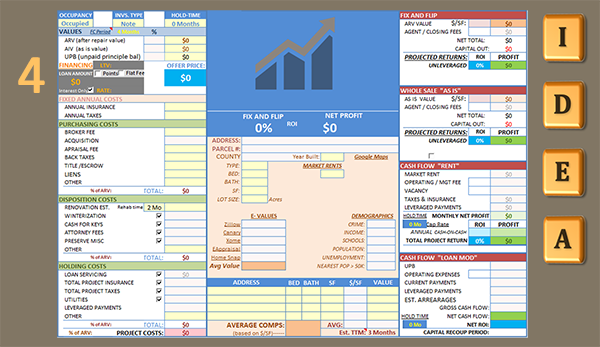

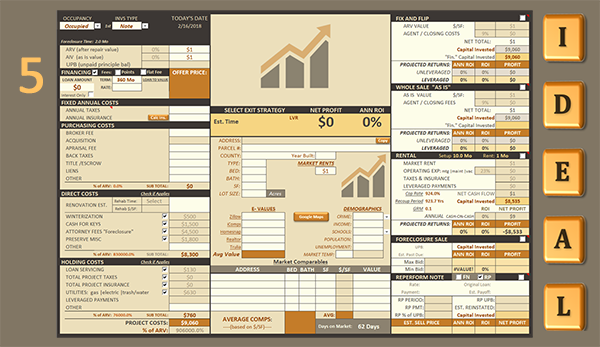

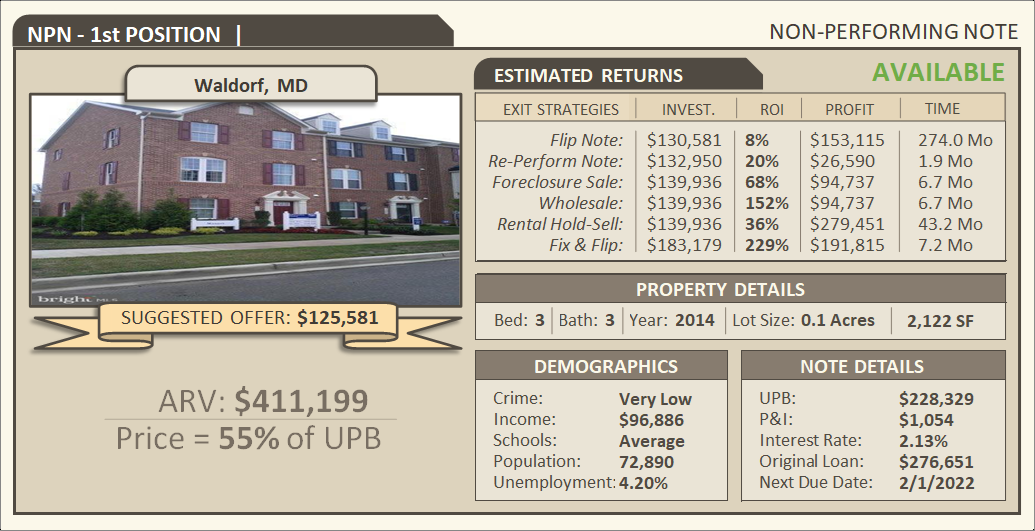

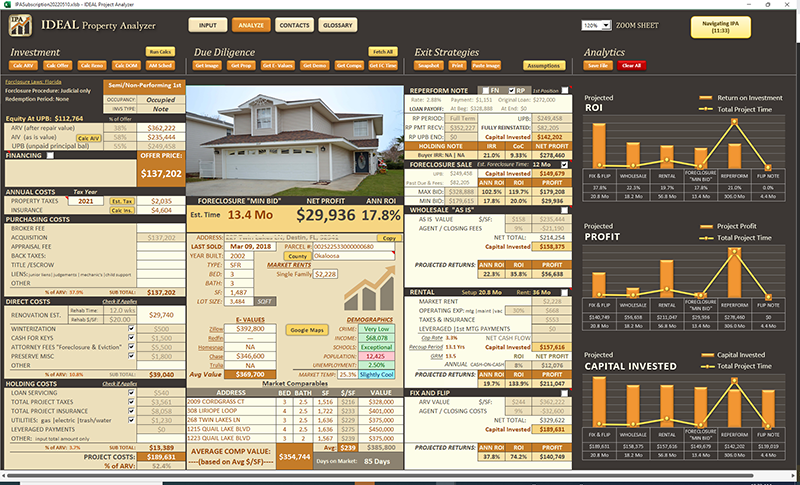

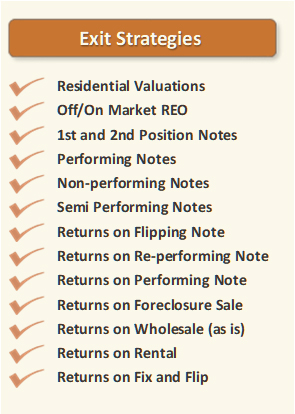

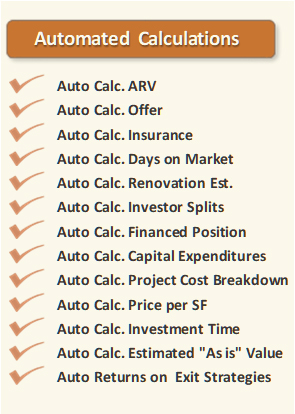

The IDEAL Project Analyzer (IPA) is a sophisticated Excel template that can analyze and manage the investment performance of Non-Performing Notes or REO against multiple exit strategies. From a single view, you can easily calculate project costs, estimate time, collect due diligence, manage contacts, enter notes, analyze multiple exit strategies, and learn as you invest from a series of video tutorials, live weekly webinars, and a glossary of terms. The best part about it, is we have made it easy to use and understand!

Watch This to See the Full Power of IPA!

Users will save time through automated due diligence features. With the click of a button, IPA searches online and retrieves important data, making it possible to analyze an asset in less than 5 minutes. Users will also benefit from added production and learning features by unlocking the "how to invest tutorials" for each exit strategy and management tools for taking notes and adding project related contacts.

For Note & REO Investors

The IPA spreadsheet is “IDEAL” for both beginner and advanced users alike. One of the main goals in developing this tool was to make it simple to understand and easy to use. A significant amount of time and energy went into designing the interface, so the user would have the freedom to explore multiple exit strategies from a single view. The IPA development team has successfully consolidated thousands of calculations into one sheet and made the experience dynamic and engaging for the user. They have taken complicated concepts and simplified them throughout. They have added management tools to save contacts, take notes, and track time as the investment matures. IPA is a must-have tool for any non-performing note or REO investor. Backed by the Revival Brothers, IPA comes with some unique options that can further benefit users through consulting services, joint-venture opportunities, and Cherry-Picked assets for sale. Contact the Revival Brothers for more information.

IPA Requirements

IPA is an Excel template that runs on a Windows only platform. Please make sure you meet the following requirements before purchasing.

- Microsoft Excel: 2016 or above for Windows (Desktop Version Only)

- Operating System: Windows 7 or Above

- Browser: Google Chrome

- Video card: For best results, a resolution of 1920 x 1200

- RAM: Min. 8 MB

Reports & Graphs Throughout

Invest With Confidence!

With built-in predictive analytics, IPA is a perfect tool to mitigate investment risks on non-performing notes, performing notes, rentals, and rehab investments. Once an address has been entered into the system, the results appear within seconds. Run multiple scenarios by exploring different offers, values, time, and costs. Instantly see your ROI, profit, time, and capital invested change as you explore alternate scenarios. The Revival Brothers use IPA every day to analyze assets for all investments. They not only use it to evaluate real estate but also to manage their projects. What better way to protect your investment than to analyze an asset using the same investment tool used by the professionals who created it.

Easy To Use!

There are five main pages: Input, AM Schedule, Analysis, Manage and Learn. On the Input page, simply select the type of investment, enter the address, and any applicable non-performing note details. On the Analysis page, everything is at your fingertips, consolidated into one screen. Here, you can manipulate any value and see the results instantly. Watch your ROI change as you explore multiple offers. Set timetables and analyze expenses, profit margins, and ROI over time. Start due diligence and collect project data. Set custom defaults to save time. Change any value and dynamically see the results in real-time. On the Manage page, you can store contacts, write notes, and quickly search through the data. Finally, the Learn page has over 150 terms, definitions, acronyms, tips, and videos to make IPA an easy and enjoyable experience.

IPA Development History

IPA was designed by professional investors, the Revival Brothers (RB), specifically for non-performing note (NPN) and REO residential markets. Over the years, RB founders Joe and Shawn King diligently searched for investment tools that would help them to better analyze assets, collect due diligence and speed up production. Frustrated with the results the industry had to offer, the RB's started creating their own tool, which they named the Ideal Project Analyzer (IPA). The IPA tool evolved over time and became increasingly more powerful. The RB's were extremely happy with their tool and the power it brought to their business. It wasn’t until several experienced colleagues mentioned how the industry desperately needed an investment analysis tool for notes and REO, that the RB's even considered bringing it to market. These same colleagues suggested, if done properly, the IPA tool could establish the RB's as a trusted company; it would also shine a light on their other internal products and services. A year later, the RB's released IPA. The response has been outstanding from both seasoned and novice investors alike.